Buying a House: the Living EnvironmentGather information on the Internet, and also visit the site to check it out in person. Information that can be collected online

Market Prices: the Real Estate Information Network System (REINS)The Real Estate Information Network System: REINS (1) Overview The Real Estate Information Network System (REINS) is a real estate information distribution organization designated by the Minister of Land, Infrastructure, Transport and Tourism based on the Building Lots and Buildings Transaction Business Law, and is commonly referred to as "REINS." Currently, four entities (East Japan, Chubu area, Kinki area, and West Japan) have been established throughout Japan, each of which is responsible for the exchange of real estate information in their respective areas. More than 100,000 transactions are concluded each year through the exchange of information provided by REINS. Areas covered by four entities of REINS East Japan, Chubu area, Kinki area, and West Japan (2) Primary Functions

Note that the real estate information of the designated distribution system is exchanged on the premise of the "duty of confidentiality" legally imposed on licensed real estate companies, and is therefore not available to the general public.

In particular, it has become common practice to conduct price assessments on pre-owned properties with reference to actual transaction prices ("contract prices") in the neighborhood to determine selling prices, etc. By consolidating contract information, REINS providing an environment for real estate companies brokering the deals to conduct price assessments appropriately and works to ensure the transparency of the real estate distribution market.

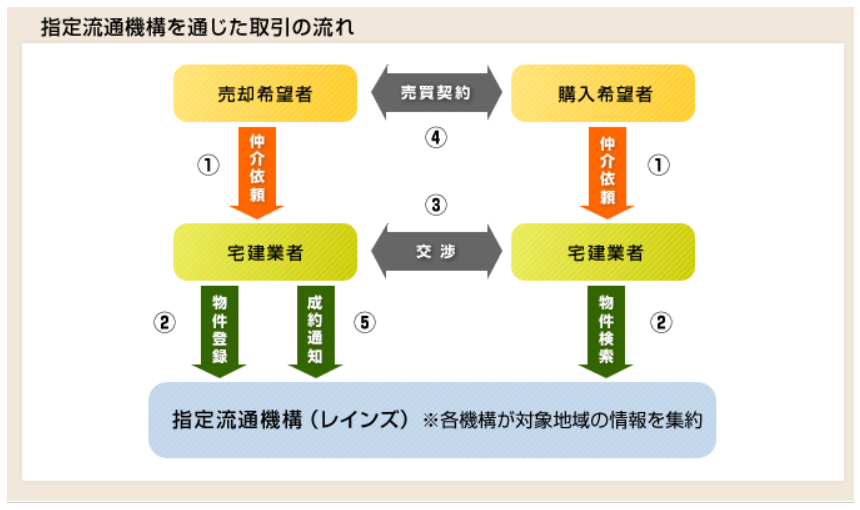

*RMI is an abbreviation for REINS Market Information. Transaction flow through the designated distribution system

REINS (the Real Estate Information Network System) *Each regional entity of REINS consolidates information on their areas.

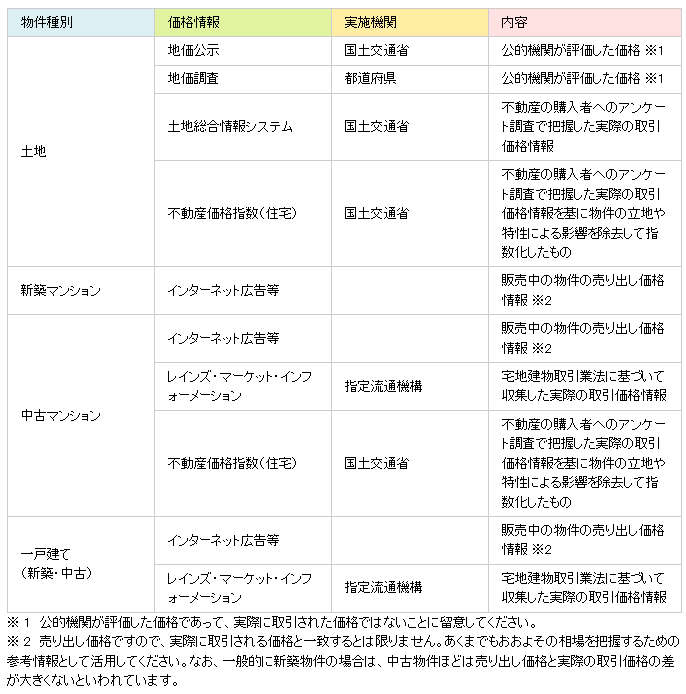

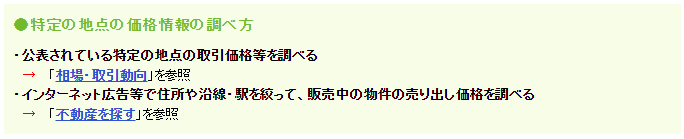

Buying a House: Market PricesResearch real estate pricing and market information. Before consulting a real estate agent, try to gather information on your own first. It is important to have a certain price image. However, be careful not to have an overly preconceived image, as this image may be incorrect. Once you have a general image, consult with a real estate company about specifics. Point 1: Find out about pricing information for a specific location. Transaction examples and other price information that can be used as a reference for knowing the price of real estate that is to be bought or sold ("subject property") are not easily obtained. The table below shows individual price information that is relatively easy to obtain for each property type. Property Type 1. Land Pricing Information

Pricing Information

Pricing Information

Pricing Information

*1 Please note that these are the prices assessed by public institutions and not the prices at which the properties were actually traded. *2 Since these are selling prices, they may not necessarily be the same as the prices actually traded. Please use them only as reference information to grasp the approximate market prices. In general, it is said that the difference between the asking price and the actual transaction price is not as large for newly constructed properties as for existing properties. How to look up price information for a specific location

Point 2: Find out about market trends in your region. Information on average market prices and trends such as price increases and decreases in each area is relatively easy to obtain. By examining this information, it is possible to grasp the approximate price range and fluctuation of each area, which can be used when considering the details of the preferred property (target area, price range, etc.) and budget. This information can also be used to correct the price information of a specific point in the past to the current price according to the rise or fall of the market (point in time correction). You can examine published market trend information by type of land, new condominium, used condominium, and single-family home. It is also effective to ask for overall market information from a real estate agency that is well-informed of the area. How to research market trends in each region Check the market trends such as average prices, average area, and number of properties in each area. Point 3: Why it is important to know the market price If you are aware of the market prices, you can determine whether you need to revise your purchase plans and preferred conditions. For example, if you find that the market prices in your desired area are higher than your budget, you can review your preferred conditions by widening the area you are looking in or by looking for used houses as well as new houses. You can also get some idea of whether the property you are considering is relatively expensive, market-rate, or inexpensive. Ultimately, it is the buyer himself/herself who decides the purchase price. In order to make a wise decision, it is very important to have a grasp of the surrounding market prices.

Buying a House: Housing PricesWhen buying a house, the price is one of the major determining factors. Since real estate is an asset that is highly individualized, it is extremely difficult to know whether the price being offered for sale is reasonable. In particular, with agency properties, the final sales price is determined through negotiations between the seller and the buyer. It is helpful to understand the following points regarding housing prices and evaluation methods. Point 1: Understanding housing prices

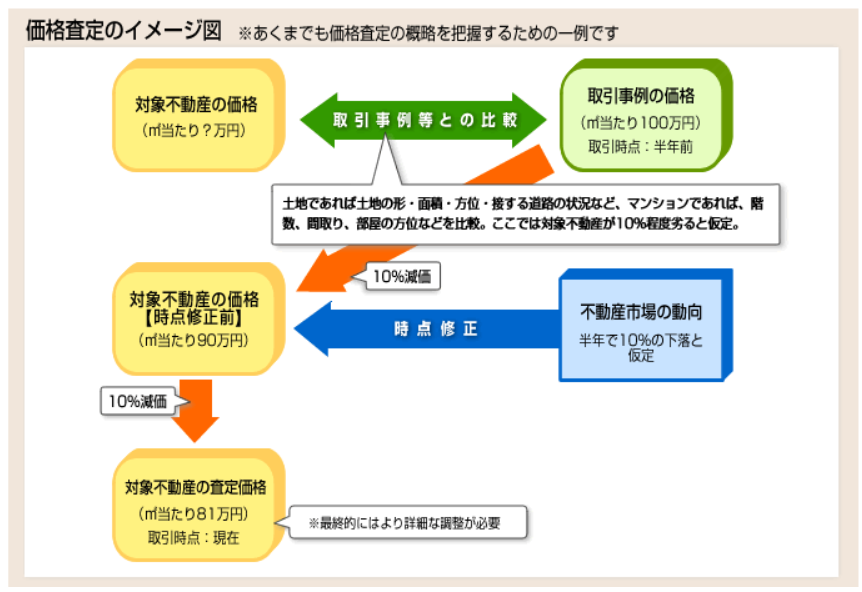

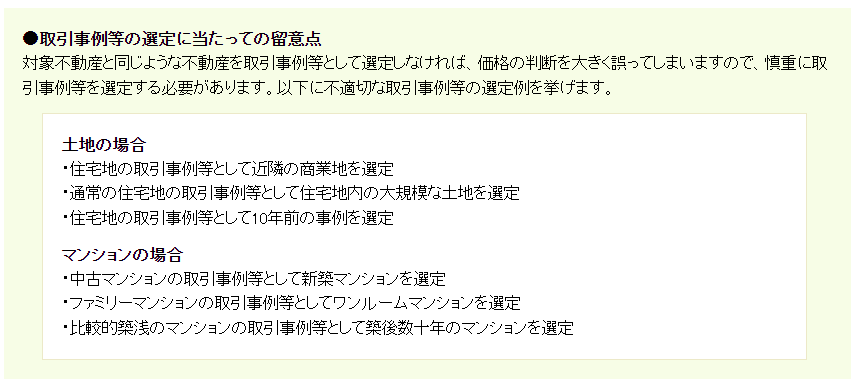

* Since real estate prices are determined for each individual transaction, it is not possible to completely verify such prices with objective data alone. It is important to (1) gather as much information as possible (including advice from experts) and fully examine the price and (2) negotiate in good faith with the other party to the final transaction to ensure that you are satisfied with your own decision. Point 2: Understanding evaluation methods A price assessment of real estate for the purpose of buying and selling is generally called a "price appraisal. There are various methods for price appraisal. The chart below shows the general structure of price appraisal for residential land (land) and condominiums with reference to the "Manual for Price Valuation" issued by the Real Estate Information Center. Please note, however, that a price assessment requires specialized consideration for each individual property. The transaction comparison method (a basic method for assessing land and condominium prices) Land and condominiums are often assessed by the transaction comparison method, which is a method of assessing the price of subject real estate by comparing it with the price of transaction cases of similar real estate. First, the subject property is compared with properties that serve as transaction examples, and the approximate price range of the subject property is assessed based on the prices of transaction examples. Then, certain adjustments are made for differences in transaction timing, taking into account trends in the overall market (this is generally referred to as "point-in-time correction"). Price Assessment Compare the prices The price of the subject property ( ? yen/㎡) ⇔ The price of a transaction example (1,000,000yen/㎡) If the subject property is land, we compare the shape, area, orientation, and condition of the roads it abuts, etc. If it is an apartment, we compare the floor level, layout, and orientation of the rooms. Here, we assume that the subject property is about 10% less in price. ⇩ 10% depreciation Point-in-time correction The price of the subject property (before point-in-time correction) (900,000yen/㎡) ⇐ Trends in the real estate market (assuming a 10% decline in six months) ⇩ 10% depreciation The appraised price of the subject property (810,000yen/㎡) Time of transaction: Current *More detailed final adjustments are needed. (1) Comparison with other transaction cases Compare the individual characteristics of the subject property with those of other transaction cases. (For instance, if it is land, the shape, area, orientation, and condition of the road that it touches, etc. are compared and if it is an apartment building, the number of floors, layout, and orientation of the rooms, etc., are compared.) For each item, the value of the property used as a transaction case for comparison is adjusted based on whether the subject property is better or worse, and the approximate value of the subject property is appraised. (For instance, if the subject property is deemed to be 10% inferior to the transaction example, the value of the transaction example is depreciated by 10%.) Points to keep in mind when selecting transaction examples If real estate similar to the subject property is not selected as a transaction example, the value will be greatly miscalculated, and therefore, transaction examples should be selected carefully. The following are examples of improperly selected transaction examples. In the case of land

In the case of condominiums

(2) Point-in-time correction Compare the market trends at the transaction points of the subject property and the real estate that serves as a transaction example. The price is adjusted according to whether the market price has risen or fallen from the point in time when the property was traded. (For example, if it is determined that the market price has declined by 10% from the point in time when the property was traded, the price calculated based on the comparison with the transaction example is further depreciated by 10%.) (3) Other points to consider The appraisal of the value of the subject property cannot be completed only by comparing it with transaction examples and making a point-in-time correction. It is necessary to take other factors into account make to determine the final assessed value. In assessing a price, it is also important to consult with experts such as a real estate company.

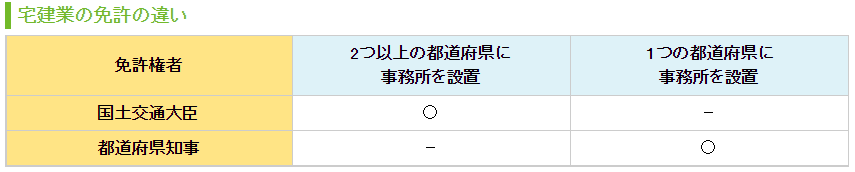

Buying a House: Building Lots and Buildings Transaction BusinessBuilding Lots and Buildings Transaction Business Point 1: Difference between Real Estate Business and Building Lots and Buildings Transaction Business The real estate business and the building lots and buildings transaction business are not synonymous. The real estate business includes buying and selling, brokerage (also known as "mediation"), leasing (landlords of land, houses, and buildings), and management (management of condominiums, management of rental properties, etc.). On the other hand, the building lots and buildings transaction business includes only those types of real estate businesses that handle transactions (distribution) such as buying, selling, and brokering. Therefore, when selling or purchasing a house, it is important to understand the building lots and buildings transaction business. Point 2: What is the building lots and buildings transaction business? The building lots and buildings transaction business (i.e., the real estate transaction business) is (1) Buying, selling, and exchanging residential land and buildings (2) Representation or mediation when buying, selling, exchanging, or borrowing and lending The Building Lots and Buildings Transaction Business Law regulates that only persons licensed by the Minister of Land, Infrastructure, Transport and Tourism or the prefectural governor are allowed to engage in the building lot and building transaction business. Whether the license is issued by the Minister of Land, Infrastructure, Transport and Tourism (MLIT) or by the prefectural governor depends on the status of the office (head office, branch office, etc.). The term of validity of a license for the real estate transaction business is five years. It is important to note here that while intermediation of leasing and renting (such as soliciting tenants) at the request of a landlord is included in the 宅建 (building lots and buildings transaction) business, leasing and renting by oneself (such as managing a building or apartment for rent) is not included in the 宅建 (building lots and buildings transaction)business and is not a business regulated by the Building Lots and Buildings Transaction Business regulations. Differences between licenses issued by the MLIT and the prefectural governor

The licensing authority (Minister of Land, Infrastructure, Transport and Tourism or prefectural governor) will also issue administrative penalties such as instructions to improve business, suspension of business, or revocation of license in the event of violations of laws and regulations by a building lots and buildings transaction business operator. Point 3: What is the role of a real estate transaction agent? A real estate transaction agent is a person who has passed the real estate transaction chief qualification examination or the real estate transaction professional qualification examination, has been registered by the prefectural governor, and has been issued a real estate transaction professional certificate, and is a distribution specialist who has extensive knowledge of real estate transactions. The Building Lots and Buildings Transaction Business Law stipulates that only a real estate transaction agent can handle the explanation of properties and contract details (explanation of important matters), which is one of the most important tasks in real estate transactions, and the signing and sealing of documents describing the written explanation and contract details.

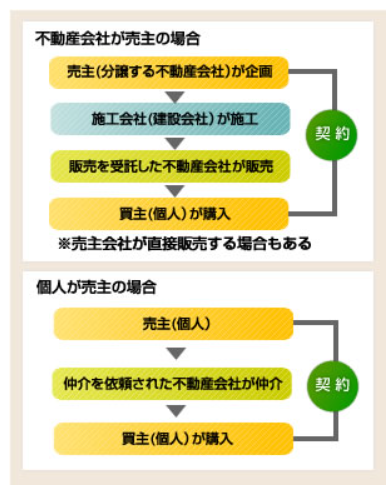

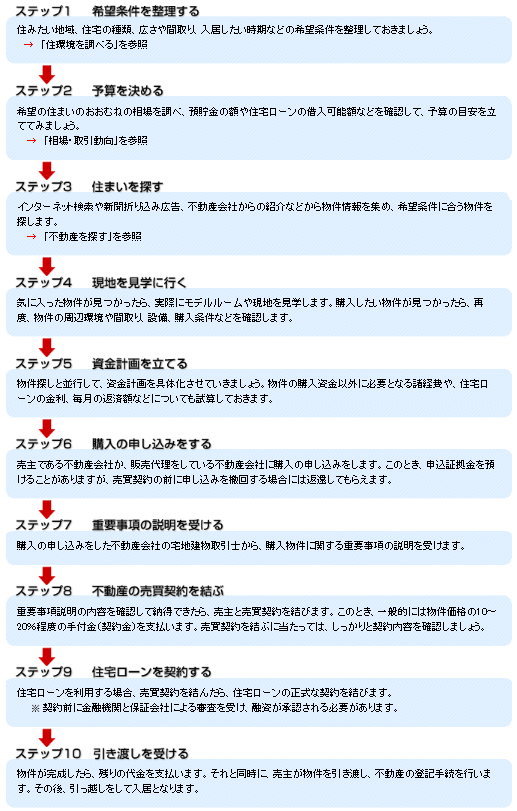

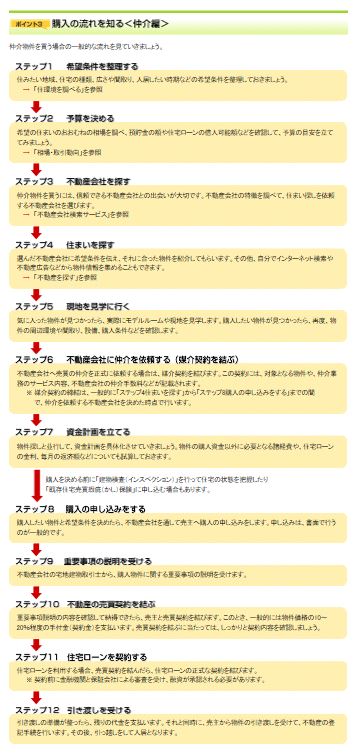

In order for a real estate company to be licensed as a real estate transaction agency, it must have at least a certain number of professional real estate agents. Buying a House: the Process of Buying a HouseOnce you have decided to buy a house, it is helpful to know what the process is before moving in so that you can plan ahead. Point 1: Difference between a House for Sale and Brokerage There are two main types of housing sales: for sale and brokerage. This changes the purchase process. (1) Property for sale This is a property purchased directly from the real estate company that is the seller. (It may also be purchased through a real estate company that has been commissioned by the seller to act as a sales agent.) Generally, newly built condominiums and newly built single-family homes with a large number of units for sale are properties for sale. (2) Property for brokerage This is a property purchased through a real estate company that has received a request from the seller to act as an intermediary. Generally, newly built detached houses and used properties with a small number of units for sale are agency properties. In the case of properties for brokerage, a brokerage fee may be charged to the real estate company, which must be confirmed in advance. When a real estate company is the seller The seller (the real estate company selling the property) plans ↓ A contractor (construction company) builds a house ↓ A real estate company entrusted with the sale sells the house ↓ A buyer (individual) purchases the house *In some cases, the seller buys and sells directly. ⇒ The seller (the real estate company selling the property) ⇕ Contract the buyer (individual) When an individual is the seller The seller (an individual) ↓ A Real estate company requested to act as an intermediary mediates the sale . ↓ A buyer (individual) purchases the house ⇒ The seller (an individual) ⇕ Contract A buyer (individual) Point 2: The Purchase Flow of a House for Sale The following is the general flow for purchasing a house for sale. *Please see point 3 for purchasing a house for brokerage, including a newly built house. Step 1 List up your preferences List up your preferences such as the area you want to live, the type of housing, the size and layout of the house, and when you want to move in. ⇩ Step 2 Set a budget Check the approximate market price of a house you are considering to buy, the amount of your savings, and the amount you can borrow for a mortgage, and establish a rough estimate of your budget. ⇩ Step 3 Look for a house Gather property information from Internet searches, newspaper inserts, referrals from real estate agencies, and other sources to find properties that match your preferences. ⇩ Step 4 Visit the site Once you find a property you like, you can actually visit the model home or the site. Once you have found the property you wish to purchase, you will again check the property's surroundings, floor plan, facilities, purchase terms, etc. ⇩ Step 5 Make a financial plan In parallel with the property search, concretize your financial plan. In addition to the funds needed to purchase the property, estimate the various expenses, mortgage interest rates, and monthly repayments that will be required. ⇩ Step 6 Make a purchase offer The seller, a real estate company, makes a purchase offer to the real estate company acting as a sales agent. At this time, an application deposit may be required, but it will be returned if the application is withdrawn before the sales contract is signed. ⇩ Step 7 Receive an explanation of important matters You will receive an explanation of important matters concerning the property to be purchased from the real estate transaction agent of the real estate company where you applied for the purchase. ⇩ Step 8 Sign a real estate sales contract If you confirm the contents of the explanation of important matters and are satisfied with it, you conclude a sales contract with the seller. At this time, a deposit (contract fee) of approximately 10% of the property price is generally paid. When signing the sales contract, make sure you have a clear understanding of the terms and conditions of the contract. ⇩ Step 9 Sign a mortgage loan When using a mortgage loan, sign a formal contract for a mortgage loan following the signing of the sale contract. *Prior to signing the contract, the loan must be reviewed and approved by the financial institution and guarantee company. ⇩ Step 10 The delivery of the property Upon the completion of construction, the remaining payment is made. At the same time, the seller will deliver the property and complete the real estate registration procedures. After that, you will move in. Point 3: The Purchase Flow of a House for Brokerage The following is the general flow for purchasing a house for brokerage. Step 1 List up your preferences List up your preferences such as the area you want to live, the type of housing, the size and layout of the house, and when you want to move in. ⇩ Step 2 Set a budget Check the approximate market price of a house you are considering to buy, the amount of your savings, and the amount you can borrow for a mortgage, and establish a rough estimate of your budget. ⇩ Step 3 Find a Real Estate Agency To buy a house for brokerage, it is important to find a reliable real estate agency. Look into the real estate agency's listings and choose the real estate agency you would like to request to find a house. ⇩ Step 4 Look for a house Let the real estate agency you have chosen know your preferences and ask them to refer you to properties that match your preferences. You can also gather property information from Internet searches and real estate advertisements on your own. ⇩ Step 5 Visit the site Once you find a property you like, you can actually visit the model home or the site. Once you have found the property you wish to purchase, you will again check the property's surroundings, floor plan, facilities, purchase terms, etc. ⇩ Step 6 Request a real estate agency to mediate (sign a brokerage contract). When formally requesting mediation of sales to a real estate agency, a brokerage contract is concluded. In this contract, the subject property, the service details, and the real estate agency's fee will be described. *A brokerage contract is generally concluded between "Step 4 Look for a house" and "Step 8 Make a purchase offer" when you decide on a real estate agency to request mediation. ⇩ Step 7 Make a financial plan In parallel with the property search, concretize your financial plan. In addition to the funds needed to purchase the property, estimate the various expenses, mortgage interest rates, and monthly repayments that will be required. *Before finalizing the purchase of a house, a building inspection may be conducted to ascertain the condition of the house. You may need to purchase an "existing house sales defect insurance. ⇩ Step 8 Make a purchase offer Once you have decided on the property you wish to purchase and your desired conditions, make an purchase offer to the seller through the real estate agency. Applications are generally made in writing. ⇩ Step 9 Receive an explanation of important matters You will receive an explanation of important matters concerning the property to be purchased from the real estate transaction agent of the real estate company. ⇩ Step 10 Sign a real estate sales agreement If you confirm the contents of the explanation of important matters and are satisfied with it, you conclude a sales contract with the seller. At this time, a deposit (contract fee) of generally 10-20% of the property price is paid. When you sign a sales contract, make sure that you have thoroughly reviewed the terms of the contract. ⇩ Step 11 Sign a mortgage loan When using a mortgage loan, sign a formal contract for a mortgage loan following the signing of the sale contract. *Prior to signing the contract, the loan must be reviewed and approved by the financial institution and guarantee company. ⇩ Step 12 The delivery of the property

When the property is ready for delivery, the remaining payment is made. At the same time, the property is handed over from the seller and the property is registered. You will then move in |

Details

AuthorArrows International Realty Corp. Archives

June 2023

Categories

All

|

RSS Feed

RSS Feed