Withholding Agents and Tax RatesA person who pays incomes subject to withholding tax in Japan to a non-resident or foreign corporation (hereinafter referred to as a "non-resident") must, in principle, withhold income tax and special income tax for reconstruction from the payment. When a person who has a domicile, residence, or office in Japan makes domestic-source-income payment outside Japan to a non-resident, the payment shall be deemed to be made within Japan, and withholding tax shall be imposed. Withholding tax is calculated by multiplying the amount of domestic source income paid by the tax rate. In some cases, such as public pensions, the amount of tax is calculated by multiplying the amount of payment by the tax rate after deducting a predetermined amount. When payment is made in a foreign currency to a non-resident, tax withholding shall be made after converting the payment into yen. In general, the exchange rate is based on the telegraphic transfer rate on the due date, but unless there is a significant delay in payment, the telegraphic transfer rate on the date of actual payment may be applied. Domestic source income subject to withholding tax and the tax rates are as follows: (1) Transfer of land, etc.: 10.21 percent (However, tax withholding is not required if the consideration for the transfer of land, etc. is 100 million yen or less and is paid by an individual who acquires the land, etc. for his/her own use or for the use of his/her relatives as a residence.) (2) Rent of real estate, etc.: 20.42 percent (However, tax withholding is not required for the rent of real estate, etc., paid by an individual who rents such real estate, etc. for his/her own use or that of his/her relatives.) Please note that when a tax treaty has been concluded between Japan and the country in which the non-resident resides, the aforementioned tax rate may be exempted or reduced in accordance with the provisions of the tax treaty. In order for such exemption or reduction to be applied, a "Notification Concerning Tax Treaty" and other relevant forms must be submitted via the payer of the domestic source income to the district director of the tax office that has jurisdiction over the payer's place of tax payment at least one day before the date of payment. Please also note that special income tax for reconstruction does not need to be withheld if the tax rate stipulated in the applicable tax treaty is less than or equal to the aforementioned rate. Payment of Withheld TaxThe income tax and special income tax for reconstruction collected at the source shall be paid, in principle, by the 10th day of the month following the month of collection, at the nearest financial institution, at the local tax office, or via e-Tax. The payer is to attach a "statement of income tax collection from non-residents and foreign corporations (payment form)" and for redemption gains of discount bonds (margin profit amounts) and income from the transfer of listed shares, etc. in custody in a special account and dividends in an elective withholding account, a statement of income tax collection from such gains and profits (payment form). In cases where payment of domestic source income is made outside Japan and tax withholding is deemed to be made in Japan because the payer has a domicile or residence in Japan or has an office, place of business, or other equivalent in Japan, the due date for payment of income tax and special income tax for reconstruction is the last day of the following month, not the 10th of the following month, in consideration of administrative procedures. Classification of Residents and Non-ResidentsUnder Japan's Income Tax Law, a "resident" is defined as an individual who has a "domicile" in Japan or has continuously had a "residence" in Japan for at least one year, and an individual other than a "resident" is defined as a "non-resident."

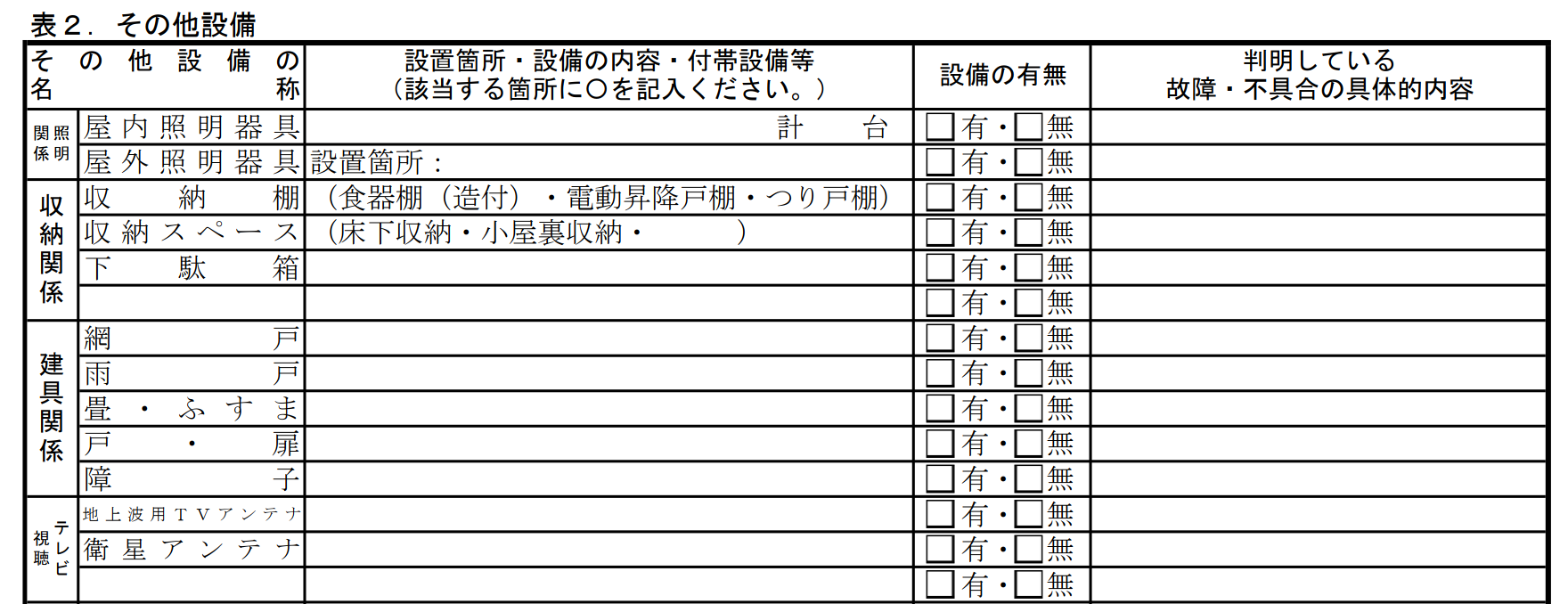

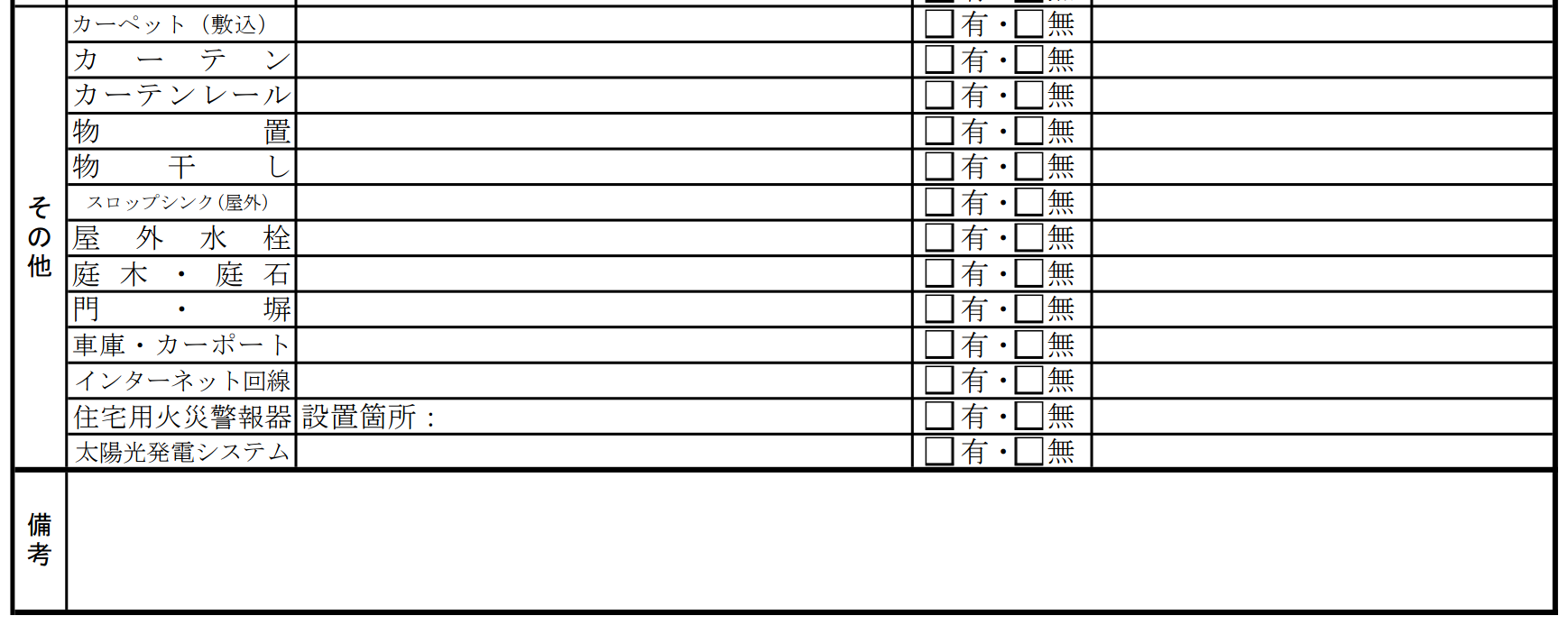

A "domicile" refers to "an individual's base of life," which is determined by objective facts. Therefore, a "domicile" is determined by where a person's activities are centered around. In certain cases, a "presumption of domicile" will be made based on a person's occupation and other factors. Therefore, a "place of residence," which is defined as "a place where a person actually resides, may differ from the person's "base of life." As for a corporation, the location of its head office or main office determines whether it is a domestic or a foreign corporation, and such determination is based on its registration and the articles of incorporation (generally referred to as the "head office domicile principle"). Facilities and Equipment List: Table 2Table 2: Other Facilities and Equipment Table 2 shows the availability of those other than the main facilities and equipment listed in Table 1 along with the details of any known malfunctions and defects thereof. Lighting Indoor lighting fixtures: Yes/No (Total number: __) Outdoor lighting fixtures: Yes/No Storage Storage cabinet: (built-in cupboard / electric lift cupboard / hanging cupboard) Yes/No Storage space: (underfloor storage / ceiling storage /_____) Yes/No Shoe rack: Yes/No Fittings and fixtures Screen door: Yes/No Storm shutter: Yes/No "Tatami" mat/"fusuma" sliding door: Yes/No Door: Yes/No "Shoji" sliding door: Yes/No Television equipment Terrestrial TV antenna: Yes/No Satellite antenna: Yes/No Others Carpet: Yes/No Curtain: Yes/No Curtain railing: Yes/No Storage room: Yes/No Balcony: Yes/No Slop sink (outdoor): Yes/No Outdoor faucet: Yes/No Garden trees and stones: Yes/No Gate and fence: Yes/No Car garage: Yes/No Internet: Yes/No (Location:_____) Residential fire alarm: Yes/No (Location:_____) Solar power generation system: Yes/No Remarks: Facilities and Equipment marked with "Yes"(有)in Note 2 was designated as a specific maintenance product (9 items) as of April 1, 2009, based on the Consumer Product Safety Law and its enforcement ordinance, as it is highly likely to cause a serious accident due to deterioration over time. However, due to the revision of the enforcement ordinance, as of August 1, 2021, the specified maintenance products are now two items: oil-fired water heater and oil-fired bath boiler. (1) For specific maintenance products (oil-fired water heaters and oil-fired bath boiler), the Seller should inform the Buyer of the following. ① The owner's information (registration or change) is required for the inspection of specific maintenance products by the manufacturer. ② The applicable product must be inspected during the inspection period set by the manufacturer. ③ The contact information for the manufacturer is shown on the product. (2) For the seven items excluded from the specific maintenance products -- indoor (city/LP) gas instant water heaters, indoor (city/LP) gas bath boiler, FF oil-fired hot-air heater, built-in electric dishwasher/dryer, electric bathroom ventilator/dryer -- for which the inspection period began before July 27, 2022 (excluding those inspected before August 1, 2021 and those whose inspection period has passed), the Seller should inform the Buyer of the above: (1) ①②③. Month/Date/Year The Seller has notified the Buyer that the facilities and equipment of the property are as described above.

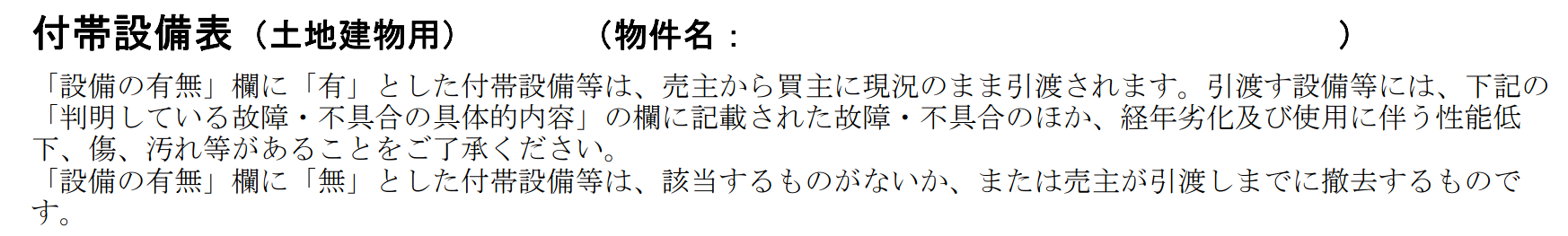

Seller's name: _____ (personal/company seal) The Buyer has been notified by the Seller as described above . Buyer's name: _____ (personal/company seal) Facilities and Equipment List (for land and buildings)Facilities and Equipment List (for Land and Buildings) (Property Name: _____) Any facilities and equipment marked "Yes"(有)in the "availability of facilities and equipment" column will be delivered by the Seller to the Buyer in their present conditions. Please be aware that the facilities and equipment to be delivered may have the malfunctions and defects listed below in the "details of known malfunctions and defects" column, as well as deterioration in performance, scratches, dirt, etc., resulting from age and use. "No"(無)in the "availability of facilities and equipment" column indicates that there is no such facilities/equipment or that they will be removed by the Seller prior to the time of delivery. Table 1: Main Equipment and Facilities Table 1 shows the availability of main facilities and equipment along with the details of any known malfunctions and defects thereof. Hot water supply equipment Water heater

⇒ Labeled as a specific maintenance product (Note 2): Yes/No

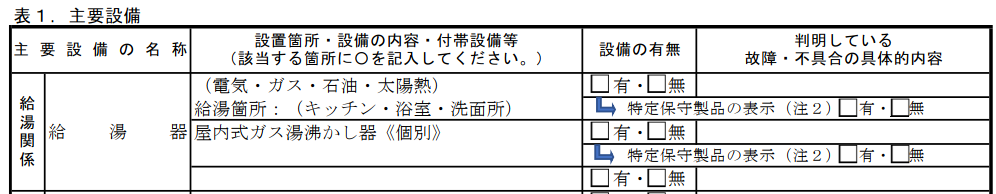

Water-related facilities Kitchen facilities

Washroom facilities

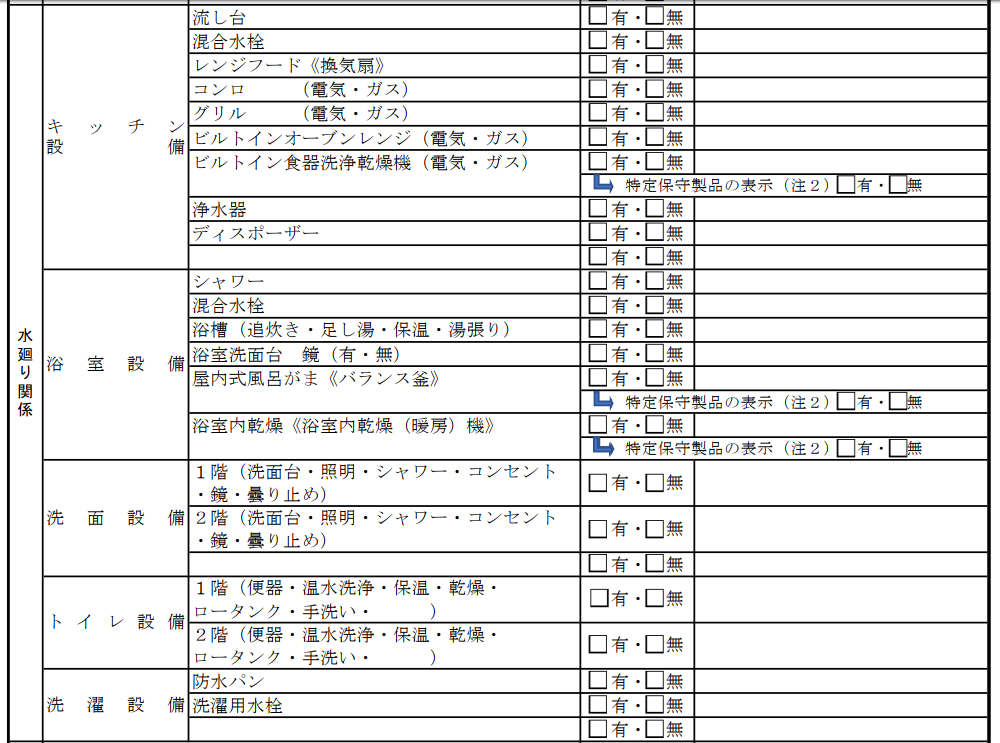

Air conditioning-related equipment

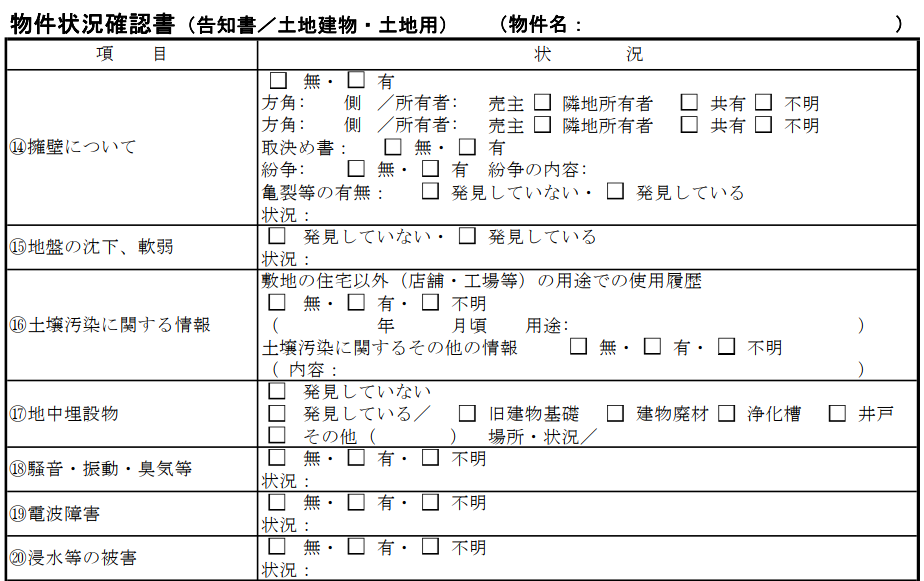

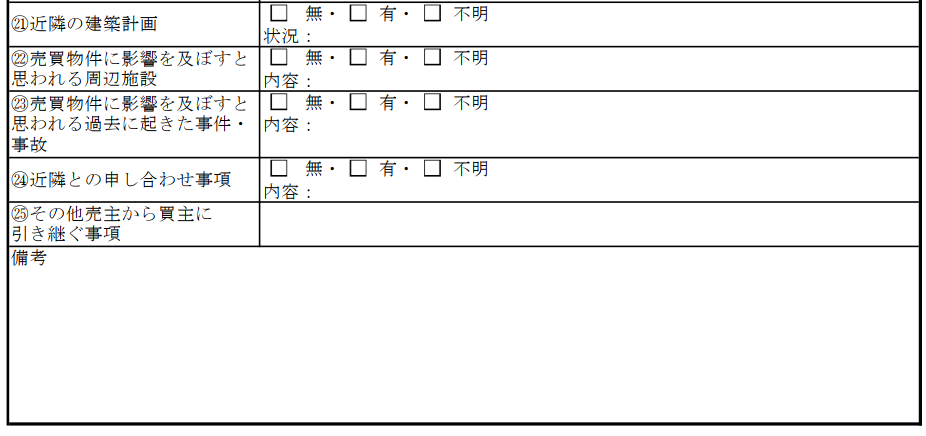

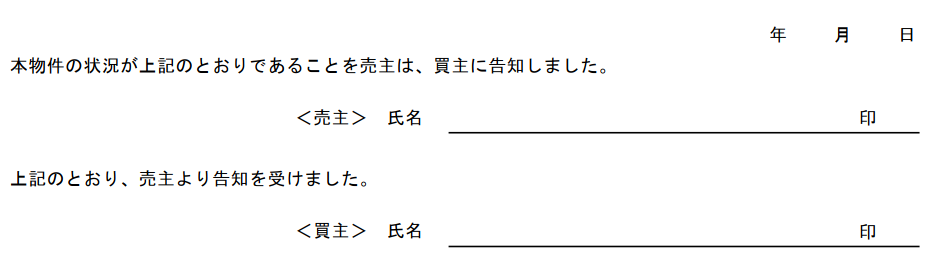

Heating and cooling equipment (electric/gas/oil): Yes/No Installation location: _____ Total: _ unit(s) Cooler: Yes/No Installation location: _____ Total: _ unit(s) Heater: Yes/No Installation location: _____ Total: _ unit(s) ⇒ Labeled as a specific maintenance product (Note 2): Yes/No Floor heater: Yes/No Installation location: _____ Total: _ unit(s) Ventilation fan: Yes/No Installation location: bathroom/washroom/toilet/_____ 24-hour ventilation system: Yes/No Others Intercom (with/without a monitor): Yes/No Remarks: Property Condition Confirmation Form 14-25Property Condition Confirmation Form (Notice for Land & Building / Land) (Property Name: __________) ⑭ About retaining walls Yes/No Direction: (Direction) side / □ Owner: Seller □ Neighboring landowner □ Shared □ Unknown Direction: (Direction) side / □ Owner: Seller □ Neighboring landowner □ Shared □ Unknown Written agreement: Yes/No Disputes: Yes/No Details:_____ Cracks or other defects: Found / Not found Condition: ⑮ Ground subsidence/softening Found / Not found Condition: _____ ⑯ Soil contamination History of non-residential use of the site (stores, factories, etc.) Yes/No/Unknown (Month/Year Used as:_____) Other information on soil contamination: Yes/No/Unknown ⑰ Underground deposits □ Not found □ Found / □Previous building foundations □ Construction waste □ Septic tank □ Well □ Other: _____ Location / Details: _____ ⑱ Noise, vibration, odor, etc. Yes/No/Unknown Details: _____ ⑲ Electromagnetic interference Yes/No/Unknown Condition: _____ ⑳ Flooding and other damage Yes/No/Unknown Condition: _____ ㉑ Neighborhood building plans Yes/No/Unknown Details: _____ ㉒ Surrounding facilities that may affect the property for sale Yes/No/Unknown Details: _____ ㉔ Neighborhood agreements Yes/No/Unknown Details: _____ ㉕ Other matters to be passed on from the Seller to the Buyer: _____ Remarks: Month/Date/Year The Seller has notified the Buyer that the condition of the Property is as described above.

The name of the Seller: _____ (personal/company seal) The Buyer has been notified by the Seller as described above. The name of the Buyer: _____ (personal/company seal) |

Details

AuthorArrows International Realty Corp. Archives

June 2023

Categories

All

|

RSS Feed

RSS Feed