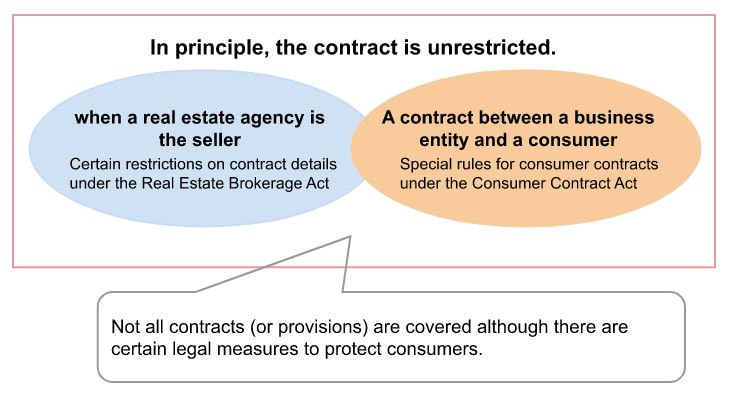

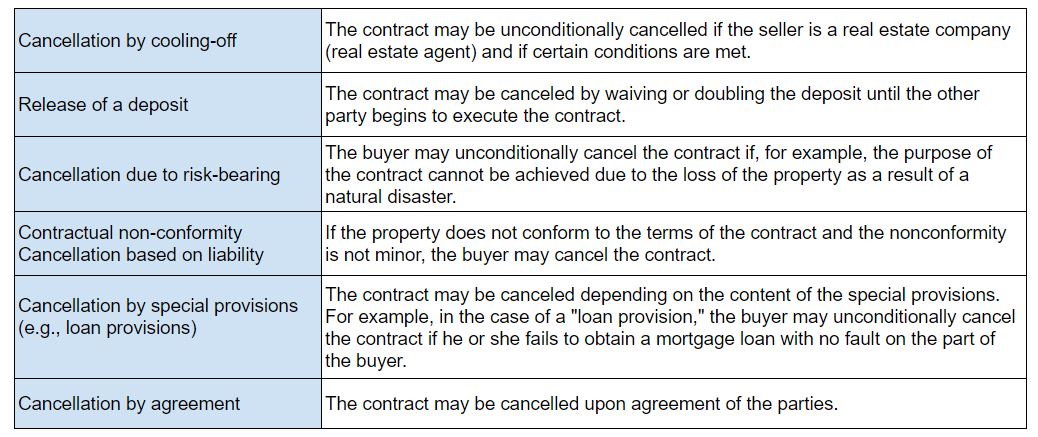

Concluding a Sales ContractAfter receiving an explanation of important points and both the buyer and seller agree on the terms of the contract, a sales contract is concluded. Once a contract is concluded, it cannot be easily cancelled. Therefore, it is important to fully confirm its contents beforehand. Keep in mind that although the real estate company provides an explanation, the contract is ultimately concluded on self-responsibility. Point 1: Know the basics of the sales The content of the contract is unrestricted in principle. The content of the contract between the seller and the buyer is unrestricted as long as it does not violate laws and regulations, offend public order and morals, or otherwise cause problems. Conversely, the principle is that the contract should be concluded at one's own risk. There are certain laws and regulations in place to ensure that consumers are not unilaterally disadvantaged by contracts, but they do not cover everything. It is important that you confirm the contents of the contract and conclude the contract at your own risk. Matters not stipulated in the contract are to be determined upon consultation in accordance with the Civil Code and other related laws and regulations. Therefore, if important contract terms are unclear, it may lead to problems after the contract is signed. Restrictions on contracts when the seller is a real estate agency When a real estate company is the seller, the Real Estate Brokerage Act provides certain restrictions so that a disadvantageous contract will not be concluded for the buyer. This protects the buyer who concludes a contract directly with the real estate company, which is the expert in real estate transactions. The Consumer Contract Act applies to contracts between business entities and consumers. Since there are differences in the ability to access information and negotiate between business entities and consumers, the Consumer Contract Act establishes specific contract rules for contracts between business entities and consumers (referred to as "consumer contracts") with the aim of protecting consumers, and also affects real estate purchase and sale contracts. For example, the Act provides that a contract can be rescinded if the consumer has misunderstood the contract, and that clauses that are disadvantageous to the consumer (such as clauses that exempt the business entity from liability for contractual nonconformity, etc.) become invalid. Although a consumer under the Consumer Contract Act refers to an individual who concludes the contract for business purposes is not covered by the protection of the Consumer Contract Act. The Consumer Contract Act applies to contracts concluded by individuals for purposes other than business. It is important to understand that it also applies to real estate sales contracts. An overview of a real estate sales contract Point 2: Understand the deposit In a real estate sales contract, it is common for the buyer to pay a "deposit" to the seller at the time the contract is concluded. There are three types of deposits: (1) Deed deposit (2) Cancellation deposit (3) Penalty deposit Generally, in a real estate sales contract, the deposit is given and received as the "cancellation deposit" described in (2). The Civil Code also states that in the absence of any special provisions regarding the nature of the deposit, it is presumed to be a cancellation deposit. A "cancellation deposit" is a deposit that allows the buyer to cancel the sales contract by waiving (not requesting the return of) the deposit already paid, and the seller to return to the buyer twice the amount of the deposit already received. However, a contract can be canceled by the deposit only until the other party executes the contract. In other words, if the other party has already fulfilled the promises stipulated in the contract, the contract cannot be cancelled by the deposit. Point 3: Once a contract is signed, it cannot be easily cancelled. Especially when conducting large transactions such as real estate sales, a contract is an important promise based on the relationship of trust between the seller and buyer. Therefore, once a contract is concluded, it generally cannot be easily canceled for the convenience of one party. The main types of contract cancellations are as follows. *The above table is a general guideline, and the procedures for cancellation differ for each individual contract. Point 4: Understand contractual non-conformity What is contractual non-conformity liability? Defects in properties, such as leaks or corrosion caused by termites, have been referred to as "defects," and the seller's liability for such defects has been called "liability for defects. However, due to the revision of the Civil Code enforced on April 1, 2020, not only the name but also the content of this liability has been drastically changed. The revised Civil Code is based on the premise that the seller is obligated to deliver a property that conforms to the terms of the contract with respect to "type, quality, and quantity" of the subject matter of the sale, and that if the seller delivers a property that does not conform to the terms of the contract with respect to those items, the seller is liable for default. For example, if the seller delivers a building that has leaks or corrosion caused by termites, the seller is in default of his/her obligation to deliver an object that conforms to the terms of the contract with respect to quality. Contents of contractual non-conformity liability When the subject matter of the contract is nonconforming as described above, the buyer can demand the repair of the nonconformity, and when the seller does not do so even after the repair is demanded, or when the repair itself is impossible, the buyer can demand a reduction of the purchase price. In addition, under the general principle of default, a claim for compensation for damages can be made, and the contract can be terminated. However, compensation for damages cannot be claimed if the seller is not responsible in any way. Cancellation is also not allowed when the nonconformity is minor. Period during which the seller is liable for nonconformity with the contract Under the Civil Code, the buyer must notify the seller of the nonconformity within one year of becoming aware of it, because it is considered unreasonable for the seller to be liable for the nonconformity for a long period of time, and because it is appropriate to settle such disputes arising from the sale as early as possible. Special provisions in sales contracts This provision of the Civil Code is an optional provision, meaning that it can be changed or modified at will, so another provision can be made by a special agreement between the parties. Especially in the case of an existing house (used house), it is difficult or impossible to determine whether a certain defect or other event constitutes a non-conformity to the contract due to age-related deterioration, natural wear and tear, etc. Therefore, in general transactions, the scope of the seller's liability is limited or the period of liability is shortened. In some cases, there is also a provision that the seller is not liable at all. Even in such cases, the seller is not exempt from liability if he/she knew of the nonconformity and failed to inform the buyer, but otherwise, the seller is exempt from liability as per the special provision. When a real estate agent (real estate company) is the seller With regard to liability for nonconformance with contract in cases where a real estate agency or a real estate company is the seller and the buyer is not, under the Real Estate Brokerage Act, a provision to the effect that the seller is liable for nonconformance with contract is valid only if the seller is notified within two years of the date of delivery. However, other than that notice period, provisions that are less favorable to the buyer than those of the Civil Code, such as "only repair claims" or "the contract can be terminated if the seller approves" other than during such notice period, is invalid. When a business entity is the seller and a consumer is the buyer All corporations are "business entities" under the Consumer Contract Act, including those that are not real estate companies. In a contract in which a business entity acts as the seller and sells to a consumer, a contract provision stating that the business entity is not liable for nonconformance is considered invalid under the same Act. Special provisions for new housing under the Housing Quality Assurance Promotion Act In the case of a newly built house, the real estate company that is the seller must assume liability for defects (*) for 10 years for the main structural parts, etc. (foundation, pillars, roof, exterior walls, etc.) of the house. In order to avoid a situation where the seller cannot fulfill its liability for defects due to bankruptcy, etc., the seller is obligated to sign an insurance policy or deposit a security deposit at the time of delivery to the buyer. The seller is required to explain to the buyer which measure, insurance or deposit, will be applied at the time of the important points explanation and the sales contract, so make sure to check the details carefully.

*The Housing Quality Promotion Act uses the term "liability for defects," but the revised Civil Code uses the term "liability for nonconformity of contract as to type and quality. Comments are closed.

|

Details

AuthorArrows International Realty Corp. Archives

June 2023

Categories

All

|

RSS Feed

RSS Feed