|

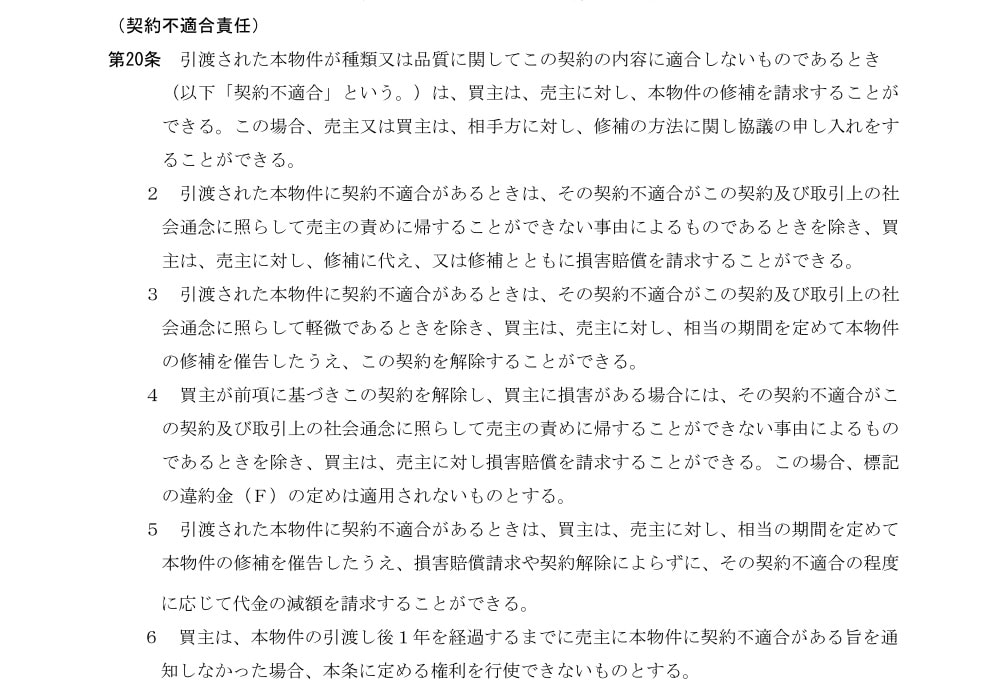

6/23/2020 Points to note when buying and selling real estate due to revision of the Civil CodeRead Now Today, we would like to explain the points to keep in mind when buying and selling real estate due to the revision of the Civil Code. First of all, due to the revision of the Civil Code in April of this year, the seller of real estate has changed from 2 choices of general or real estate agent to 3 choices of general individual, general corporation or real estate agent. In addition, the seller's liability for defect warranty has been changed to non-conformity liability. The details are as follows. Due to the revision of the Civil Code, the word "defective" is no longer used and has been changed to "not compatible with the contract." In addition, as a result of being arranged as contract (default) liability, the provisions of liability for non-conformance of contracts are applied regardless of specific or unspecified items, and the target of non-conformance of contracts is not limited to primitive defects. In addition to the cancellations and damages that have been made up until now, buyers have also been granted additional completion claims and reduction claims. In addition, the claim for damages now requires the responsibility of the seller. In other words, the protection of the buyer is stronger than ever before. In addition, the wording of the contract has been changed as follows. (Nonconformance liability) When the delivered Property does not conform to the contents of this contract in terms of type or quality (hereinafter referred to as “conformance to contract”), the Buyer may request the Seller to repair the Property. In this case, the seller or the buyer may request the other party to discuss the repair method. 2. If there is a contract nonconformity for the delivered property, the buyer, damages may be requested to the seller in place of or together with the repair. 3. When there is a contract nonconformity of the delivered property, the buyer shall set a reasonable period of time for the seller unless the contract nonconformity is minor in light of this contract and the social conventions of transactions. The buyer can cancel this contract after issuing a notice to repair the property. 4 If the buyer cancels this contract based on the preceding paragraph and the buyer has damage, except when the nonconformity of the contract cannot be attributed to the seller's blame in light of this contract and the social conventions of transactions, the buyer may claim damages against the seller. In this case, the penalties specified in the contract shall not apply. 5 When the delivered property has a contract nonconformity, the buyer notifies the seller of the repair of the property for a considerable period of time, the buyer can request a reduction in the price according to the degree of nonconformity of the contract, without depending on the claim for damages or the cancellation of the contract. 6 The buyer shall not be able to exercise the rights set forth in this article if the buyer does not notify the seller that there is a contract incompatibility with the property within one year after the delivery of the property. A consumer contract in a real estate transaction is when the seller is a business operator other than the real estate agent and the buyer is a consumer (transaction to which the Consumer Contract Law applies). Tomorrow, we will explain the necessary documents etc. in case the seller is a corporation.

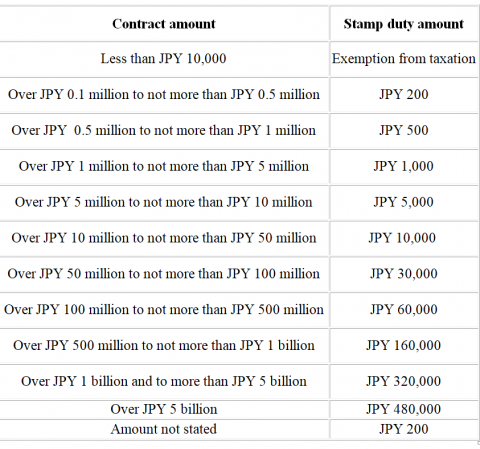

Today, we will explain the stamp tax (stamp duty) that will be affixed to the contract when you make a purchase or sale of real estate. At the time of a real estate sales contract, both the buyer and the seller will sign and seal the contract, and store each part. At that time, it is obligatory to affix a stamp to the contract kept by each. You can pay the tax by purchasing the stamp tax, attaching it to the contract, and postmarking it. The documents that require stamp duty are the 1st document to the 20th document, and the real estate sales contract corresponds to the 1st document of the stamp tax list. There are four types of documents that correspond to the first document. 1 Real estate, mining right, intangible property right, ship or aircraft, or contract for transfer of business 2 Contract for setting or transferring land rights or land lease rights 3 Consumption loan agreement 4 Transportation contract Stamp tax is also explained as follows. Stamp tax is levied on certain documents such as contracts, bills and share certificates. As a rule, the tax is levied by affixing revenue stamps covering the amount equal to the stamp tax to those documents. However, in certain cases, such as when many taxable documents are processed repeatedly, taxpayers may, for convenience, choose self-assessment or payment in cash. Tax rates vary from 200 yen to 600,000 yen per document. Revenue stamps are also used for payment of registration license tax levied when registering the establishment or transfer of property rights and for payment of national examination fees. OUTLINE OF TAX ENFORCEMENT https://www.nta.go.jp/english/report2003/text/02/01.htm The table below shows the actual amount of stamp duty. The deadline for applying special measures for stamp duty reduction has been extended to March 31, 2022.

Reduction of Stamp Duty on Real Estate Sales Contracts https://www.nta.go.jp/law/shitsugi/inshi/08/10.htm Therefore, the amount of money stated in the real estate sales contract will be paid against the above table. Generally, agents will purchase it in advance at a post office and bring it with you at the time of contract. The buyer/seller will only pay and will also postmark when signing the contract. |

Details

AuthorArrows International Realty Corp. Archives

June 2023

Categories

All

|

RSS Feed

RSS Feed