Buy the Property, Use Bank LoanWhat is a Housing Loan/Mortgage? As the name implies, a housing loan is money you borrow from a financial institution to buy or renovate a house. Of course, it would be nice if you could just pay for it yourself, but there are not many people who can cover the entire cost of a house that costs tens of millions of yen with the money they have on hand. Therefore, when buying a house, most people will use a house loan/mortgage and make monthly payments. Since a housing loan is a loan from a financial institution, interest is naturally charged on it. The amount of interest is calculated by multiplying the borrowed money (principal) by the interest rate (%), which is the percentage of the annual interest cost. However, since the interest rate is a percentage of the annual interest, it must be divided by 12 months to calculate the amount of interest to be paid each month. For example, if you borrow 30 million yen at an interest rate of 3%, the first repayment will cost you 30 million x 0.03 / 12 = 75,000 yen in interest. Furthermore, interest will be charged on the second and subsequent repayments according to the balance of the principal. Calculated in this way, if the loan is repaid in 30 years, the interest will amount to about 15,530,000 yen, and the total payment will amount to about 45,530,000 yen. (*Calculated using the equal principal and interest method, which is often used in loan repayment) In the monthly loan repayment, you are not only paying for the principal, but also for these interest payments. The longer the repayment period, the larger the total payment will be, since the interest will grow according to the length of time you borrow the loan. On the other hand, if the repayment period is shortened, the total repayment amount will be less, but the monthly payment will increase, thus putting a greater burden on the family budget. Therefore, when taking out a house loan/mortgage, it is important to consider the balance of your life cycle and lifestyle, such as job stability, whether you have children, and the timing of your retirement, when deciding on the amount to borrow and the repayment period. What are the advantages of using a real estate investment loan? The leverage effect. The leverage effect refers to the "principle of leverage" in investing. It refers to making a large amount of profit with a small investment. In real estate investment, it is to make a large profit with little personal capital by using a loan. When you use a real estate investment loan, the loan can cover most of the property price. In addition to requiring a small down payment, the profit generated by a profitable property is high. The leverage effect increases the "investment yield," which is the ratio of profit to the amount invested. For example, instead of earning a profit of 300,000 yen on an investment of 30 million yen, you can buy a 30 million yen property with an initial cost of 3 million yen and earn a profit of 300,000 yen. So what kind of bank loans are available? Let's take a look at the list of banks. Here is a list of banks that our customers have inquired about using. Please note that each bank has its own criteria, and therefore the availability of loans will vary. The answers will vary depending on the borrower's attributes and the property to be purchased. Once you have decided on the property you are considering purchasing, please consult with your bank. Bank of Kyoto (京都銀行) Housing Loan/Mortgage https://www.kyotobank.co.jp/kojin/loan/jyutaku/index.html Machiya Loan https://www.kyotobank.co.jp/kojin/campaign/kyomachiya/index.html THE KYOTO SHINKIN BANK (京都信用金庫) Housing Loan/Mortgage https://www.kyoto-shinkin.co.jp/personal/loan/housing/ Machiya Loan https://www.kyoto-shinkin.co.jp/catalog/s07-850.htm Kyoto Chuo Shinkin Bank (京都中央信用金庫) Housing Loan/Mortgage https://www.chushin.co.jp/kariru/home/ Machiya Loan https://www.chushin.co.jp/kariru/home/residence/index.html PRESTIA (SMBC信託銀行) Housing Loan/Mortgage https://www.smbctb.co.jp/product/loan/housing/ Second House Loan https://www.smbctb.co.jp/product/loan/second_loan.html Investment Loan https://www.smbctb.co.jp/product/loan/investment_loan.html SURUGA bank Ltd. (スルガ銀行) Housing Loan/Mortgage https://www.surugabank.co.jp/surugabank/kojin/service/dream_j/ Machiya Loan https://www.surugabank.co.jp/surugabank/kojin/service/machiya/ Second House Loan https://www.surugabank.co.jp/surugabank/kojin/service/resort/ Investment Loan https://www.surugabank.co.jp/surugabank/kojin/service/real_estate/ SHINSEI Bank, Limited. (新生銀行) Housing Loan/Mortgage https://www.shinseibank.com/english/housing/ MUFG Bank, Ltd. (三菱UFJ銀行) Housing Loan/Mortgage https://www.bk.mufg.jp/kariru/jutaku/index.html Second House Loan https://www.bk.mufg.jp/kariru/jutaku/shouhin/second/index.html Rakuten Bank, Ltd. (楽天銀行) Housing Loan/Mortgage https://www.rakuten-bank.co.jp/loan/mortgage-collateral/ AEON Bank,Ltd. (イオン銀行) Housing Loan/Mortgage https://www.aeonbank.co.jp/housing_loan/www.aeonbank.co.jp/housing_loan/ ARUHI Corporation. (アルヒ) Housing Loan/Mortgage https://www.aruhi-corp.co.jp/product/ SUMITOMO MITSUI TRUST LOAN & FINANCE CO.,LTD. (三井住友トラスト・ローン&ファイナンス) Housing Loan/Mortgage https://www.smtlf.jp/housingloan/lineup/home.html Investment Loan https://www.smtlf.jp/housingloan/lineup/apart.html SBI Estate Finance Co.,Ltd. (SBIエステートファイナンス) Investment Loan https://www.sbi-efinance.co.jp/loan/investment/ The Tokyo Star Bank, Limited(東京スター銀行) Housing Loan/Mortgage https://www.tokyostarbank.co.jp/products/loan/homeloan_star/ Investment Loan https://www.tokyostarbank.co.jp/products/loan/mortgage_collateral/ SAISON FUNDEX CO., LTD. (セゾンファンデックス) Investment Loan https://www.fundex.co.jp/business/product/f/investment.html ORIX Bank Corporation (オリックス銀行)

Investment Loan https://www.orixbank.co.jp/personal/property/ What's the difference between a real estate investment loan and housing loan?Some of you may be researching real estate investment and are wondering about the difference between real estate investment loans and housing loans. Real estate investment loans are for the purchase of income-producing real estate for the purpose of earning rental income. A housing loan is only applicable to the property that will become your home. Although they may seem similar, these two loans are completely different financing systems. By knowing the differences, you can choose the right loan for your purpose. In this article, we will introduce the differences between real estate investment loans and housing loans and how to utilize them. The main difference between a real estate investment loan and a housing loan is the purpose of purchasing the property: whether you will rent it to others to earn income or live in it by yourself. Based on this purpose, there are various differences. Let's take a look at the six differences here. Purpose of Loan A housing loan and a real estate investment loan may seem like similar loans when you think of them as being used to pay for the purchase of a property. However, the purpose of using the property for the loan is different. A housing loan is a loan to be used for the purchase or expansion of a home. The purpose of the loan is to cover the cost of the home in which the borrower lives. It cannot be used to cover the cost of purchasing a property for the purpose of renting it out. A real estate investment loan is a loan that is taken out to generate income through real estate investment. When purchasing real estate for profit, you need to take out a real estate investment loan instead of a housing loan. Financial institutions' screening criteria are also based on the intended use of the property. Taking out a housing loan to pay for the purchase of income-producing real estate is a serious breach of contract. Source of Repayment There is a difference between a housing loan and a real estate investment loan in terms of what is used as the repayment source. The repayment source is the money that is used to repay the loan. The source of repayment for a housing loan is generally your monthly salary. In the case of a housing loan, which is a loan for a house, the repayment source is generated from the income from the individual's labor. A housing loan is a loan for personal consumption only. The concept of repayment source is basically the same as other personal loans. In the case of real estate investment loans, on the other hand, the source of repayment is the monthly rental income. In the case of real estate investment loans, which are loans for income-producing real estate, the repayment source is generated from the rental income earned from tenants through rental management. Even if you are an individual investor, it is assumed that you will be running a business called rental management. Loan Amount There is also a difference in the loan amount. The maximum loan amount is higher for real estate investment loans than for housing loans. The difference is whether the loan is for an individual or for a business investor. The maximum loan amount for a housing loan is 5 to 8 times the individual's annual income. In general, the upper limit is 5 to 6 times, but it can be 7 to 8 times depending on the individual's attributes. The maximum loan amount for real estate investment loans is sometimes 10 to 20 times your annual income. The reason for this amount is that not only rental income but also salary income and savings are taken into account. Interest Rates on Loans There is a difference between housing loans and real estate investment loans, not only in the loan amount but also in the interest rate of the loan. The interest rate is usually higher for real estate investment loans than for housing loans. This difference is due to the difference in the risk of loan default. The interest rate on housing loans is about 0.5%~2.0% per year. Salary income will not decrease significantly as long as the individual continues to work. Housing loans that use salary income as the source of repayment can be said to have low interest rates due to the low risk of default. The interest rate for real estate investment loans is about 1.5%~4.5% per annum. If the loan amount is large, the repayment amount will also be large. However, rental income, which is the source of repayment, may not always be constant. Vacancies and declines in rent can occur, increasing the risk of default. For this reason, interest rates tend to be lower on real estate investment loans for properties that are expected to generate stable income. Details of Loan Screening There is a difference in the loan screening process between home loans and real estate investment loans. The difference can be described as whether to look only at the creditworthiness of the individual or also at the profitability of the property. In housing loans, personal attributes are the criteria for loan screening. Attributes are related to an individual's repayment ability and creditworthiness. Specifically, they include annual income, length of service, amount of savings, amount of debt with other companies, and history of financial accidents. In addition to personal attributes, real estate investment loans carefully check the profitability of the property. This includes the area in which the property is built, the age of the property, the rent setting, and the history of past property transactions. The type of property you choose will also affect whether or not you can get a loan. Different financial institutions have different standards for loan screening, so even if you don't pass the screening at one bank, it is possible that you will pass at another bank. Restrictions Housing loans and real estate investment loans differ in whether they can be signed in the name of a corporation or not. The property for which the cost is covered by a housing loan is supposed to be occupied by the contractor. It is a loan for the home and cannot be signed in the name of a corporation. The property you purchase with a real estate investment loan is operated for rental management, where you rent it out to tenants and earn rental income. The loan is for the business of earning real estate income, not salary income, and can be contracted in the name of a corporation. There is also a difference in the age limit of the contractor. For housing loans, the source of repayment is usually salary income. Taking into account the retirement age, the upper age limit is set at about 65~70 years old. In real estate investment loans, the source of repayment is the rental income from rental management. Depending on the profitability of the property and your asset status, you may be able to take out a loan at the age of 70 or older. Will I be able to get a housing loan if I have a real estate investment loan? Let's also look at whether taking out a real estate investment loan will prevent you from getting a housing loan. As mentioned above, real estate investment loans can be as high as 10~20 times your annual income. The state in which you are taking out a real estate investment loan is one in which you have a large amount of debt from other companies. Financial institutions that screen housing loans determine the repayment ability of individuals. The general perception may be that you are likely to fail the loan screening process because you are already approaching the upper limit of your repayment capacity. It is not easy to get a loan approval, but it is possible to get a loan depending on the conditions. The maximum amount for a home loan is 5 to 8 times your annual income. Within this amount, as long as the repayment ratio of the two loans combined is not too large, you can get a loan. The repayment ratio is the ratio of annual repayment amount to annual income. Some financial institutions consider real estate income to be combined with salary income. Although there are no fixed standards for loan screening, the larger your real estate income, the more favorable your loan screening will be. Which should you buy first, your home or your investment property? If you want to get both a real estate investment loan and a home loan, which one should you get first? There could be a scenario where a person earns a profit from real estate investment and makes a good living, but lives in a rental house because he or she cannot get a housing loan. It is only theoretical, but in conclusion, it is more effective to take out a real estate investment loan first. When you take out a real estate investment loan to purchase income-producing real estate, you will receive rental income. Many financial institutions consider this income as annual income. Increasing your annual income will also lead to a higher maximum loan amount. Buying income-producing real estate means that the maximum housing loan amount will naturally increase. On the other hand, if you take out a housing loan first, the loan amount for your real estate investment loan will be diminished because of the pressure on the loan amount. However, it is difficult to say for sure, as each financial institution has a different approach to screening, and whether or not a loan will be approved depends on the individual's financial situation. If you are considering purchasing a house, it is recommended that you inform the person in charge of sales of your ideas. Can I buy an investment property with a housing loan? Some people may wonder if it is possible to buy an income-producing property with a housing loan. As we have mentioned, a housing loan is a loan for a property as a home. Basically, you cannot purchase income-producing real estate with a housing loan. There are special cases in which a property purchased for one's own living purpose is consequently rented out to others. However, it is a breach of contract to use a housing loan even though you are supposed to be investing in real estate. The financial institution checks for this breach of contract even after the purchase of the property. If you are found to have violated the contract, it is customary to pay the remaining balance in a lump sum. In the worst case, you may be charged with fraud, so be careful. Why some people try to invest in real estate using a housing loan

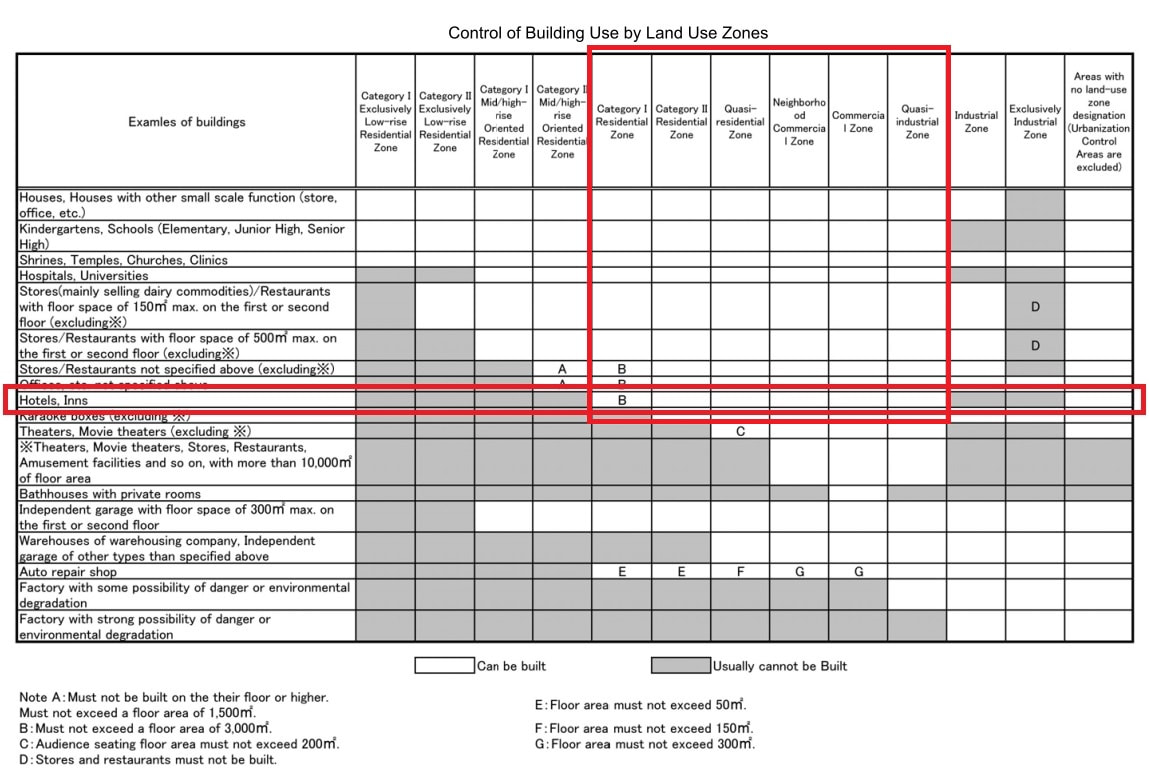

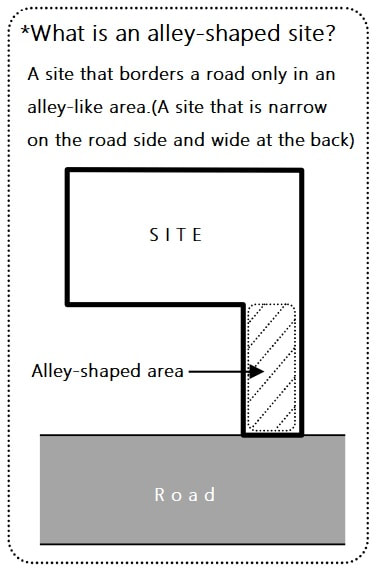

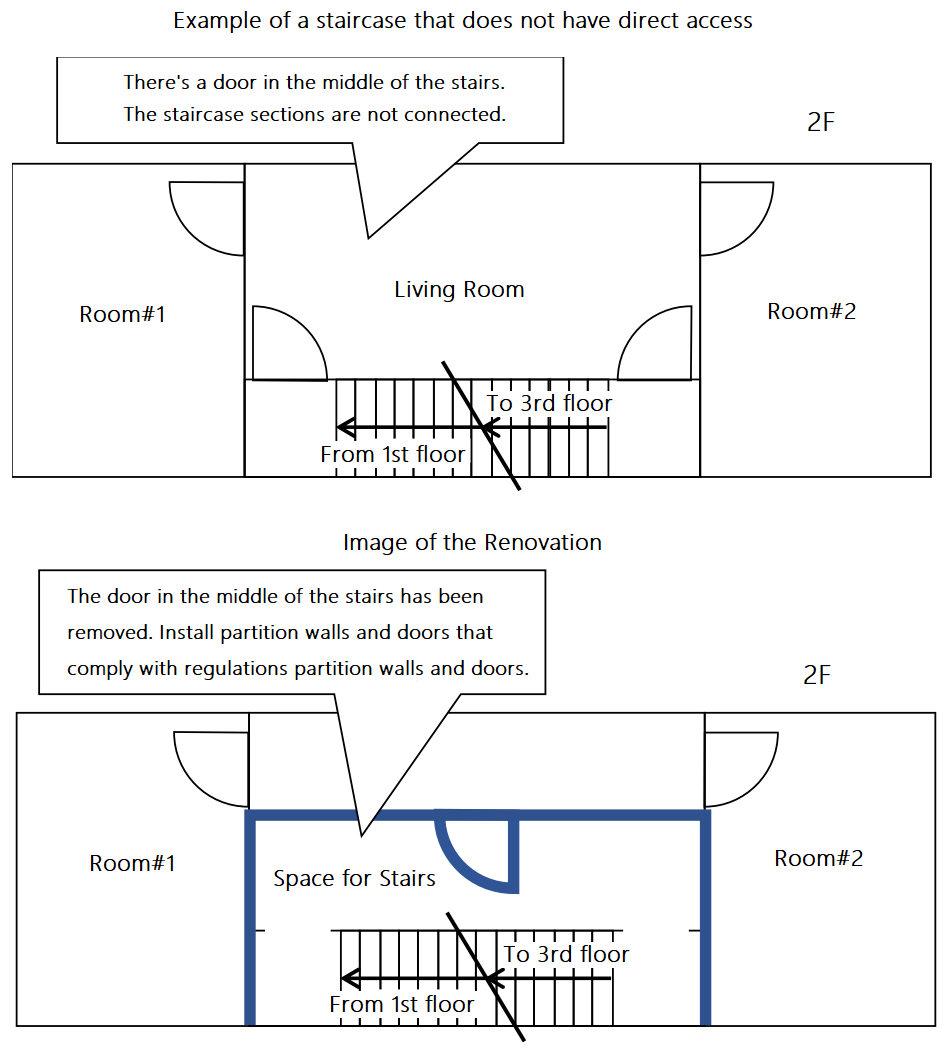

A housing loan is a loan for a property for your home. Despite knowing this, there are still people who try to invest in real estate using housing loans. The interest rates for housing loans are variable and range from 0.5% to 2.0% per year. Compared to real estate investment loans, where annual interest rates range from 1.5% to 4.5%, interest rates are low and screening standards are said to be relatively loose. If you look only at the basic terms and conditions of the loan, such as interest rate and approval, housing loans are more advantageous. For these reasons, many people want to use housing loans for income-producing real estate. However, borrowing a loan from a financial institution under the guise of a housing loan and using it for real estate investment is, of course, illegal. Even if the loan is approved, you may be asked to repay the loan in full if the forgery is discovered. Even if you are recommended by a real estate agent, do not go ahead with it. Major provisions of the Building Standards Act applicable to accommodation facilities under the Hotel Business LawFor those who are planning to open an accommodation facility based on the Ryokan Business Act In order to operate a lodging facility (hotel, inn, guesthouse, etc.) based on the Ryokan Business Act, the building in which the business is planned to be conducted must meet the structural and equipment standards stipulated in the Ryokan Business Act and the Fire Service Act. The Building Standards Act stipulates the zoning districts in which lodging facilities (including entrance halls outside facilities) can operate. Kyoto city ask that you confirm the zoning of the property before considering it, as follows. < Regulations Other than Zoning > When changing the use of an existing building and using it as a lodging facility, even if no building permit is required (e.g., area less than 200m², not involving expansion, renovation, or major repair or redecoration), it is necessary to comply with various provisions of the Building Standards Act. Please refer to the following main provisions of the Building Standards Act for the details of the regulations. In addition, before using the facility as a lodging facility, it is necessary to complete the necessary procedures based on the Barrier Free Ordinance. Major provisions of the Building Standards Act applicable to accommodation facilities under the Hotel Business Law - As a general rule, buildings on alley-shaped site* (see explanation below) cannot be changed to inns. - If the existing building does not conform to the provisions of the Building Standard Act, it is necessary to change the use of the building after the illegal part is removed. - In principle, the building must be fireproof when changing the use of the third floor or more to an inn. Even if the building is not a fireproof building (limited to 3 stories and less than 200m² in total area), it is necessary to install a pit compartment and alarm system. *An automatic fire alarm system or an automatic fire alarm system for specified small facilities with a receiver is required. This is not a residential fire alarm system. **Linen rooms and employee offices are also "ryokan uses". - If there is fire use, ventilation equipment must be installed. - Emergency lighting must be installed. - The site passage (passage from the exit of the building to the road, etc.) must be 1.5m or more (From April 2020, 0.9m or more for buildings with 3 or less floors and a total floor area of less than 200m²). - The width of alleys, etc. must be at least 1.5m regardless of the size of the building, as in the past, for buildings to be used as accommodation facilities in accordance with the provisions of 9-67 of the Kyoto City Building Law Handbook. - For rooms without windows, the walls, etc. that separate the rooms must be made of fireproof or noncombustible materials. * In addition to guest rooms, rest rooms and kitchens are also "rooms". - In the case of a change of use of a row of buildings (attached houses) to an inn (including a partial change of use), the boundary wall between the row of buildings and the inn shall be a partition wall for fire prevention. It is necessary to use a wall of quasi-fireproof construction and compartmentalize it to the shed or ceiling. - In addition, depending on the floor area and other factors, it may be necessary to install two or more direct staircases, smoke exhaustion equipment, interior restrictions, etc. - If the building is to be expanded, remodeled, repaired, or redecorated, it must also comply with road access and structural regulations. - There are cases where procedures based on the Building Standards Act are required even when only renovations are to be done. Confirming whether or not a building complies with the Building Standards Act requires specialized knowledge. Even if you do not need to apply for a building permit, , if necessary, please consult with an architect or other professional to ensure that your plans and construction are carried out legally. The responsibility for using a building in violation of the law lies with the construction client (business) or building owner. Supplement for those who are planning to open an accommodation facility based on the Ryokan Business Act For inns with three floors and a total area of less than 200 m². 1 Overview With the enforcement of the revised Building Standards Act in June 2019, buildings with three floors and a total floor area of less than 200m² can be used as inns, etc., without having to be fireproof buildings, provided that alarm systems and certain compartments are installed. 2 Precautions (*Please be sure to check the following. In the case of a change of use of 200m² or less (not involving expansion, renovation, or large-scale repair), no application for building certification is required. However, due to the change of use, the provisions of the Building Standards Act will apply, and it will be necessary to comply with various regulations. Specialized knowledge is required to investigate whether or not these buildings comply with the Building Standards Act. Even if you do not need to apply for a building permit, please be sure to consult with an architect or other specialist before legally carrying out any planning or construction work. The responsibility for using a building in violation of the law lies with the construction client (business) or building owner. 3 Necessary actions (1) Alarm system An automatic fire alarm system or an automatic fire alarm system for specified small facilities with a receiver is required. This is not a residential fire alarm system. (2) Pit compartment a. Overview The stairs and other parts of the building must be separated by partition walls and doors. b. Form of stairs The staircase must be a "direct staircase" and the stairs from the third floor to the first floor must be connected without interruption. It is not possible to pass through the living room on the way, nor is it possible to have a door. c. "Partition walls" and "Doors" The Ministry of Land, Infrastructure, Transport and Tourism (MLIT) gives the following examples in their explanation Partition walls: Partition walls with plasterboard of 9.5 mm or more in thickness on both sides Door: Flush door (with self-closing mechanism and smoke blocking performance, etc.) * You cannot use fusuma, shoji, walls made of plywood of about 3 mm thick, or doors made of plain glass. Examples of non-direct staircases and their responses

|

Details

AuthorArrows International Realty Corp. Archives

June 2023

Categories

All

|

RSS Feed

RSS Feed