|

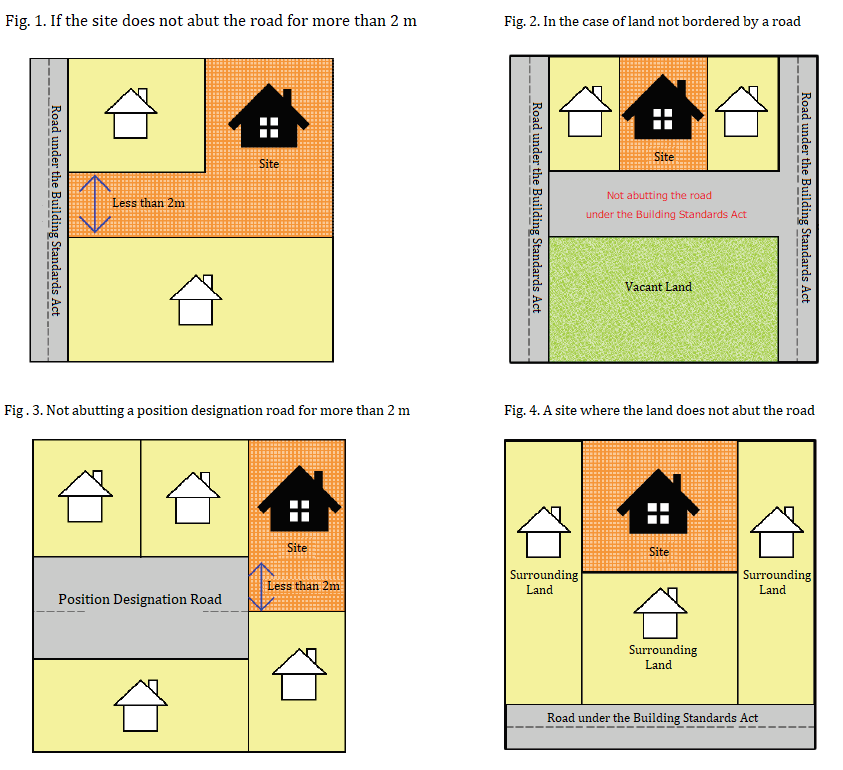

There are many properties that cannot be rebuilt in Kyoto. It's a term we don't often hear in other cities, but we'll explain the non-rebuildability and talk about the advantages and disadvantages of each. A "non-rebuilding" property is literally a property that cannot be rebuilt in the future once the building is demolished. For example, if the width of the access road (the part where the road meets the site) is less than 2 meters, it is not possible to re-build. It is also not possible to re-build if it only abuts a road that is not recognized as a road under the Building Standards Act. This is because it would not meet the "duty of accessibility" set forth in Article 43 of the Building Standards Act. If it does not abut the road, for example, in the event of a fire, the fire engines may not be able to do enough to put out the fire. The same is true when an ambulance is called. In other words, this law is about ensuring the safety of the residents. On the other hand, if it is a road under the Building Standards Act, it means that the private road also fulfills the duty of connecting. A non-rebuildable property is a land that is handicapped, which means that it can be remodeled but cannot be rebuilt. As a result, prices are often set low and you may find it advantageous. This is clearly stated in the real estate advertisement for non-rebuildable properties, so be sure to check the content of the advertisement carefully and be careful not to say "I could buy the land cheaply, but could not build it!". Advantages of non-rebuildable property

1: Price is low The inability to reconstruct means that the value of the land and the value of the property are very low, so you can buy much cheaper than comparable properties in the neighboring area. 2: Remodeling and renovation are possible It cannot be rebuilt, but large-scale reforms and renovations are possible. 3: Property tax is cheap Due to the low asset value, the property tax valuation is also set low. Therefore, the property tax, city planning tax, inheritance tax, and gift tax calculated based on the property tax valuation are also cheaper. Disadvantages of non-rebuildable properties 1: Cannot be rebuilt After all, this disadvantage is the biggest. For example, if those properties destroyed by an earthquake, you can no longer build buildings on that land. 2: Cannot use mortgage The collateral value is also very low and you cannot buy it using a mortgage. In other words, you have to make a one-time payment in cash. Note that some financial institutions may be able to use the loan, but interest rates will be considerably high. 3: Difficult to sell Due to restrictions, it may be difficult for buyers to find it even if they are put on sale. In addition, because the mortgage is not available, it is difficult to sell because it is limited to buyers who can buy cash. Will non-rebuildable property be covered by fire insurance? There is no reason why you cannot take out fire insurance because it cannot be rebuilt. Basically, if you have a building, you can get fire insurance. In addition, premiums will not be expensive because they cannot be rebuilt. Because the purpose of fire insurance is not just for rebuilding. You will also be paid to cover expenses such as repairs. If it is completely destroyed by an earthquake or the like, there is a risk that it will not be possible to rebuild even if there is an insurance premium. However, depending on the degree of damage, it may be possible to fully repair it with insurance money, so it is important to be prepared in case of emergency. Let's say you buy a property for 10 million yen and have 10 million yen in fire insurance and 5 million yen in earthquake insurance. If your home is completely destroyed due to an earthquake instead of a fire, you will receive an insurance benefit of 5 million yen. In this way, non-rebuildable properties have different characteristics from ordinary properties, so it is necessary to know in advance when considering purchasing. Comments are closed.

|

Details

AuthorArrows International Realty Corp. Archives

June 2023

Categories

All

|

RSS Feed

RSS Feed