What's the difference between a real estate investment loan and housing loan?Some of you may be researching real estate investment and are wondering about the difference between real estate investment loans and housing loans. Real estate investment loans are for the purchase of income-producing real estate for the purpose of earning rental income. A housing loan is only applicable to the property that will become your home. Although they may seem similar, these two loans are completely different financing systems. By knowing the differences, you can choose the right loan for your purpose. In this article, we will introduce the differences between real estate investment loans and housing loans and how to utilize them. The main difference between a real estate investment loan and a housing loan is the purpose of purchasing the property: whether you will rent it to others to earn income or live in it by yourself. Based on this purpose, there are various differences. Let's take a look at the six differences here. Purpose of Loan A housing loan and a real estate investment loan may seem like similar loans when you think of them as being used to pay for the purchase of a property. However, the purpose of using the property for the loan is different. A housing loan is a loan to be used for the purchase or expansion of a home. The purpose of the loan is to cover the cost of the home in which the borrower lives. It cannot be used to cover the cost of purchasing a property for the purpose of renting it out. A real estate investment loan is a loan that is taken out to generate income through real estate investment. When purchasing real estate for profit, you need to take out a real estate investment loan instead of a housing loan. Financial institutions' screening criteria are also based on the intended use of the property. Taking out a housing loan to pay for the purchase of income-producing real estate is a serious breach of contract. Source of Repayment There is a difference between a housing loan and a real estate investment loan in terms of what is used as the repayment source. The repayment source is the money that is used to repay the loan. The source of repayment for a housing loan is generally your monthly salary. In the case of a housing loan, which is a loan for a house, the repayment source is generated from the income from the individual's labor. A housing loan is a loan for personal consumption only. The concept of repayment source is basically the same as other personal loans. In the case of real estate investment loans, on the other hand, the source of repayment is the monthly rental income. In the case of real estate investment loans, which are loans for income-producing real estate, the repayment source is generated from the rental income earned from tenants through rental management. Even if you are an individual investor, it is assumed that you will be running a business called rental management. Loan Amount There is also a difference in the loan amount. The maximum loan amount is higher for real estate investment loans than for housing loans. The difference is whether the loan is for an individual or for a business investor. The maximum loan amount for a housing loan is 5 to 8 times the individual's annual income. In general, the upper limit is 5 to 6 times, but it can be 7 to 8 times depending on the individual's attributes. The maximum loan amount for real estate investment loans is sometimes 10 to 20 times your annual income. The reason for this amount is that not only rental income but also salary income and savings are taken into account. Interest Rates on Loans There is a difference between housing loans and real estate investment loans, not only in the loan amount but also in the interest rate of the loan. The interest rate is usually higher for real estate investment loans than for housing loans. This difference is due to the difference in the risk of loan default. The interest rate on housing loans is about 0.5%~2.0% per year. Salary income will not decrease significantly as long as the individual continues to work. Housing loans that use salary income as the source of repayment can be said to have low interest rates due to the low risk of default. The interest rate for real estate investment loans is about 1.5%~4.5% per annum. If the loan amount is large, the repayment amount will also be large. However, rental income, which is the source of repayment, may not always be constant. Vacancies and declines in rent can occur, increasing the risk of default. For this reason, interest rates tend to be lower on real estate investment loans for properties that are expected to generate stable income. Details of Loan Screening There is a difference in the loan screening process between home loans and real estate investment loans. The difference can be described as whether to look only at the creditworthiness of the individual or also at the profitability of the property. In housing loans, personal attributes are the criteria for loan screening. Attributes are related to an individual's repayment ability and creditworthiness. Specifically, they include annual income, length of service, amount of savings, amount of debt with other companies, and history of financial accidents. In addition to personal attributes, real estate investment loans carefully check the profitability of the property. This includes the area in which the property is built, the age of the property, the rent setting, and the history of past property transactions. The type of property you choose will also affect whether or not you can get a loan. Different financial institutions have different standards for loan screening, so even if you don't pass the screening at one bank, it is possible that you will pass at another bank. Restrictions Housing loans and real estate investment loans differ in whether they can be signed in the name of a corporation or not. The property for which the cost is covered by a housing loan is supposed to be occupied by the contractor. It is a loan for the home and cannot be signed in the name of a corporation. The property you purchase with a real estate investment loan is operated for rental management, where you rent it out to tenants and earn rental income. The loan is for the business of earning real estate income, not salary income, and can be contracted in the name of a corporation. There is also a difference in the age limit of the contractor. For housing loans, the source of repayment is usually salary income. Taking into account the retirement age, the upper age limit is set at about 65~70 years old. In real estate investment loans, the source of repayment is the rental income from rental management. Depending on the profitability of the property and your asset status, you may be able to take out a loan at the age of 70 or older. Will I be able to get a housing loan if I have a real estate investment loan? Let's also look at whether taking out a real estate investment loan will prevent you from getting a housing loan. As mentioned above, real estate investment loans can be as high as 10~20 times your annual income. The state in which you are taking out a real estate investment loan is one in which you have a large amount of debt from other companies. Financial institutions that screen housing loans determine the repayment ability of individuals. The general perception may be that you are likely to fail the loan screening process because you are already approaching the upper limit of your repayment capacity. It is not easy to get a loan approval, but it is possible to get a loan depending on the conditions. The maximum amount for a home loan is 5 to 8 times your annual income. Within this amount, as long as the repayment ratio of the two loans combined is not too large, you can get a loan. The repayment ratio is the ratio of annual repayment amount to annual income. Some financial institutions consider real estate income to be combined with salary income. Although there are no fixed standards for loan screening, the larger your real estate income, the more favorable your loan screening will be. Which should you buy first, your home or your investment property? If you want to get both a real estate investment loan and a home loan, which one should you get first? There could be a scenario where a person earns a profit from real estate investment and makes a good living, but lives in a rental house because he or she cannot get a housing loan. It is only theoretical, but in conclusion, it is more effective to take out a real estate investment loan first. When you take out a real estate investment loan to purchase income-producing real estate, you will receive rental income. Many financial institutions consider this income as annual income. Increasing your annual income will also lead to a higher maximum loan amount. Buying income-producing real estate means that the maximum housing loan amount will naturally increase. On the other hand, if you take out a housing loan first, the loan amount for your real estate investment loan will be diminished because of the pressure on the loan amount. However, it is difficult to say for sure, as each financial institution has a different approach to screening, and whether or not a loan will be approved depends on the individual's financial situation. If you are considering purchasing a house, it is recommended that you inform the person in charge of sales of your ideas. Can I buy an investment property with a housing loan? Some people may wonder if it is possible to buy an income-producing property with a housing loan. As we have mentioned, a housing loan is a loan for a property as a home. Basically, you cannot purchase income-producing real estate with a housing loan. There are special cases in which a property purchased for one's own living purpose is consequently rented out to others. However, it is a breach of contract to use a housing loan even though you are supposed to be investing in real estate. The financial institution checks for this breach of contract even after the purchase of the property. If you are found to have violated the contract, it is customary to pay the remaining balance in a lump sum. In the worst case, you may be charged with fraud, so be careful. Why some people try to invest in real estate using a housing loan

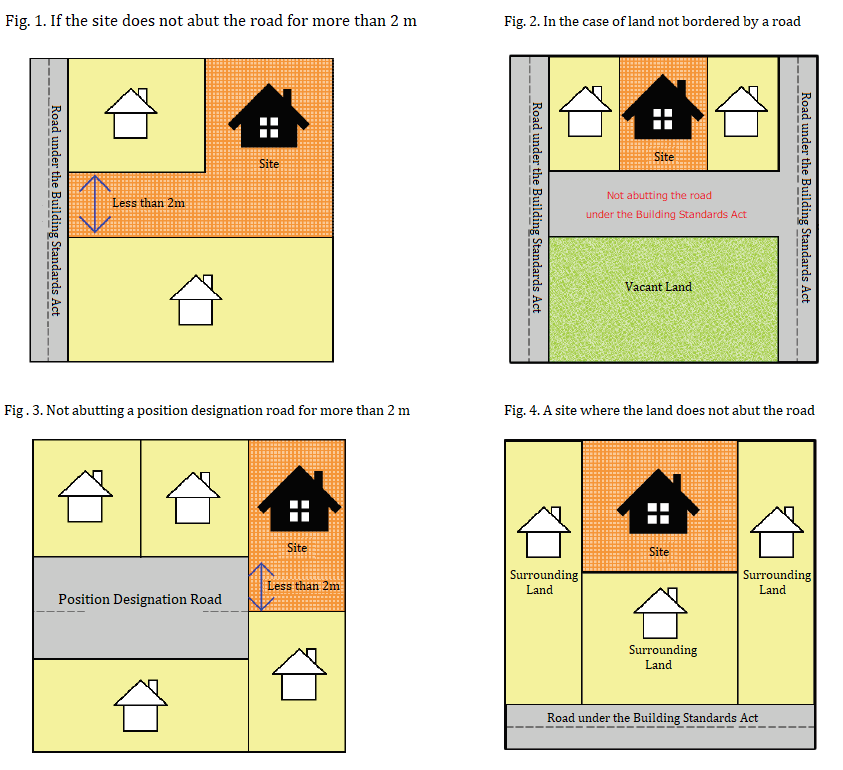

A housing loan is a loan for a property for your home. Despite knowing this, there are still people who try to invest in real estate using housing loans. The interest rates for housing loans are variable and range from 0.5% to 2.0% per year. Compared to real estate investment loans, where annual interest rates range from 1.5% to 4.5%, interest rates are low and screening standards are said to be relatively loose. If you look only at the basic terms and conditions of the loan, such as interest rate and approval, housing loans are more advantageous. For these reasons, many people want to use housing loans for income-producing real estate. However, borrowing a loan from a financial institution under the guise of a housing loan and using it for real estate investment is, of course, illegal. Even if the loan is approved, you may be asked to repay the loan in full if the forgery is discovered. Even if you are recommended by a real estate agent, do not go ahead with it. Can't borrow even if you have the income and ability to repay the loan? 4 Patterns that prevent you from getting a mortgage on an existing home purchaseRising land prices and building costs have caused the price of new properties to rise. As a result, used homes are attracting attention. Renovation properties", which renovated used homes to be more stylish and functional than new homes, have become popular, and the number of people considering the purchase of used homes is increasing. Incidentally, renovation is a type of reform, which means to renovate an existing home to have better performance than when it was new. Nowadays, there are mortgage loans that can be borrowed together with the cost of renovation, so if you are thinking of buying and renovating an existing house, if you do the renovation at the same time of purchase, you can borrow a mortgage to combine the cost of purchase and renovation of the house. Many people know that in order to take out a mortgage loan, you need to have a certain income and the ability to repay the loan. But did you know that there are cases where you can't get a mortgage even if you have the income and the ability to repay the loan? That's what we call an "Existing Home with No Mortgage Available". Why can't I get a mortgage?When financial institutions provide mortgage loans, they screen the "person" and "property". The "person" screening is based on the applicant's income, place of employment, and whether or not he or she has any other loans, and whether or not he or she will be able to repay the mortgage without delay. On the other hand, the screening for "property" is based on whether the property is worth lending money to. Mortgages are lent against the property (land or building) that the loan recipient is purchasing. Simply put, if the borrower is unable to repay the loan, the financial institution will sell the property and use the proceeds to repay the loan. However, in some cases, financial institutions do not recognize the value of the collateral and will not lend the mortgage even if the loan applicant's ability to repay the loan. A "financial institution does not recognize the value of the collateral" means that even if you try to sell it, a buyer cannot be found, or even if you can sell it, it was judged that you cannot collect the loan. If you consider a house to be an asset, you should not buy a property that you cannot get a mortgage loan for. So, what kind of property is such a mortgage loan not available? <Case 1> Leasehold houses and houses with fixed term leasesA leasehold is simply "the right to rent someone else's land and build your own building on that land". A fixed term land lease is a tenancy for a fixed period of time (generally 50 years or more), and the principle is that after the term expires, the building is demolished and the land is cleared and returned to the owner. Although it is necessary to pay the deposit and the monthly ground rent at the time of a contract, since the land rent is not included, it seems to be a case where it can be purchased at about 40-50% of a general house. However, it can be difficult to get a mortgage loan because the ownership of the land does not belong to the person who bought it and financial institutions cannot use the land as collateral. Some financial institutions make it clear that they will not handle leasehold or fixed-term leasehold homes. However, it is common for new condominiums for sale to have an affiliated loan, so you can get a mortgage. <Case 2> Housing built in an urbanization control areaThe house can be built in the area that corresponds to the "urbanization area" defined by the city planning law. Although "the urbanization control area" has a name similar to this, it is the area where urbanization must be controlled, that is, urbanization must be suppressed, and a general house cannot be built in principle. In fact, some people have built their houses and are living in them even before they were set up in the urbanization control area. The house built in those urbanization control areas can be purchased, but the borrowing of the mortgage becomes difficult. In addition, the relief measure "the existing housing site" which permits building exceptionally, such as the person who lived before it is set up in an urbanization control area, also exists. <Case 3> Reserved land for land readjustment projectsLand readjustment projects are "projects to improve public facilities such as roads, parks and rivers, and to demarcate land in order to improve the use of residential land. In some cases, land owners have to bear the costs of land readjustment projects, but in such cases, the land owners do not bear the costs in monetary terms, but rather the land owners within the area gradually pool their land to establish a reservation, which is then disposed of and used to cover the project costs. Some financial institutions do not offer mortgages for the purchase of this reservation land for the land rezoning project. However, some financial institutions do sell "reservation loans" specifically for reservation land, so please consult with your financial institution on an individual basis. <Case 4> Property that cannot be reconstructedA property that is designated as non-reconstructable cannot be "rebuilt". There are several reasons for being designated as non-reconstructable, but the most common is a case of violating the "duty of access". So, what is the duty of accessibility? The Building Standards Act basically dictates that the land on which a construction site is to be built must abut a road that is at least 4 meters wide and at least 2 meters long. When this regulation is established, the building that has already been built cannot be demolished because "it is in violation", so the building remains as it is, but "rebuilding" is not allowed, which is a property that cannot be rebuilt. If the streets are narrow, the possibility of the fire spreading increases, so it is also meant to strengthen the fire prevention system. In some old streets, buildings are crowded at both ends of narrow streets, or houses are built in alleys and corridors from the street. The above are the main, when buying real estate, the mortgage is not available, and even if it is available, the collateral valuation is low.

When buying the real estate which exists in these cases, there are cases where the method of payment is limited to cash. Let's confirm whether it does not fall under the above beforehand, and try to make a smooth transaction. There are many properties that cannot be rebuilt in Kyoto. It's a term we don't often hear in other cities, but we'll explain the non-rebuildability and talk about the advantages and disadvantages of each. A "non-rebuilding" property is literally a property that cannot be rebuilt in the future once the building is demolished. For example, if the width of the access road (the part where the road meets the site) is less than 2 meters, it is not possible to re-build. It is also not possible to re-build if it only abuts a road that is not recognized as a road under the Building Standards Act. This is because it would not meet the "duty of accessibility" set forth in Article 43 of the Building Standards Act. If it does not abut the road, for example, in the event of a fire, the fire engines may not be able to do enough to put out the fire. The same is true when an ambulance is called. In other words, this law is about ensuring the safety of the residents. On the other hand, if it is a road under the Building Standards Act, it means that the private road also fulfills the duty of connecting. A non-rebuildable property is a land that is handicapped, which means that it can be remodeled but cannot be rebuilt. As a result, prices are often set low and you may find it advantageous. This is clearly stated in the real estate advertisement for non-rebuildable properties, so be sure to check the content of the advertisement carefully and be careful not to say "I could buy the land cheaply, but could not build it!". Advantages of non-rebuildable property

1: Price is low The inability to reconstruct means that the value of the land and the value of the property are very low, so you can buy much cheaper than comparable properties in the neighboring area. 2: Remodeling and renovation are possible It cannot be rebuilt, but large-scale reforms and renovations are possible. 3: Property tax is cheap Due to the low asset value, the property tax valuation is also set low. Therefore, the property tax, city planning tax, inheritance tax, and gift tax calculated based on the property tax valuation are also cheaper. Disadvantages of non-rebuildable properties 1: Cannot be rebuilt After all, this disadvantage is the biggest. For example, if those properties destroyed by an earthquake, you can no longer build buildings on that land. 2: Cannot use mortgage The collateral value is also very low and you cannot buy it using a mortgage. In other words, you have to make a one-time payment in cash. Note that some financial institutions may be able to use the loan, but interest rates will be considerably high. 3: Difficult to sell Due to restrictions, it may be difficult for buyers to find it even if they are put on sale. In addition, because the mortgage is not available, it is difficult to sell because it is limited to buyers who can buy cash. Will non-rebuildable property be covered by fire insurance? There is no reason why you cannot take out fire insurance because it cannot be rebuilt. Basically, if you have a building, you can get fire insurance. In addition, premiums will not be expensive because they cannot be rebuilt. Because the purpose of fire insurance is not just for rebuilding. You will also be paid to cover expenses such as repairs. If it is completely destroyed by an earthquake or the like, there is a risk that it will not be possible to rebuild even if there is an insurance premium. However, depending on the degree of damage, it may be possible to fully repair it with insurance money, so it is important to be prepared in case of emergency. Let's say you buy a property for 10 million yen and have 10 million yen in fire insurance and 5 million yen in earthquake insurance. If your home is completely destroyed due to an earthquake instead of a fire, you will receive an insurance benefit of 5 million yen. In this way, non-rebuildable properties have different characteristics from ordinary properties, so it is necessary to know in advance when considering purchasing. |

Details

AuthorArrows International Realty Corp. Archives

June 2023

Categories

All

|

RSS Feed

RSS Feed