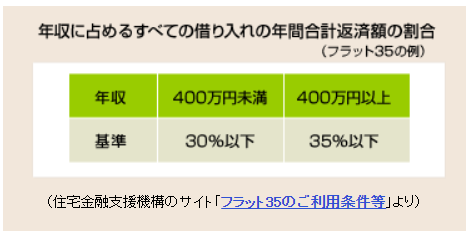

Buying a House: the Budget 2Estimate the amount of the loan based on the amount you can afford to repay. Consider how much you can afford to repay. First, review your current household income and expenditures, and identify the amount of monthly household surplus that can be used to repay the loan, including the amount of expenditures and reserves that will decrease as a result of the home purchase. Next, subtract the expected increase in expenses due to the purchase of the house from this amount, and estimate the amount that can be repaid each month. However, it is safer to consider this amount as the maximum amount and to plan your repayment with a little extra time to spare. You can also find simulations on the Internet that calculate the amount you can borrow based on your annual income and monthly repayments. Point 1: Do not base your loan on the financial institution's loan limit. Banks and other financial institutions set standards for mortgage loan limits based on the ratio of the amount borrowed to the property price and the ratio of the annual repayment amount to annual income including tax. For example, "Flat 35" (a mortgage loan provided by the Japan Housing Finance Agency (JHF) in partnership with private financial institutions) stipulates that the loan amount must be between 1 million yen and 80 million yen (in units of 10,000 yen), within the construction or purchase price. The ratio of the annual repayment amount to annual income including tax is also defined as shown in the table below. However, this is only the standard for "Flat 35". The amount of money that can be repaid depends on each household's financial situation. For example, you may need money for your child's education or for your parent's nursing care, or you may want to buy a new car. you should determine the amount you can borrow after considering your individual circumstances and knowing the maximum amount of repayment for your family budget. Ratio of total annual repayments of all loans to annual income (Example of Flat 35) From "Flat 35 Terms and Conditions" on the website of Japan Housing Finance Agency (JHF) Point 2: Determine the amount you can borrow based on the amount you can afford to pay back. Figure out how much you can afford to pay back each month. Consider how much you can afford to repay. First, review your current household income and expenditures, and identify the amount of monthly household surplus that can be used to repay the loan, including the amount of expenditures and reserves that will decrease as a result of the home purchase. Next, subtract the expected increase in expenses due to the purchase of the house from this amount, and estimate the amount that can be repaid each month. However, it is safer to consider this amount as the maximum amount and to plan your repayment with a little extra time to spare.

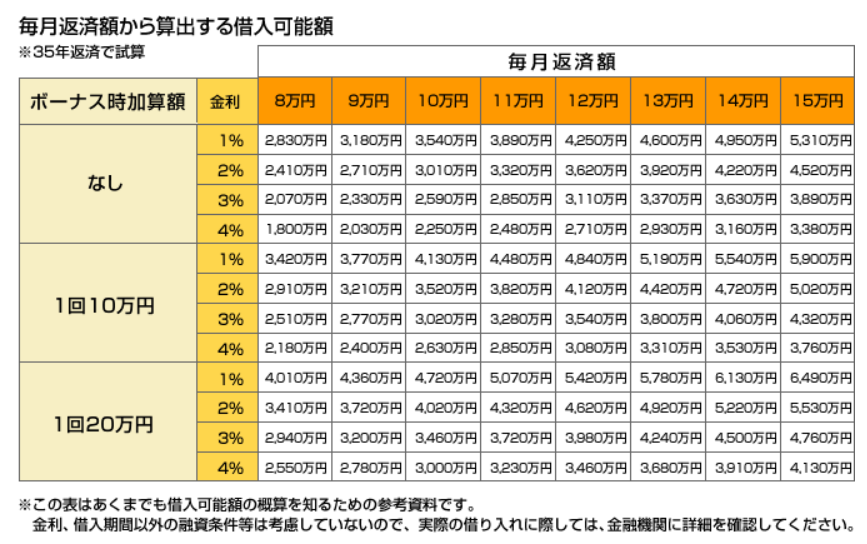

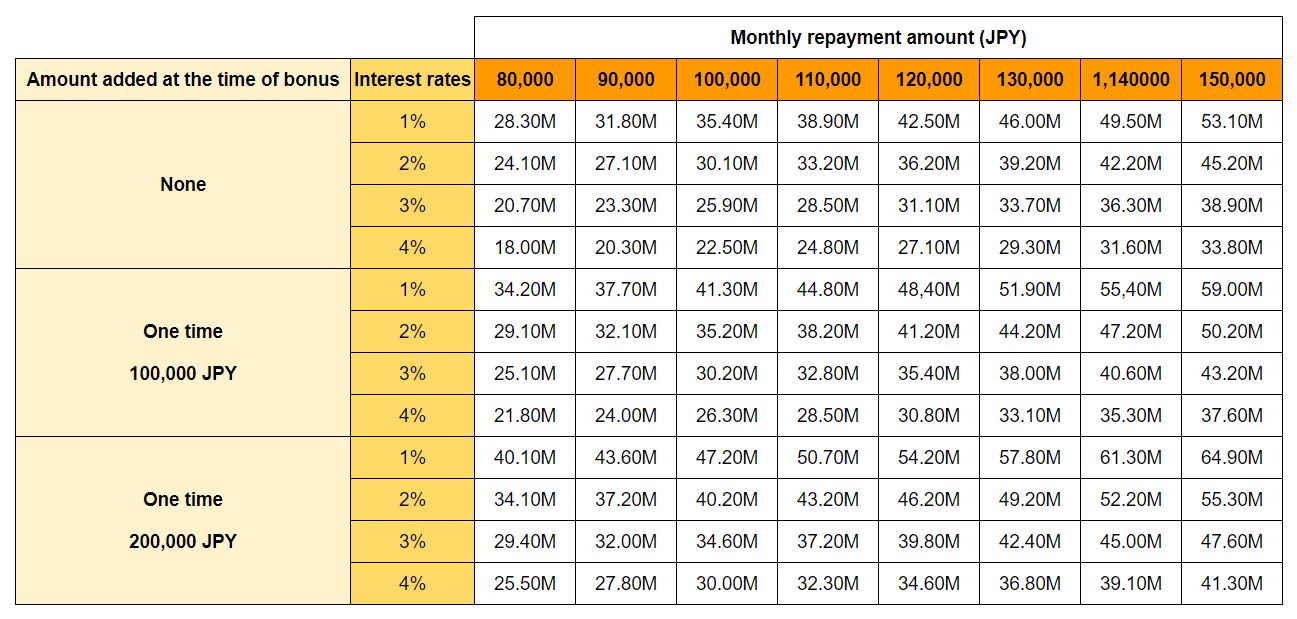

* *As for the amount of taxes, management fees and reserve for repairs (in the case of condominiums), ask the real estate agency for a rough estimate once you have decided on a potential purchase property. Example of an estimate of the amount that can be repaid Estimate the amount you can borrow from the monthly repayment amount. Once you have estimated the amount you can repay each month, use the table below to find out the approximate amount you can borrow. For example, if the monthly repayment is 80,000 yen, the bonus repayment is zero yen, the interest rate is 2%, and the repayment is over 35 years, the amount that can be borrowed is 24,100,000 yen. Although you should not rely too heavily on bonuses, you may want to consider using bonus repayments if the amount paid is expected to be somewhat stable. A simulation that calculates the amount that can be borrowed based on annual income and monthly repayments is available on the Internet and can be entered to find out. The important thing is to consider your financial plan with this borrowing capacity as the "upper limit. Be sure to plan your finances carefully, assuming a decrease in income, an increase in expenses, and, in the case of a loan with variable interest rates, an increase in repayments due to a rise in interest rates. Amount that can be borrowed based on the monthly repayment amount *Calculated based on 35-year repayment *This table is for reference purposes only to give you an idea of the approximate amount you can borrow.

Please confirm the details with the financial institution when actually borrowing funds. Comments are closed.

|

Details

AuthorArrows International Realty Corp. Archives

June 2023

Categories

All

|

RSS Feed

RSS Feed