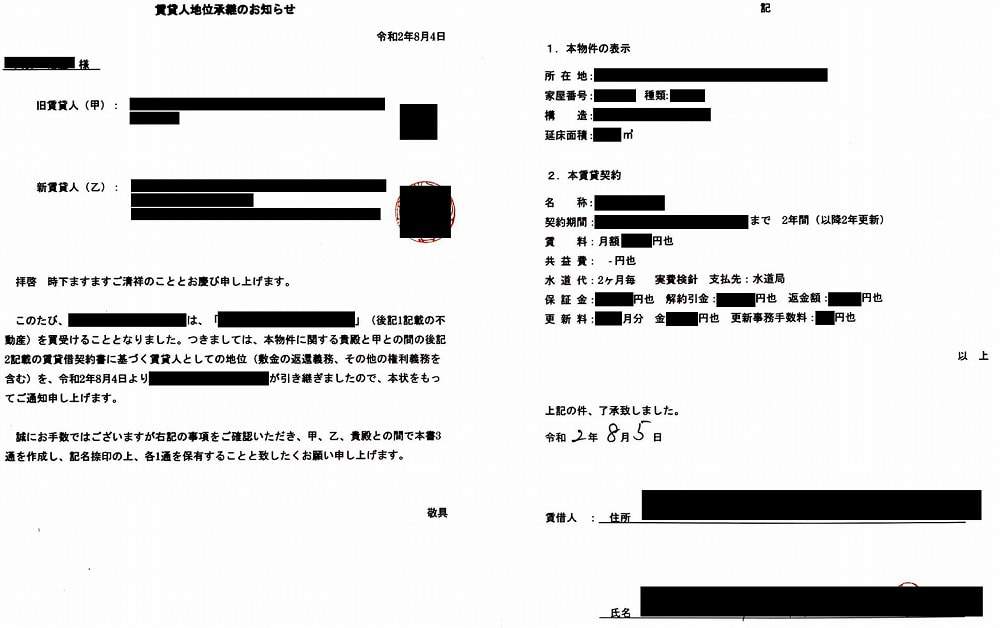

What should be notified to tenants after purchasing a property under lease?In purchasing real estate, you may purchase real estate that is already leased as an investment property. The real estate purchase and sale is called sales with the burden of a lease, and an existing lease contract is taken over as it is. In the explanation of important matters received when real estate is purchased, it becomes "exclusive use by a third party - yes" and "relation of right - tenant (lease)". Here, after purchasing real estate, we will explain what kind of notice is made to a tenant. What is the purpose of the notice?First, the purpose of notifying the lessee of a change of ownership is to notify the lessee of a change of title and a change in the person to whom rent is to be paid. The lease is a contract between the original lessor and the current lessee. Therefore, a notice is required that the new owner has succeeded to the lessor's position. Normally, it is sufficient to make a notice of the change of lessor signed and sealed by all three parties, without making a new lease contract again. Also, when the owner changes, the account to which rent is to be paid will change. The lessee pays monthly rent to the lessor, but if the management company is the same as the existing company, the rent will be paid to the same company. In many cases, the management company will also change and will notify the tenant of the change in the account to which rent is to be paid. To prepare a notice signed and sealed by the new lessor and the old lessor.The lessee is notified of the change of ownership immediately after the property transaction is completed. The notice of change should be stamped by both the old lessor and the new lessor, and the lessee should be notified. If you receive a notice from another party pretending to be the lessor, it may be a fraud. The management company or lessor will contact the lessee in advance. Giving legitimate notice after the transaction is complete is the safest way to eliminate the tenant's concerns. In the notice of change, we will prepare an informational letter with the address, name and seal of the old and new lessor, the date of the assignment of rights, and a statement that we would like the lessee to sign and seal the lease. The letter will include an indication of the subject property and a description of the terms of the lease agreement. By indicating the real estate, you can confirm that the real estate to be notified is correct. In addition, it can be confirmed whether there is a difference in the interpretation of both parties by stating the terms and conditions of the lease contract that we had a copy of beforehand. In this way, trouble later on can be avoided. It is the following details. Real Estate Indications - Location - Housing number - Structure - Total floor area The Lease Agreement - Property Name - Contract Period - Rent - Common Service Fee - Water payment - Security Deposit, Deposit / Deduction amount and Refund - Contract Renewal fees, Renewal procedures fees, etc. The trouble at the time of the contract renewal and the leaving can be prevented by having the above contents described and the tenant confirm it. Since it leads to the trouble afterwards if these small points are neglected, let's prepare the document firmly at the time of a real estate transaction. Once the real estate transaction is complete, notify the tenant as soon as possible and have them sign and seal the confirmation. Be sure to date these documents so that you can look back and check them later when you need to confirm them. If you use a guarantor company, the procedure of the change of the lessor is carried out to the guarantor company, too. Check the necessary documents in advance and be prepared to get the old lessor's signature at the completion of the transaction. These procedures are designed to avoid problems later on, in order to buy an investment property and definitely get the rent. If you are considering the purchase of investment property, please contact us for more information.

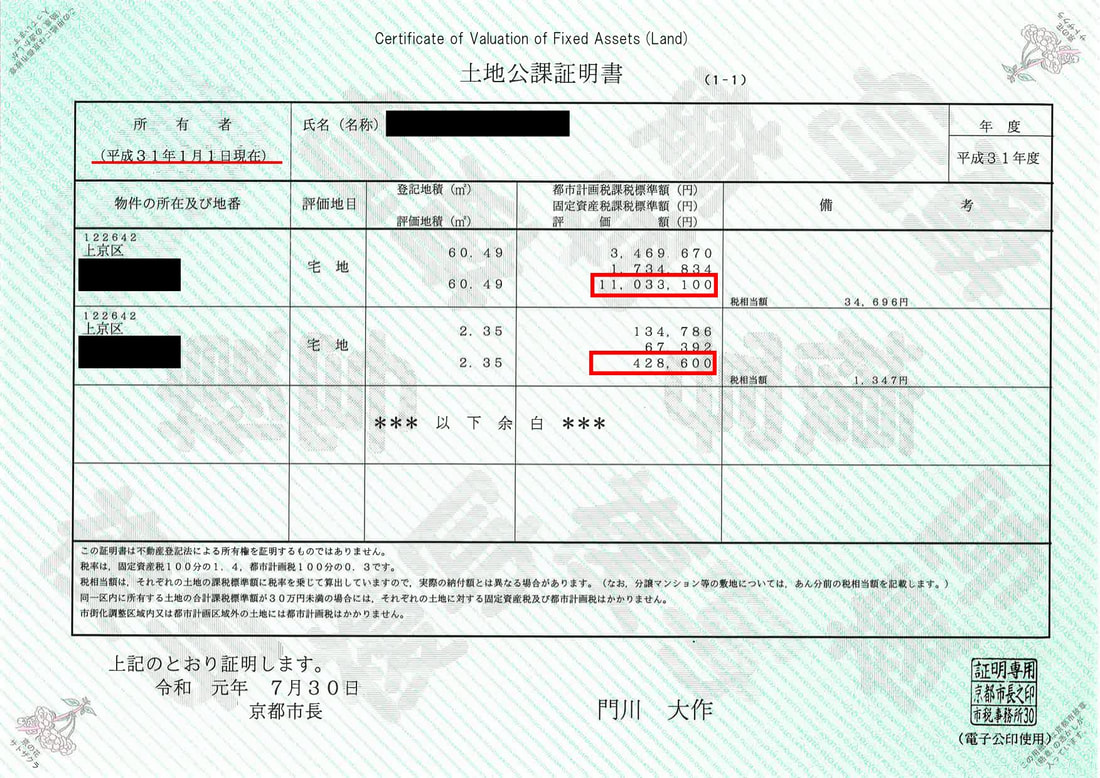

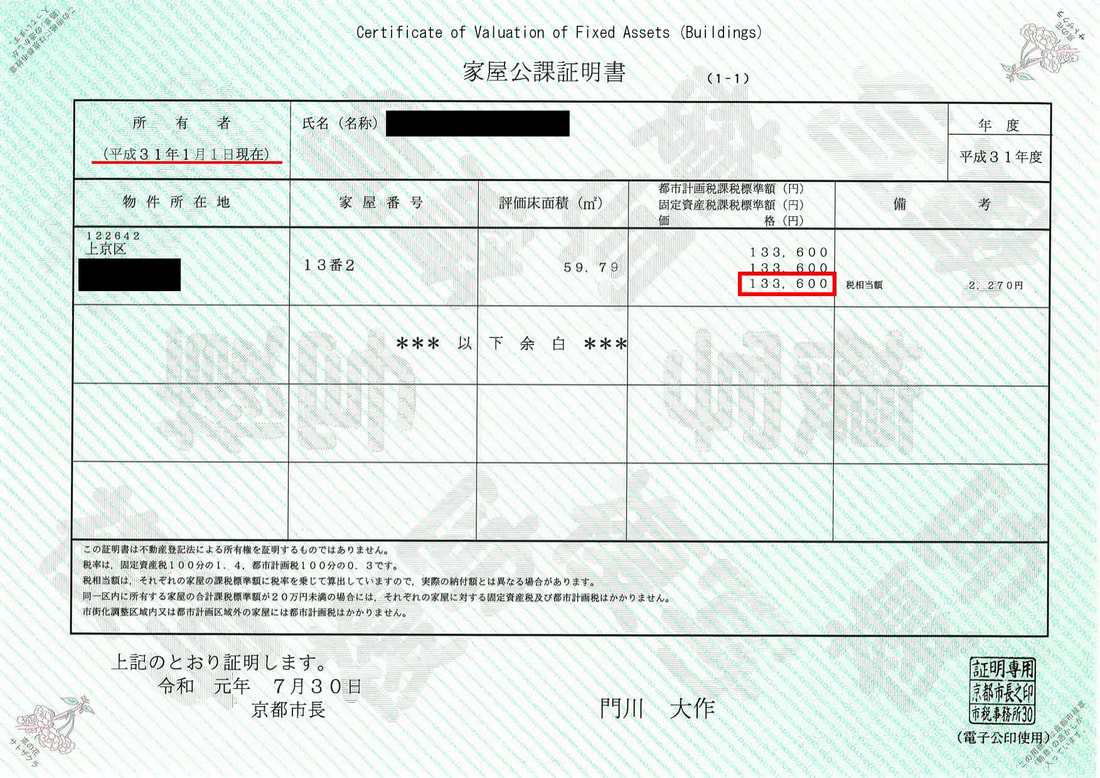

The costs associated with owning a property include taxes, repair costs, and administrative costs. Some costs are one-time costs, some are incurred monthly, and some are ongoing in the future. Let's start with taxes. There are three types of taxes: real estate acquisition tax, which occurs when you own real estate; real estate property tax, which occurs when you continue to own real estate; real estate transfer tax, which occurs when you transfer ownership of real estate; or real estate inheritance tax, which occurs when you inherit real estate by inheritance. The tax calculation is based on the assessed value listed on the property's public tax certificate. The real estate acquisition tax is a tax that only occurs once when the property is acquired. The real estate property tax is payable on January 1 of each year by the person or corporation holding the ownership of the property. When selling real estate, because a tax will be generated against the profit on the transfer of real estate, it will be necessary to grasp the acquisition cost, etc.

The inheritance tax on real estate is getting tougher with each year's revisions, so we need to check the law when the inheritance occurs. The basic interpretation is that when calculating the inheritance tax for undivided heritage, the heirs and inheritance are based on the country of origin of the heir. In addition, when calculating the total amount of inheritance tax, the heirs and inheritance share are based on Japanese law. It is best to check with your tax accountant for details, as it may or may not be related to whether you have lived in Japan. Next, regarding the repair costs, it will be the condominium that will be paid a fixed amount. There is a management union to which each owner belongs in the condominium, and through the union, repair expenses for future repairs of the building are funded. If the building age is short, the repair costs will be low, and the repair costs will rise as the building age passes. https://realestate-kyoto.com/APARTMENTforSale Of course, even detached houses will be repaired in the future, so repair costs will be incurred when repairing. Finally, there is the cost of management, but here we will discuss two types of management costs. The first one is the management fee that is paid to the company that manages the whole common part of the condominium when you own the condominium. The management company entrusted by the management association will maintain the entire building and carry out daily cleaning and other activities. Unlike the cost of repairs, they do not increase from year to year, but if the cost of management increases, there is a possibility of a rate increase. There are other management costs, for example, if we, Arrows International Realty Corp. manage the building, if the owner uses the building as a holiday home, we may be commissioned to pay a monthly fee. We can handle monthly utility bills and annual property tax payments, whether it's a patrol check of your building or an inquiry from a neighboring resident. If we provide such a service, we will receive a building maintenance fee from the owner. https://www.arrowsrealty.com/vacation-home-management-in-kyoto.html The above are the maintenance costs if you own the property. If you would like an individual consultation, please contact us via the website. Today we will talk about the documents necessary for purchasing real estate in Japan.

The only documents required are the notarized affidavit, the officially certified address certificate in Japan. All that is left is to sign the documents prepared by the judicial scrivener. It's very easy and concise. This proof of address must be a official document and must be AFFIDAVIT notarized at the embassy of the country of nationality or at the notary office. If the lawyer is registered as a notary, the document with the lawyer's certification (Notarization) is valid and the word of Attorney must be included in the signed document. If you are staying in a country where you do not have nationality, you will need to create a notarized affidavit at the embassy of your country in your country where you are staying. When you complete the real estate transaction and register the transfer of ownership, judicial scrivener will submit this affidavit to the Regional Legal Affairs Bureau along with other signed documents. The affidavit will be translated into Japanese in advance, and if there is a Kanji (Chinese) display, the Kanji (Chinese) will be registered as it is, and if it is in alphabetical form, it will be registered in Katakana. The registration of ownership of real estate requires a judicial scrivener to face the buyer and strictly confirm the identity of the buyer. However, it is possible to confirm the identity of the buyer and confirm his / her will through online. Therefore, it is possible to purchase real estate and register ownership even if you do not come to Japan. I don't know if many people have the right perception, but it is easy to own real estate in Japan. If you buy real estate in Japan, you will get ownership of the real estate. Ownership is the right to own real estate, land and buildings, and it is possible to use real estate for general residence, investment and development. Ownership can be acquired by individuals, corporations, and overseas corporations that do not have an address in Japan.

There is no limit to the ownership of Japan, and it is possible to hold the ownership semipermanently. Can I get a visa if I buy real estate? I have a common question. Unfortunately, in Japan, ownership of real estate is not tied to the visa required for residence, and a visa is not automatically obtained. Also, the bank account is not linked and it is not possible to open the account automatically. Real estate ownership is applied and registered by the Legal Affairs Bureau. Generally, real estate is delivered and applied by a judicial scrivener. The application will be closed on that date, and it will be possible to obtain the actual entitlement after the deadline of about 2 weeks. Ownership can be acquired individually or by multiple people, and even parents, children, couples, and acquaintances can register and acquire it by setting the ownership ratio. If you no longer own the ownership, you can register the ownership of the ownership and transfer it to your relatives. |

Details

AuthorArrows International Realty Corp. Archives

June 2023

Categories

All

|

RSS Feed

RSS Feed