|

Rent management is one of the tasks of building management. Rent management is to check whether the rent of the building entrusted by the landlord is paid monthly by the lessee, receive the rent, pay the necessary expenses, and transfer it to the landlord. If the rent has not been paid, we will petition for demand for payment, request payment and keep the rent properly. If the rent is not paid even if a demand for payment is made, a request for a replacement is made to the guarantee company, the renter's rent will be reset and paid, and the rent will be received.

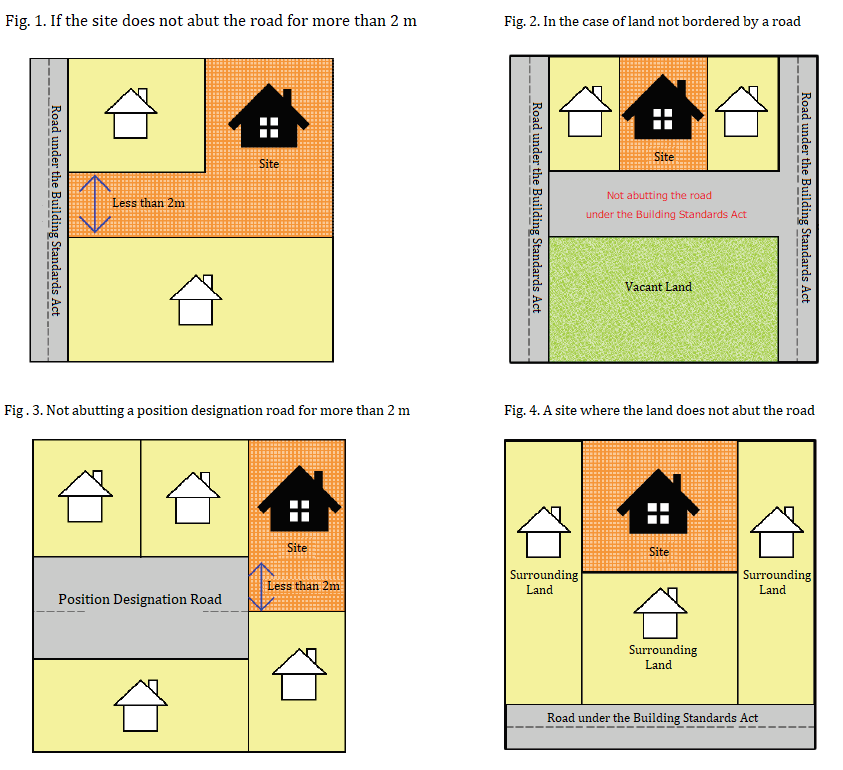

Typically, rent is paid in advance, and June rent is paid at the end of May. The rent is paid to the management company by the end of the month, and the rent payment is confirmed at the beginning of the month as a management task. If the last day of the month is a Saturday or Sunday like this month, we will confirm the payment on the following Monday, and if the payment has not been made on the first day, we will contact each tenant and remind them to transfer the rent. If we do not receive a transfer of the rent by the transfer request of the telephone, a reminder is issued by the letter. But in most cases, it's only forgetting of the transfer. we receive the rent immediately. If the rent cannot be paid even if we send the reminder letter, we will request the guarantor company for the advance payment. The guarantor company will pay the rent on behalf of the lessee. The guarantor company first informs the lessee that the rent has not been paid, but if the rent is still not paid, the rent is remitted to the management company. The guarantee company will receive the rent for the advance payment directly from the lessee. The role of the guarantor company is to perform a tenants screening at the time of moving in and to reimburse late rent. The main income of the guarantee company is the guarantee fee received from the lessee at the time of contract and the annual guarantee contract renewal fee. Basically it will be a recurring revenue model, and the more the number of guarantees increases, the more stable fees will come. However, if the economy becomes excessively depressed and rents are often delayed, the amount of money in hand will decrease as a result of the advancement. Even after the Great East Japan Earthquake, the warranty company suffered enormous damage. However, the use of a guarantee company is now mandatory for most rental contracts, regardless of whether you are Japanese or an international student. By using a guarantee company, the landlord will find it easier to rent a room, and the tenant will find it easier to rent a room by using a guarantee company, or by not needing a guarantor. This is now a common business practice in Japan for lease agreements. There are many properties that cannot be rebuilt in Kyoto. It's a term we don't often hear in other cities, but we'll explain the non-rebuildability and talk about the advantages and disadvantages of each. A "non-rebuilding" property is literally a property that cannot be rebuilt in the future once the building is demolished. For example, if the width of the access road (the part where the road meets the site) is less than 2 meters, it is not possible to re-build. It is also not possible to re-build if it only abuts a road that is not recognized as a road under the Building Standards Act. This is because it would not meet the "duty of accessibility" set forth in Article 43 of the Building Standards Act. If it does not abut the road, for example, in the event of a fire, the fire engines may not be able to do enough to put out the fire. The same is true when an ambulance is called. In other words, this law is about ensuring the safety of the residents. On the other hand, if it is a road under the Building Standards Act, it means that the private road also fulfills the duty of connecting. A non-rebuildable property is a land that is handicapped, which means that it can be remodeled but cannot be rebuilt. As a result, prices are often set low and you may find it advantageous. This is clearly stated in the real estate advertisement for non-rebuildable properties, so be sure to check the content of the advertisement carefully and be careful not to say "I could buy the land cheaply, but could not build it!". Advantages of non-rebuildable property

1: Price is low The inability to reconstruct means that the value of the land and the value of the property are very low, so you can buy much cheaper than comparable properties in the neighboring area. 2: Remodeling and renovation are possible It cannot be rebuilt, but large-scale reforms and renovations are possible. 3: Property tax is cheap Due to the low asset value, the property tax valuation is also set low. Therefore, the property tax, city planning tax, inheritance tax, and gift tax calculated based on the property tax valuation are also cheaper. Disadvantages of non-rebuildable properties 1: Cannot be rebuilt After all, this disadvantage is the biggest. For example, if those properties destroyed by an earthquake, you can no longer build buildings on that land. 2: Cannot use mortgage The collateral value is also very low and you cannot buy it using a mortgage. In other words, you have to make a one-time payment in cash. Note that some financial institutions may be able to use the loan, but interest rates will be considerably high. 3: Difficult to sell Due to restrictions, it may be difficult for buyers to find it even if they are put on sale. In addition, because the mortgage is not available, it is difficult to sell because it is limited to buyers who can buy cash. Will non-rebuildable property be covered by fire insurance? There is no reason why you cannot take out fire insurance because it cannot be rebuilt. Basically, if you have a building, you can get fire insurance. In addition, premiums will not be expensive because they cannot be rebuilt. Because the purpose of fire insurance is not just for rebuilding. You will also be paid to cover expenses such as repairs. If it is completely destroyed by an earthquake or the like, there is a risk that it will not be possible to rebuild even if there is an insurance premium. However, depending on the degree of damage, it may be possible to fully repair it with insurance money, so it is important to be prepared in case of emergency. Let's say you buy a property for 10 million yen and have 10 million yen in fire insurance and 5 million yen in earthquake insurance. If your home is completely destroyed due to an earthquake instead of a fire, you will receive an insurance benefit of 5 million yen. In this way, non-rebuildable properties have different characteristics from ordinary properties, so it is necessary to know in advance when considering purchasing. Two-handed trading is a method of brokering real estate sales by both the seller and buyer of real estate. If you buy real estate only once in your life, I think it's a word that even Japanese people rarely hear. Let's start talking about this deal today. First, if the transaction is questioned as legal or illegal, it becomes legal. In a two-handed transaction, a real estate agent acts as an agent for the seller and an agent for the buyer only by one company. There is no illegality here, and the real estate brokerage fee charged is also a regular amount. So what is the problem with this fact? In that case, an intermediary company who has received an intermediary contract from the seller monopolizes the information and does not accept the intermediary of another company. Generally, intermediary contracts are divided into the following three types.

※There are two types of Non-Exclusive Brokerage Service Agreement: "explicit type" in which the requested party is announced and "indefinite type" in which it is not disclosed. In the case of "explicit type", if you negotiate with a company that has not announced it, you will need to pay operating expenses etc. In general, a real estate agent proposes Privilegedand Exclusive Brokerage Service Agreement or Exclusive Brokerage Service Agreement which can monopolize information at the beginning. In this way, first of all, the real estate agent can get the agency fee of the seller's side reliably. There is nothing ethically wrong with that. However, the way the information is handled afterwards can make a big difference.

If the real estate agent thinks of the seller, expands the sales outlet as much as possible, and shares the information with other real estate agents, the seller's desired price will be broader and the information will be communicated to those who are considering purchasing. Information is provided directly to the real estate agents, and by registering with REINS, strictly speaking, real estate agents throughout Japan can introduce the property. Such real estate agents are sensible and reliable. However, the reality is that large real estate agents, in particular, have severe sales quotas, so they choose a method that can obtain both the brokerage fee of the seller and the brokerage fee of the buyer. That is the holding of information. First of all, there are cases where the prescribed REINS is not registered. Even if it is registered, there are cases where it will be registered when they receive the purchase application through their client. In addition, even the information is registered, when they receive an inquiry from another company, there are cases where false information is provided such as it's currently in a business negotiation. At the time of the response, other companies will not be able to broker the real estate. Such inconvenient facts will not be communicated to the seller, but only if the agent finds a buyer, it is possible that a prospective purchaser has appeared. If such a method is taken by the agent, whichever comes first if another real estate company finds a buyer, or if the real estate price goes down a bit, but the agent still gets brokerage fees for both the seller and the buyer. This is a fact and a secret that any real estate agent knows. There is nothing wrong with a real estate agent working hard to become an agent for the seller. If the agent is a company that can take the right action, you can make a request. Today is the case of buying real estate, and is the story of the case where the property you are concerned about is found.

There are several ways to look for real estate to buy in Kyoto, including browsing real estate search sites, asking a real estate agent to suggest a desired property, and finding a property by chance while walking around the city. In the midst of all of this, today's story, can you buy the real estate that you found while walking in the city? When you come to Kyoto for sightseeing, have you ever wondered Is this house empty? No one lives there? And then, have you ever wondered What? Maybe we can buy this house? For example, if the person next door came out, don't you want to ask Does anyone live in this house? For example, if you find the tape on the post and find someone is carrying out luggage, don't you like to talk to them? For example, when you find the property which seems nobody lives because there is garbage scattered around the entrance, have you ever thought Oops! can I buy this? From the conclusion, it is impossible. Unfortunately, even if it's a vacant house or no one is using it, even you knock on the door and ask does anyone live here? or ask do you want to sell it?, they won't say Yes to you, they won't sell it. Until the real estate goes on the market, twists and turns, it will continue to change with the property for sale beyond many stages. First, as an example, vacant homes receive many letters every month from real estate agents. A letter is sent every month to the owner's address, by checking the home address from the register, and by dropping directly on the vacant property. They receive letters from many companies, from large and small, and not just one contractor. And they get letters from a lot of real estate agents, even in the real estate where it's currently residing. This means that a real estate agent who wants to conduct real estate sales brokerage will walk around the city every day, wearing out the soles of his/her shoes, throwing out letters when he or she finds an empty house, and sending out monthly letters when they finds the owner. So, before you find the property, many professional real estate agents make sales pitches again and again that We'll sell high, We'll buy, We'll find the Buyer, and so on. And to say that if the property is not yet on the market is to say that the owner doesn't want to sell the property. If you decline for another reason, the descendants who inherited the property are not yet ready to sell it. If the parents die, the child will own the property through inheritance. If the property is vacant, then yes, the child has a separate estate and has no plans to use the property. Maybe he/she'll put it up for rent. However, this is not a very realistic case, as it would require renovation costs. Many Japanese people inherit real estate from their parents and keep it intact for two to six years. This is because there are cases where the real estate is disposed of after waiting for the thoughts of the ancestors, the 3rd anniversary of death, and the 7th anniversary of death. This is still a good thing, but if there is more than one heir and the heirs are in trouble with each other, it will be impossible to buy it in the first place. When real estate compares the state in which the old house is located with the state of the vacant land, the property tax will be cheaper if the old house is located. Therefore, it is more convenient as an heir to leave it as it is if it is necessary to pay the tax even if the old house which is not used is left unattended. Next time, I'm going to tell you why real estate agents want to do a sales brokerage. Kyoto is an ancient city with many old buildings in Japan. We would like to introduce Shiga Prefecture, which is next to it, which is not well known today.

Shiga Prefecture has Japan's largest lake, Lake Biwa, and Lake Biwa Canal, which was created in the Meiji era, is used to drain the lake water to the west adjacent Kyoto city. The water passes from Lake Biwa, through the Keage Incline, through the Okazaki area, and reaches the Kamo River. There is a hydrophobic ship in the canal, and there are sightseeing ships from Otsu City to Keage. The Lake Biwa Canal Cruise https://biwakososui.kyoto.travel/en/ Shiga Prefecture also has many tourist attractions, and a lake exists in the middle of the land surrounded by mountains. There are four seasons to enjoy, skiing and snowboarding in winter, cherry blossom viewing in spring, BBQ, fishing and fireworks at Lake Biwa in summer, autumn leaves in the mountains, and an environment where you can fully enjoy nature. To Shiga Prefecture, it's possible to visit Otsu Station (2 stations from JR Kyoto Station) and Biwako-Hamaotsu Station (Keihan Line). In Otsu City, there are also old-fashioned shopping streets and Otsu Port where you can walk along the well maintained lakeshore, where you can stop by and spend a leisurely time. Also, if you like cycling and driving, you can also enjoy cycling around Lake Biwa. Lake Biwa is called the North lake and the South lake separately, and the north of Lake Biwa Bridge is the North Lake. One round of Lake Biwa is 200km, and one round of North Lake is 140km. It takes about 4 to 5 hours to drive around, so it's a good idea to spend a day enjoying the drive while taking a break. Shiga Prefecture is a very attractive city where you can enjoy nature. Enjoy the air, scenery, mountains and lakes, culture in Kyoto, and nature in Shiga. SHIGA・BIWAKO https://en.biwako-visitors.jp/ In the coming season, please enjoy swimming, bass fishing and BBQ with friends and family in Shiga prefecture. Today, we are going to talk about the case of a client who moved to Kyoto instead of investing in it.

It's about the story when I was working at former job, they were a couple living in the United States who were looking for a second house to stay in when they came to Kyoto. They have two large dogs and were looking for a villa with a garden so that they could come to Kyoto with their dogs and run around. They wanted a good environment, a place where they could walk back to the station, and a relatively large house. It may have been a few months since I first received the inquiry, but at the end of the year there was a very good property. Within walking distance from the subway Karasuma line station, there was a garden that could go around the house, and it was a property with a natural environment. I immediately gave the information to the customer, and because of the year-end and New Year's holidays, I received an application to purchase the property before actually viewing it, and concluded the contract through an agent in the middle of January. At the end of the same month, we finished the handover of the property and the customer successfully purchased a house in Kyoto. After that, it was used as a second home, and during the vacancy period, it was rented out. Then, a full-scale plan to move to Kyoto came out earlier than originally planned. First, we renovated the room together with a construction company in Kyoto, and changed the floor plan to make it easier for the owner to live in. The gardener also took care of the garden, and the building was ready. In parallel, the administrative scrivener established a foundation for them, and applied for a visa to reside in Japan. The administrative scrivener I knew was fluent in English and took care of all the paperwork involved in the application. The reason why they formed an incorporated association instead of a corporation is because of their own work. It was not long before the wife's visa was approved and the husband's visa was also issued. This couple is still working and practicing medicine in the United States. And even though they are in Kyoto, as doctors specializing in psychiatry, they are working in an American clinic and working with American patients. A few years ago now, they practiced remote work and started working from home in Kyoto, regardless of where they live, in a country on the other side of the globe. After getting over the Corona pandemic, I think more people will be able to work without being affected by their location in the future. Why don't you work in a villa in Kyoto as if you were in an office, making your travel destination look like an office? In today's case, an investor residing in Asia established a corporation in Japan, opened a bank account, purchased a property, and rented it out.

Originally, the owner who liked Kyoto had a few real estate properties in Kyoto city under the names of individual and family. The properties were not investment properties, but a second homes for him and his family when he came to Kyoto. We decided to put one of these properties up for lease, and since there was commercial property for sale in a good location for investment, he decided to increase the number of properties in Kyoto. In this scheme, a non-resident investor establishes a corporation in Kyoto, purchases real estate in the name of a corporation, opens a new bank account in the name of the corporation, transfers the lease agreement to the name of the corporation, then receive the rent in new bank account. This time, we have not set directors’ remuneration yet, but it is possible to receive remuneration from corporations, and when traveling to Japan, airline tickets and travel expenses can be recorded as necessary expenses. Also, even if an officer inherits, the real estate in the name of the corporation will not be changed and the inheritance of shares will occur. First of all, the establishment of a corporation requires a certificate of seal and signature of the investor. In countries with a seal certification system, documents can be prepared at the embassies or notary public offices of the countries of that nationality. You can also create a proof of signature at an embassy in your country. In some cases, a notarial deed may be required for the incorporation. If you have any questions, please contact us individually. The position of the investor this time is to be the representative director and the investor. We've registered an extra person as a board member, but having a local resident in the business with will make it easier to open a bank account and complete the necessary paperwork. Therefore, in this case, I am participating in the corporation as an officer. A corporate registration is the same as a real estate registration, where documents are prepared and applied for and registered through a judicial scrivener. For real estate sales and registration, it does not matter whether you sign a real estate contract after the establishment of the corporation or establish a corporation after the contract is concluded. If you make a real estate contract first, the buyer's name in the contract will be the individual, and we will add "The Seller and the Buyer agree to transfer the buyer's position to a third party after the contract" to the special provisions. By doing so, it becomes possible to transfer the purchaser's position to a corporation that will be established at a later date, and to register the sales contract contracted by an individual in the name of the corporation. As with the case of registering a earning property in the name of an individual, the procedure of taking over the lease contract is also performed at the same time when the real estate is handed over. The documents include notifying each lessee of the succession to the status of the property, changing the names of various contracts (high voltage power supply, air conditioner lease, internet, elevator inspection, notice to the management association, etc.), and entering into a new management contract. At this point, the establishment of the corporation is completed, and all procedures are completed in the name of the corporation. Also, regarding the opening of bank accounts, it is best to open it through a person who lives in Japan if possible. Even by the representative director, if not the resident in Japan, the bank refuses the application for opening the account for some reason. There are many reasons for the bank to refuse, such as contact information not being in Japan, communication in Japanese not being possible, and address not being in Japan. Therefore, the easiest and safest way is to create a new bank account through someone who can conduct a credit check on the account opener conducted by the bank. If you use this investment scheme that includes the creation of a corporation, you will be able to obtain a loan from a bank, a guest house license at a Japanese corporation, buy or sell a corporation, and get a visa for going and going. These methods require a trusted partner, so please contact us directly if you are interested . Let's take a look at the second real estate investment case, which is a single wooden apartment building with four units in Kyoto city, ownership registered in the names of both parents and children, who are living in Hong Kong.

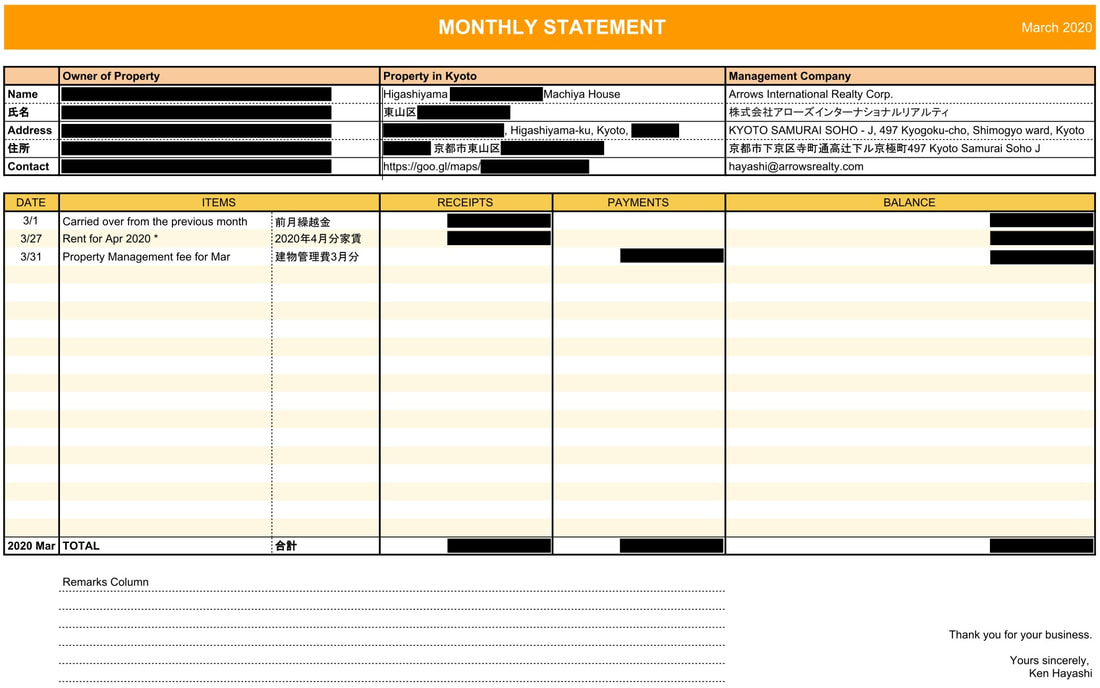

The investors are not residents in Japan, the registered owners are parents and children, and the registered address is Hong Kong. The investment target is a wooden apartment, 4 units, and an old apartment that was located on land that cannot be re-built. This time, the investment is to buy an existing apartment at a cheap price, no tenants, renovate it, operate it as a rental, and sell it for an exit. The real estate purchase amount is 10 million yen or less, renovation costs are about 7 million yen, and rental income is about 1.6 million yen per year. Real estate prices were very low, as the property was in such disrepair condition that it needed major renovations, was before land prices soared, and could pn the not re-buildable land. Since investors could not come to Kyoto at the time of contract or settlement, they delegated to an agent and completed the transaction. For the renovation, we prepared a room with a unit bath for the university students and a room with a shower room only. Initially we did not install furniture, but now we are operating as a rental with furniture as furnished apartment. For the renovation, we asked a local contractor through the management company, and the management company confirmed the progress of the construction and detailed specifications. For rent management, we have been promoting recruitment centered on companies that are strong in renting students, and we have achieved almost full occupancy management. When international students rent a room, they prefer furnished rooms, so there are refrigerators, washing machines, beds, desks, and chairs. The internet is also contracted with the apartment, so it is possible to use it immediately after moving in. Currently we are both renting and selling an apartment at same time. Since the investor has an account of Bank of China opened in Japan, the rent is remitted monthly to the Japanese account. We are executing an exit strategy while investing and renting the property, including renovations. For renovations, we have English-speaking contractors and architect partners, so please contact us if you are interested. Case 2: Gross yield approx. 10%, Net yield approx. 8.87% *Management fee, fire insurance and property annual fixed asset tax included Today we're going to look at each investor's individual investment case. First of all, the investor in this case is a citizen of a country whose passport is in Europe, whose residence is in Asia, and who owns one property in Japan. The investment target is a remodeled Kyo-Machiya house, an attached house located in Higashiyama-ku, Kyoto City. The reason for investing is that they come to Japan regularly for work, love Kyoto, and want to have a vacation house in Kyoto to enjoy a relaxing time after retiring the work. The property in which they invested was a Kyo-Machiya house built in 1927 and renovated in 2019, a four-minute walk from Tofukuji. The investment method is for long-term leasing, they plan to use it as their own second home in the future when they retire from the company. In this case, the married couple registered 50% ownership of the property each, and the family owned the property. After purchasing the property, they signed a building management contract with us, and we began offering rentals immediately afterwards. The acquisition tax and property tax of the real estate are paid from the rental income, and the deposited rent is kept and managed by management company until instructed by the owner. The monthly balance report is shared in a folder on the cloud, and the monthly balance and deposit information are also shared. For the tenant recruitment, we will share the information with each agency and conduct business activities to find tenants. The management company takes photographs, draws up floor plans, assesses rents, and sets detailed conditions when recruiting. Once the details are finalized, we use the network system of real estate agents to register the information and recruit tenants through e-mails, faxes, and websites. Once we receive an offer for rent, we work with the guarantee company to screen the tenants, and take care of the necessary procedures such as the contract, fire insurance and other necessary procedures on owners behalf.

Before the tenants moving in, we will make sure that the room is cleaned and free of defects, change the locks and make sure it is ready to move in and hand the keys to the new tenant. The management company will take care of any inquiries or requests after tenants move in, and the owner basically does not do any work for management. We also provide information to owner's tax accountant and pay the income tax via owner's tax accountant. Therefore, after signing the management contract, there is no problem if owner leaves the various tasks to the management company. Case 1: Gross yield 6.04%, Net yield 5.28% *Management fee, fire insurance and property annual fixed asset tax included Today it's about investing in real estate. First of all, is it possible to buy real estate for investment and receive rent? Whether you need Japanese nationality, do you need a visa? Do you need to live in Japan or can you invest without living? The answer is that you can invest and receive rent. First of all, when considering the purchase of real estate, it is not necessary to compartmentalize whether it is real estate for residence or real estate for investment. When purchasing real estate, the Civil Code and the Building Lots and Buildings Transaction Business Act are the main rules, and when entering into a lease agreement, the Civil Code and Act on Land and Building Leases are the main rules. Whether or not you are Japanese has no effect on the purchase of the property, and you do not have to be a resident of Japan. With regard to Act on Land and Building Leases, it is not necessary for the owner of the real estate to be Japanese, nor is it necessary to live in Japan. Let's talk about the cases we manage.

*For Japanese corporations, the owner is a non-Japanese citizen. *Consultation on the establishment of a corporation is also available. The details will be explained at another time. Although the property is owned by a Japanese corporation, there are cases where the owner lives in Japan or resides outside of Japan. A foreign company establishes a new company in Japan and the rent is deposited into the newly established bank account in Japan. If you earn rental income from real estate, you will be subject to taxes on your real estate income claim and profits. We have tax partners who are fluent in English and Chinese, so please feel free to contact us.

Tomorrow we will explain each case. |

Details

AuthorArrows International Realty Corp. Archives

June 2023

Categories

All

|

RSS Feed

RSS Feed