4-1 The Budget

Basic ideas of purchase costs

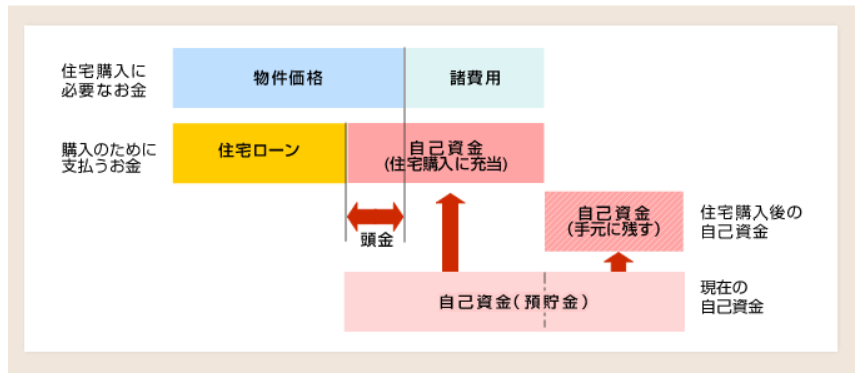

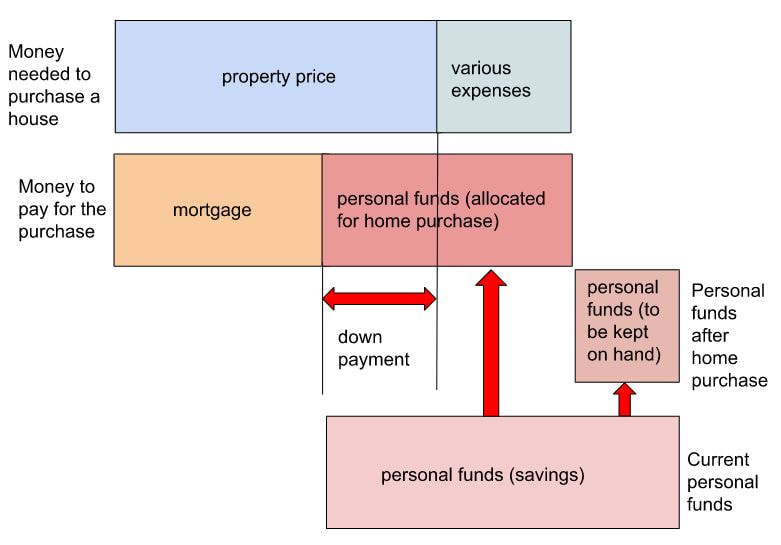

It is important to set an approximate budget before you begin the specifics of your property search. The following is an overview of the budget required to purchase a house and the concept of financial planning.

Point 1 Get a general idea of the budget needed to purchase a house.

You cannot buy a house merely by securing funds equivalent to the purchase price of a property. Taxes, registration fees, mortgage expenses, moving expenses, and funds for purchasing furniture, appliances, and curtains are required. In addition, for newly built condominiums, a repair reserve fund of several hundred thousand yen is required in many cases at the time of purchase, and in the case of brokered properties, a brokerage fee is charged by the real estate company.

In other words, in order to purchase a house, it is necessary to prepare funds for the property price plus these various expenses. The necessary funds (property price + various expenses) for purchasing a house calculated as described above need to be prepared by self-financing or taking out a mortgage loan.

Property Price + Other Expenses = Own Funds + Mortgage Loan

If you are thinking of buying an existing house and remodeling it, you should also include the cost of remodeling in your estimate. Although most people pay for remodeling with their own funds, if you have taken out a mortgage to finance the purchase and can afford the repayments, you can also use the loan to pay for the remodeling costs.

In other words, in order to purchase a house, it is necessary to prepare funds for the property price plus these various expenses. The necessary funds (property price + various expenses) for purchasing a house calculated as described above need to be prepared by self-financing or taking out a mortgage loan.

Property Price + Other Expenses = Own Funds + Mortgage Loan

If you are thinking of buying an existing house and remodeling it, you should also include the cost of remodeling in your estimate. Although most people pay for remodeling with their own funds, if you have taken out a mortgage to finance the purchase and can afford the repayments, you can also use the loan to pay for the remodeling costs.

Point 2 Know how much you can use from your personal funds for a down payment.

Now, let's calculate the amount of your personal funds, such as savings, that can be used for a down payment on a home purchase. First, the amount to be allocated to the home purchase fund is determined by considering the amount of personal funds to be kept on hand, taking into account living expenses, education, and other expenses after the home purchase. Then, the down payment will be the amount obtained by subtracting the various expenses from the personal funds to be allocated for the house purchase.

Down payment = Total amount of personal funds - Current living expenses - Miscellaneous expenses for home purchase

Down payment = Total amount of personal funds - Current living expenses - Miscellaneous expenses for home purchase

4-2 The Budget

Estimate the amount of the loan based on the amount you can afford to repay.

Consider how much you can afford to repay. First, review your current household income and expenditures, and identify the amount of monthly household surplus that can be used to repay the loan, including the amount of expenditures and reserves that will decrease as a result of the home purchase. Next, subtract the expected increase in expenses due to the purchase of the house from this amount, and estimate the amount that can be repaid each month. However, it is safer to consider this amount as the maximum amount and to plan your repayment with a little extra time to spare. You can also find simulations on the Internet that calculate the amount you can borrow based on your annual income and monthly repayments.

Point 1: Do not base your loan on the financial institution's loan limit.

Banks and other financial institutions set standards for mortgage loan limits based on the ratio of the amount borrowed to the property price and the ratio of the annual repayment amount to annual income including tax.

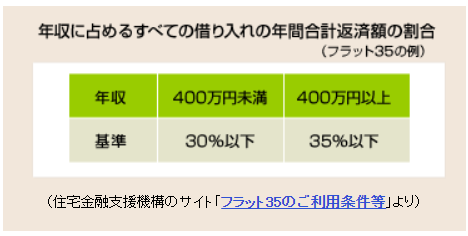

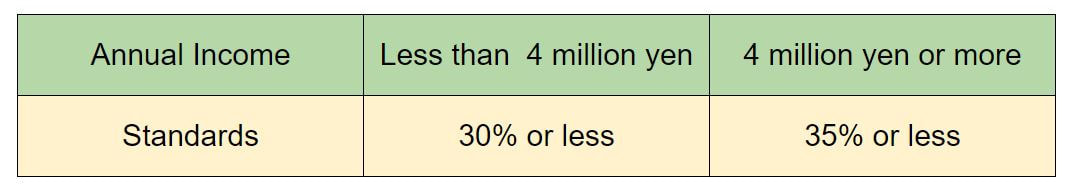

For example, "Flat 35" (a mortgage loan provided by the Japan Housing Finance Agency (JHF) in partnership with private financial institutions) stipulates that the loan amount must be between 1 million yen and 80 million yen (in units of 10,000 yen), within the construction or purchase price. The ratio of the annual repayment amount to annual income including tax is also defined as shown in the table below.

However, this is only the standard for "Flat 35". The amount of money that can be repaid depends on each household's financial situation. For example, you may need money for your child's education or for your parent's nursing care, or you may want to buy a new car. you should determine the amount you can borrow after considering your individual circumstances and knowing the maximum amount of repayment for your family budget.

For example, "Flat 35" (a mortgage loan provided by the Japan Housing Finance Agency (JHF) in partnership with private financial institutions) stipulates that the loan amount must be between 1 million yen and 80 million yen (in units of 10,000 yen), within the construction or purchase price. The ratio of the annual repayment amount to annual income including tax is also defined as shown in the table below.

However, this is only the standard for "Flat 35". The amount of money that can be repaid depends on each household's financial situation. For example, you may need money for your child's education or for your parent's nursing care, or you may want to buy a new car. you should determine the amount you can borrow after considering your individual circumstances and knowing the maximum amount of repayment for your family budget.

Ratio of total annual repayments of all loans to annual income (Example of Flat 35)

Ratio of total annual repayments of all loans to annual income (Example of Flat 35)

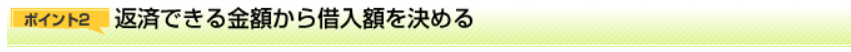

Point 2: Determine the amount you can borrow based on the amount you can afford to pay back.

Figure out how much you can afford to pay back each month.

Consider how much you can afford to repay.

First, review your current household income and expenditures, and identify the amount of monthly household surplus that can be used to repay the loan, including the amount of expenditures and reserves that will decrease as a result of the home purchase. Next, subtract the expected increase in expenses due to the purchase of the house from this amount, and estimate the amount that can be repaid each month. However, it is safer to consider this amount as the maximum amount and to plan your repayment with a little extra time to spare.

* *As for the amount of taxes, management fees and reserve for repairs (in the case of condominiums), ask the real estate agency for a rough estimate once you have decided on a potential purchase property.

First, review your current household income and expenditures, and identify the amount of monthly household surplus that can be used to repay the loan, including the amount of expenditures and reserves that will decrease as a result of the home purchase. Next, subtract the expected increase in expenses due to the purchase of the house from this amount, and estimate the amount that can be repaid each month. However, it is safer to consider this amount as the maximum amount and to plan your repayment with a little extra time to spare.

- How to calculate the amount of expenditure that will decrease after purchasing a house

- How to calculate the amount of expenses that will increase after purchasing a house

* *As for the amount of taxes, management fees and reserve for repairs (in the case of condominiums), ask the real estate agency for a rough estimate once you have decided on a potential purchase property.

Example of an estimate of the amount that can be repaid

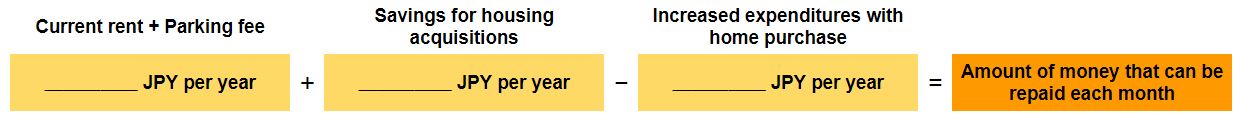

Estimate the amount you can borrow from the monthly repayment amount.

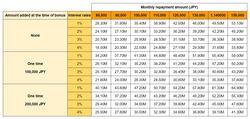

Once you have estimated the amount you can repay each month, use the table below to find out the approximate amount you can borrow.

For example, if the monthly repayment is 80,000 yen, the bonus repayment is zero yen, the interest rate is 2%, and the repayment is over 35 years, the amount that can be borrowed is 24,100,000 yen. Although you should not rely too heavily on bonuses, you may want to consider using bonus repayments if the amount paid is expected to be somewhat stable.

A simulation that calculates the amount that can be borrowed based on annual income and monthly repayments is available on the Internet and can be entered to find out.

The important thing is to consider your financial plan with this borrowing capacity as the "upper limit. Be sure to plan your finances carefully, assuming a decrease in income, an increase in expenses, and, in the case of a loan with variable interest rates, an increase in repayments due to a rise in interest rates.

For example, if the monthly repayment is 80,000 yen, the bonus repayment is zero yen, the interest rate is 2%, and the repayment is over 35 years, the amount that can be borrowed is 24,100,000 yen. Although you should not rely too heavily on bonuses, you may want to consider using bonus repayments if the amount paid is expected to be somewhat stable.

A simulation that calculates the amount that can be borrowed based on annual income and monthly repayments is available on the Internet and can be entered to find out.

The important thing is to consider your financial plan with this borrowing capacity as the "upper limit. Be sure to plan your finances carefully, assuming a decrease in income, an increase in expenses, and, in the case of a loan with variable interest rates, an increase in repayments due to a rise in interest rates.

Amount that can be borrowed based on the monthly repayment amount

*Calculated based on 35-year repayment

*Calculated based on 35-year repayment

*This table is for reference purposes only to give you an idea of the approximate amount you can borrow.

Please confirm the details with the financial institution when actually borrowing funds.

Please confirm the details with the financial institution when actually borrowing funds.

4-3 Buying a House: the Budget

Mak1ing a larger down payment

The larger your down payment is, the less you will borrow and the lower your loan repayment burden will be.

The lower your loan repayment burden, the more secure your household finances will be in the future, so consider ways to increase your down payment as much as possible.

The lower your loan repayment burden, the more secure your household finances will be in the future, so consider ways to increase your down payment as much as possible.

Point 1: Plan to increase your savings.

During the repayment period of a mortgage loan, there is a risk that household financial circumstances may change, such as an increase in children's educational expenses or a decrease in income due to retirement, and you may be unable to pay the originally planned loan repayment amount.

However, if you can increase your down payment and lighten your repayment amount, you can reduce such risks. For this reason, it is important to plan ahead and save for the future.

However, if you can increase your down payment and lighten your repayment amount, you can reduce such risks. For this reason, it is important to plan ahead and save for the future.

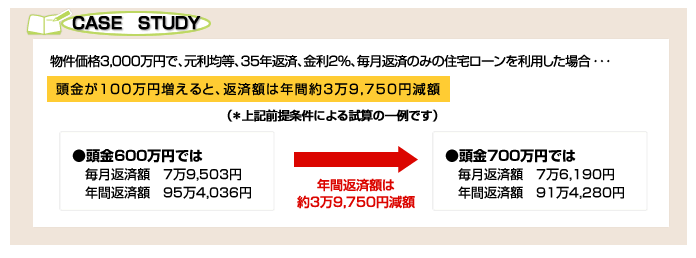

📖CASE STUDY

If a mortgage loan is taken out for a property price of 30 million yen, with equal principal and interest, 35-year repayment, 2% interest rate, and monthly repayment only...

If the down payment increases by 1 million yen, the annual repayment amount decreases by about 39,750 yen.

*This is an example of an estimate based on the above assumptions.

*This is an example of an estimate based on the above assumptions.

|

With a down payment of

6 million yen Monthly repayment: 79,503 yen Annual repayment: 954,036 yen |

➡

The annual repayment amount is reduced by approx. 39,750 yen |

With a down payment of 7 million yen

Monthly repayment: 76,190 yen Annual repayment: 914,280 yen |

Point 2: Points to keep in mind when receiving financial assistance from your parents

You may be receiving financial assistance from your parents when purchasing a house. You can receive financial assistance by "borrowing from your parents" or "receiving a gift from your parents".

When borrowing funds from your parents, it is important to note that in order for the loan to be recognized as a borrowing and not a gift, an IOU must be prepared and the interest rate, repayment method, and other conditions must be the same as those for a loan from a third party, even if the loan is from your parents.

It should also be noted that gifts received from your parents are subject to gift taxation, even if between you and your parents. However, there are cases where tax exemptions are available for gifts received from parents or grandparents, so please check in advance.

When borrowing funds from your parents, it is important to note that in order for the loan to be recognized as a borrowing and not a gift, an IOU must be prepared and the interest rate, repayment method, and other conditions must be the same as those for a loan from a third party, even if the loan is from your parents.

It should also be noted that gifts received from your parents are subject to gift taxation, even if between you and your parents. However, there are cases where tax exemptions are available for gifts received from parents or grandparents, so please check in advance.