|

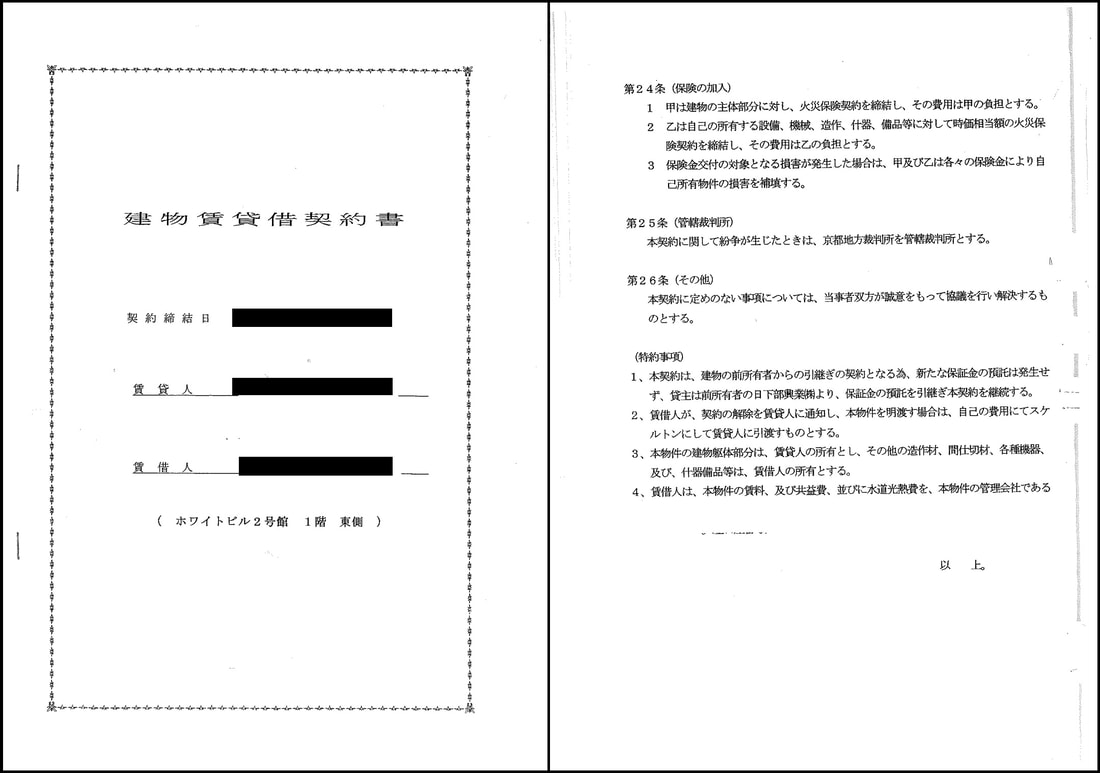

We had a meeting today because the tenant of the property we are managing will move out at the end of the month. This is an Okonomiyaki restaurant that has been operating for over 40 years. An elderly lady was operating by herself, but the restaurant was open from midnight until 5:00 and 6:00. It's a real Shin'ya Shokudō, known in English as Midnight Diner. At the beginning of this year, she was a little sick and had to take a break. Then the coronavirus attacked there, and due to the self-restraint of going out and the request of self-restraint of business, it became impossible to foresee the future, then she decided to shut down her business. This time, with the cancellation of the lease agreement, the procedure will basically follow the terms of the contract and the delivery conditions at the time of cancellation. Since it has been operating for over 40 years, neither the current owner nor the management company can understand the initial state. The points to keep in mind this time were the following. 1. 2 months notice of cancellation 2. When the lessee hands over the property, the lessor refunds the deposit 3. The lessee shall make a skeleton at his/her own expense and hand it over to the lessor. When we were first consulted about cancellation, we followed the prescribed procedure and received a written notice of cancellation and the tenant's signature. We were notified of the cancellation by phone, but it is necessary to make sure to put it in writing, otherwise it will be said or unsaid afterwards.

The lease agreement this time was an agreement using the system called Guarantee Money and Non-refundable Restoration Fee. Therefore, we will calculate the security deposit to be refunded according to the number of years of the contract and refund it after receiving the delivery of the property. The most difficult part of the process is the passing the property by the skeleton state. The condition of the skeleton is often the case when renting a property for commercial use, meaning that everything will be removed. The removal of fixtures, walls, floors, ceilings, etc. installed by each tenant until the building's structure can be seen is called the handing over of a skeleton. Therefore, we had a meeting today with the lessee and the construction company, and decided the scheduled construction date and the confirmation date of the progress. After all, it is not possible to confirm how far the skeleton can be made without removing the stuff, so it is necessary to confirm in the middle. Possibly, it may be sharing the block fence with the next store, so ask them to return to the skeleton state while watching the progress. The above is today's meeting and the procedure for cancellation. As a management company, we will need to confirm that the building has been vacated, and prepare for repairs, such as recruiting new tenants and waterproofing the building so that it can be used by the next tenant. Since this is an earning property, we will be making detailed adjustments to obtain rental income as soon as possible, at what rent and under what conditions, while considering the cost effectiveness of the property. Today, we would like to talk about the work of building management after the tenant has moved out.

First, the management company that receives notice of the cancellation will set up a date and time to be present with the tenant. The purpose of this is to check the condition of the room when it is handed over, and the person in charge of the management company and the tenant will check the room together on the day. At this time, the renter will be asked to arrange the delivery of all luggage, the disposal of garbage, and cancellation of water, electricity, gas, and internet in advance. By doing so, we will be able to check the empty room, and no one will receive bills for utility expenses after the fact. In the meeting, the damaged area is mainly checked. We will check the condition of the room and the burden of each, whether it is the damage due to the renter's responsibility or the burden on the lessor. Therefore, if there is damage due to the renter's responsibility, we will confirm whether he/she will compensate from the security deposit or pay additional repair costs. By carrying out this kind of work together, it is possible to prevent troubles at a later date, such as the fact that the security deposit was not returned and the requested repair cost was high. When the lessee vacates the room, the principle is to return it to its original condition. Therefore, without leaning unduly to one side or the other, be fair and determine who, what and to what extent will bear the burden. The next step is to restore the room to a leasable condition. For example, cleaning a room, repairing damaged areas, repairing or replacing damage or wear and tear due to age, upgrading equipment, or work to increase the value of a room. The only work actually done by the management company is to arrange for the work to be done by each specialist contractor. For example, cleaning and replacement of wallpaper is done by a cloth company. Cleaning is a cleaning company. Repairs depend on the location, but it is a water supplier, carpenter, or electrician. We will also ask a specialist Tatami shop to change the tatami mat. In addition, check the expiration date of the fire alarm, replace the faucet rubber packing at the water leak point, and replace the original plug of the washing machine with a new type. After that, a new key is exchanged and the tenant can move in anytime. These multiple tasks are from the move-out to the move-in of the new lessee. Even with all the preparations done so far, there are cases in which problems can be identified even after actually starting living. Even in such a case, by responding promptly, tenants can be reassured and trusted. Recognize a good relationship with the tenants, have them move in for a longer time, and make a good investment for the landlord. Today we would like to talk about the points to note when non-residents invest in real estate. When investing in real estate in Japan, it does not matter whether the buyer is Japanese, resident or non-resident. However, if you are a non-resident and you want to get rent from the property you invest in, then note the following: Cases other than the rent paid by individuals who rented the land and house for themselves or their relatives to reside in. So what happens in the case above? The National Tax Agency has the following information. No.12014 Real estate income of non-residents https://www.nta.go.jp/english/taxes/individual/12014.htm

In such a case, there are two points to keep in mind.

First, the lessee has to pay the withholding tax collected to the tax office every month. This puts a heavy burden on the lessee and results in complicated tax procedures. If the rent is high, there is a possibility that the corporation has a lease agreement, and inevitably additional corporate paperwork will occur. Due to this increase in processing, there is a possibility that the lease contract will be terminated. Therefore, the method of avoiding such complicated processing from the lessee is to change the contract so that we will enter into a sublease agreement with the landlord, enter into a lease through us, and we will be obligated to pay tax. By doing this, the original lessee will rent a room from us, so there will be no additional burden. Our additional operating costs are covered by normal property management fees and are not incurred separately. The second point is to make the tax accountant a partner of the tax advisor. Every year, you will be required to file a tax return for real estate income, and at the same time, please request a refund for the withholding tax. By doing this, you will be asked to refund the tax by accurately claiming the tax and overpaying the tax. The above are points to keep in mind when investing in real estate. These cases include special circumstances, so please consult us individually. We can also introduce tax accountants who are fluent in English and Chinese. Please contact us for more details. Rent management is one of the tasks of building management. Rent management is to check whether the rent of the building entrusted by the landlord is paid monthly by the lessee, receive the rent, pay the necessary expenses, and transfer it to the landlord. If the rent has not been paid, we will petition for demand for payment, request payment and keep the rent properly. If the rent is not paid even if a demand for payment is made, a request for a replacement is made to the guarantee company, the renter's rent will be reset and paid, and the rent will be received.

Typically, rent is paid in advance, and June rent is paid at the end of May. The rent is paid to the management company by the end of the month, and the rent payment is confirmed at the beginning of the month as a management task. If the last day of the month is a Saturday or Sunday like this month, we will confirm the payment on the following Monday, and if the payment has not been made on the first day, we will contact each tenant and remind them to transfer the rent. If we do not receive a transfer of the rent by the transfer request of the telephone, a reminder is issued by the letter. But in most cases, it's only forgetting of the transfer. we receive the rent immediately. If the rent cannot be paid even if we send the reminder letter, we will request the guarantor company for the advance payment. The guarantor company will pay the rent on behalf of the lessee. The guarantor company first informs the lessee that the rent has not been paid, but if the rent is still not paid, the rent is remitted to the management company. The guarantee company will receive the rent for the advance payment directly from the lessee. The role of the guarantor company is to perform a tenants screening at the time of moving in and to reimburse late rent. The main income of the guarantee company is the guarantee fee received from the lessee at the time of contract and the annual guarantee contract renewal fee. Basically it will be a recurring revenue model, and the more the number of guarantees increases, the more stable fees will come. However, if the economy becomes excessively depressed and rents are often delayed, the amount of money in hand will decrease as a result of the advancement. Even after the Great East Japan Earthquake, the warranty company suffered enormous damage. However, the use of a guarantee company is now mandatory for most rental contracts, regardless of whether you are Japanese or an international student. By using a guarantee company, the landlord will find it easier to rent a room, and the tenant will find it easier to rent a room by using a guarantee company, or by not needing a guarantor. This is now a common business practice in Japan for lease agreements. Let's take a look at the second real estate investment case, which is a single wooden apartment building with four units in Kyoto city, ownership registered in the names of both parents and children, who are living in Hong Kong.

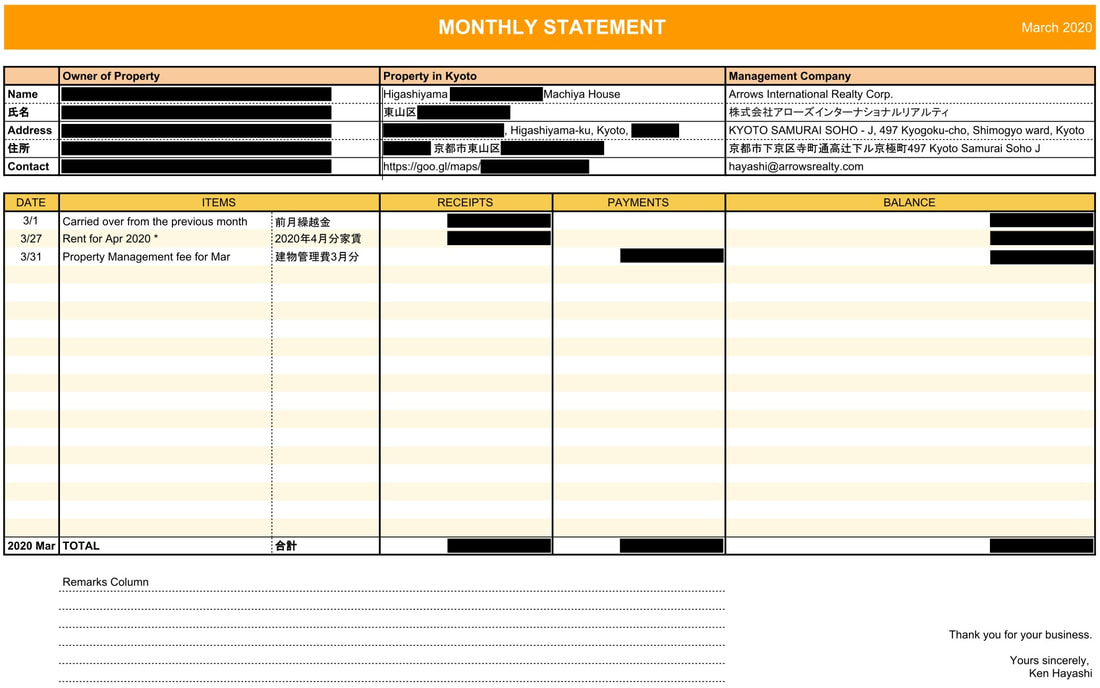

The investors are not residents in Japan, the registered owners are parents and children, and the registered address is Hong Kong. The investment target is a wooden apartment, 4 units, and an old apartment that was located on land that cannot be re-built. This time, the investment is to buy an existing apartment at a cheap price, no tenants, renovate it, operate it as a rental, and sell it for an exit. The real estate purchase amount is 10 million yen or less, renovation costs are about 7 million yen, and rental income is about 1.6 million yen per year. Real estate prices were very low, as the property was in such disrepair condition that it needed major renovations, was before land prices soared, and could pn the not re-buildable land. Since investors could not come to Kyoto at the time of contract or settlement, they delegated to an agent and completed the transaction. For the renovation, we prepared a room with a unit bath for the university students and a room with a shower room only. Initially we did not install furniture, but now we are operating as a rental with furniture as furnished apartment. For the renovation, we asked a local contractor through the management company, and the management company confirmed the progress of the construction and detailed specifications. For rent management, we have been promoting recruitment centered on companies that are strong in renting students, and we have achieved almost full occupancy management. When international students rent a room, they prefer furnished rooms, so there are refrigerators, washing machines, beds, desks, and chairs. The internet is also contracted with the apartment, so it is possible to use it immediately after moving in. Currently we are both renting and selling an apartment at same time. Since the investor has an account of Bank of China opened in Japan, the rent is remitted monthly to the Japanese account. We are executing an exit strategy while investing and renting the property, including renovations. For renovations, we have English-speaking contractors and architect partners, so please contact us if you are interested. Case 2: Gross yield approx. 10%, Net yield approx. 8.87% *Management fee, fire insurance and property annual fixed asset tax included Today we're going to look at each investor's individual investment case. First of all, the investor in this case is a citizen of a country whose passport is in Europe, whose residence is in Asia, and who owns one property in Japan. The investment target is a remodeled Kyo-Machiya house, an attached house located in Higashiyama-ku, Kyoto City. The reason for investing is that they come to Japan regularly for work, love Kyoto, and want to have a vacation house in Kyoto to enjoy a relaxing time after retiring the work. The property in which they invested was a Kyo-Machiya house built in 1927 and renovated in 2019, a four-minute walk from Tofukuji. The investment method is for long-term leasing, they plan to use it as their own second home in the future when they retire from the company. In this case, the married couple registered 50% ownership of the property each, and the family owned the property. After purchasing the property, they signed a building management contract with us, and we began offering rentals immediately afterwards. The acquisition tax and property tax of the real estate are paid from the rental income, and the deposited rent is kept and managed by management company until instructed by the owner. The monthly balance report is shared in a folder on the cloud, and the monthly balance and deposit information are also shared. For the tenant recruitment, we will share the information with each agency and conduct business activities to find tenants. The management company takes photographs, draws up floor plans, assesses rents, and sets detailed conditions when recruiting. Once the details are finalized, we use the network system of real estate agents to register the information and recruit tenants through e-mails, faxes, and websites. Once we receive an offer for rent, we work with the guarantee company to screen the tenants, and take care of the necessary procedures such as the contract, fire insurance and other necessary procedures on owners behalf.

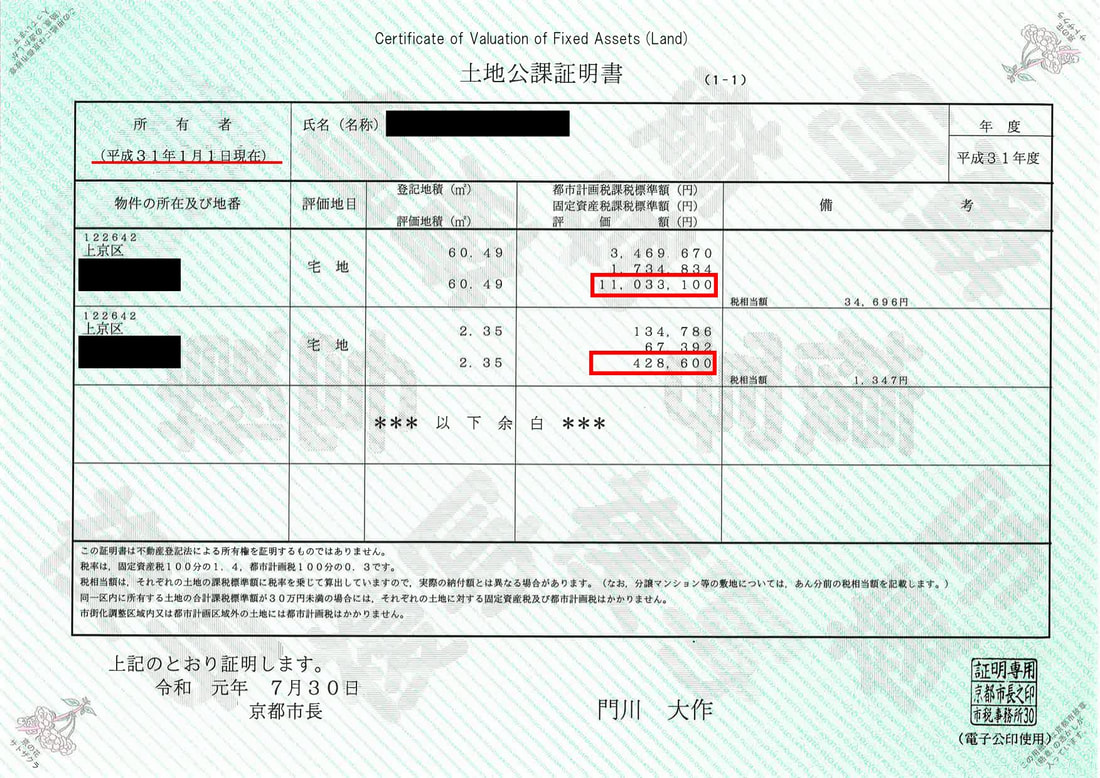

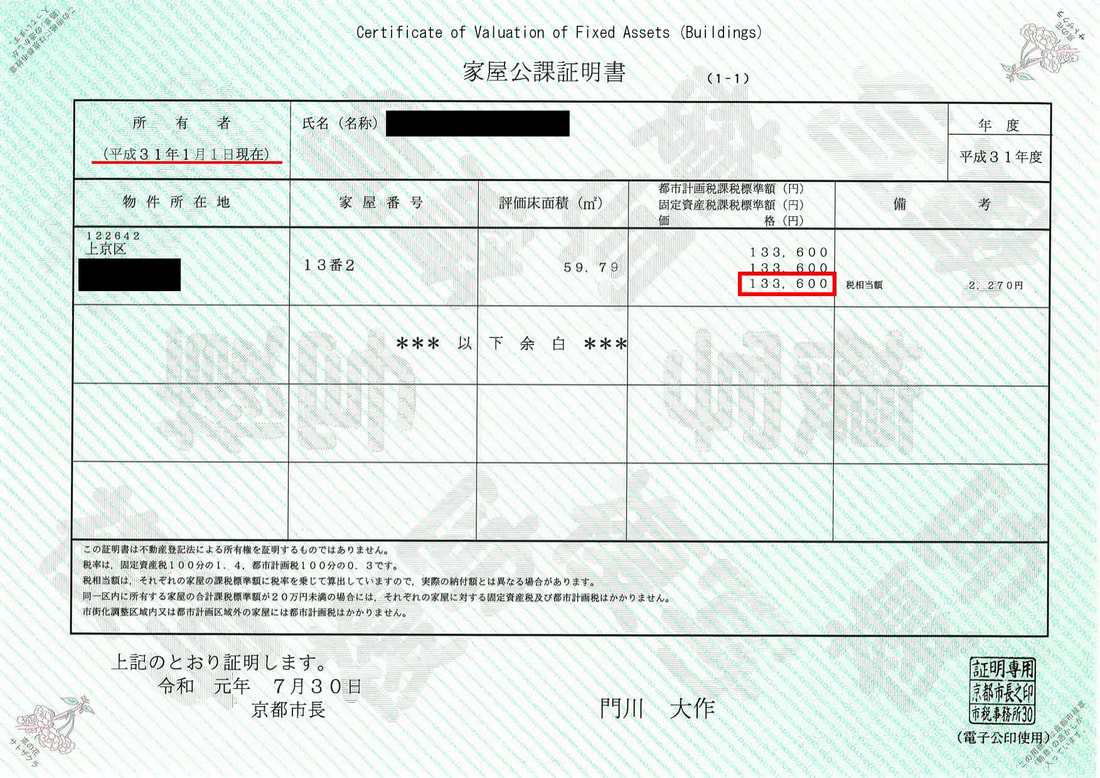

Before the tenants moving in, we will make sure that the room is cleaned and free of defects, change the locks and make sure it is ready to move in and hand the keys to the new tenant. The management company will take care of any inquiries or requests after tenants move in, and the owner basically does not do any work for management. We also provide information to owner's tax accountant and pay the income tax via owner's tax accountant. Therefore, after signing the management contract, there is no problem if owner leaves the various tasks to the management company. Case 1: Gross yield 6.04%, Net yield 5.28% *Management fee, fire insurance and property annual fixed asset tax included The costs associated with owning a property include taxes, repair costs, and administrative costs. Some costs are one-time costs, some are incurred monthly, and some are ongoing in the future. Let's start with taxes. There are three types of taxes: real estate acquisition tax, which occurs when you own real estate; real estate property tax, which occurs when you continue to own real estate; real estate transfer tax, which occurs when you transfer ownership of real estate; or real estate inheritance tax, which occurs when you inherit real estate by inheritance. The tax calculation is based on the assessed value listed on the property's public tax certificate. The real estate acquisition tax is a tax that only occurs once when the property is acquired. The real estate property tax is payable on January 1 of each year by the person or corporation holding the ownership of the property. When selling real estate, because a tax will be generated against the profit on the transfer of real estate, it will be necessary to grasp the acquisition cost, etc.

The inheritance tax on real estate is getting tougher with each year's revisions, so we need to check the law when the inheritance occurs. The basic interpretation is that when calculating the inheritance tax for undivided heritage, the heirs and inheritance are based on the country of origin of the heir. In addition, when calculating the total amount of inheritance tax, the heirs and inheritance share are based on Japanese law. It is best to check with your tax accountant for details, as it may or may not be related to whether you have lived in Japan. Next, regarding the repair costs, it will be the condominium that will be paid a fixed amount. There is a management union to which each owner belongs in the condominium, and through the union, repair expenses for future repairs of the building are funded. If the building age is short, the repair costs will be low, and the repair costs will rise as the building age passes. https://realestate-kyoto.com/APARTMENTforSale Of course, even detached houses will be repaired in the future, so repair costs will be incurred when repairing. Finally, there is the cost of management, but here we will discuss two types of management costs. The first one is the management fee that is paid to the company that manages the whole common part of the condominium when you own the condominium. The management company entrusted by the management association will maintain the entire building and carry out daily cleaning and other activities. Unlike the cost of repairs, they do not increase from year to year, but if the cost of management increases, there is a possibility of a rate increase. There are other management costs, for example, if we, Arrows International Realty Corp. manage the building, if the owner uses the building as a holiday home, we may be commissioned to pay a monthly fee. We can handle monthly utility bills and annual property tax payments, whether it's a patrol check of your building or an inquiry from a neighboring resident. If we provide such a service, we will receive a building maintenance fee from the owner. https://www.arrowsrealty.com/vacation-home-management-in-kyoto.html The above are the maintenance costs if you own the property. If you would like an individual consultation, please contact us via the website. When canceling the lease contract and moving out, tenants first contact the management company. Generally, it is necessary to notify one to two months in advance, and it is possible to cancel before the expiration of the contract period. When the management company receive the notice of the cancellation of the contract, we will start listing for rental first with "vacant schedule" in order to find the next tenant.

The busiest period for renting in Japan is moving to April and planning for international students to go to university from October. If the time is missed, the demand for moving will drop significantly, so we will continue to seek rent until the next high season. Another problem all over the world is the decrease in rent due to the decrease in sales and income due to Covid-19. In the case of commercial real estate, sales have been affected significantly, and because the Japanese government has not yet completed payment of special benefits, there are many calls for a reduction in rent and a grace period. With the demand for new rentals being extremely low, having tenants continue to move in will make landlords to receive more rent throughout the year. With regard to residential rentals, the number of people requesting a reduction in rent has increased due to a decrease in income. Those who are doing business as individuals are in a very difficult situation with a decrease in sales and a decrease in income. When such a contact is received, we will immediately report it to the landlord, consider the best measures and take the best way for both parties. We sincerely hope that the situation will improve soon. After purchasing real estate for investment by our clients, we may offer or manage rentals. Today, we would like to introduce the questions, requests, and inquiries from tenants.

Inquiries from new occupants include garbage problems, building equipment problems, rent problems, and other issues related to moving out. The first thing we will be asked about is date and the location of the garbage collection . When renting a detached house, we will have to dispose of the garbage at the collection place according to the collection date in the area. Regarding the collection place, the place often differs depending on the type of garbage, and the garbage will be discharged according to the rules in the town. Also, there is a fixed time to dispose of garbage, and most of them will be disposed of at designated places from early morning until 8 am. The collection place may change every year, and we will comply with the local regulations and dispose of the garbage. By the way, Kyoto City has its own garbage bag, so we can purchase it at a convenience store and put out the garbage in the designated bag. In the case of condominiums, there is a dedicated garbage collection box on the premises of the condominium, so we can just put it out on a fixed day. Building facilities include equipment malfunctions, internet usage, and television viewing. If the period of unoccupied house is long, the new tenants may be able to discover the defect by using the equipment. In that case, if it is the equipment of the building, and if the landlord has a duty to repair it, we will make a repair arrangement as soon as possible to eliminate the malfunction of the equipment. In the case of condominiums, there is a common antenna for watching TV, so we can watch it simply by connecting a cable. In the case of a detached house, there are cases where the antenna is not installed, so we ask to use a cable TV etc. to watch TV. |

Details

AuthorArrows International Realty Corp. Archives

June 2023

Categories

All

|

RSS Feed

RSS Feed