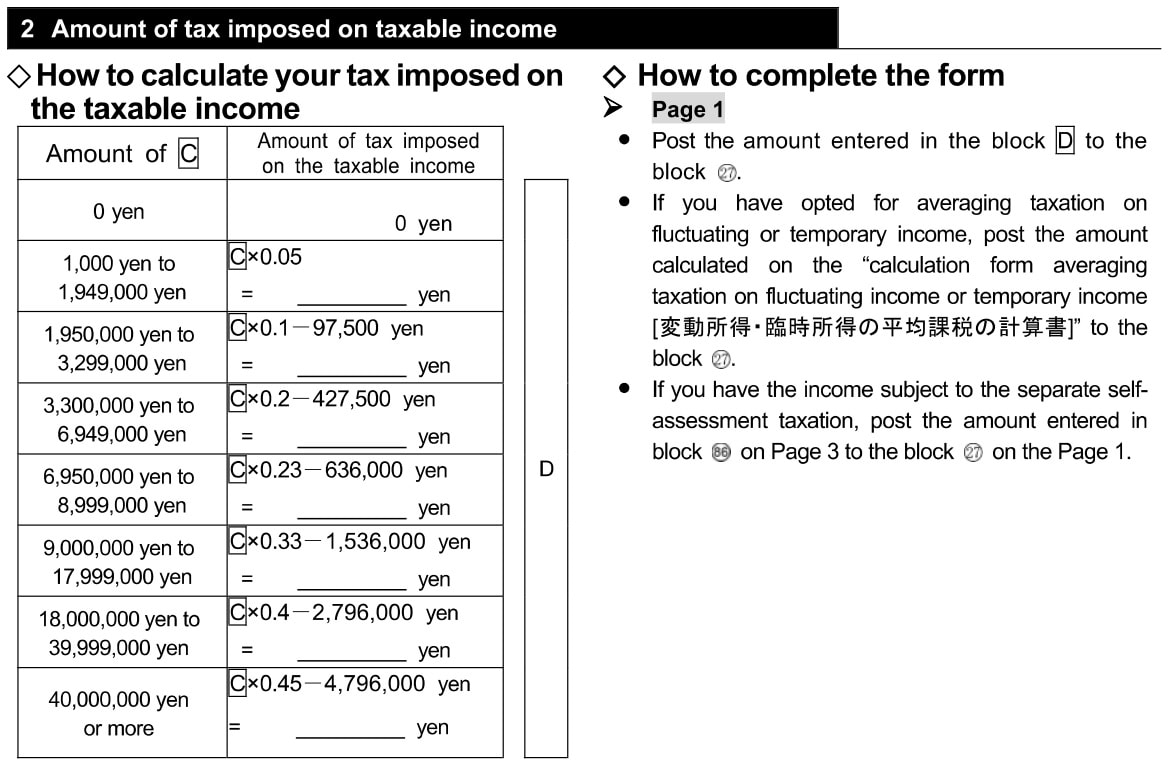

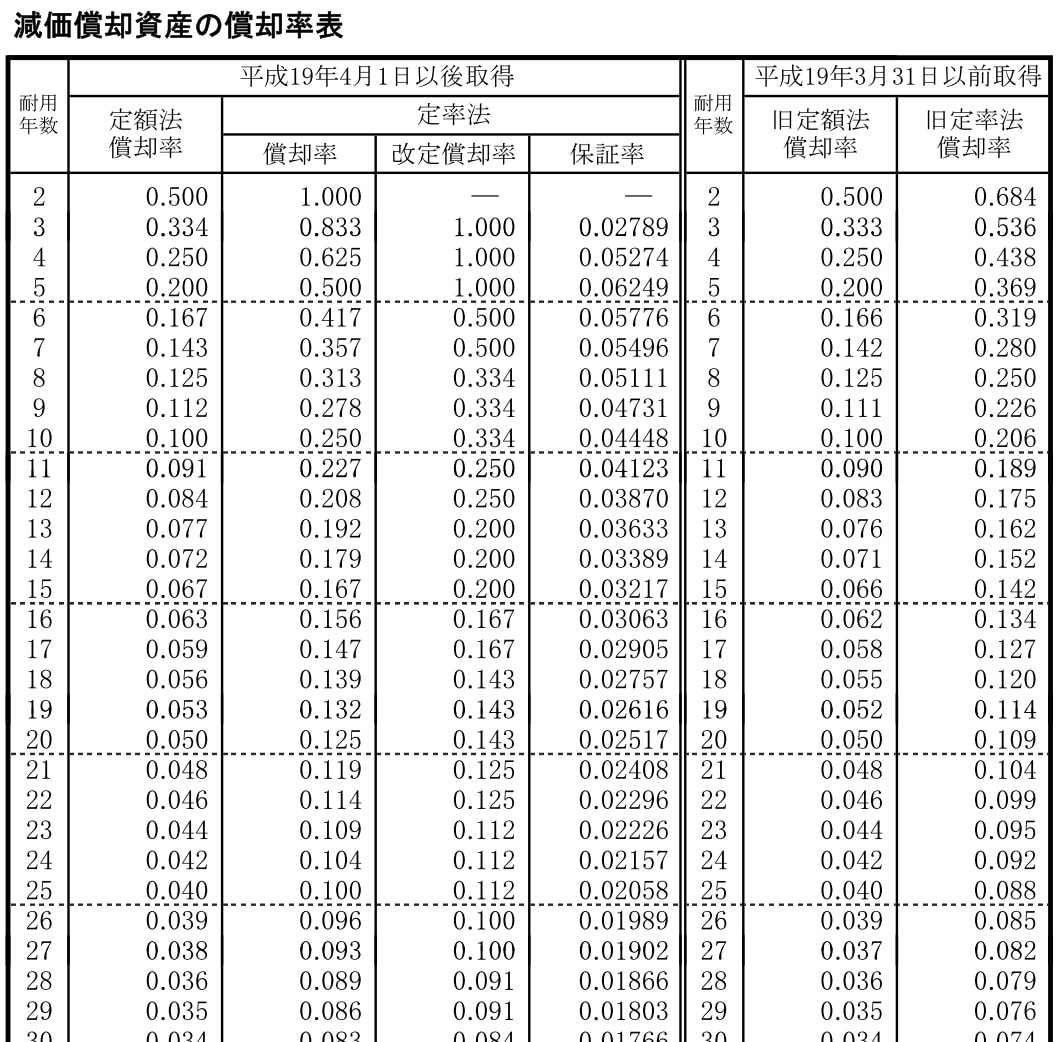

What are the actual profits and costs of investing in an apartment?Today, we received an inquiry about one room in a condominium and the following question arrived. I would like to know what would be the investment return of this apartment if for rent for about 5 years... Today's content explains the costs and actual profits of non-residents who make real estate investments in condominiums in Kyoto. About calculation of income tax of real estateThe tax on rent income is not uniform because the income tax rate varies depending on the taxable income amount. The amount of taxable income is not only considered as real estate income, but it also relates to salary income. This also involves income deductions, so it is not possible to simply calculate "how much is the tax on rent income". How to calculate income tax on rent income In order to obtain the income tax amount, it is necessary to calculate the taxable income amount and derive the tax rate. The taxable income amount can be calculated by the following formula. Taxable income amount = (Salary income + Real estate income) - Various income deductions Breakdown of various income deductions depends on each situation such as basic deduction, salary deduction, spouse deduction. Income tax is called the progressive tax rate, and the higher the income, the greater the tax burden. As shown in the table below, the tax rate of rent income is determined according to the total income, and is divided into 7 levels from 5% up to 45% according to the taxable income amount. The formula for calculating the income tax amount is as follows. Income tax amount = taxable income amount ✕ tax rate - deduction amount For non-residents, the rent obtained from rent investment in Japan is calculated as annual income. About depreciationDepreciation refers to a calculation method for acquiring depreciable assets and allocating the expenses (construction costs and purchase prices) incurred in acquiring the assets by dividing them into the number of years set for each type. Depreciable assets are fixed assets that businesses acquire for the purpose of using them for business purposes, and lose their value over time, and the purchase price is set at 100,000 yen or more. Buildings, cars, machinery, equipment, software, etc. are typical depreciable assets. Concept of building depreciation When calculating the depreciation of real estate, it is important to separate land from buildings. As mentioned above, depreciable assets, including buildings, are those that lose value over time, whereas land does not change in value over time, so it won't be subject to depreciation. When you build a building only on the land you already own, the price of the building is clear. When you purchase land and buildings, the purchase price includes the price of buildings and land, so it may be necessary to calculate only the price of buildings separately. How to calculate the useful life of used assets when the building age does not exceed the useful life The calculation method when the building age does not exceed the useful life is as follows. Service life = (Statutory service life - Age) + age x 0.2 (round down) The following is part of the depreciation rate table for depreciable assets. Using various formulas as above, calculate the estimated cost, tax to be paid, etc. from the estimated rent and derive the final profit. Below are the answers to our customers today. Annual Rent 6,600,000 yen Annual Cost ; - maintenance fee 670,440 yen - reserve fund 137,400 yen - others 24,420 yen - fire insurance 60,000 yen (roughly amount) - fixed asset tax 280,000 yen (roughly amount) - property management fee 217,800 yen (3% of rent and tax) - tax accountant payment 200,000 yen (roughly amount) - real estate acquisition tax (one time) 1,000,000 yen (roughly amount) - depreciation 1,780,000 yen (roughly amount) First Year Income 3,884,446 yen breakdown - rent income 6,600,000 yen - cost 2,590,060 yen - gross profit 4,009,940 yen - tax 125,494 yen Second Year and After 4,829,446 yen breakdown - rent income 6,600,000 yen - cost 1,540,060 yen - gross profit 5,059,940 yen - tax 230,494 yen 1st yr plus 2-5 yrs income = 23,202,230 yen Tax accountants can also be introduced individually. If you have any questions about real estate investment or have any real estate interests, please contact us.

Today we would like to talk about the points to note when non-residents invest in real estate. When investing in real estate in Japan, it does not matter whether the buyer is Japanese, resident or non-resident. However, if you are a non-resident and you want to get rent from the property you invest in, then note the following: Cases other than the rent paid by individuals who rented the land and house for themselves or their relatives to reside in. So what happens in the case above? The National Tax Agency has the following information. No.12014 Real estate income of non-residents https://www.nta.go.jp/english/taxes/individual/12014.htm

In such a case, there are two points to keep in mind.

First, the lessee has to pay the withholding tax collected to the tax office every month. This puts a heavy burden on the lessee and results in complicated tax procedures. If the rent is high, there is a possibility that the corporation has a lease agreement, and inevitably additional corporate paperwork will occur. Due to this increase in processing, there is a possibility that the lease contract will be terminated. Therefore, the method of avoiding such complicated processing from the lessee is to change the contract so that we will enter into a sublease agreement with the landlord, enter into a lease through us, and we will be obligated to pay tax. By doing this, the original lessee will rent a room from us, so there will be no additional burden. Our additional operating costs are covered by normal property management fees and are not incurred separately. The second point is to make the tax accountant a partner of the tax advisor. Every year, you will be required to file a tax return for real estate income, and at the same time, please request a refund for the withholding tax. By doing this, you will be asked to refund the tax by accurately claiming the tax and overpaying the tax. The above are points to keep in mind when investing in real estate. These cases include special circumstances, so please consult us individually. We can also introduce tax accountants who are fluent in English and Chinese. Please contact us for more details. |

Details

AuthorArrows International Realty Corp. Archives

June 2023

Categories

All

|

RSS Feed

RSS Feed