Buying a House: Finding a Home 3How to Read Real Estate Advertisements (Prohibited Matters) In real estate advertising, "bait and switch" and "misleading representations" are prohibited. Take a look at the display examples to see if there are any violations of the terms and conditions that should be displayed, such as missing items or misleading wording. Point 1: Beware of bait-and-switch advertisements, etc. A bait-and-switch advertisement is an advertisement for a property that cannot be traded and includes the following:

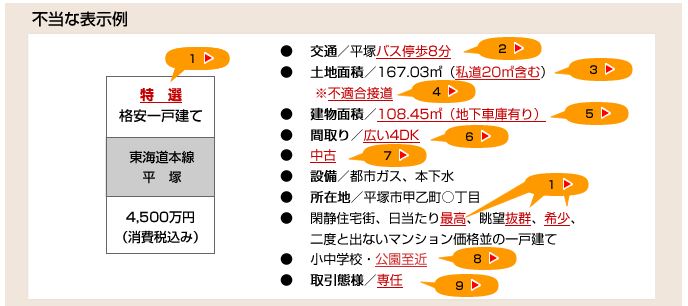

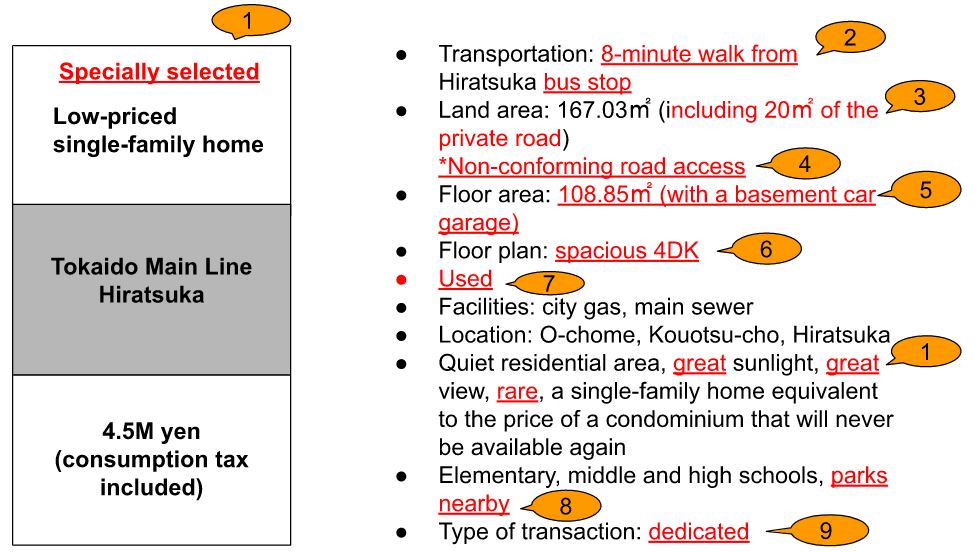

Point2: Misrepresentation in real estate advertising you should know about *This example is for newspaper inserts. Examples of company name, building license number, name of organization, company address, etc. are omitted. Examples of misrepresentation 1. "Specially Selected," "Best," "Outstanding," "Rare," etc.

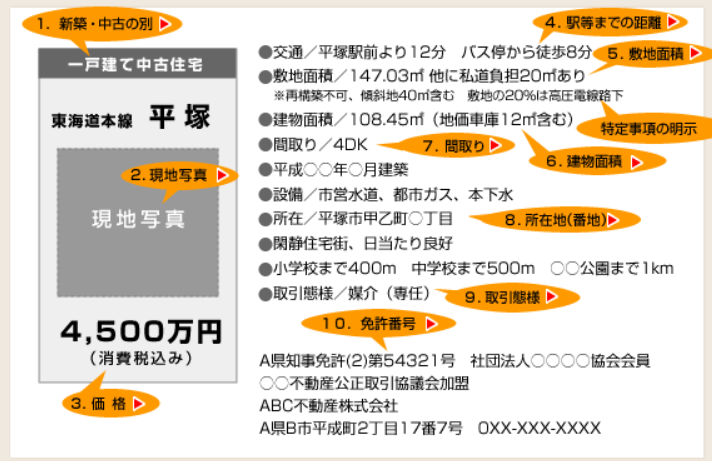

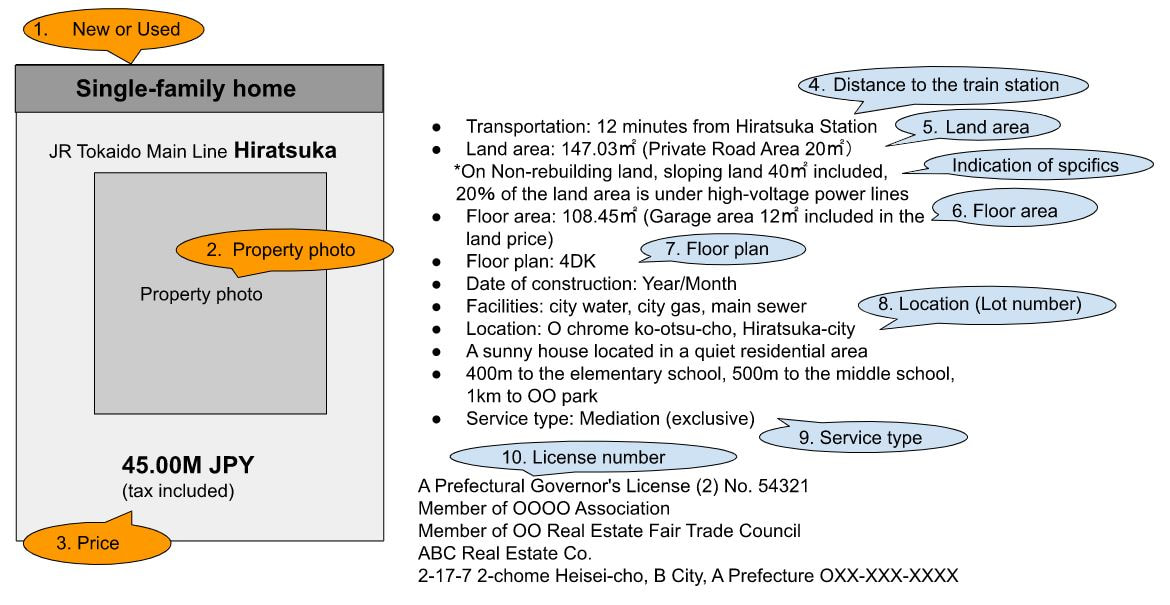

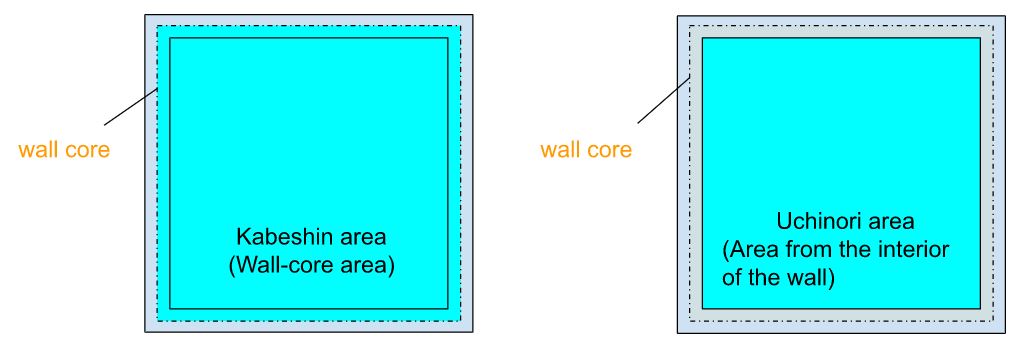

In addition to terms such as "specially selected" that indicate that the real estate has been selected according to certain criteria, terms that give the impression of extremely low prices ("cheap", etc.), terms that imply superiority over other companies ("first in the industry", "best in Japan", etc.), and terms that indicate the highest quality are prohibited unless there is objective and concrete evidence to support the use. 2. 8-minute walk from the bus stop The time required to take a bus from the nearest station to the nearest bus stop and the time required to walk from the bus stop to the property must be indicated. 3. 20㎡ private road included The property area and the private road area (if any) must be indicated clearly and separately. 4. Non-conforming road access When a building is constructed in a city planning area or a quasi-city planning area, the site must, in principle, abut a 4m or wider road under the Building Standard Law by at least 2m. In the case of a "non-conforming road" that does not meet this requirement, the property must be marked as "no building allowed" or "no re-building allowed. 5. Floor area: 108.45㎡ (with a basement car garage) A car garage cannot be included in the floor area. 6. Spacious 4DK Subjective expressions such as "spacious" and "bright" are prohibited. 7. Used The date of construction must be indicated. 8. Proximity to parks When indicating public facilities such as schools and parks, the distance must be clearly indicated instead of using subjective expressions such as "close by. 9. Dedicated service It is necessary to clearly indicate the real estate company's position on transactions by specifying which of "seller," "lessor," "mediation," and "agency" corresponds to the transaction mode. Buying a House: Finding a Home 2How to Read Real Estate Advertisements (Basics) Since real estate advertisements contain a lot of information about individual properties, you need to properly understand the information in the advertisements when considering properties to buy. Point 1: Property search starts with gathering a wide range of information. To find a desired property, the first step is to gather information on a wide range of properties that might meet your requirements through the Internet, information magazines, newspaper inserts, and other means. Therefore, it is important to understand how to read the advertisements in order to correctly understand the contents listed in these publications. ∙ Search for information on condominiums, single-family homes, and commercial properties Point 2: All you need to know about real estate advertising terms and conditions Real estate advertisements are subject to a number of regulations regarding the method of display, etc., for the purpose of consumer protection. One is the regulation under the Real Estate Brokerage Act, which prohibits exaggerated advertisements and restricts when advertisements can be started. In addition, the "Fair Competition Code Concerning Real Estate Representation" ("Representation Code"), an industry self-regulation approved by the Fair Trade Commission, defines the manner and standards for displaying advertisements. Basic Real Estate Advertising Rules and Regulations The listing terms and conditions define the items that must be displayed in real estate advertisements and the standards for displaying them. The basic terms and conditions are shown in the chart below. *The above example is for general newspaper and magazine advertisements. 1. New or Used In real estate advertisements, the property is indicated as "new" when it is less than one year old and has not been occupied (no one has ever lived in the property). All other properties are indicated as "used." 2. Property photo As a general rule, photographs must be used in advertisements only if they are of a building that is actually for sale. However, if the building has not yet been completed, photographs of other properties may be used as long as they are identical to the building actually for sale, and this fact needs to be clearly stated. 3. Price The price including consumption tax for the building is displayed. 4. Distance to the train station, etc. The time required on foot is calculated as 1 minute (rounded up to the nearest minute) for every 80 meters of road distance from the station. The time required for waiting at traffic lights, going up and down pedestrian bridges, going up and down hills, crossing roads, etc. are not taken into account. In addition, the time required to reach the platform may be longer because it is based on the nearest station entrance to the property, not from the ticket gate. 5. Land area The area is displayed in units of square meters, and may not be displayed in units of "tsubo". The area indicated in square meters is divided by 3.3 to obtain the approximate area in tsubo. 6. Floor Area The total floor area is shown in square meters. If a basement or garage is included, a statement to that effect and the area of the basement or garage are to be indicated. Balconies in condominiums and two-tiered attic storage with high ceilings in the rooms are not included in the area. In principle, the floor area of a building is indicated by the "kabeshin" (wall-core) area measured from the center of the wall, but the area on the registration record (registry) is indicated by the "uchinori" area measured from the inside of the wall (interior side). However, for used condominiums, the internal area on the registration record (registry book) may be indicated. 7. Floor plan When describing a floor plan, indications such as 4LDK are often used. The numbers represent the number of bedrooms, L represents the living room, D represents the dining room, and K represents the kitchen. According to the Building Standard Law, bedrooms must have a certain amount of frontage for lighting and ventilation, so rooms that do not meet these requirements are labeled as a storage room (N) or service room (S). The indication code stipulates that 1 tatami mat, which indicates the size of a living room, is converted to a minimum of 1.62㎡. 8. Location (Lot number) The location of the property is indicated up to the lot number in the case of a newly built house for sale. In the case of an existing house, the lot number can be omitted, so it is often not indicated. In addition, the lot number is the number indicated in the registration record (registry), which may differ from the commonly used residential number. 9. Service type Whether the position of the real estate company which publishes an advertisement is "Seller" or "Agency" or "Mediation (agency)" is always clearly indicated. This transaction mode determines whether a mediating fee is necessary or not. Moreover, there is general mediation, full-time mediation, etc. in mediation, but in the case of full-time mediation, an indication like mediation (full-time) is permitted. 10. License number The name of the real estate company and its license number are listed so that you can confirm that the company has received the necessary licenses for real estate transactions. The number in parentheses indicates the number of times the license has been renewed, and the higher the number, the longer the company has been in business. Specific matters that must be clearly indicated If the use of land is subject to legal restrictions or the shape of the land is so irregular that it cannot be used effectively, this fact is clearly indicated in the advertisement. The specific items that must be clearly indicated in real estate advertisements are as follows. 1. Land in an urbanization control area

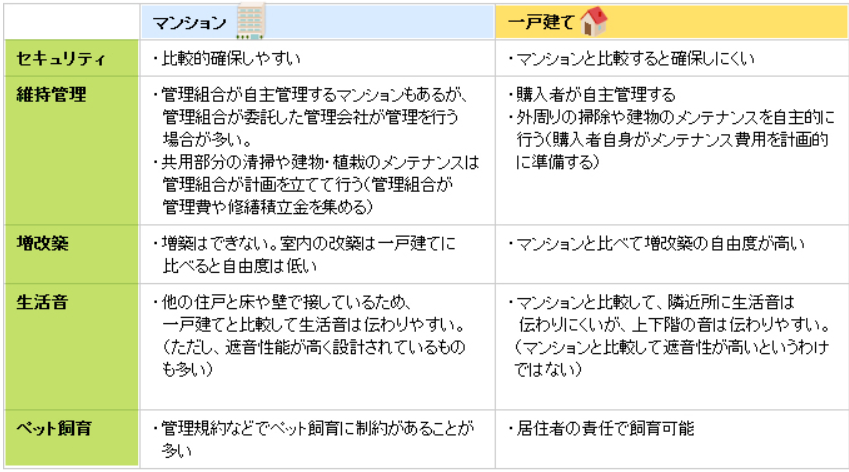

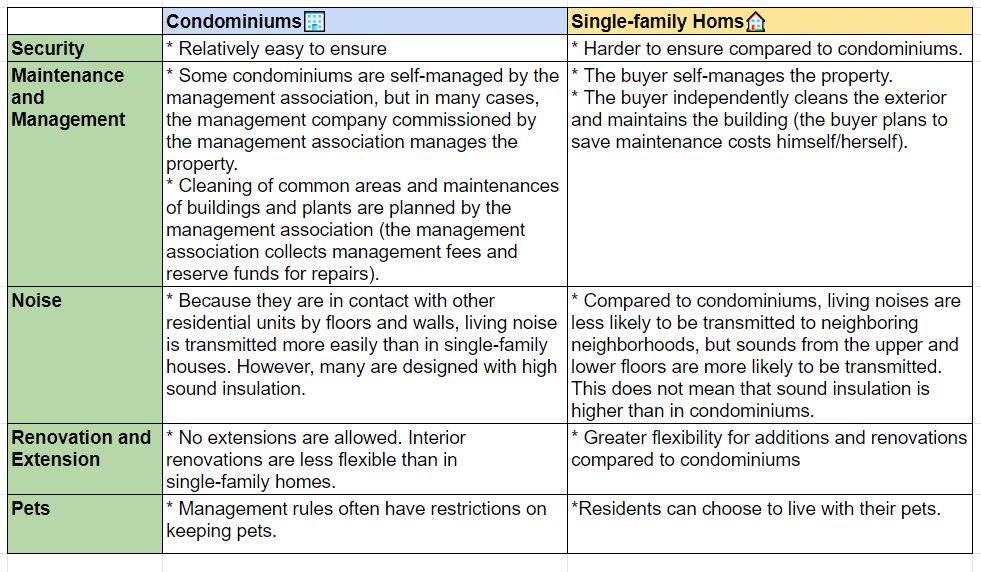

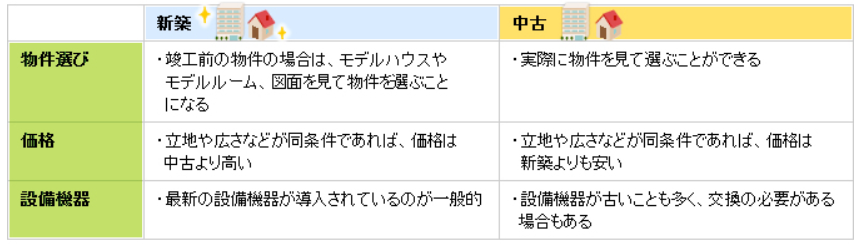

In principle, land cannot be developed or buildings cannot be constructed within the urbanization control area designated in the city plan, and this fact must be clearly indicated. 2. Land that does not legally abut a road Land that does not abut a road of 2 meters or more as stipulated by the Building Standards Law cannot be used for buildings. Such land is labeled as " no building allowed" or, in the case of an existing house, as " no rebuilding allowed." 3. Land requiring setback (road setback) Setback means that when the width of the road bordering the land is less than 4m, the land is set back 2m from the center of the road to construct a building. The setback is considered to be the road and no building can be constructed. The land that requires a setback is indicated as such. If the area of the setback required is approximately 10% or more of the total area of the land, the area is also indicated. 4. Land with an old house, etc. When there is an old house or an abandoned house on the land that is the subject of the transaction, it is indicated as "There is an old house" or "There is an abandoned house" etc. 5. Land under high-voltage lines When all or part of the land is under high voltage lines, a statement to that effect and the approximate area of the land must be indicated. When the construction of buildings or other structures is prohibited, the indication will read, for example, "No buildings or other structures are allowed under the high-voltage lines. 6. Land with slopes and significantly irregularly shaped land In the case of land that includes sloping land and the ratio of sloping land is approximately 30% or more, or even if the ratio is less than 30%, the fact that the land includes sloping land and its area is indicated if the effective use of the land is significantly hindered by the inclusion of sloping land, etc. In addition, the fact that the land is significantly irregularly shaped and hinders effective use of the land is also indicated. In the case of a markedly irregularly shaped lot, etc., which prevents the effective use of land, a statement to that effect is also indicated. 7. Land on or under a cliff not covered by a retaining wall If the land is on or under a cliff that is not covered by a retaining wall, this must be indicated. 8. Land with building conditions Land with building conditions is land that is sold or purchased on the condition that a building contract will be concluded with the seller of the land or a construction company designated by the seller within a certain period of time after the contract is concluded. The details of the building conditions and the measures to be taken if the building contract is not concluded are to be clearly indicated. Buying a House: Finding a Home 1List up your housing preferences When purchasing a home, it is necessary to consider whether to buy a condominium or a single-family home, and whether to buy a newly built or used property. It is important to discuss with your family how you would like to live after the purchase, what kind of life you would like to lead, and what kind of home would be best for you to realize your dreams. Point 1: Envision the life you want to lead. First, envision what kind of lifestyle you would like to lead. For example, "you might want a single-family house because you want to keep pets," or "you might want a condominium because it is too much trouble to maintain the garden and exterior," etc. By imagining the kind of life you want to realize in concrete terms, you can find a form of housing that will fulfill that desire. Point2: Know the characteristics of the property types. Both condominiums and single-family homes have their own characteristics. Everyone has their own preferences for housing, so use the table below to consider what makes a home comfortable to live in for you. Condominiums vs. single-family homes Characteristics of each of newly built and used houses When looking for a used home, there are several mechanisms in place to address concerns about the quality of older buildings. These include the following methods to check the quality of an existing house.

Point3: Understanding condominium management (1) Exclusive and common areas

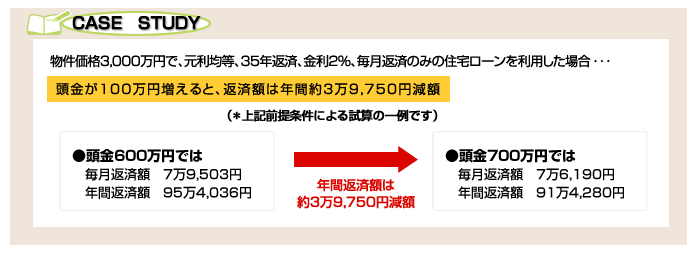

A condominium differs significantly from a single-family home in that the property is co-owned by the owners of each unit: unit ownership. While the site is co-owned by all unit owners/purchasers, the building is divided into "exclusive use" and "common use" areas. Exclusive areas are the living space inside the house that is partitioned off by walls and ceilings and are owned by the owner. Common areas are the entrances to the entire building, elevators, stairs, corridors, exterior walls, bicycle parking lots, garbage storage areas, etc., which are shared by all condominium unit owners. (2) The role of the management association The common areas are managed by a management association whose members are all condominium unit owners. The management association decides on management policies, such as a long-term repair plan, including when and how to inspect and repair the buildings and facilities in the common areas, and all unit owners accumulate the necessary expenses for this purpose (called a repair reserve fund). In general, the daily cleaning of common areas is carried out by a management company entrusted by the management association. (3) Management regulations and bylaws for use A condominium is a place for communal living, and rules are necessary to ensure that everyone can live comfortably together. These rules are called the management regulations and bylaws for use. The management regulations mainly stipulate the operation of the management association, and includes the scope of exclusive areas and common areas, the amount of management fees and reserve funds for repairs, and whether or not pets are allowed. The bylaws for use stipulate the rules and promises for daily life in the condominium, such as how to use the balcony. Buying a House: the Budget 3Mak1ing a larger down payment The larger your down payment is, the less you will borrow and the lower your loan repayment burden will be. The lower your loan repayment burden, the more secure your household finances will be in the future, so consider ways to increase your down payment as much as possible. Point 1: Plan to increase your savings. During the repayment period of a mortgage loan, there is a risk that household financial circumstances may change, such as an increase in children's educational expenses or a decrease in income due to retirement, and you may be unable to pay the originally planned loan repayment amount. However, if you can increase your down payment and lighten your repayment amount, you can reduce such risks. For this reason, it is important to plan ahead and save for the future. 📖CASE STUDY If a mortgage loan is taken out for a property price of 30 million yen, with equal principal and interest, 35-year repayment, 2% interest rate, and monthly repayment only... If the down payment increases by 1 million yen, the annual repayment amount decreases by about 39,750 yen. *This is an example of an estimate based on the above assumptions.

Point 2: Points to keep in mind when receiving financial assistance from your parents You may be receiving financial assistance from your parents when purchasing a house. You can receive financial assistance by "borrowing from your parents" or "receiving a gift from your parents".

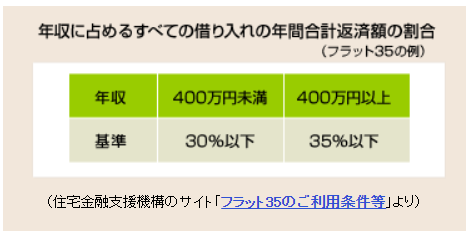

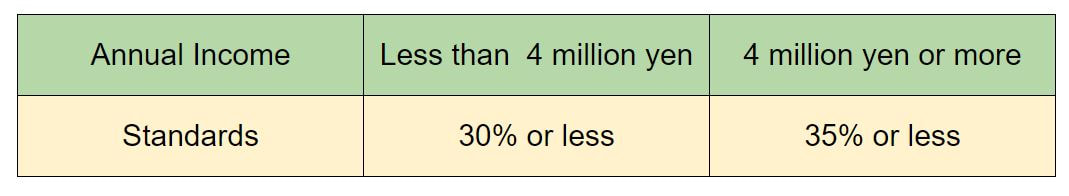

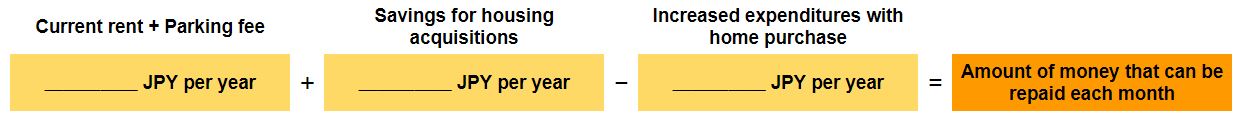

When borrowing funds from your parents, it is important to note that in order for the loan to be recognized as a borrowing and not a gift, an IOU must be prepared and the interest rate, repayment method, and other conditions must be the same as those for a loan from a third party, even if the loan is from your parents. It should also be noted that gifts received from your parents are subject to gift taxation, even if between you and your parents. However, there are cases where tax exemptions are available for gifts received from parents or grandparents, so please check in advance. Buying a House: the Budget 2Estimate the amount of the loan based on the amount you can afford to repay. Consider how much you can afford to repay. First, review your current household income and expenditures, and identify the amount of monthly household surplus that can be used to repay the loan, including the amount of expenditures and reserves that will decrease as a result of the home purchase. Next, subtract the expected increase in expenses due to the purchase of the house from this amount, and estimate the amount that can be repaid each month. However, it is safer to consider this amount as the maximum amount and to plan your repayment with a little extra time to spare. You can also find simulations on the Internet that calculate the amount you can borrow based on your annual income and monthly repayments. Point 1: Do not base your loan on the financial institution's loan limit. Banks and other financial institutions set standards for mortgage loan limits based on the ratio of the amount borrowed to the property price and the ratio of the annual repayment amount to annual income including tax. For example, "Flat 35" (a mortgage loan provided by the Japan Housing Finance Agency (JHF) in partnership with private financial institutions) stipulates that the loan amount must be between 1 million yen and 80 million yen (in units of 10,000 yen), within the construction or purchase price. The ratio of the annual repayment amount to annual income including tax is also defined as shown in the table below. However, this is only the standard for "Flat 35". The amount of money that can be repaid depends on each household's financial situation. For example, you may need money for your child's education or for your parent's nursing care, or you may want to buy a new car. you should determine the amount you can borrow after considering your individual circumstances and knowing the maximum amount of repayment for your family budget. Ratio of total annual repayments of all loans to annual income (Example of Flat 35) From "Flat 35 Terms and Conditions" on the website of Japan Housing Finance Agency (JHF) Point 2: Determine the amount you can borrow based on the amount you can afford to pay back. Figure out how much you can afford to pay back each month. Consider how much you can afford to repay. First, review your current household income and expenditures, and identify the amount of monthly household surplus that can be used to repay the loan, including the amount of expenditures and reserves that will decrease as a result of the home purchase. Next, subtract the expected increase in expenses due to the purchase of the house from this amount, and estimate the amount that can be repaid each month. However, it is safer to consider this amount as the maximum amount and to plan your repayment with a little extra time to spare.

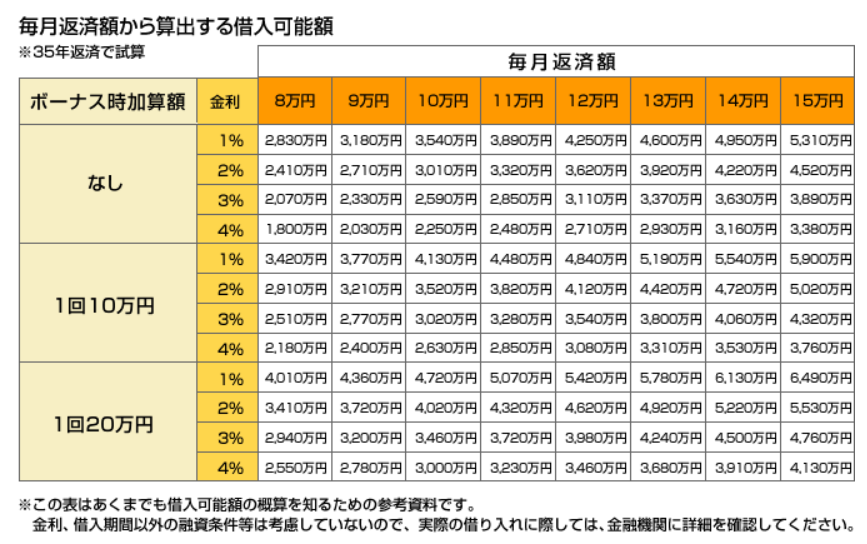

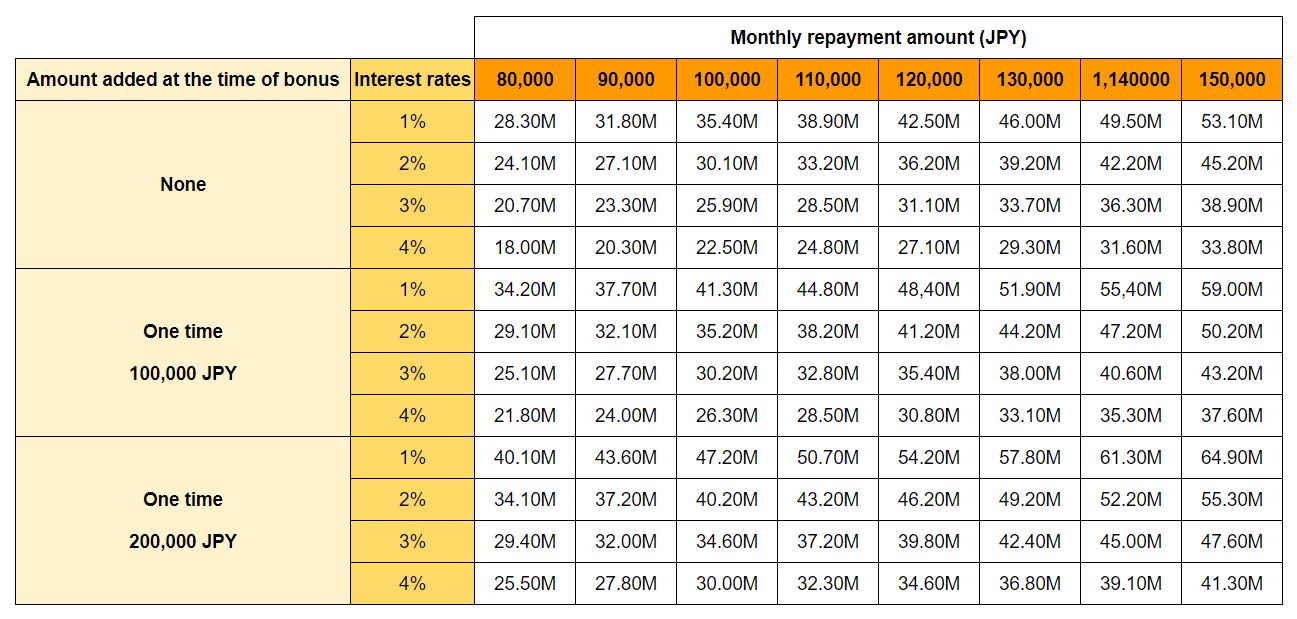

* *As for the amount of taxes, management fees and reserve for repairs (in the case of condominiums), ask the real estate agency for a rough estimate once you have decided on a potential purchase property. Example of an estimate of the amount that can be repaid Estimate the amount you can borrow from the monthly repayment amount. Once you have estimated the amount you can repay each month, use the table below to find out the approximate amount you can borrow. For example, if the monthly repayment is 80,000 yen, the bonus repayment is zero yen, the interest rate is 2%, and the repayment is over 35 years, the amount that can be borrowed is 24,100,000 yen. Although you should not rely too heavily on bonuses, you may want to consider using bonus repayments if the amount paid is expected to be somewhat stable. A simulation that calculates the amount that can be borrowed based on annual income and monthly repayments is available on the Internet and can be entered to find out. The important thing is to consider your financial plan with this borrowing capacity as the "upper limit. Be sure to plan your finances carefully, assuming a decrease in income, an increase in expenses, and, in the case of a loan with variable interest rates, an increase in repayments due to a rise in interest rates. Amount that can be borrowed based on the monthly repayment amount *Calculated based on 35-year repayment *This table is for reference purposes only to give you an idea of the approximate amount you can borrow.

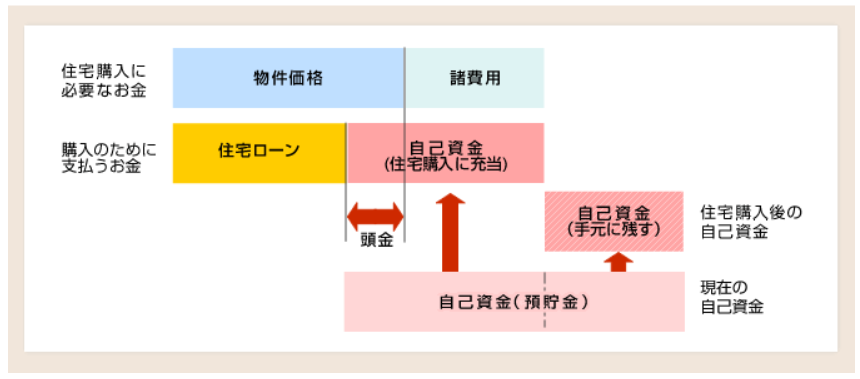

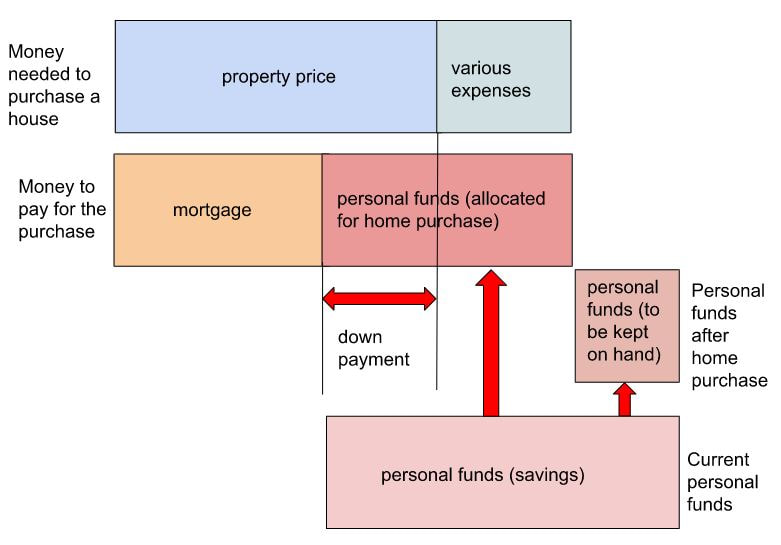

Please confirm the details with the financial institution when actually borrowing funds. Buying a House: the BudgetBasic ideas of purchase costs It is important to set an approximate budget before you begin the specifics of your property search. The following is an overview of the budget required to purchase a house and the concept of financial planning. Point 1 Get a general idea of the budget needed to purchase a house. You cannot buy a house merely by securing funds equivalent to the purchase price of a property. Taxes, registration fees, mortgage expenses, moving expenses, and funds for purchasing furniture, appliances, and curtains are required. In addition, for newly built condominiums, a repair reserve fund of several hundred thousand yen is required in many cases at the time of purchase, and in the case of brokered properties, a brokerage fee is charged by the real estate company. In other words, in order to purchase a house, it is necessary to prepare funds for the property price plus these various expenses. The necessary funds (property price + various expenses) for purchasing a house calculated as described above need to be prepared by self-financing or taking out a mortgage loan. Property Price + Other Expenses = Own Funds + Mortgage Loan If you are thinking of buying an existing house and remodeling it, you should also include the cost of remodeling in your estimate. Although most people pay for remodeling with their own funds, if you have taken out a mortgage to finance the purchase and can afford the repayments, you can also use the loan to pay for the remodeling costs. Point 2 Know how much you can use from your personal funds for a down payment. Now, let's calculate the amount of your personal funds, such as savings, that can be used for a down payment on a home purchase. First, the amount to be allocated to the home purchase fund is determined by considering the amount of personal funds to be kept on hand, taking into account living expenses, education, and other expenses after the home purchase. Then, the down payment will be the amount obtained by subtracting the various expenses from the personal funds to be allocated for the house purchase.

Down payment = Total amount of personal funds - Current living expenses - Miscellaneous expenses for home purchase |

Details

AuthorArrows International Realty Corp. Archives

June 2023

Categories

All

|

RSS Feed

RSS Feed