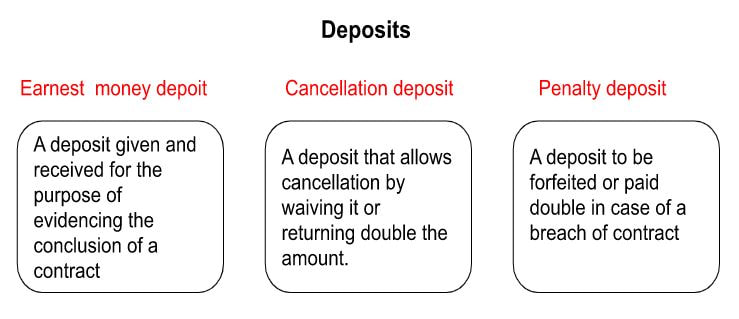

Buying a House: the DepositsThere are three types of deposits: (1) earnest money deposit, (2) cancellation deposit, and (3) penalty deposit. Differences in the Deposits (1) Earnest money deposit A deposit given and received for the purpose of evidencing the conclusion of a contract. (2) Cancellation deposit A cancellation deposit is a deposit that allows

A deposit that, in the event of a breach of contract by either party, will be forfeited or doubled as "punishment" for the breach of contract, in addition to compensation for damages. Cancellation by Earnest Money Deposits The termination of a contract by means of a cancellation deposit is generally referred to as "release of deposit." For example, if circumstances have changed significantly since the contract was concluded, it is possible to cancel the contract by waiving or doubling back the deposit. However, the contract can be canceled with release of deposit only until the other party begins to fulfill the contract. In other words, if the other party has already performed the promises stipulated in the contract, the deposit cannot be cancelled. However, in releasing a deposit, there are often troubles over "whether the other party has started to fulfill the contract or not. In addition, since both the seller and the buyer have the right to terminate the contract during the period when release of deposit is possible, it remains uncertain whether the contract will be fulfilled or not. Therefore, the period that allows cancellation by release of deposit may be limited to "within ● days from the date of the contract" or "until ●●● year". An overview of the deposits * A deposit is presumed to be a cancelation deposit if not otherwise specified.

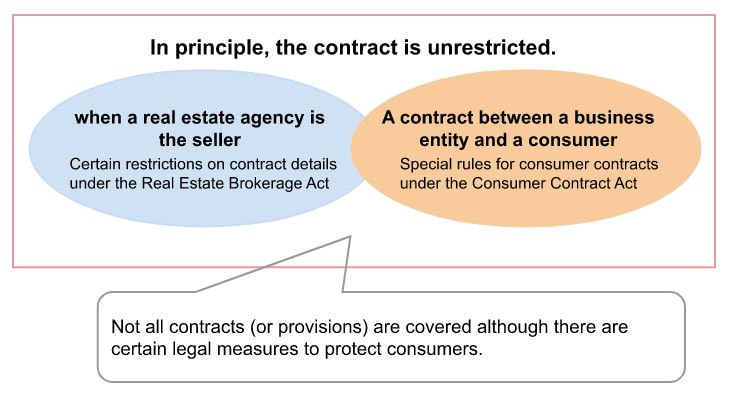

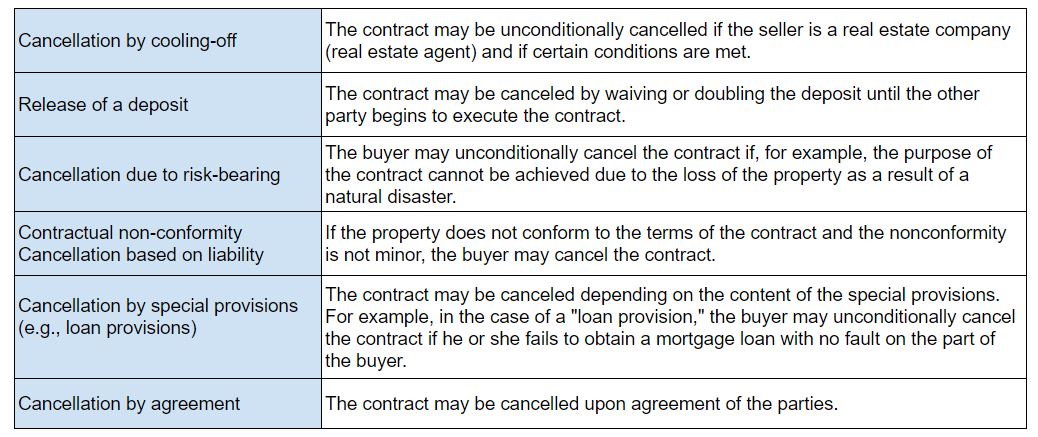

Concluding a Sales ContractAfter receiving an explanation of important points and both the buyer and seller agree on the terms of the contract, a sales contract is concluded. Once a contract is concluded, it cannot be easily cancelled. Therefore, it is important to fully confirm its contents beforehand. Keep in mind that although the real estate company provides an explanation, the contract is ultimately concluded on self-responsibility. Point 1: Know the basics of the sales The content of the contract is unrestricted in principle. The content of the contract between the seller and the buyer is unrestricted as long as it does not violate laws and regulations, offend public order and morals, or otherwise cause problems. Conversely, the principle is that the contract should be concluded at one's own risk. There are certain laws and regulations in place to ensure that consumers are not unilaterally disadvantaged by contracts, but they do not cover everything. It is important that you confirm the contents of the contract and conclude the contract at your own risk. Matters not stipulated in the contract are to be determined upon consultation in accordance with the Civil Code and other related laws and regulations. Therefore, if important contract terms are unclear, it may lead to problems after the contract is signed. Restrictions on contracts when the seller is a real estate agency When a real estate company is the seller, the Real Estate Brokerage Act provides certain restrictions so that a disadvantageous contract will not be concluded for the buyer. This protects the buyer who concludes a contract directly with the real estate company, which is the expert in real estate transactions. The Consumer Contract Act applies to contracts between business entities and consumers. Since there are differences in the ability to access information and negotiate between business entities and consumers, the Consumer Contract Act establishes specific contract rules for contracts between business entities and consumers (referred to as "consumer contracts") with the aim of protecting consumers, and also affects real estate purchase and sale contracts. For example, the Act provides that a contract can be rescinded if the consumer has misunderstood the contract, and that clauses that are disadvantageous to the consumer (such as clauses that exempt the business entity from liability for contractual nonconformity, etc.) become invalid. Although a consumer under the Consumer Contract Act refers to an individual who concludes the contract for business purposes is not covered by the protection of the Consumer Contract Act. The Consumer Contract Act applies to contracts concluded by individuals for purposes other than business. It is important to understand that it also applies to real estate sales contracts. An overview of a real estate sales contract Point 2: Understand the deposit In a real estate sales contract, it is common for the buyer to pay a "deposit" to the seller at the time the contract is concluded. There are three types of deposits: (1) Deed deposit (2) Cancellation deposit (3) Penalty deposit Generally, in a real estate sales contract, the deposit is given and received as the "cancellation deposit" described in (2). The Civil Code also states that in the absence of any special provisions regarding the nature of the deposit, it is presumed to be a cancellation deposit. A "cancellation deposit" is a deposit that allows the buyer to cancel the sales contract by waiving (not requesting the return of) the deposit already paid, and the seller to return to the buyer twice the amount of the deposit already received. However, a contract can be canceled by the deposit only until the other party executes the contract. In other words, if the other party has already fulfilled the promises stipulated in the contract, the contract cannot be cancelled by the deposit. Point 3: Once a contract is signed, it cannot be easily cancelled. Especially when conducting large transactions such as real estate sales, a contract is an important promise based on the relationship of trust between the seller and buyer. Therefore, once a contract is concluded, it generally cannot be easily canceled for the convenience of one party. The main types of contract cancellations are as follows. *The above table is a general guideline, and the procedures for cancellation differ for each individual contract. Point 4: Understand contractual non-conformity What is contractual non-conformity liability? Defects in properties, such as leaks or corrosion caused by termites, have been referred to as "defects," and the seller's liability for such defects has been called "liability for defects. However, due to the revision of the Civil Code enforced on April 1, 2020, not only the name but also the content of this liability has been drastically changed. The revised Civil Code is based on the premise that the seller is obligated to deliver a property that conforms to the terms of the contract with respect to "type, quality, and quantity" of the subject matter of the sale, and that if the seller delivers a property that does not conform to the terms of the contract with respect to those items, the seller is liable for default. For example, if the seller delivers a building that has leaks or corrosion caused by termites, the seller is in default of his/her obligation to deliver an object that conforms to the terms of the contract with respect to quality. Contents of contractual non-conformity liability When the subject matter of the contract is nonconforming as described above, the buyer can demand the repair of the nonconformity, and when the seller does not do so even after the repair is demanded, or when the repair itself is impossible, the buyer can demand a reduction of the purchase price. In addition, under the general principle of default, a claim for compensation for damages can be made, and the contract can be terminated. However, compensation for damages cannot be claimed if the seller is not responsible in any way. Cancellation is also not allowed when the nonconformity is minor. Period during which the seller is liable for nonconformity with the contract Under the Civil Code, the buyer must notify the seller of the nonconformity within one year of becoming aware of it, because it is considered unreasonable for the seller to be liable for the nonconformity for a long period of time, and because it is appropriate to settle such disputes arising from the sale as early as possible. Special provisions in sales contracts This provision of the Civil Code is an optional provision, meaning that it can be changed or modified at will, so another provision can be made by a special agreement between the parties. Especially in the case of an existing house (used house), it is difficult or impossible to determine whether a certain defect or other event constitutes a non-conformity to the contract due to age-related deterioration, natural wear and tear, etc. Therefore, in general transactions, the scope of the seller's liability is limited or the period of liability is shortened. In some cases, there is also a provision that the seller is not liable at all. Even in such cases, the seller is not exempt from liability if he/she knew of the nonconformity and failed to inform the buyer, but otherwise, the seller is exempt from liability as per the special provision. When a real estate agent (real estate company) is the seller With regard to liability for nonconformance with contract in cases where a real estate agency or a real estate company is the seller and the buyer is not, under the Real Estate Brokerage Act, a provision to the effect that the seller is liable for nonconformance with contract is valid only if the seller is notified within two years of the date of delivery. However, other than that notice period, provisions that are less favorable to the buyer than those of the Civil Code, such as "only repair claims" or "the contract can be terminated if the seller approves" other than during such notice period, is invalid. When a business entity is the seller and a consumer is the buyer All corporations are "business entities" under the Consumer Contract Act, including those that are not real estate companies. In a contract in which a business entity acts as the seller and sells to a consumer, a contract provision stating that the business entity is not liable for nonconformance is considered invalid under the same Act. Special provisions for new housing under the Housing Quality Assurance Promotion Act In the case of a newly built house, the real estate company that is the seller must assume liability for defects (*) for 10 years for the main structural parts, etc. (foundation, pillars, roof, exterior walls, etc.) of the house. In order to avoid a situation where the seller cannot fulfill its liability for defects due to bankruptcy, etc., the seller is obligated to sign an insurance policy or deposit a security deposit at the time of delivery to the buyer. The seller is required to explain to the buyer which measure, insurance or deposit, will be applied at the time of the important points explanation and the sales contract, so make sure to check the details carefully.

*The Housing Quality Promotion Act uses the term "liability for defects," but the revised Civil Code uses the term "liability for nonconformity of contract as to type and quality. What to Check in the Important Points ExplanationBefore signing a contract, an "important points explanation" is always given. Important points regarding the property to be purchased and the terms and conditions of the transaction are explained. It is important to understand the details before making a final decision on whether or not to purchase the property. Point 1: What is an important points explanation? The Real Estate Brokerage Act stipulates that a real estate company must provide an important points explanation regarding the property to be purchased to the prospective buyer before concluding a sales contract. An explanation of important points must be given orally by a licensed real estate agent after he/she has signed and sealed a written document describing the contents and given the document to the client. It is possible that you may decide not to purchase the property after receiving the explanation of important points, so it is important to receive the explanation of important points at an earlier stage. After receiving an explanation, you will want to take sufficient time to consider the matter and resolve any questions before signing the contract. For this reason, it is advisable to confirm in advance with the real estate agency the schedule for the important points explanation and the sales contract. There tends to be little time to consider the situation in the final stage of negotiations related to buying and selling. Make sure to set aside enough time in the schedule so that you can make a final decision after careful consideration. Online (IT) Explanation of Important Points An explanation of important points is required to be provided orally by delivering a document signed and sealed by a licensed real estate agent. However, when certain requirements are met, a non-personal explanation using "IT" (computers and other terminals) such as videoconferencing is now considered the same as a face-to-face explanations of important points. In order to implement an IT explanation, the following four requirements must be met.

Point 2: The important points to check The important points explanation may seem difficult because it contains some technical details, but you will be able to understand it if you have it explained to you one by one in detail. In addition, it will be easier to understand if you grasp the overall picture of the important points explanation and then check the key points. The following is an explanation of eight items that you should particularly check in the important points explanation. The flow of explanation of important points  A licensed real estate agent will sign and seal the document, provide the document, and give an oral explanation. 1. Basic confirmation before receiving an explanation A licensed real estate agent provides a written document and a verbal explanation. 2. Basic property checks

⇩  prospective buyer "I have confirmed and understood what has been explained to me." ⇩  The conclusion of the sales contract Point 3: What is a notice? In the transaction of an used house, the past history and hidden defects of the house may become an issue, but there is a limit to what a real estate company can understand about all of these matters that are originally known only to the seller or owner. Therefore, many real estate companies ask the seller to submit a written notice (a written confirmation of incidental facilities and property conditions), conduct a property investigation based on it, and reflect it in the explanation of important points. Guidelines Concerning Notification of Death of a Person by a Real Estate Agent

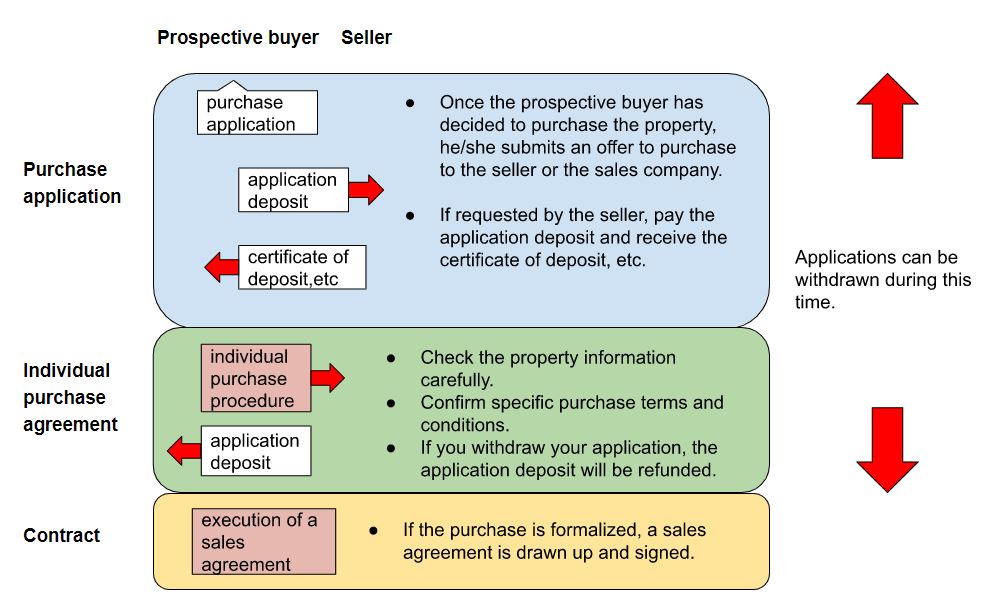

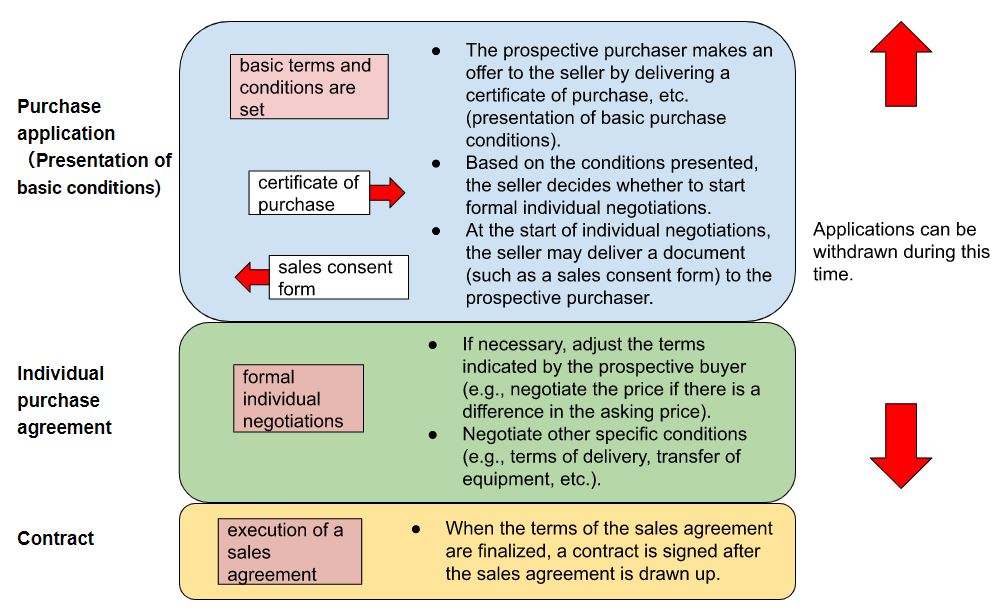

When a real estate agent is aware of a person's death and believes that it will have an important influence on the decision to conclude a contract for a real estate transaction, it is necessary to notify the customer of this fact. However, each person has his or her own view of death, and the degree to which it affects his or her judgment of the contract differs. Therefore, in October 2021, the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) compiled the "Guidelines for Notification of Death of a Person by a Real Estate Agent." It provide guidelines on the extent to which real estate agents should investigate the death of a person and the extent to which they should notify the prospective buyer of the death of a person. The guidelines state that real estate agents should investigate the death of a person by asking the seller to include it in the "notice" and that they are not required to investigate the death of a person by asking around the neighborhood or researching on the Internet. Regarding notification in sales transactions, the law states that notification is not required for "natural death or unforeseen death in daily life (natural death such as senility, death from illness due to chronic disease, or accidental death such as a fall or aspiration)." However, even in such cases, notification is required if the property has been left unattended for a long period of time, and if special cleaning such as deodorization and disinfection or major renovation has been performed. In the case of an incident occurring in a neighboring dwelling unit of the subject property or in a common area that is not normally used, no notification is required. However, it is necessary to give notice in cases where the death of a person is an incident or has a significant social impact, or when it is considered to have an important influence on the decision to conclude a contract. Making the Final Decision to PurchaseWhat to consider when applying for purchase Once you have decided on the property you want to buy, before making an offer to purchase, double-check that the property meets your requirements and that there are no problems before making an offer to purchase. Proceed with the transaction carefully, referring to the following points when making an offer to purchase. Point 1: Decide on a property to purchase and make an offer to purchase. Once you find a property you like, discuss terms and conditions in detail. Do not hesitate to ask the real estate company for information you would like to know about the property, and also thoroughly check the property and confirm any points of concern during the site visit. While consulting with the real estate company, make your desired purchase conditions specific. Once the basic conditions have been established, present the conditions to the seller and make an offer to purchase. At this stage, basic conditions such as the desired purchase price and desired delivery date are often presented first. However, if there are other prerequisites for the purchase in addition to the basic conditions, they may be presented. In the case of a used property, you may also request for repairs to the property. Point 2: What is the process from purchase application to negotiation? The negotiation process after submitting an offer to purchase differs between new properties for sale and used properties. For new properties for sale Generally, applications to purchase a new property for sale are made at the local sales office. When offering to purchase a property, you are often required to pay what is known as an "application deposit" (approximately 50,000-100,000 yen). The application deposit is paid to show that the intention to purchase is genuine (i.e., that it is not a "pretense"), and when the contract is executed, it is applied to the deposit and the purchase price of the property. However, the legal nature of the application deposit is not always clear, and there are many troubles surrounding its return. Therefore, if you are asked to pay the application deposit, be sure to confirm the handling of the application deposit and receive a certificate of deposit, etc. that states the purpose of the money transfer (that the money was transferred as the application deposit), the amount, and the date of payment. After paying the application deposit and submitting an application to purchase, you will proceed with the specific procedures up to the purchase, such as confirming property information and contract terms in more detail. For used properties In the case of used properties, the application for purchase (presentation of basic conditions) is often made in the form of a document called a "certificate of purchase" or similar document, which is given to the seller through the real estate agency. A certificate of purchase is a document signed and sealed stating the basic terms of purchase, such as the desired purchase price, payment terms, and desired delivery date, and is a request for the start of preferential individual negotiation, based on the specific purchase desire, "I want to buy this property under these terms and conditions. Note that in the case of used properties, payment of an application deposit, etc., is generally not required. Subsequently, if the seller, based on the conditions presented by the prospective purchaser, determines that a contract is viable, formal individual negotiations will begin. Since the seller narrows down the negotiating parties to some extent at this stage, it is important to proceed with subsequent negotiations in good faith. In individual negotiations, differences in terms and conditions between the two parties are adjusted, and more specific terms and conditions are determined. Point 3: Is it possible to withdraw after application? It is possible that after an application for purchase (presentation of basic terms and conditions), the buyer may wish to withdraw the application due to disagreement on various terms and conditions after specific negotiations have been conducted. In such a case, it is generally possible to withdraw the application as long as a purchase agreement has not been concluded. In addition, an application deposit, if paid, will be refunded.

However, you should keep in mind that the seller, especially of a pre-owned property, has begun individual negotiations based on a certain degree of likelihood that a contract will be concluded. Be very careful when withdrawing your application, because if you are found to be dishonest, you may have a problem with the seller. |

Details

AuthorArrows International Realty Corp. Archives

June 2023

Categories

All

|

RSS Feed

RSS Feed