|

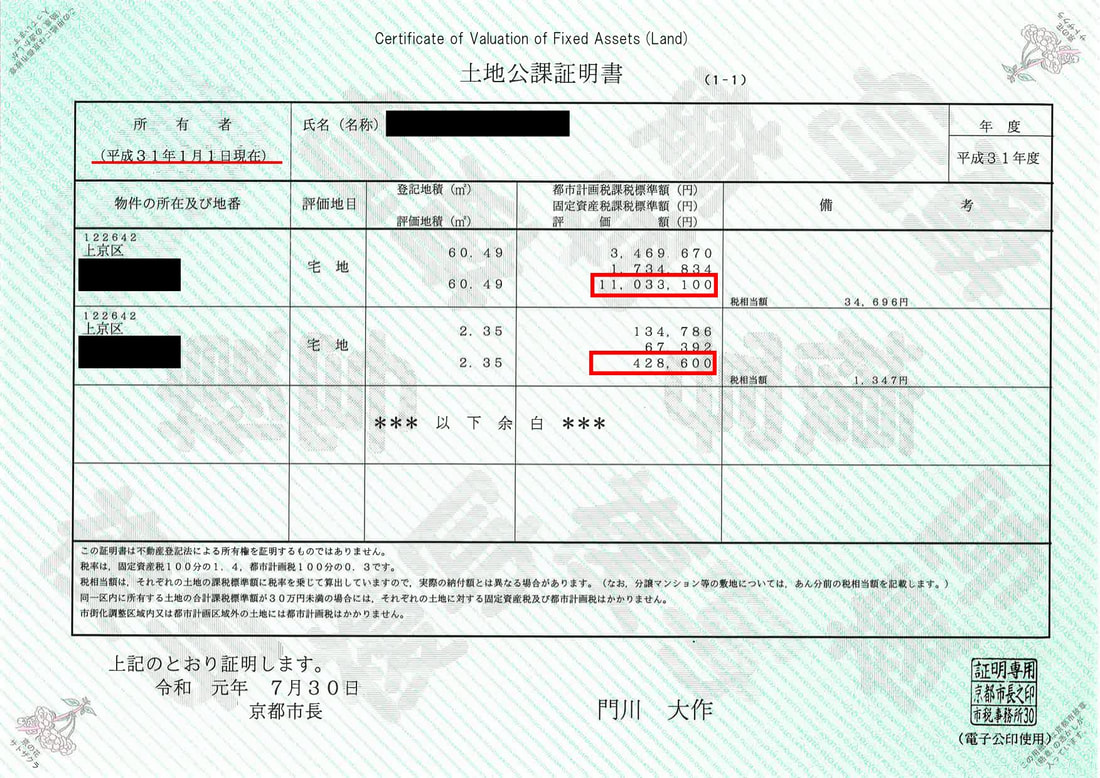

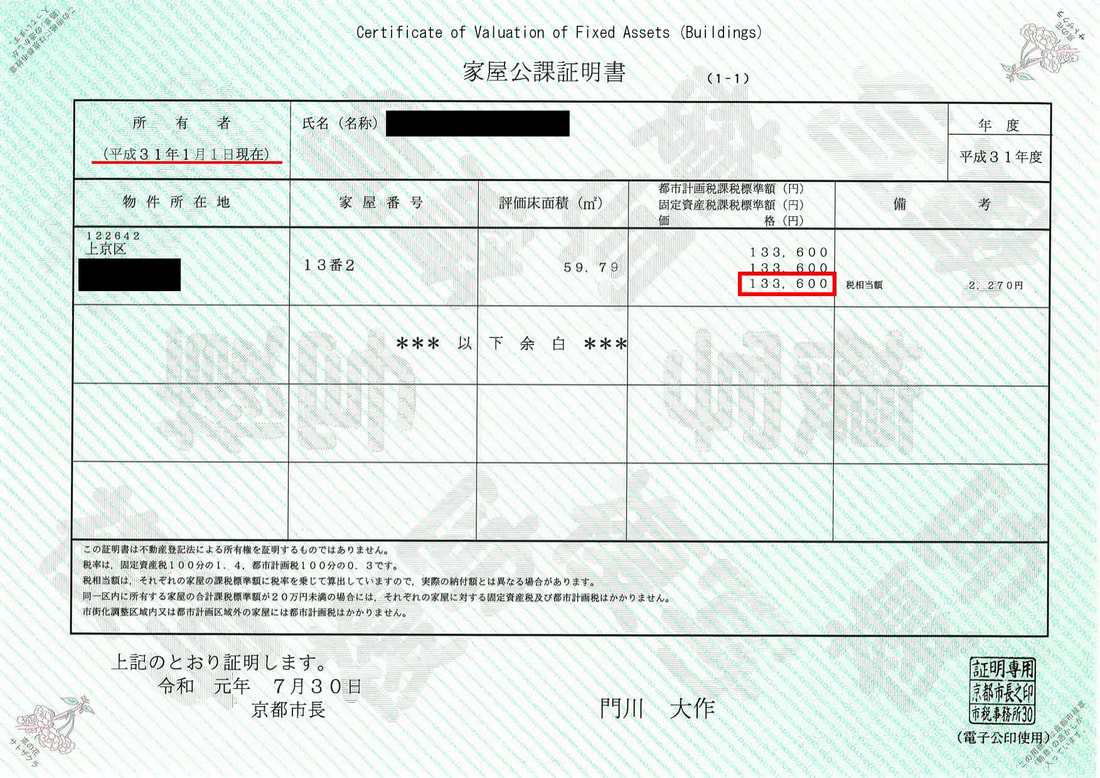

The costs associated with owning a property include taxes, repair costs, and administrative costs. Some costs are one-time costs, some are incurred monthly, and some are ongoing in the future. Let's start with taxes. There are three types of taxes: real estate acquisition tax, which occurs when you own real estate; real estate property tax, which occurs when you continue to own real estate; real estate transfer tax, which occurs when you transfer ownership of real estate; or real estate inheritance tax, which occurs when you inherit real estate by inheritance. The tax calculation is based on the assessed value listed on the property's public tax certificate. The real estate acquisition tax is a tax that only occurs once when the property is acquired. The real estate property tax is payable on January 1 of each year by the person or corporation holding the ownership of the property. When selling real estate, because a tax will be generated against the profit on the transfer of real estate, it will be necessary to grasp the acquisition cost, etc.

The inheritance tax on real estate is getting tougher with each year's revisions, so we need to check the law when the inheritance occurs. The basic interpretation is that when calculating the inheritance tax for undivided heritage, the heirs and inheritance are based on the country of origin of the heir. In addition, when calculating the total amount of inheritance tax, the heirs and inheritance share are based on Japanese law. It is best to check with your tax accountant for details, as it may or may not be related to whether you have lived in Japan. Next, regarding the repair costs, it will be the condominium that will be paid a fixed amount. There is a management union to which each owner belongs in the condominium, and through the union, repair expenses for future repairs of the building are funded. If the building age is short, the repair costs will be low, and the repair costs will rise as the building age passes. https://realestate-kyoto.com/APARTMENTforSale Of course, even detached houses will be repaired in the future, so repair costs will be incurred when repairing. Finally, there is the cost of management, but here we will discuss two types of management costs. The first one is the management fee that is paid to the company that manages the whole common part of the condominium when you own the condominium. The management company entrusted by the management association will maintain the entire building and carry out daily cleaning and other activities. Unlike the cost of repairs, they do not increase from year to year, but if the cost of management increases, there is a possibility of a rate increase. There are other management costs, for example, if we, Arrows International Realty Corp. manage the building, if the owner uses the building as a holiday home, we may be commissioned to pay a monthly fee. We can handle monthly utility bills and annual property tax payments, whether it's a patrol check of your building or an inquiry from a neighboring resident. If we provide such a service, we will receive a building maintenance fee from the owner. https://www.arrowsrealty.com/vacation-home-management-in-kyoto.html The above are the maintenance costs if you own the property. If you would like an individual consultation, please contact us via the website. Comments are closed.

|

Details

AuthorArrows International Realty Corp. Archives

June 2023

Categories

All

|

RSS Feed

RSS Feed