Dealing with Problems Related to Defects in the Property after Moving inAfter purchasing a house, troubles over defects in the property may occur. In order to deal with such problems properly, it is important to have a good understanding of the contents of the sales contract, as well as the related legal system, insurance, after-sales service, warranty system, etc. Point 1: Meaning and Duration of Liability for Contractual Nonconformity When there is a defect in the purchased house, such as a leak or corrosion caused by ants, it was previously called a "defect," and the seller's liability for such defects was called "defect liability. However, the amendment to the Civil Code, which came into effect on April 1, 2020, has substantially revised not only the name of this liability but also its content. The revised Civil Code is based on the premise that the seller is obligated to deliver a property that conforms to the terms of the contract with respect to "type, quality, and quantity" of the subject property of the sale, and if the seller delivers a property that does not conform to the terms of the contract with respect to those items, the seller's liability will be default liability. For example, if the seller delivers a building that leaks or is corroded by white ants, he is in default of his obligation to deliver a property that conforms to the terms of the contract with respect to quality. When there is such a nonconformity in the subject matter of the contract (the object), the buyer can demand that it be repaired, and when the seller does not do so even after such a demand, or when the repair itself is impossible, the buyer can demand a reduction of the purchase price. In addition, under the general principle of default, a claim for compensation for damages can be made, and the contract can be terminated. However, compensation for damages cannot be claimed if the seller is not responsible in any way. Cancellation is also not allowed when the nonconformity is minor. Regarding the period during which the seller must assume this responsibility, the Civil Code considers it unreasonable for the seller to assume responsibility for nonconformity for a long period of time and, because it is appropriate to resolve disputes arising from sales as early as possible. The buyer must notify the seller within one year from the time when he/she becomes aware of the nonconformity. Special arrangements This provision of the Civil Code is an optional provision, meaning that it can be changed or modified at will, so another provision (covenant) can be made by a special agreement between the parties. Particularly in the case of existing houses (used houses), it is very difficult or impossible to determine whether a certain result or other event constitutes nonconformity to the contract due to age-related deterioration, natural wear and tear, etc. Therefore, in general transactions, the scope of the seller's liability is specified or the period of liability is shortened. In some cases, there may be a covenant that the seller is not liable at all. Even in such cases, the seller is not exempt from liability if he knew of the nonconformity and did not inform the buyer of it, but otherwise he is exempt from liability as per the covenant. When a real estate company is the seller In cases where a real estate agent is the seller and the buyer is not a real estate agent, a covenant under the Real Estate Brokerage Act to the effect that the seller is liable for non-conformity to the contract only if the seller is notified within two years of the date of delivery is valid. However, other covenants that are more disadvantageous to the buyer than the provisions of the Civil Code, such as "limited to a claim for repairs" or "the contract can be terminated only if the seller approves", are invalid. When the seller is a corporation and the buyer is an individual consumer When the seller is a corporation and the buyer is an individual consumer, all legal entities such as corporations, even if they are not real estate companies, are "corporations" under the Consumer Contract Act. In a contract in which a corporation is the seller and sells to an individual consumer, a contract clause stating that "the corporation shall not be liable for nonconformance with contract" is considered invalid under the Act. (1) The legal system for liability for defects of newly built houses In the case of a newly built house, the following laws protect the buyer. Even if the seller is bankrupt or the seller does not have the resources to pay for damages, the necessary expenses will be paid through insurance or warranty refund.

Under the Housing Quality Assurance Law, the seller, etc. who has delivered a newly built house is obligated to assume liability for defects* concerning the major structural components of the house (foundation, foundation, columns, diagonal materials, etc.) and the parts that prevent rainwater infiltration (roof, exterior walls, doors of openings, etc.) for 10 years after the delivery. Therefore, for these defects, it is possible to claim for repair of the property, compensation for damages, or cancellation of the contract (cancellation of the contract is limited to sales contracts and serious defects) for 10 years after the delivery. *The Law, even after the revision of the Civil Code, refers to contractual nonconformity as "defects."

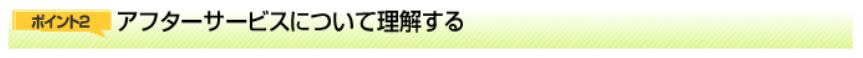

Under the Housing Defects Liability Enforcement Law, the seller of a newly built house is obligated to "purchase insurance" or "deposit a security deposit" to ensure that the seller is liable for defects*. Under this system, even if the seller becomes unable to assume liability for defects due to bankruptcy or other reasons, the seller is required to fulfill its liability to consumers through insurance or a deposit of security money deposited in advance. *The Housing Defects Liability Enforcement Law and the Civil Code, since amended, still refer to contractual nonconformity as "defects." (2) Points to keep in mind concerning used houses In the case of a used house, there is no system like that of a newly built house, so the seller's liability for defect warranty is based on the contract. If the seller is a real estate company that is a registered real estate broker, it is liable for non-conformity to the contract for at least a certain period of time, but if the real estate company goes bankrupt, etc., it is highly likely that the seller will not be able to seek repair or other measures. In addition, if the seller is an individual, there are many contracts that shorten the period of liability for non-conformity to the contract. Therefore, in the case of used properties, it is important to thoroughly check the property before signing a contract to identify any defects in advance. For this reason, recently, due in part to the revision of the Real Estate Brokerage Act, there has been an increase in the number of cases where inspections (building condition surveys) are requested to check the building condition in advance. Point 2: Understanding after-sales service In newly built houses*, apart from contractual non-conformity liability, the seller company may provide a voluntary after-sales service to repair certain defects free of charge. Each company has its own standards regarding the types of defects covered by the after-sales service and the duration of the service. For example, leaks and rainwater leaks involving basic structural components, cracks and damage affecting structural strength, etc., have a 10-year period, the same as under the Housing Quality Assurance Law while damage to walls and malfunctioning equipment often have a 2-5 year period. Recently, some new houses have after-sales service periods of more than 10 years, so it is important to confirm the existence of an after-sales service system and the details of such a system. *In the case of existing homes, some brokerage firms may offer their own after-sales service, such as repairing certain defects. When selecting a real estate company, be sure to ask about the availability of warranties. Examples of after-sales service standards (The Japan Association of Realtors) If any of the ancillary equipment in the newly built house has specified maintenance products as stipulated in the Consumer Products Safety Act, the owner's information should be registered with the manufacturer, etc. immediately after the delivery of the house. In the case of an existing house, if there are specified maintenance products stipulated in the Consumer Products and Product Safety Law in the ancillary equipment you have taken over, provide or change the owner information to the manufacturer, etc. You will receive product safety notices such as inspection notices and recalls. Point 3: Difference between liability for noncompliance with the contract and after-sales service Liability for non-conformity to the contract is a liability stipulated by law, while after-sales service is just a voluntary service provided by real estate companies and others as part of their consumer services. Although both share the same objective of consumer protection, it is important to note that the subject matter and period of liability are different. Liability for nonconformity to the contract is limited to "nonconformity of the property to the contract at the time of the transaction." In general, the period for which the seller is liable is specified in the contract. In addition, the Housing Quality Assurance Law provides for a 10-year warranty period from the date of delivery for newly built houses that have defects in major structural components. In contrast, the after-sales service covers "certain defects specified in the contract" and is not limited to nonconformity with the contract. In addition, the after-sales service is not limited to major structural components as stipulated in the Housing Quality Assurance Act, but may also cover fittings and equipment, etc. The scope and period of after-sales service are defined by each contract, so it is important to understand the details of the after-sales service. Point 4: Insurance programs for contractual nonconformity liability *The term "defect" here refers to "non-conformity to contract regarding type or quality" under the revised Civil Code, and the term "liability for defects" will remain in relation to this system even after the Civil Code is revised. Under the Housing Defect Liability Insurance system, the seller of a newly built house, such as a real estate company, concludes an insurance contract with a housing defect liability insurance company to cover the cost of repairing defects in the event that they are found in the house. If the seller is bankrupt and cannot repair the defects, the buyer can claim the cost of repairing the defects (insurance money) directly from the housing defect liability insurance corporation. How the insurance works Housing defect liability insurance available for used homes The Existing Home Sales Defects Insurance is a liability insurance program available for existing homes. This insurance is an insurance program that includes an inspection of the existing house and a warranty. The basic performance of the house must pass an inspection by a professional architect. If the seller, a real estate company or an individual, has this insurance, repair costs and other insurance benefits will be paid to the real estate company, inspection agency, or other business (or to the buyer if the business goes bankrupt, etc.) even if defects are found in the used house that has been sold (flood, typhoon, earthquake, eruption, tsunami, fire, white ant insect infestation, natural wear and tear, and improper use of the home are not covered by the policy).

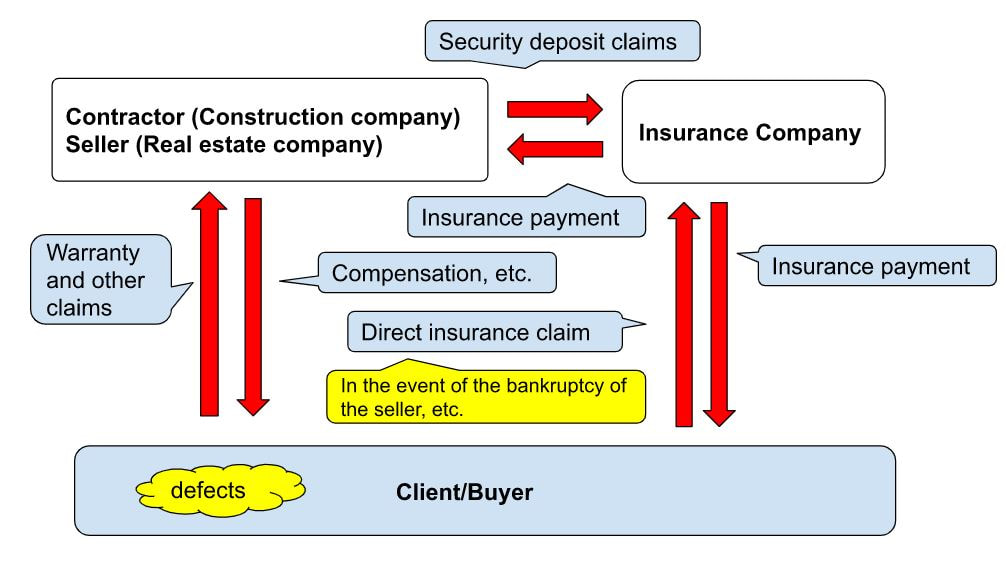

Procedures for the Mortgage Tax Credit Programf you purchase a house using a mortgage loan, you may be eligible for the mortgage tax reduction program (generally known as the "mortgage deduction"). However, there are certain conditions regarding the purchased home and loan that must be met in order to be eligible for the program, so be sure to check them carefully. Point 1: System Overview and Tax Returns If you use a mortgage loan to build or acquire a house (including the land acquired together with the house) or to make certain additions or renovations, a certain amount calculated based on the year-end loan balance will be deducted from your income tax and inhabitant tax. However, in order to receive the deduction, both company employees and self-employed persons must apply for the deduction on their tax returns. For company employees, a tax return must be filed for the first year, but from the second year onward, a refund can be received through the year-end adjustment at the employer. Point 2: Mortgage Deduction Procedure Flow and Required In order to receive the mortgage deduction, you must file an income tax return in the year following the year you move in and submit documents such as a withholding tax certificate (for company employees) and a copy of your residence certificate. In addition, a statement of calculation must be prepared when filing the return, so please obtain and confirm your tax return and other documents as soon as possible. Documents required for mortgage deduction and where to obtain them

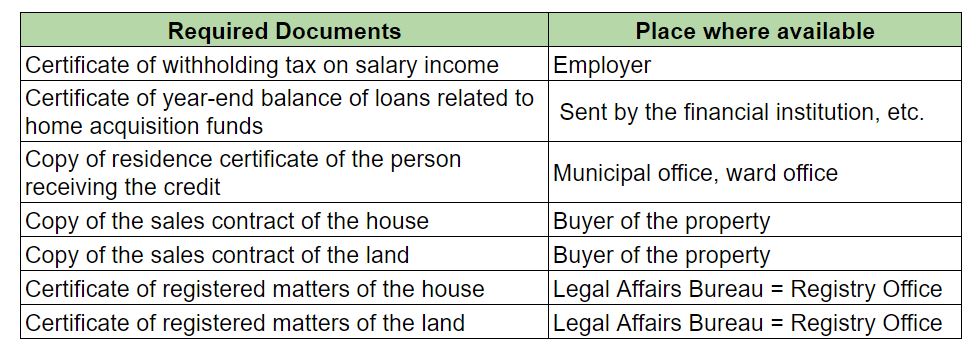

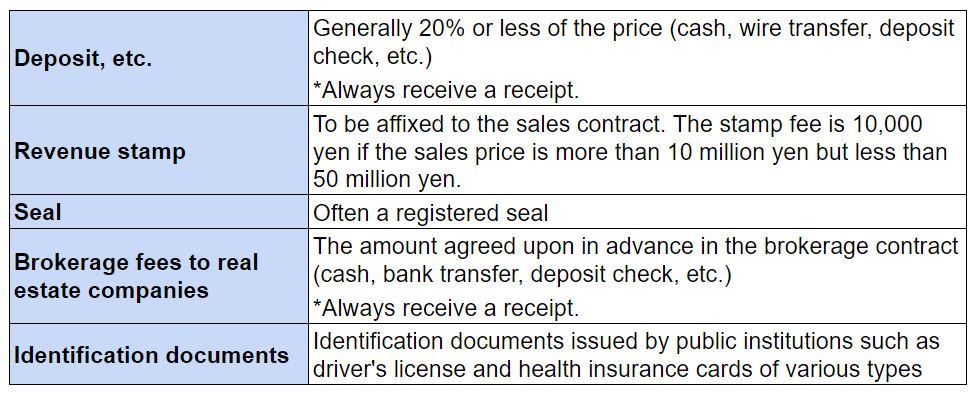

Important Points to keep in mind until moving in.After signing the contract, you should know about the points to check and the process of delivery. Point 1: Pre-move-in viewing to check the finish. Newly built houses In the case of a newly built house, a preview is held to check the finishes of the completed house before delivery. Here are two points to check. The first thing to check is that the finishes are in accordance with the contract and specifications. Make sure that the interior materials, fittings, housing equipment, etc. are in accordance with the contract. Next, check the "state of finishes. Check to see if the fittings open and close smoothly, if the edges and joints of the walls, flooring, ceilings, etc. are properly treated, and if there are any scratches. If any defects are found, request that they be repaired before the delivery. If there are no problems, the preview ends with the signing and sealing of a document stating that you have checked the condition of the house and its finishes. However, once you have signed and sealed the document, responsibility for any problems that may be pointed out afterwards tends to become ambiguous. Before signing and sealing the documents, make sure to check them thoroughly at the preview. Existing houses In the case of an existing house, in some cases, the seller or the real estate company will be present to check the site before the delivery date. Make sure that the condition of the property is in accordance with the terms of the contract, such as whether the promised repairs, etc. have been completed and whether there are any incidental facilities that are to be taken over. If the seller has given you a notice (report on ancillary facilities and property condition), check based on it Point 2: What if there is a delay in moving or some other discrepancy with the terms of the contract? It is possible that the construction period will be extended and the property will not be completed by the delivery date, that the seller who is residing in the property delays moving out, or that the vacating of the property is delayed due to the delay in the vacating process of the property where the tenant is moving, etc., In such cases, the property will not be delivered according to the contract. As a buyer, you will be in trouble as well, as you have already made arrangements to move out and have a fixed date to vacate the rental housing in which you are living. Thus, if delivery cannot be made by the date agreed upon in the contract and there is no prospect of delivery at all, one option would be to claim cancellation of the contract on the grounds of the seller's default of contract (breach of promise). If you find that the seller is in default (not executing the contract), not limited to a delay in delivery, you need to determine whether the seller is likely to be able to execute what was promised in the contract and whether the other party is responding in good faith, and then decide whether to take practical measures such as postponing delivery or canceling the contract. On the other hand, if there is a slight delay in delivery, measures such as compensation for expenses incurred due to the delay in delivery may be considered. First, consider how to respond to the situation with the real estate company. Point 3: Settle the balance at the time of delivery Upon delivery, the buyer prepares the balance due, various expenses, and necessary documents. Before the time of delivery, please check with the real estate agency to ensure that nothing has been left out. Items to be provided by the buyer at the time of delivery (1) Examples of money to be prepared

(2) Examples of required documents to be prepared

If the remaining balance is to be covered by a mortgage, preparations for loan execution should not be neglected. The seller, buyer, real estate company, financial institution representative, judicial scrivener, and other related parties will be present at the delivery of the property. Then, generally, the loan is executed, the balance is settled, and application for registration (cancellation of the seller's mortgage, transfer of ownership from the seller to the buyer, and establishment of the buyer's mortgage) are made at the same time. If any one of these procedures is incomplete, there is a risk that the settlement of the balance and delivery of the property will not be completed, so it is important to pay close attention to these procedures. After the settlement of the balance is completed, the buyer will receive the keys and the delivery will be completed. Settlement and Delivery Process

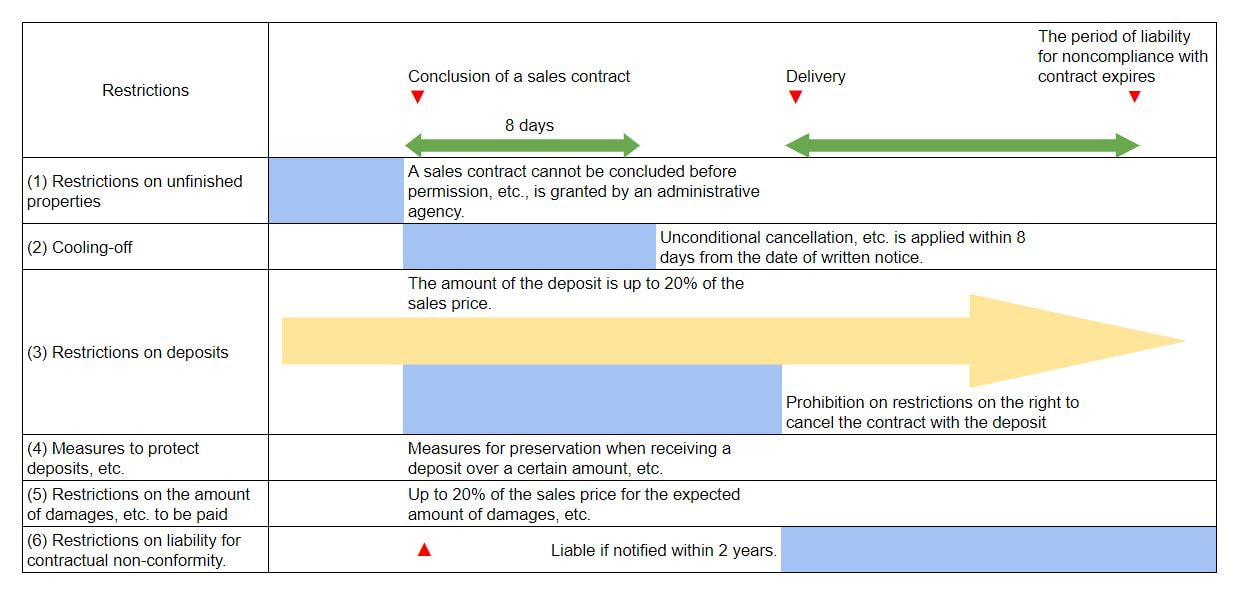

Regulations When the Seller Is a Real Estate AgentWhen a real estate company (real estate agent) is the seller, the following restrictions are set in the sales contract. (1) Restrictions on contracts for properties that have not yet been complete Permission or confirmation, etc. (hereinafter referred to as "permits, etc.") from an administrative agency is required for the creation of land or construction of buildings above a certain size. Without these permits, land cannot be developed or buildings cannot be constructed. Therefore, a real estate company (real estate agent) cannot conclude a sales contract for an uncompleted property for which land development or building construction has not yet taken place prior to obtaining the permits, etc. from the administrative agency. When conducting sales and purchases of uncompleted newly built properties for sale, confirm that permits, etc. are in place. (2) Cooling-off When a real estate company (real estate agent) is the seller, cooling-off (unconditional cancellation of contract, etc.) is applicable to the buyer if certain conditions are met. The requirements are as follows. Check whether the cooling-off is applicable to your contract.

(3) Restrictions on deposits When a real estate company (real estate agent) receives a deposit, the following restrictions apply, so please make sure to check them carefully.

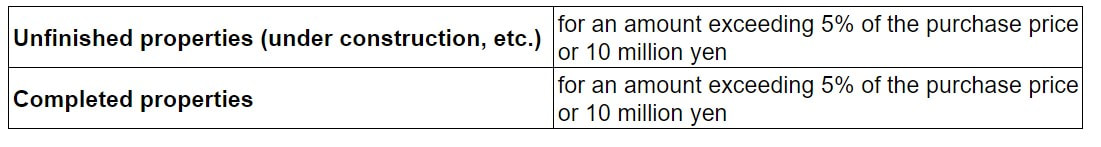

(4) Protection of deposits, etc. When a real estate company (real estate agent) receives a deposit or a portion of the sales price (hereinafter referred to as "deposit, etc.") exceeding a certain amount at the time of concluding a sales contract, the company must take measures to protect the deposit, etc. The security measures are a guarantee by a bank or a guarantee company, etc., or insurance by an insurance company. This means that even in the unlikely event that the real estate company (real estate agent) goes bankrupt, the deposit, etc. paid at the time of signing the contract will be returned. Check to see if the amount of the deposit, etc. to be paid is covered by the protection measures. The amount of deposit, etc. subject to protection *For an amount that is not listed above, the protective measures are optional. (5) Restrictions on the amount of scheduled compensation for damages A real estate company (real estate transaction agent) may not conclude a contract in which the total amount of the penalty or scheduled amount of compensation for damages in the event of a breach of contract exceeds 20% of the sales price. If this is violated, the portion exceeding 20% will become invalid, and the total amount of the penalty and scheduled amount of compensation for damages will be 20% of the sales price. (6) Limitations on provisions regarding liability for non-conformity to the contract Even if a real estate company (real estate agent) makes a provision less favorable to the buyer than the provisions of the Civil Code regarding liability for non-conformity to contract, the provision will be invalid. However, a provision stating, "We will assume responsibility only if we are notified within two years from the date of delivery. is valid, although it is less favorable to the buyer than the provisions of the Civil Code. In case the provision is invalid, the principle provisions of the Civil Code will be applied. Regulations when the seller is a real estate agent In case the property is a newly built house

The seller of a newly built house must assume liability for defects (liability for nonconformity to the contract) of the main structural parts (foundation, pillars, roof, exterior walls, etc.) for at least 10 years from the date of delivery. If the property to be purchased is a newly-built house, please confirm the period and details of the liability for defects carefully. In order to ensure the fulfillment of liability for defects, the seller is obliged to subscribe to insurance or deposit a security deposit. It is important to confirm what measures will be taken for the new house you are planning to purchase. Points to Check When Concluding a Sales ContractSince a real estate sales contract is a major transaction involving high-value assets, a written contract is generally prepared and exchanged. The Real Estate Brokerage Act also obliges real estate companies (real estate agents) to deliver a document describing the contents of the contract without delay after the contract is concluded, with the real estate agent's name and seal affixed. The revised part of the Real Estate Brokerage Act of the Digital Improvement Act took effect on May 18, 2022, making the seal of a real estate transaction agent unnecessary when a paper document is delivered upon conclusion of this contract, and also making it possible to provide the document digitally. This section describes the main points that should be confirmed in a sales contract. There are, of course, other points that should be confirmed, so if you have any questions, be sure to check with your real estate agent until there is no uncertain points left. Point 1: What to check in a sales contract The following is a list of common items in a sales contract and points to be checked. However, keep in mind that the details of the contract and the points to be checked will vary depending on the individual contract. (1) Description of the property for sale Check for any errors in the description of the property to be purchased. Generally, the property is indicated in the contract based on the registration record (registry). It is a prerequisite of the sales contract that the property to be sold or purchased is clearly defined. (2) Sales price, amount of deposit, and payment date Confirm the amount of the sales price, deposit, etc. and the date of payment. Note that failure to pay by the due date may constitute a breach of contract. Also, carefully check the handling of the deposit. Confirm what kind of deposit (cancellation deposit, deed of promise, or penalty deposit) it is and whether the amount is appropriate (approximately what percentage of the purchase price it is). If the deposit is a cancellation deposit, check how long it is possible to cancel the contract. If there are any concerns about the seller's credibility, the buyer should proceed with caution when paying a large deposit or other such payment. (3) Actual measurement of land and settlement of land price The area of land may differ from the area indicated in the registration record (registry) to the actual area. Therefore, the seller often measures the actual area of the land before delivery. If, as a result of the actual measurement, the area of the registration record (registry) differs from the area actually measured, the sales price may be settled according to the difference in area. (It is also possible to only take the actual measurement and not to settle the price.) Generally, the settlement of the sales price is made using the unit price per square meter based on the original sales price and the original sales area (the area on the registration record (registry)). (4) Transfer of ownership and delivery Confirm the timing of transfer of ownership and delivery. Check if there are any problems based on the schedule for moving, etc. While the transfer of ownership and delivery take place in exchange for payment of the price, in practice, real estate transactions are often completed when the documents necessary for the registration of transfer of ownership and the keys are handed over to the buyer at the place of payment. (5) Transfer of auxiliary facilities, etc. In the case of an existing house, it is necessary to clarify the transfer of facilities such as interior lighting and air conditioning, as well as garden trees and garden stones on the premises. Troubles surrounding the taking over of such auxiliary facilities and equipment are surprisingly common, so it is necessary to fully discuss with the seller what will be taken over and what will be removed prior to signing the contract. It is also important to confirm in advance the condition of the equipment to be taken over, including whether it is in disrepair. When signing a contract, it is common to check each item of equipment one by one using a list of ancillary equipment, etc. (The list used confirm the conditions of the ancillary equipment is called a "notice" or "property condition report.) (6) Discharge of Burdens Confirm that the property to be purchased will be acquired with full title. For example, the property with any rights that would prevent the full exercise of ownership, such as mortgages or leasehold rights, will be delivered with the seller's responsibility to remove such rights. Note that if the property is delivered without such rights being removed, it may not be available for use as planned after purchase. In the sale of investment properties, it is often the case that the property is occupied by tenants, in which case only the lease agreement with the tenants will be taken over by the buyer. In this case, it is necessary to clarify the rights to be taken over and the rights not to be taken over. (7) Settlement of taxes and public dues, etc. In a real estate sales contract, it is common for the seller and buyer to settle taxes and public dues such as fixed property tax and city planning tax. In addition, other expenses such as management fees may also be settled. Settlements are often made on a pro-rata basis based on the date of delivery. Settlement fees such as these are also required separately from the sales price, so it is important to confirm the details. (8) Cancellation by forfeit Since the contract may be cancelled due to some unforeseen circumstances, the parties concerned should confirm what kind of arrangements are in place for cancellation by forfeit. Of course, by agreement between the parties, it is possible to make a contract that does not allow for the release of a deposit, or to limit the period during which the deposit can be released. The amount of the deposit is generally set within the range of up to 20% of the purchase price. If the deposit is small, the burden is small when you cancel the contract, but the risk of cancellation by the other party is high. On the other hand, if the deposit is large, the risk of cancellation by the other party is low, although the burden is greater when you terminate the contract. Be sure to check the amount of the cancellation deposit as well. (9) Loss or damage to the property prior to delivery (burden of risk) This is an arrangement in the event that the property to be purchased is lost or damaged after the conclusion of the sales contract for reasons for which neither the seller nor the buyer is responsible, such as the total destruction of the building due to a natural disaster. In a real estate transaction, the seller generally restores the property before handing it over. However, if the restoration of the property will cost an excessive amount of money, or if the buyer cannot achieve the purpose of the contract because the property has been lost or damaged (for example, it cannot be restored to a livable condition), the contract can be terminated unconditionally. This is an arrangement in case of emergency, so be sure to check it carefully. (10) Cancellation for breach of contract except for nonconformity This is an arrangement for canceling a contract due to breach of contract (i.e., breach of promise, which is legally called "default"). If either the seller or the buyer is in default, the other party can cancel the contract. If the contract is cancelled due to a breach of contract, the party who breached the contract generally pays a penalty. In many cases, the penalty, etc. is generally set within the range of up to 20% of the sales price. Although a sales contract is not concluded on the assumption that the contract will be violated, there are contingencies, so be sure to check the contract carefully in advance. (11) Exclusion of Anti-Social Forces In order to "exclude antisocial forces" from real estate transactions, standard model clauses for exclusion of antisocial forces have been introduced. Confirm that the sales contract includes clauses assuring that "neither the seller nor the buyer is a crime syndicate or other anti-social force" and "the property will not be used as an office or other base of activities of anti-social forces. If any of these are violated, the contract can be terminated. (12) Loan provisions If the buyer is unable to obtain a mortgage loan despite the fact that he/she is not at fault, the buyer will not be able to pay the purchase price and will ultimately be in breach of the contract. Since the buyer should avoid such a situation, it is common for the buyer to attach a loan provision to the purchase agreement when purchasing a house with a mortgage loan. The buyer can unconditionally cancel the sales contract in the event that the mortgage loan review is unsuccessful. However, this provision does not apply if the buyer is unable to obtain a loan due to the buyer's fault, for example, if the buyer fails to follow the necessary procedures for loan approval. Even if a loan provision is in place, it is important to fully consider the financial plan before signing the contract and to have a good prospect of obtaining a loan. Please note that in some cases, additional optional construction works or specification changes in newly built condominiums may not be covered by the loan provision. (13) Liability for nonconformity to the contract If there is a defect in the property sold or purchased, the buyer can make certain claims against the seller. The seller's liability in this case was previously referred to as "defect liability. However, due to an amendment to the Civil Code, the name has been changed to "liability for nonconformity to the contract" as of April 1, 2020, and its contents have also changed significantly. The seller is obligated under the sales contract to deliver the property that conforms to the terms of the contract with respect to the type, quality, and quantity of the property. If the seller fails to fulfill this obligation and delivers the property, he or she is liable for nonconformity to the contract. In such a case, according to the provisions of the Civil Code, the buyer can demand repair of the property, reduction of the price, or compensation for damages, and can cancel the contract if the non-conformity is not minor. However, this provision of the Civil Code is a general rule when the parties have not made any agreement, and the parties may make other arrangements. In actual contracts, special provisions are usually made regarding the extent to which the seller is liable for nonconformity and the period for which the seller is liable. Therefore, as a buyer, you should carefully check the contents of the contract regarding the extent to which the seller is liable and the period of time for which he/she can make a claim. If a building condition survey has been conducted and a summary of the results is explained as an important matter before a contract is signed, the summary of the survey results will be included as "matters confirmed by both parties regarding the condition of the main structural members of the building, etc." (If a building condition survey has not been conducted, it will be indicated as "none.") Point 2: Regulations when the seller is a real estate company (real estate agent) When a real estate company is the seller, the Real Estate Brokerage Act sets restrictions on sales contracts. If applicable, please check the contents of the contract and make sure in advance that the contract does not violate any restrictions before signing the sales contract. Point 3: Learn about the sales contract process After receiving an explanation of important matters and being satisfied with the contents of the contract and the property, it is time to conclude the sales contract. In principle, the buyer and seller will meet to read out the sales contract and make a final confirmation of the contents of the contract. The contract is then signed and sealed, and the deposit, etc. is paid. The deposit, etc. may be prepared in cash, by wire transfer to a designated account, or by deposit check. If a real estate company acts as an intermediary, a brokerage fee is often paid at the time of contracting. If there is oversight in the contract procedures, a sales contract cannot be concluded, which will cause inconvenience to the seller and other parties involved, so be sure to be well prepared before signing the contract. In real estate transactions, the Law for Prevention of Transfer of Criminal Proceeds requires the seller or the real estate company acting as an intermediary to present identification documents and to declare the seller's occupation and the purpose of the transaction. Main items required at the time of signing

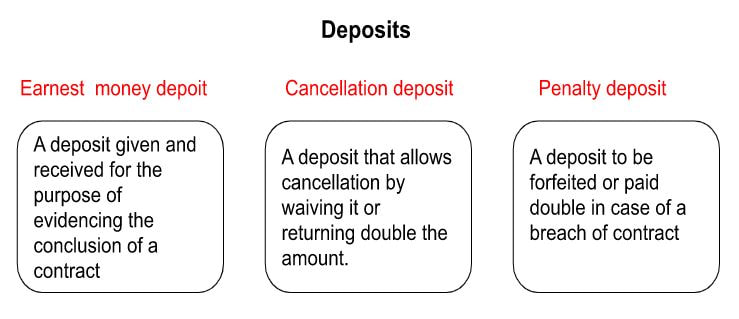

Buying a House: the DepositsThere are three types of deposits: (1) earnest money deposit, (2) cancellation deposit, and (3) penalty deposit. Differences in the Deposits (1) Earnest money deposit A deposit given and received for the purpose of evidencing the conclusion of a contract. (2) Cancellation deposit A cancellation deposit is a deposit that allows

A deposit that, in the event of a breach of contract by either party, will be forfeited or doubled as "punishment" for the breach of contract, in addition to compensation for damages. Cancellation by Earnest Money Deposits The termination of a contract by means of a cancellation deposit is generally referred to as "release of deposit." For example, if circumstances have changed significantly since the contract was concluded, it is possible to cancel the contract by waiving or doubling back the deposit. However, the contract can be canceled with release of deposit only until the other party begins to fulfill the contract. In other words, if the other party has already performed the promises stipulated in the contract, the deposit cannot be cancelled. However, in releasing a deposit, there are often troubles over "whether the other party has started to fulfill the contract or not. In addition, since both the seller and the buyer have the right to terminate the contract during the period when release of deposit is possible, it remains uncertain whether the contract will be fulfilled or not. Therefore, the period that allows cancellation by release of deposit may be limited to "within ● days from the date of the contract" or "until ●●● year". An overview of the deposits * A deposit is presumed to be a cancelation deposit if not otherwise specified.

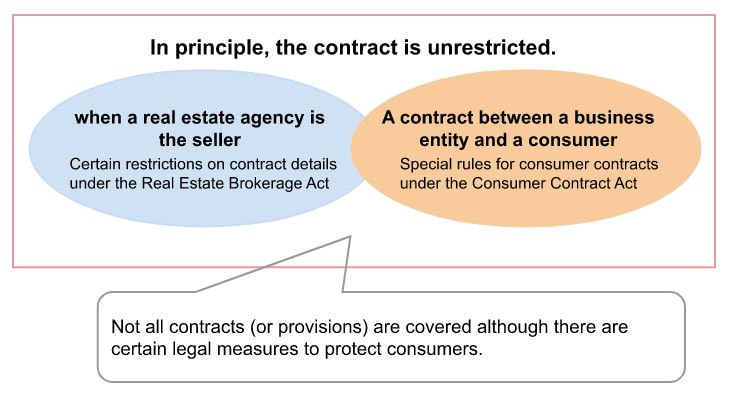

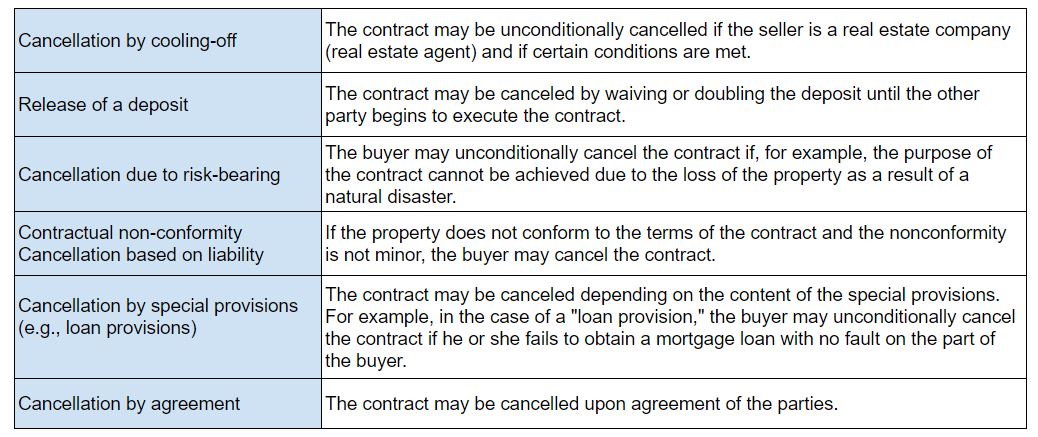

Concluding a Sales ContractAfter receiving an explanation of important points and both the buyer and seller agree on the terms of the contract, a sales contract is concluded. Once a contract is concluded, it cannot be easily cancelled. Therefore, it is important to fully confirm its contents beforehand. Keep in mind that although the real estate company provides an explanation, the contract is ultimately concluded on self-responsibility. Point 1: Know the basics of the sales The content of the contract is unrestricted in principle. The content of the contract between the seller and the buyer is unrestricted as long as it does not violate laws and regulations, offend public order and morals, or otherwise cause problems. Conversely, the principle is that the contract should be concluded at one's own risk. There are certain laws and regulations in place to ensure that consumers are not unilaterally disadvantaged by contracts, but they do not cover everything. It is important that you confirm the contents of the contract and conclude the contract at your own risk. Matters not stipulated in the contract are to be determined upon consultation in accordance with the Civil Code and other related laws and regulations. Therefore, if important contract terms are unclear, it may lead to problems after the contract is signed. Restrictions on contracts when the seller is a real estate agency When a real estate company is the seller, the Real Estate Brokerage Act provides certain restrictions so that a disadvantageous contract will not be concluded for the buyer. This protects the buyer who concludes a contract directly with the real estate company, which is the expert in real estate transactions. The Consumer Contract Act applies to contracts between business entities and consumers. Since there are differences in the ability to access information and negotiate between business entities and consumers, the Consumer Contract Act establishes specific contract rules for contracts between business entities and consumers (referred to as "consumer contracts") with the aim of protecting consumers, and also affects real estate purchase and sale contracts. For example, the Act provides that a contract can be rescinded if the consumer has misunderstood the contract, and that clauses that are disadvantageous to the consumer (such as clauses that exempt the business entity from liability for contractual nonconformity, etc.) become invalid. Although a consumer under the Consumer Contract Act refers to an individual who concludes the contract for business purposes is not covered by the protection of the Consumer Contract Act. The Consumer Contract Act applies to contracts concluded by individuals for purposes other than business. It is important to understand that it also applies to real estate sales contracts. An overview of a real estate sales contract Point 2: Understand the deposit In a real estate sales contract, it is common for the buyer to pay a "deposit" to the seller at the time the contract is concluded. There are three types of deposits: (1) Deed deposit (2) Cancellation deposit (3) Penalty deposit Generally, in a real estate sales contract, the deposit is given and received as the "cancellation deposit" described in (2). The Civil Code also states that in the absence of any special provisions regarding the nature of the deposit, it is presumed to be a cancellation deposit. A "cancellation deposit" is a deposit that allows the buyer to cancel the sales contract by waiving (not requesting the return of) the deposit already paid, and the seller to return to the buyer twice the amount of the deposit already received. However, a contract can be canceled by the deposit only until the other party executes the contract. In other words, if the other party has already fulfilled the promises stipulated in the contract, the contract cannot be cancelled by the deposit. Point 3: Once a contract is signed, it cannot be easily cancelled. Especially when conducting large transactions such as real estate sales, a contract is an important promise based on the relationship of trust between the seller and buyer. Therefore, once a contract is concluded, it generally cannot be easily canceled for the convenience of one party. The main types of contract cancellations are as follows. *The above table is a general guideline, and the procedures for cancellation differ for each individual contract. Point 4: Understand contractual non-conformity What is contractual non-conformity liability? Defects in properties, such as leaks or corrosion caused by termites, have been referred to as "defects," and the seller's liability for such defects has been called "liability for defects. However, due to the revision of the Civil Code enforced on April 1, 2020, not only the name but also the content of this liability has been drastically changed. The revised Civil Code is based on the premise that the seller is obligated to deliver a property that conforms to the terms of the contract with respect to "type, quality, and quantity" of the subject matter of the sale, and that if the seller delivers a property that does not conform to the terms of the contract with respect to those items, the seller is liable for default. For example, if the seller delivers a building that has leaks or corrosion caused by termites, the seller is in default of his/her obligation to deliver an object that conforms to the terms of the contract with respect to quality. Contents of contractual non-conformity liability When the subject matter of the contract is nonconforming as described above, the buyer can demand the repair of the nonconformity, and when the seller does not do so even after the repair is demanded, or when the repair itself is impossible, the buyer can demand a reduction of the purchase price. In addition, under the general principle of default, a claim for compensation for damages can be made, and the contract can be terminated. However, compensation for damages cannot be claimed if the seller is not responsible in any way. Cancellation is also not allowed when the nonconformity is minor. Period during which the seller is liable for nonconformity with the contract Under the Civil Code, the buyer must notify the seller of the nonconformity within one year of becoming aware of it, because it is considered unreasonable for the seller to be liable for the nonconformity for a long period of time, and because it is appropriate to settle such disputes arising from the sale as early as possible. Special provisions in sales contracts This provision of the Civil Code is an optional provision, meaning that it can be changed or modified at will, so another provision can be made by a special agreement between the parties. Especially in the case of an existing house (used house), it is difficult or impossible to determine whether a certain defect or other event constitutes a non-conformity to the contract due to age-related deterioration, natural wear and tear, etc. Therefore, in general transactions, the scope of the seller's liability is limited or the period of liability is shortened. In some cases, there is also a provision that the seller is not liable at all. Even in such cases, the seller is not exempt from liability if he/she knew of the nonconformity and failed to inform the buyer, but otherwise, the seller is exempt from liability as per the special provision. When a real estate agent (real estate company) is the seller With regard to liability for nonconformance with contract in cases where a real estate agency or a real estate company is the seller and the buyer is not, under the Real Estate Brokerage Act, a provision to the effect that the seller is liable for nonconformance with contract is valid only if the seller is notified within two years of the date of delivery. However, other than that notice period, provisions that are less favorable to the buyer than those of the Civil Code, such as "only repair claims" or "the contract can be terminated if the seller approves" other than during such notice period, is invalid. When a business entity is the seller and a consumer is the buyer All corporations are "business entities" under the Consumer Contract Act, including those that are not real estate companies. In a contract in which a business entity acts as the seller and sells to a consumer, a contract provision stating that the business entity is not liable for nonconformance is considered invalid under the same Act. Special provisions for new housing under the Housing Quality Assurance Promotion Act In the case of a newly built house, the real estate company that is the seller must assume liability for defects (*) for 10 years for the main structural parts, etc. (foundation, pillars, roof, exterior walls, etc.) of the house. In order to avoid a situation where the seller cannot fulfill its liability for defects due to bankruptcy, etc., the seller is obligated to sign an insurance policy or deposit a security deposit at the time of delivery to the buyer. The seller is required to explain to the buyer which measure, insurance or deposit, will be applied at the time of the important points explanation and the sales contract, so make sure to check the details carefully.

*The Housing Quality Promotion Act uses the term "liability for defects," but the revised Civil Code uses the term "liability for nonconformity of contract as to type and quality. What to Check in the Important Points ExplanationBefore signing a contract, an "important points explanation" is always given. Important points regarding the property to be purchased and the terms and conditions of the transaction are explained. It is important to understand the details before making a final decision on whether or not to purchase the property. Point 1: What is an important points explanation? The Real Estate Brokerage Act stipulates that a real estate company must provide an important points explanation regarding the property to be purchased to the prospective buyer before concluding a sales contract. An explanation of important points must be given orally by a licensed real estate agent after he/she has signed and sealed a written document describing the contents and given the document to the client. It is possible that you may decide not to purchase the property after receiving the explanation of important points, so it is important to receive the explanation of important points at an earlier stage. After receiving an explanation, you will want to take sufficient time to consider the matter and resolve any questions before signing the contract. For this reason, it is advisable to confirm in advance with the real estate agency the schedule for the important points explanation and the sales contract. There tends to be little time to consider the situation in the final stage of negotiations related to buying and selling. Make sure to set aside enough time in the schedule so that you can make a final decision after careful consideration. Online (IT) Explanation of Important Points An explanation of important points is required to be provided orally by delivering a document signed and sealed by a licensed real estate agent. However, when certain requirements are met, a non-personal explanation using "IT" (computers and other terminals) such as videoconferencing is now considered the same as a face-to-face explanations of important points. In order to implement an IT explanation, the following four requirements must be met.

Point 2: The important points to check The important points explanation may seem difficult because it contains some technical details, but you will be able to understand it if you have it explained to you one by one in detail. In addition, it will be easier to understand if you grasp the overall picture of the important points explanation and then check the key points. The following is an explanation of eight items that you should particularly check in the important points explanation. The flow of explanation of important points  A licensed real estate agent will sign and seal the document, provide the document, and give an oral explanation. 1. Basic confirmation before receiving an explanation A licensed real estate agent provides a written document and a verbal explanation. 2. Basic property checks

⇩  prospective buyer "I have confirmed and understood what has been explained to me." ⇩  The conclusion of the sales contract Point 3: What is a notice? In the transaction of an used house, the past history and hidden defects of the house may become an issue, but there is a limit to what a real estate company can understand about all of these matters that are originally known only to the seller or owner. Therefore, many real estate companies ask the seller to submit a written notice (a written confirmation of incidental facilities and property conditions), conduct a property investigation based on it, and reflect it in the explanation of important points. Guidelines Concerning Notification of Death of a Person by a Real Estate Agent

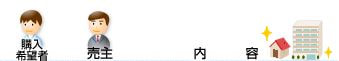

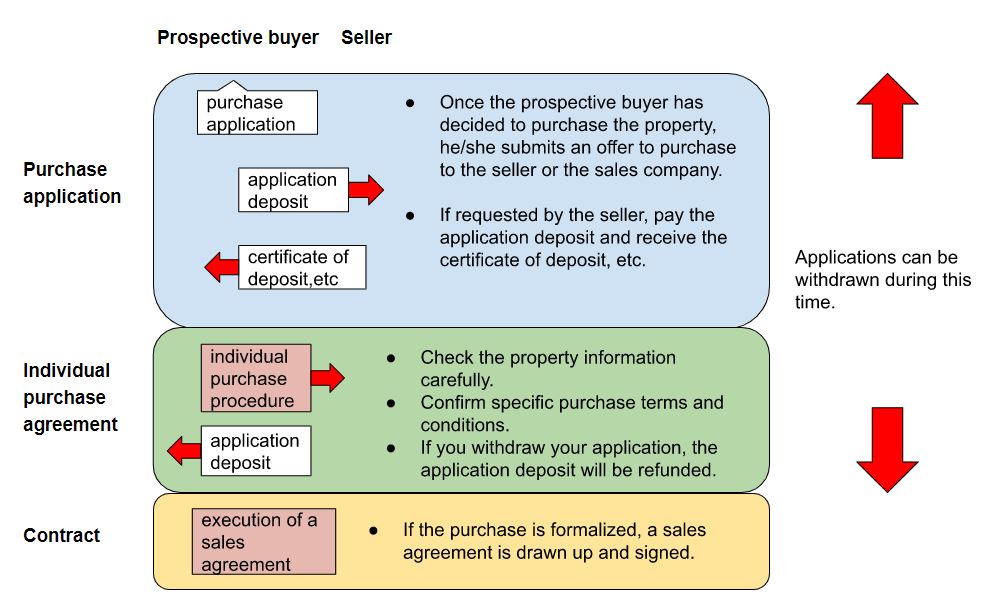

When a real estate agent is aware of a person's death and believes that it will have an important influence on the decision to conclude a contract for a real estate transaction, it is necessary to notify the customer of this fact. However, each person has his or her own view of death, and the degree to which it affects his or her judgment of the contract differs. Therefore, in October 2021, the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) compiled the "Guidelines for Notification of Death of a Person by a Real Estate Agent." It provide guidelines on the extent to which real estate agents should investigate the death of a person and the extent to which they should notify the prospective buyer of the death of a person. The guidelines state that real estate agents should investigate the death of a person by asking the seller to include it in the "notice" and that they are not required to investigate the death of a person by asking around the neighborhood or researching on the Internet. Regarding notification in sales transactions, the law states that notification is not required for "natural death or unforeseen death in daily life (natural death such as senility, death from illness due to chronic disease, or accidental death such as a fall or aspiration)." However, even in such cases, notification is required if the property has been left unattended for a long period of time, and if special cleaning such as deodorization and disinfection or major renovation has been performed. In the case of an incident occurring in a neighboring dwelling unit of the subject property or in a common area that is not normally used, no notification is required. However, it is necessary to give notice in cases where the death of a person is an incident or has a significant social impact, or when it is considered to have an important influence on the decision to conclude a contract. Making the Final Decision to PurchaseWhat to consider when applying for purchase Once you have decided on the property you want to buy, before making an offer to purchase, double-check that the property meets your requirements and that there are no problems before making an offer to purchase. Proceed with the transaction carefully, referring to the following points when making an offer to purchase. Point 1: Decide on a property to purchase and make an offer to purchase. Once you find a property you like, discuss terms and conditions in detail. Do not hesitate to ask the real estate company for information you would like to know about the property, and also thoroughly check the property and confirm any points of concern during the site visit. While consulting with the real estate company, make your desired purchase conditions specific. Once the basic conditions have been established, present the conditions to the seller and make an offer to purchase. At this stage, basic conditions such as the desired purchase price and desired delivery date are often presented first. However, if there are other prerequisites for the purchase in addition to the basic conditions, they may be presented. In the case of a used property, you may also request for repairs to the property. Point 2: What is the process from purchase application to negotiation? The negotiation process after submitting an offer to purchase differs between new properties for sale and used properties. For new properties for sale Generally, applications to purchase a new property for sale are made at the local sales office. When offering to purchase a property, you are often required to pay what is known as an "application deposit" (approximately 50,000-100,000 yen). The application deposit is paid to show that the intention to purchase is genuine (i.e., that it is not a "pretense"), and when the contract is executed, it is applied to the deposit and the purchase price of the property. However, the legal nature of the application deposit is not always clear, and there are many troubles surrounding its return. Therefore, if you are asked to pay the application deposit, be sure to confirm the handling of the application deposit and receive a certificate of deposit, etc. that states the purpose of the money transfer (that the money was transferred as the application deposit), the amount, and the date of payment. After paying the application deposit and submitting an application to purchase, you will proceed with the specific procedures up to the purchase, such as confirming property information and contract terms in more detail. For used properties In the case of used properties, the application for purchase (presentation of basic conditions) is often made in the form of a document called a "certificate of purchase" or similar document, which is given to the seller through the real estate agency. A certificate of purchase is a document signed and sealed stating the basic terms of purchase, such as the desired purchase price, payment terms, and desired delivery date, and is a request for the start of preferential individual negotiation, based on the specific purchase desire, "I want to buy this property under these terms and conditions. Note that in the case of used properties, payment of an application deposit, etc., is generally not required. Subsequently, if the seller, based on the conditions presented by the prospective purchaser, determines that a contract is viable, formal individual negotiations will begin. Since the seller narrows down the negotiating parties to some extent at this stage, it is important to proceed with subsequent negotiations in good faith. In individual negotiations, differences in terms and conditions between the two parties are adjusted, and more specific terms and conditions are determined. Point 3: Is it possible to withdraw after application? It is possible that after an application for purchase (presentation of basic terms and conditions), the buyer may wish to withdraw the application due to disagreement on various terms and conditions after specific negotiations have been conducted. In such a case, it is generally possible to withdraw the application as long as a purchase agreement has not been concluded. In addition, an application deposit, if paid, will be refunded.

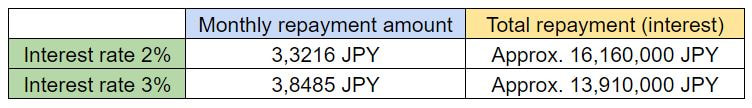

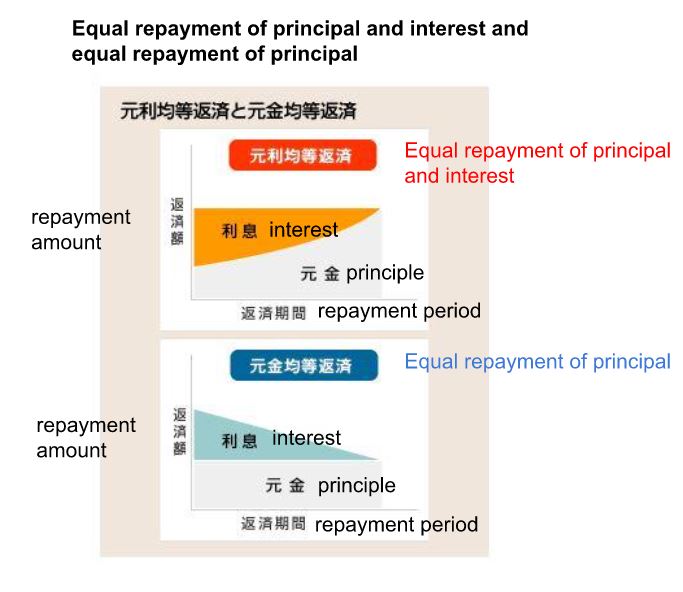

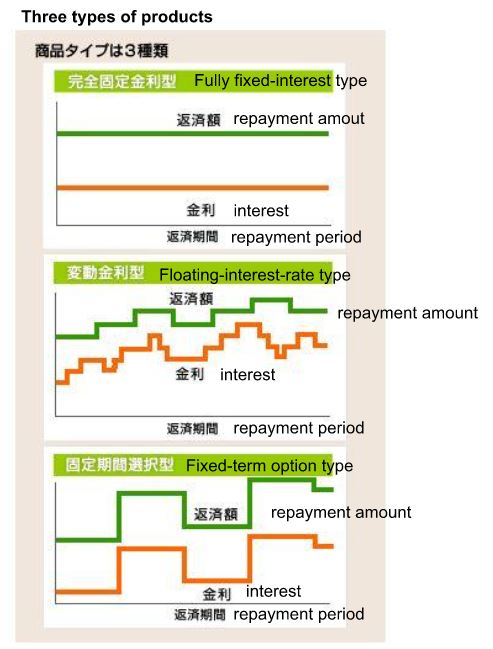

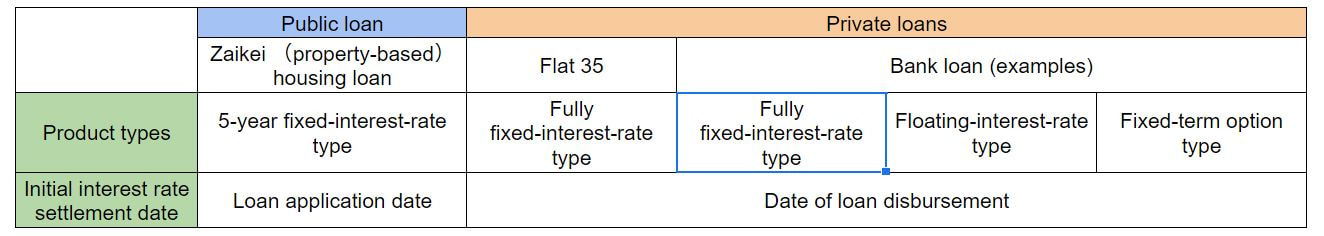

However, you should keep in mind that the seller, especially of a pre-owned property, has begun individual negotiations based on a certain degree of likelihood that a contract will be concluded. Be very careful when withdrawing your application, because if you are found to be dishonest, you may have a problem with the seller. Financial Planning and MortgageTypes of Mortgage Loans When you take out a mortgage loan, you will be making repayments over a long period of time. There are various types of mortgage products, and the applicable interest rate and repayment amount will differ depending on which product you choose. The following is a brief overview of how mortgage loans work and the features of each product in order to help you plan your finances appropriately. Point 1: Know how interest rates work and their characteristics. Check interest rates first. The lower the interest rate, the lower the interest expense and the lower the total repayment amount. For example, if you borrow 10 million yen and make equal monthly repayments of principal and interest over 35 years, the difference in total repayments will be approximately 2.25 million yen if the interest rate is 3% or 2%. Note that, in general, the interest rate on a mortgage loan is applied at the time of loan origination, not at the time of loan application. This means that there is a risk that the interest rate at the time of actual borrowing may be higher than the interest rate confirmed when you applied for the mortgage loan. In particular, when purchasing a newly built property for sale before it is completed, it is advisable to make a financial plan with sufficient time to consider the risk of interest rate increases since the loan will be executed after the property is completed. Check the repayment method. There are two main types of principal and interest repayment methods: (1) equal repayment of principal and interest (a method in which the total amount of principal and interest to be repaid each time is set to be constant) and (2) equal repayment of principal (a method in which the amount of principal to be repaid each time is set to be constant). Equal repayment of principal and interest makes it easier to make a household budget schedule because the monthly repayment amount is fixed, but the pace of principal repayment is slower than with equal repayment of principal and interest, and if the loan term is the same, the total payment amount will be higher with equal repayment of principal and interest. On the other hand, equal repayment of principal has the advantage of allowing the borrower to repay the principal amount faster, but the initial monthly repayment amount is higher. However, if the borrower is willing to make principal repayments quickly even if the initial repayment burden is heavier, it is advantageous to choose the equal principal repayment option. Since many financial institutions only offer mortgages with equal repayment of principal and interest, it is advisable to check the mortgage products of each financial institution as early as possible when considering borrowing. Point 2: Three main types of mortgage products There are various product types, depending on how the interest rate is set relative to the principal. The three main types as follows. (1) Fully fixed-interest-rate type The fully fixed interest rate type is a product in which the interest rate is fixed for the entire loan period. Generally, if interest rates are expected to rise during the fixed interest rate period, the initial applicable interest rate will be higher than the variable interest rate type, etc. However, even if interest rates fluctuate during the borrowing period, the amount of mortgage loan repayment will not change from the initially set amount. (2) Floating-interest-rate type Floating-rate loans have interest rates that are reviewed semiannually, and the repayment amount is reviewed every five years based on interest rate movements. However, even if the repayment amount rises as interest rates fluctuate, it is capped at 1.25 times the existing repayment amount. In the event of a rise in interest rates, the initial applicable interest rate is generally lower than that of the fully fixed-rate type, but the borrower bears the risk of subsequent interest rate rises. (3) Fixed-term option type In the fixed-term option type, the interest rate is fixed for a certain period, such as 3 years or 5 years, and at the end of that period, the interest rate is set again (fixed term or variable interest rate) and the repayment amount is reviewed according to that interest rate. The choice of the fixed period varies from financial institution to financial institution. If the interest rate after the fixed period ends has risen significantly, the repayment amount may increase significantly because there is no upper limit to the amount of increase in the repayment amount as there is with the variable interest rate type. Other types of bank loans include those that combine multiple products and those with floating interest rates but with a maximum interest rate. Note that the available product types may be limited depending on the mortgage loan. For Zaikei (property-based) housing loan, only the 5-year fixed-rate type, in which a fixed interest rate is applied for 5 years, is available, while Flat 35 (a mortgage loan provided by the Japan Housing Finance Agency in cooperation with private financial institutions) is only available in the fully fixed-rate type. Major Mortgage Product Types

|

Details

AuthorArrows International Realty Corp. Archives

June 2023

Categories

All

|

RSS Feed

RSS Feed