What's the difference between a real estate investment loan and housing loan?Some of you may be researching real estate investment and are wondering about the difference between real estate investment loans and housing loans. Real estate investment loans are for the purchase of income-producing real estate for the purpose of earning rental income. A housing loan is only applicable to the property that will become your home. Although they may seem similar, these two loans are completely different financing systems. By knowing the differences, you can choose the right loan for your purpose. In this article, we will introduce the differences between real estate investment loans and housing loans and how to utilize them. The main difference between a real estate investment loan and a housing loan is the purpose of purchasing the property: whether you will rent it to others to earn income or live in it by yourself. Based on this purpose, there are various differences. Let's take a look at the six differences here. Purpose of Loan A housing loan and a real estate investment loan may seem like similar loans when you think of them as being used to pay for the purchase of a property. However, the purpose of using the property for the loan is different. A housing loan is a loan to be used for the purchase or expansion of a home. The purpose of the loan is to cover the cost of the home in which the borrower lives. It cannot be used to cover the cost of purchasing a property for the purpose of renting it out. A real estate investment loan is a loan that is taken out to generate income through real estate investment. When purchasing real estate for profit, you need to take out a real estate investment loan instead of a housing loan. Financial institutions' screening criteria are also based on the intended use of the property. Taking out a housing loan to pay for the purchase of income-producing real estate is a serious breach of contract. Source of Repayment There is a difference between a housing loan and a real estate investment loan in terms of what is used as the repayment source. The repayment source is the money that is used to repay the loan. The source of repayment for a housing loan is generally your monthly salary. In the case of a housing loan, which is a loan for a house, the repayment source is generated from the income from the individual's labor. A housing loan is a loan for personal consumption only. The concept of repayment source is basically the same as other personal loans. In the case of real estate investment loans, on the other hand, the source of repayment is the monthly rental income. In the case of real estate investment loans, which are loans for income-producing real estate, the repayment source is generated from the rental income earned from tenants through rental management. Even if you are an individual investor, it is assumed that you will be running a business called rental management. Loan Amount There is also a difference in the loan amount. The maximum loan amount is higher for real estate investment loans than for housing loans. The difference is whether the loan is for an individual or for a business investor. The maximum loan amount for a housing loan is 5 to 8 times the individual's annual income. In general, the upper limit is 5 to 6 times, but it can be 7 to 8 times depending on the individual's attributes. The maximum loan amount for real estate investment loans is sometimes 10 to 20 times your annual income. The reason for this amount is that not only rental income but also salary income and savings are taken into account. Interest Rates on Loans There is a difference between housing loans and real estate investment loans, not only in the loan amount but also in the interest rate of the loan. The interest rate is usually higher for real estate investment loans than for housing loans. This difference is due to the difference in the risk of loan default. The interest rate on housing loans is about 0.5%~2.0% per year. Salary income will not decrease significantly as long as the individual continues to work. Housing loans that use salary income as the source of repayment can be said to have low interest rates due to the low risk of default. The interest rate for real estate investment loans is about 1.5%~4.5% per annum. If the loan amount is large, the repayment amount will also be large. However, rental income, which is the source of repayment, may not always be constant. Vacancies and declines in rent can occur, increasing the risk of default. For this reason, interest rates tend to be lower on real estate investment loans for properties that are expected to generate stable income. Details of Loan Screening There is a difference in the loan screening process between home loans and real estate investment loans. The difference can be described as whether to look only at the creditworthiness of the individual or also at the profitability of the property. In housing loans, personal attributes are the criteria for loan screening. Attributes are related to an individual's repayment ability and creditworthiness. Specifically, they include annual income, length of service, amount of savings, amount of debt with other companies, and history of financial accidents. In addition to personal attributes, real estate investment loans carefully check the profitability of the property. This includes the area in which the property is built, the age of the property, the rent setting, and the history of past property transactions. The type of property you choose will also affect whether or not you can get a loan. Different financial institutions have different standards for loan screening, so even if you don't pass the screening at one bank, it is possible that you will pass at another bank. Restrictions Housing loans and real estate investment loans differ in whether they can be signed in the name of a corporation or not. The property for which the cost is covered by a housing loan is supposed to be occupied by the contractor. It is a loan for the home and cannot be signed in the name of a corporation. The property you purchase with a real estate investment loan is operated for rental management, where you rent it out to tenants and earn rental income. The loan is for the business of earning real estate income, not salary income, and can be contracted in the name of a corporation. There is also a difference in the age limit of the contractor. For housing loans, the source of repayment is usually salary income. Taking into account the retirement age, the upper age limit is set at about 65~70 years old. In real estate investment loans, the source of repayment is the rental income from rental management. Depending on the profitability of the property and your asset status, you may be able to take out a loan at the age of 70 or older. Will I be able to get a housing loan if I have a real estate investment loan? Let's also look at whether taking out a real estate investment loan will prevent you from getting a housing loan. As mentioned above, real estate investment loans can be as high as 10~20 times your annual income. The state in which you are taking out a real estate investment loan is one in which you have a large amount of debt from other companies. Financial institutions that screen housing loans determine the repayment ability of individuals. The general perception may be that you are likely to fail the loan screening process because you are already approaching the upper limit of your repayment capacity. It is not easy to get a loan approval, but it is possible to get a loan depending on the conditions. The maximum amount for a home loan is 5 to 8 times your annual income. Within this amount, as long as the repayment ratio of the two loans combined is not too large, you can get a loan. The repayment ratio is the ratio of annual repayment amount to annual income. Some financial institutions consider real estate income to be combined with salary income. Although there are no fixed standards for loan screening, the larger your real estate income, the more favorable your loan screening will be. Which should you buy first, your home or your investment property? If you want to get both a real estate investment loan and a home loan, which one should you get first? There could be a scenario where a person earns a profit from real estate investment and makes a good living, but lives in a rental house because he or she cannot get a housing loan. It is only theoretical, but in conclusion, it is more effective to take out a real estate investment loan first. When you take out a real estate investment loan to purchase income-producing real estate, you will receive rental income. Many financial institutions consider this income as annual income. Increasing your annual income will also lead to a higher maximum loan amount. Buying income-producing real estate means that the maximum housing loan amount will naturally increase. On the other hand, if you take out a housing loan first, the loan amount for your real estate investment loan will be diminished because of the pressure on the loan amount. However, it is difficult to say for sure, as each financial institution has a different approach to screening, and whether or not a loan will be approved depends on the individual's financial situation. If you are considering purchasing a house, it is recommended that you inform the person in charge of sales of your ideas. Can I buy an investment property with a housing loan? Some people may wonder if it is possible to buy an income-producing property with a housing loan. As we have mentioned, a housing loan is a loan for a property as a home. Basically, you cannot purchase income-producing real estate with a housing loan. There are special cases in which a property purchased for one's own living purpose is consequently rented out to others. However, it is a breach of contract to use a housing loan even though you are supposed to be investing in real estate. The financial institution checks for this breach of contract even after the purchase of the property. If you are found to have violated the contract, it is customary to pay the remaining balance in a lump sum. In the worst case, you may be charged with fraud, so be careful. Why some people try to invest in real estate using a housing loan

A housing loan is a loan for a property for your home. Despite knowing this, there are still people who try to invest in real estate using housing loans. The interest rates for housing loans are variable and range from 0.5% to 2.0% per year. Compared to real estate investment loans, where annual interest rates range from 1.5% to 4.5%, interest rates are low and screening standards are said to be relatively loose. If you look only at the basic terms and conditions of the loan, such as interest rate and approval, housing loans are more advantageous. For these reasons, many people want to use housing loans for income-producing real estate. However, borrowing a loan from a financial institution under the guise of a housing loan and using it for real estate investment is, of course, illegal. Even if the loan is approved, you may be asked to repay the loan in full if the forgery is discovered. Even if you are recommended by a real estate agent, do not go ahead with it. You can still do DIY in a Rental. What is the Key to Actually Doing DIY?DIY stands for "Do It Yourself," which means to make your own furniture and decorations. DIY is popular among women as well as men because it allows you to change a room into a space of your choice on a low budget, but many people may have the image that DIY is difficult to do in a rental house. However, with a little ingenuity, it is possible to do DIY in a rental property. In this article, we will introduce in detail the points to keep in mind when doing a do-it-yourself project in a rental house, and actual DIY examples, with explanations. You can DIY in a rental house.It is possible to enjoy DIY in a rental home with some creativity. For example, if the furniture is already in use, it belongs to you, so you can do whatever you want with it without damaging the room. Just remaking the furniture you have on hand can change the atmosphere of the room, and one of the appealing aspects of DIY is that you can change it to make it more user-friendly for you. If you want to change the wallpaper, there are easy to use wall stickers that you can put up and peel off, easy to try out such as masking tape, or even peel-off wallpaper that can be used on the entire wall. There are also wallpaper sheets that can be painted over. These products can be restored to their original state without damaging the wallpaper when they are removed, so they can be used in a rental house without any worries. In addition, if you have an inset floor mat, it has an absorbent backing and can change the look of your floor simply by placing it without the use of glue. Cushioned floor mats are convenient for protecting the floor at the same time. They come in a variety of patterns and materials and can be changed to suit your taste and mood. In addition, there are also tile sheets that can be used around the water, glass film for windows, and many other products on the market depending on the purpose and location. What to Look for When Doing a DIY Project in a Rental HouseThere are a few things to keep in mind when it comes to actually doing a DIY project. The first thing you want to pay attention to in order to do a DIY project in a rental house is that the work should be done to the extent that it can be restored to its original condition. Restoration means that the property must be returned to its original condition when you move out. If you damage a wall or floor in the process of DIY, you may have to pay for the repair, so please be careful. It is also important to abide by the management rules of the apartment or condominium and carry out the work. Be sure to check with your landlord before doing any DIY work, including the matter of restoration of the original condition. During DIY construction, you may end up causing problems for neighbors with noise and other disturbances. If you are in a housing complex, one way to avoid this problem is to use a material cutting service at a home improvement center or a workshop for buyers. You can also rent tools and equipment here, and you can work without worrying about dust and noise. If you work at home, make sure you do it at a sensible time. DIY PracticeSo what are some of the actual DIY's you can do in your rental home? Here are a few examples to get you started. Wall Redecoration If you want to make a big change in the atmosphere of a room, you can redecorate the walls. If you don't use strong adhesives, you can redecorate your walls without damaging them. As we touched on a little earlier, decorating your walls with peel-off wall stickers or masking tape is an easy way to redecorate. There are many different types of stickers available for use on a point instead of the whole wall, so you can make a big difference in the impression you make. If you want to redecorate an entire wall, use peel-off wallpaper. It can change the entire wall, which can significantly change the atmosphere of the room. If you want to apply paint directly, you can achieve this by using peel-off wallpaper sheets for paint. Other popular options are to put up styrofoam walling like bricks or to install thin boards as temporary walls to create your own arrangement. Floor and Balcony One of the most popular floor redecorating solutions is a built-in floor mat. There are many different types of floor mats available, including flooring mats and carpet mats, which you can easily redecorate simply by placing them on the floor. Many of them have a non-slip surface on the back of the floor mat, which prevents them from sliding around in your daily life and is easy to remove. Some of those floor mats are washable, so they are clean and easy to use. Another type of floor mat is the sheet type, which can be cut into any size and placed on the floor without any gaps. There are also balcony floor coverings that can be placed on balconies for easy redecoration. There are many different types of floor coverings available, with natural wood and artificial grass being the most popular. There are also fences that you can simply assemble, and some of them can be used to decorate with pots for gardening and other purposes. Kitchen The kitchen area is a popular DIY project, especially when it comes to efficiency and functionality. When doing a DIY project, be sure to plan ahead to improve the usability of your kitchen. You can also use propped-up shelves or propping rods to provide more storage or a workbench. Water-resistant, peel-off stickers and wallpaper are great for redecorating kitchen walls and shelves. Not only do they change the look and feel of your kitchen, but they also prevent grease splatters and stains from sticking to your walls. Rental properties for DIY With more and more people doing DIY, a new type of rental property called a do-it-yourself lease has begun to emerge. These properties are based on the premise that the tenant is free to do their own DIY, and in exchange for the tenant paying for the work, the rent is cheaper than usual, among other advantages. Whether the work is done by a contractor or by the tenant themselves, you can rent the property without any problems. This is a great option for those who want to do some serious DIY work without having to worry about damaging the walls and floors. Choose a property that matches your level of DIY. It is possible to do some DIY in a rental property with some creativity, but it has to be done within a set scope. If you want to make a big change in the image of a room or if you want to try a real DIY project, you have the option of choosing a DIY-ready property. To get the home of your dreams, you can choose a property that suits your level of motivation and DIY skills. With more of these properties on the market, there are more options for investment properties from the investor's side. For example, it is possible to keep costs down on the side of investors by renting out properties on a do-it-yourself basis with minimal infrastructure such as water, electricity, gas, and leaks necessary for life, and other repairs and replacements. It is no longer necessary to rent out the property in a clean condition, and at rents slightly lower than the market rate, you can invest in real estate with a large investment cost down. This type of investment should be quoted separately from the investment to be made to rent out as a regular rental and as a minimum investment for a do-it-yourself property. If you are interested in this type of investment, please contact us for more information.

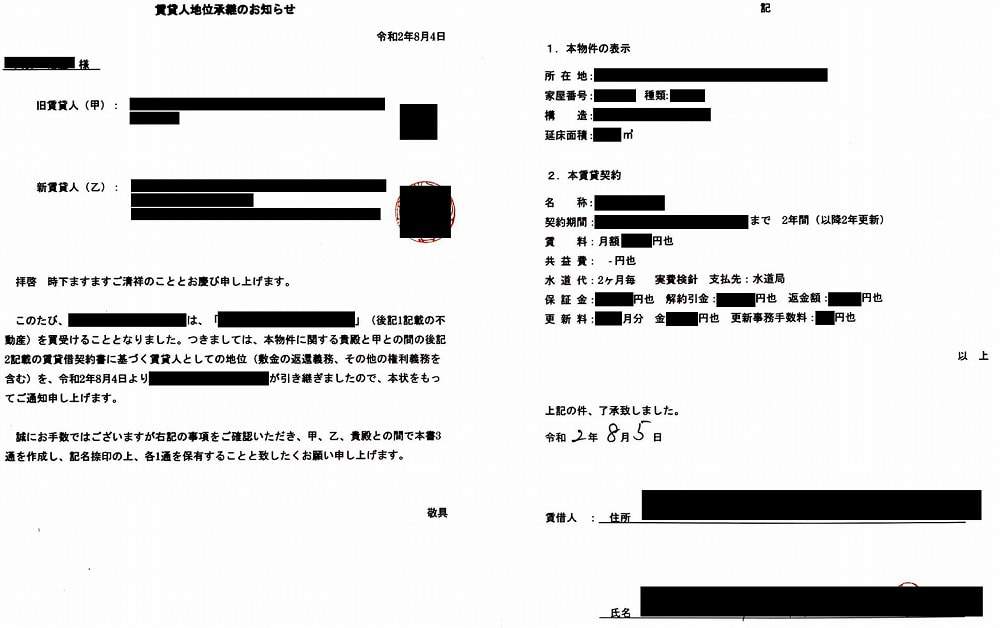

What should be notified to tenants after purchasing a property under lease?In purchasing real estate, you may purchase real estate that is already leased as an investment property. The real estate purchase and sale is called sales with the burden of a lease, and an existing lease contract is taken over as it is. In the explanation of important matters received when real estate is purchased, it becomes "exclusive use by a third party - yes" and "relation of right - tenant (lease)". Here, after purchasing real estate, we will explain what kind of notice is made to a tenant. What is the purpose of the notice?First, the purpose of notifying the lessee of a change of ownership is to notify the lessee of a change of title and a change in the person to whom rent is to be paid. The lease is a contract between the original lessor and the current lessee. Therefore, a notice is required that the new owner has succeeded to the lessor's position. Normally, it is sufficient to make a notice of the change of lessor signed and sealed by all three parties, without making a new lease contract again. Also, when the owner changes, the account to which rent is to be paid will change. The lessee pays monthly rent to the lessor, but if the management company is the same as the existing company, the rent will be paid to the same company. In many cases, the management company will also change and will notify the tenant of the change in the account to which rent is to be paid. To prepare a notice signed and sealed by the new lessor and the old lessor.The lessee is notified of the change of ownership immediately after the property transaction is completed. The notice of change should be stamped by both the old lessor and the new lessor, and the lessee should be notified. If you receive a notice from another party pretending to be the lessor, it may be a fraud. The management company or lessor will contact the lessee in advance. Giving legitimate notice after the transaction is complete is the safest way to eliminate the tenant's concerns. In the notice of change, we will prepare an informational letter with the address, name and seal of the old and new lessor, the date of the assignment of rights, and a statement that we would like the lessee to sign and seal the lease. The letter will include an indication of the subject property and a description of the terms of the lease agreement. By indicating the real estate, you can confirm that the real estate to be notified is correct. In addition, it can be confirmed whether there is a difference in the interpretation of both parties by stating the terms and conditions of the lease contract that we had a copy of beforehand. In this way, trouble later on can be avoided. It is the following details. Real Estate Indications - Location - Housing number - Structure - Total floor area The Lease Agreement - Property Name - Contract Period - Rent - Common Service Fee - Water payment - Security Deposit, Deposit / Deduction amount and Refund - Contract Renewal fees, Renewal procedures fees, etc. The trouble at the time of the contract renewal and the leaving can be prevented by having the above contents described and the tenant confirm it. Since it leads to the trouble afterwards if these small points are neglected, let's prepare the document firmly at the time of a real estate transaction. Once the real estate transaction is complete, notify the tenant as soon as possible and have them sign and seal the confirmation. Be sure to date these documents so that you can look back and check them later when you need to confirm them. If you use a guarantor company, the procedure of the change of the lessor is carried out to the guarantor company, too. Check the necessary documents in advance and be prepared to get the old lessor's signature at the completion of the transaction. These procedures are designed to avoid problems later on, in order to buy an investment property and definitely get the rent. If you are considering the purchase of investment property, please contact us for more information.

What is the risk of lessee and market?We explained that the rent income from real estate involves four risks: vacancy, early cancellation, rent decline, and delinquency. This time, we will explain what kind of risks are involved in terms of the lessee's attributes, type, and market. Relationship between lessee attributes and riskThe tenant attributes of real estate for rent can be broadly classified into three categories: “residential”, “office”, and “store”. In real estate investment, the magnitude of risk varies depending on the lessee's attributes. We will explain the risks associated with attributes from the perspective of stable income.

The above is a general comparison that does not take individual circumstances into consideration. Stores and offices are subject to the risks of withdrawal and relocation, depending on location conditions and economic conditions. In addition, if there are vacancies, we must search for a store or company that meets the conditions, taking into consideration the location and other factors. Therefore, it can generally take some time to secure a new tenant. Naturally, residences are affected by location and economy, and there is a risk of vacancy, but since it is essential as a home of life, new lessee can be found unless rent conditions such as rent are set unreasonably. The cycle of finding new tenant is generally shorter than in offices and stores. From this point of view, by the stability of rent income, it can be said that the risk of residential is lower than stores and offices. Relationship between type of lessee and riskAs mentioned above, the risk of income differs depending on the lessee's attributes, but in addition, the risk level also changes depending on the “business type”, “scale” and “quality” of the lessee in each attribute.

Again, this is just a general idea, and of course it depends on the individual case. As for offices, it is important to consider how the company is generating stable income and the occupation where stable income can be obtained. In terms of stores, restaurants are generally said to be at higher risk from the perspective of fire risk. In this way, the risk varies depending on the attributes and quality of the lessee. In other words, cultivate a sense of risk by imagining the possibility of obtaining stable income and the different probabilities. Supply and demand and risk of real estate for rent (Condominiums for sale also become competitors)If the rent obtained from the investment target real estate is higher than the market price in the neighborhood, there is a high possibility that the rent will have to be reduced at the same level as the market price at the timing of contract renewal or replacement of the borrower. Therefore, even if the yield at the time of property purchase is high, the rent may be reduced in the future due to replacement of the lessee or negotiations for rent reduction, etc., and as a result, the yield may decrease. Number of rental units and risk (the more rental units, the smaller the risk)The degree of risk also changes depending on the number of real estate units you invest. If the number of rented units is large, the ratio of one rent to the total rent is small, so even if one vacant unit is vacant, the impact on rent income will be small. Conversely, if the number of rented units is small, the ratio of one rent to the total rent will be large, so if vacant, the impact on rent income will be large. In other words, the impact of vacancy per unit increases as the number of rental units decreases, and the impact decreases as the number of units increases. As shown in the table below, even if the investment amount and the yield are both the same, the income and yield when there are vacant rooms will differ due to the difference in the number of rental units.

SummaryWe explained the risk related to income in two times, the last time and this time, but it does not mean that the risk is bad because it is high or low. If the risk is high, you can buy cheaply and get a high yield accordingly. In addition, if the risk is low, the yield will inevitably be low, so you may not be able to expect high profits, but stable operation may be possible. First of all, it is important to understand the risks and develop a sense and image that you can make an investment commensurate with the risks. When investing in real estate, it is important to understand the intuition of the land, the unique circumstances of the real estate, demand, and major trends. However, starting with a small investment and gradually increasing it, you will be able to accumulate know-how and select the appropriate property from various investment targets. We also accept questions related to investment, so please feel free to contact us.

What is the risk of rent income?Real estate investment is often very large compared to stock investment. If you succeed, you will get a stable profit, but if you fail, you will regularly lose. Therefore, if you do not fully understand the characteristics and risks of real estate, you cannot make a successful investment. So what are the specific risks involved in real estate investment? This time we will discuss the risks associated with income from real estate. Vacancy risk (vacancy is negative, not zero income)The main source of income from real estate investment is the monthly rent income earned by lessee (residents, tenants) by renting real estate. Therefore, if lessee moves out for some reason, owner will not be able to earn rent income until owner finds a new lessee. Moreover, as a property of real estate, management costs, property taxes, city planning taxes, and other expenses are incurred regardless of whether there is a lessee or not. Therefore, if rent income does not come in due to vacancy, the balance will be not zero, but negative. For example, if six months of the year are vacant and you cannot get rent, the rent income will of course be halved, but expenses will be incurred throughout the year, so the actual income and yield will be less than half.

Early termination system advantageous to LesseeWhen entering into a lease agreement between the lessor and the lessee, the contract period is usually set for 2 to 3 years. However, even during the term of the contract, it is possible to cancel the contract in advance, excluding special contract types, by prior notice from the lessee (6 months to 1 month). In other words, for the lessor, the contract period specified in the lease contract is only expected to earn rent income, and even during the contract period, there is always the risk of being canceled early (vacant). When land prices, commodity prices, and rents were rising, it was called the “lender market” and it was relatively easy to secure a new tenants even when there were vacancies. Also, at that time, land prices and rents were on the rise, so in some cases owners were able to rent under conditions that were more favorable than previous rents. In addition, key money and other lump-sum payments can also be received, so the early cancellation by the lessee was not a major issue. However, with the increase in the supply of rental properties, the number of vacancies has increased, and the polarization of land prices and rents is now remarkable, and it is called the “borrower market”, it's becoming a serious problem for the lessor whether or not a new lessee can be secured promptly after the tenant moves out, and whether the lessee can pay at the previous rent level. In the current “borrower market”, stable income cannot be obtained unless the next step is taken promptly when it becomes clear that the lessee has terminated early or has terminated. Risk associated with falling rentIf the rent obtained from the real estate to be invested is higher than the market price in the neighborhood, there is a high possibility that you will be forced to reduce the rent at the same level as the neighboring market at the time of contract renewal or when the lessee is replaced. Therefore, even if the yield at the time of purchasing a property is high, the rent may be reduced in the future due to the replacement of the lessee, negotiations for reducing the rent, etc., and as a result, the yield may decrease.

Risk of rent arrearage (rent arrearage are harder to handle than vacancies)Even if the lessee has already been secured and there is no concern about vacancy for a while, but there is a risk of the rent will not be paid as planned due to the economical situation of the borrower and individual circumstances, etc. If the rent is overdue, a reminder to the lessee and a reminder to the guarantor will be required. In addition, if you request a real estate agent or lawyer to do business for moving out due to demand for rent, collection, or nonpayment of rent, there will be a charge. Thus, in addition to the effort and expense involved in paying rent in arrears, you may suffer even more damage than if the property were vacant, since you will not be able to secure a new tenant and generate income in the meantime. Even if the eviction is established, it is not known whether the rent for non-payment can be recovered or not. Therefore, if you are investing in real estate, you will need to conduct a thorough investigation into the creditworthiness of guarantor as well as the creditworthiness of the lessee. It is desirable to investigate the lessee's past arrears history when buying the real estate that is already in lease. SummaryInvesting involves risk, and there is no investment product without risk. In real estate investment, a thorough understanding of the characteristics of these risks will determine the success or failure of your investment. In addition, the various risks associated with rental income discussed in this article can be mitigated to some extent through your own efforts, ingenuity and judgment. We will discuss ways to mitigate these risks in the next section.

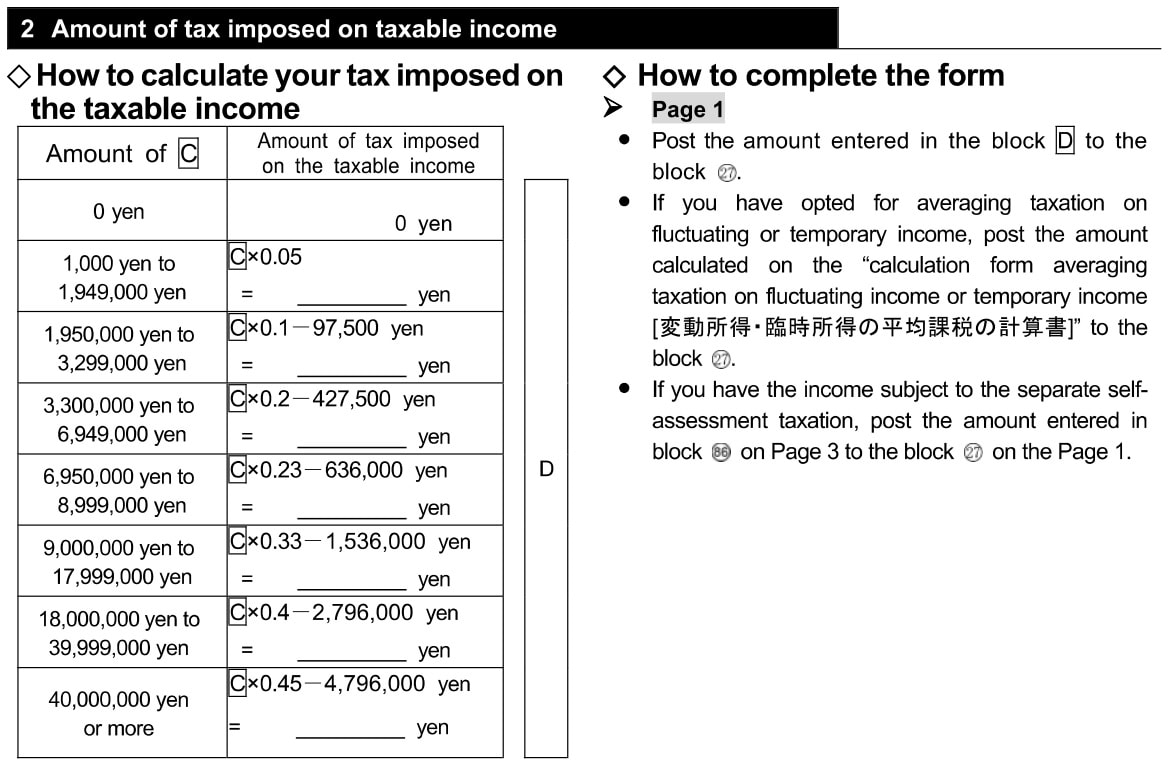

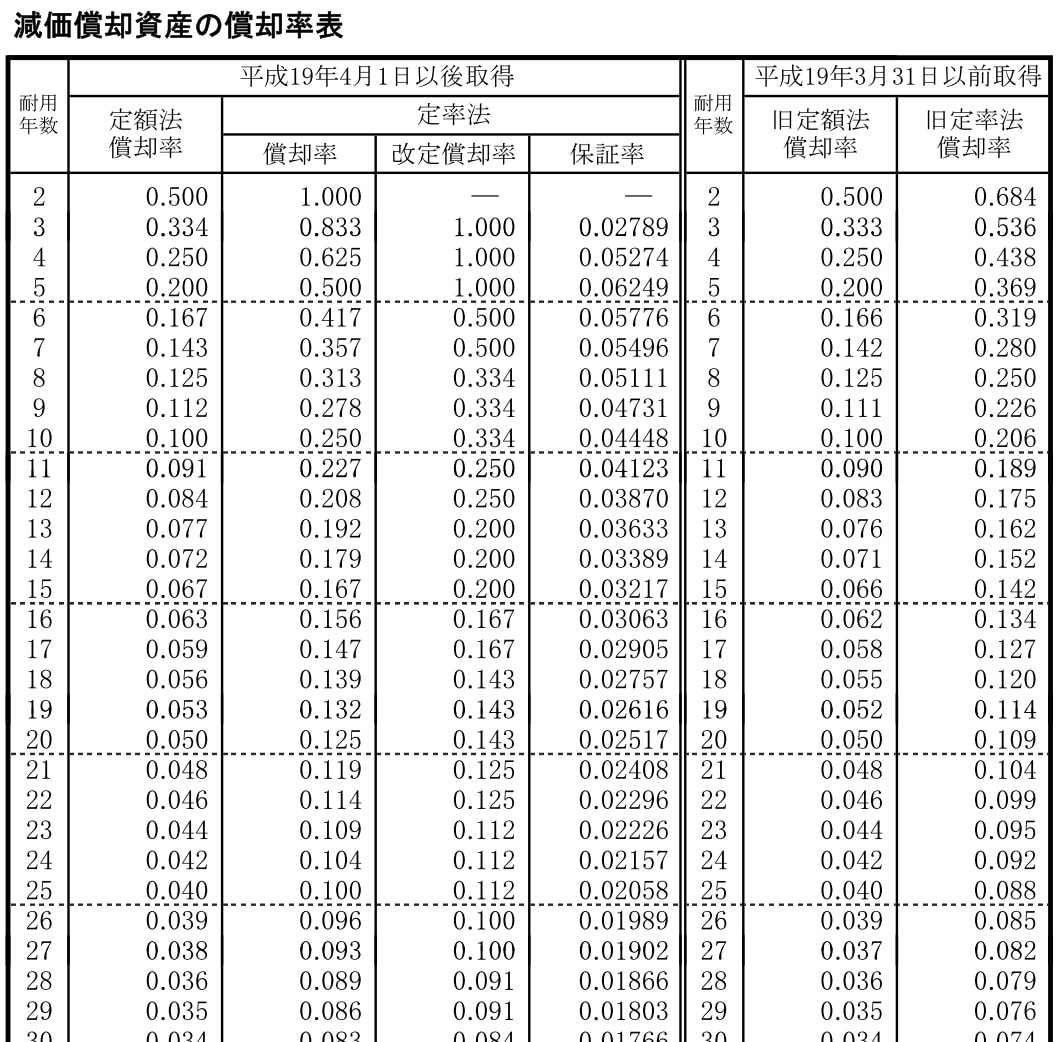

What are the actual profits and costs of investing in an apartment?Today, we received an inquiry about one room in a condominium and the following question arrived. I would like to know what would be the investment return of this apartment if for rent for about 5 years... Today's content explains the costs and actual profits of non-residents who make real estate investments in condominiums in Kyoto. About calculation of income tax of real estateThe tax on rent income is not uniform because the income tax rate varies depending on the taxable income amount. The amount of taxable income is not only considered as real estate income, but it also relates to salary income. This also involves income deductions, so it is not possible to simply calculate "how much is the tax on rent income". How to calculate income tax on rent income In order to obtain the income tax amount, it is necessary to calculate the taxable income amount and derive the tax rate. The taxable income amount can be calculated by the following formula. Taxable income amount = (Salary income + Real estate income) - Various income deductions Breakdown of various income deductions depends on each situation such as basic deduction, salary deduction, spouse deduction. Income tax is called the progressive tax rate, and the higher the income, the greater the tax burden. As shown in the table below, the tax rate of rent income is determined according to the total income, and is divided into 7 levels from 5% up to 45% according to the taxable income amount. The formula for calculating the income tax amount is as follows. Income tax amount = taxable income amount ✕ tax rate - deduction amount For non-residents, the rent obtained from rent investment in Japan is calculated as annual income. About depreciationDepreciation refers to a calculation method for acquiring depreciable assets and allocating the expenses (construction costs and purchase prices) incurred in acquiring the assets by dividing them into the number of years set for each type. Depreciable assets are fixed assets that businesses acquire for the purpose of using them for business purposes, and lose their value over time, and the purchase price is set at 100,000 yen or more. Buildings, cars, machinery, equipment, software, etc. are typical depreciable assets. Concept of building depreciation When calculating the depreciation of real estate, it is important to separate land from buildings. As mentioned above, depreciable assets, including buildings, are those that lose value over time, whereas land does not change in value over time, so it won't be subject to depreciation. When you build a building only on the land you already own, the price of the building is clear. When you purchase land and buildings, the purchase price includes the price of buildings and land, so it may be necessary to calculate only the price of buildings separately. How to calculate the useful life of used assets when the building age does not exceed the useful life The calculation method when the building age does not exceed the useful life is as follows. Service life = (Statutory service life - Age) + age x 0.2 (round down) The following is part of the depreciation rate table for depreciable assets. Using various formulas as above, calculate the estimated cost, tax to be paid, etc. from the estimated rent and derive the final profit. Below are the answers to our customers today. Annual Rent 6,600,000 yen Annual Cost ; - maintenance fee 670,440 yen - reserve fund 137,400 yen - others 24,420 yen - fire insurance 60,000 yen (roughly amount) - fixed asset tax 280,000 yen (roughly amount) - property management fee 217,800 yen (3% of rent and tax) - tax accountant payment 200,000 yen (roughly amount) - real estate acquisition tax (one time) 1,000,000 yen (roughly amount) - depreciation 1,780,000 yen (roughly amount) First Year Income 3,884,446 yen breakdown - rent income 6,600,000 yen - cost 2,590,060 yen - gross profit 4,009,940 yen - tax 125,494 yen Second Year and After 4,829,446 yen breakdown - rent income 6,600,000 yen - cost 1,540,060 yen - gross profit 5,059,940 yen - tax 230,494 yen 1st yr plus 2-5 yrs income = 23,202,230 yen Tax accountants can also be introduced individually. If you have any questions about real estate investment or have any real estate interests, please contact us.

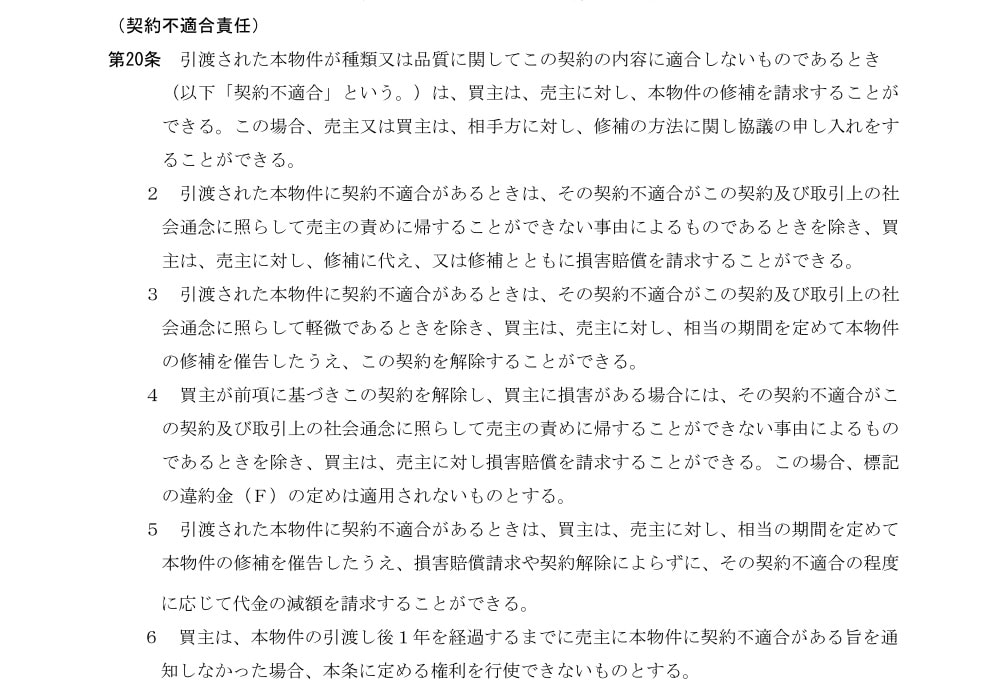

6/23/2020 Points to note when buying and selling real estate due to revision of the Civil CodeRead Now Today, we would like to explain the points to keep in mind when buying and selling real estate due to the revision of the Civil Code. First of all, due to the revision of the Civil Code in April of this year, the seller of real estate has changed from 2 choices of general or real estate agent to 3 choices of general individual, general corporation or real estate agent. In addition, the seller's liability for defect warranty has been changed to non-conformity liability. The details are as follows. Due to the revision of the Civil Code, the word "defective" is no longer used and has been changed to "not compatible with the contract." In addition, as a result of being arranged as contract (default) liability, the provisions of liability for non-conformance of contracts are applied regardless of specific or unspecified items, and the target of non-conformance of contracts is not limited to primitive defects. In addition to the cancellations and damages that have been made up until now, buyers have also been granted additional completion claims and reduction claims. In addition, the claim for damages now requires the responsibility of the seller. In other words, the protection of the buyer is stronger than ever before. In addition, the wording of the contract has been changed as follows. (Nonconformance liability) When the delivered Property does not conform to the contents of this contract in terms of type or quality (hereinafter referred to as “conformance to contract”), the Buyer may request the Seller to repair the Property. In this case, the seller or the buyer may request the other party to discuss the repair method. 2. If there is a contract nonconformity for the delivered property, the buyer, damages may be requested to the seller in place of or together with the repair. 3. When there is a contract nonconformity of the delivered property, the buyer shall set a reasonable period of time for the seller unless the contract nonconformity is minor in light of this contract and the social conventions of transactions. The buyer can cancel this contract after issuing a notice to repair the property. 4 If the buyer cancels this contract based on the preceding paragraph and the buyer has damage, except when the nonconformity of the contract cannot be attributed to the seller's blame in light of this contract and the social conventions of transactions, the buyer may claim damages against the seller. In this case, the penalties specified in the contract shall not apply. 5 When the delivered property has a contract nonconformity, the buyer notifies the seller of the repair of the property for a considerable period of time, the buyer can request a reduction in the price according to the degree of nonconformity of the contract, without depending on the claim for damages or the cancellation of the contract. 6 The buyer shall not be able to exercise the rights set forth in this article if the buyer does not notify the seller that there is a contract incompatibility with the property within one year after the delivery of the property. A consumer contract in a real estate transaction is when the seller is a business operator other than the real estate agent and the buyer is a consumer (transaction to which the Consumer Contract Law applies). Tomorrow, we will explain the necessary documents etc. in case the seller is a corporation.

Today we would like to talk about the points to note when non-residents invest in real estate. When investing in real estate in Japan, it does not matter whether the buyer is Japanese, resident or non-resident. However, if you are a non-resident and you want to get rent from the property you invest in, then note the following: Cases other than the rent paid by individuals who rented the land and house for themselves or their relatives to reside in. So what happens in the case above? The National Tax Agency has the following information. No.12014 Real estate income of non-residents https://www.nta.go.jp/english/taxes/individual/12014.htm

In such a case, there are two points to keep in mind.

First, the lessee has to pay the withholding tax collected to the tax office every month. This puts a heavy burden on the lessee and results in complicated tax procedures. If the rent is high, there is a possibility that the corporation has a lease agreement, and inevitably additional corporate paperwork will occur. Due to this increase in processing, there is a possibility that the lease contract will be terminated. Therefore, the method of avoiding such complicated processing from the lessee is to change the contract so that we will enter into a sublease agreement with the landlord, enter into a lease through us, and we will be obligated to pay tax. By doing this, the original lessee will rent a room from us, so there will be no additional burden. Our additional operating costs are covered by normal property management fees and are not incurred separately. The second point is to make the tax accountant a partner of the tax advisor. Every year, you will be required to file a tax return for real estate income, and at the same time, please request a refund for the withholding tax. By doing this, you will be asked to refund the tax by accurately claiming the tax and overpaying the tax. The above are points to keep in mind when investing in real estate. These cases include special circumstances, so please consult us individually. We can also introduce tax accountants who are fluent in English and Chinese. Please contact us for more details. Let's take a look at the second real estate investment case, which is a single wooden apartment building with four units in Kyoto city, ownership registered in the names of both parents and children, who are living in Hong Kong.

The investors are not residents in Japan, the registered owners are parents and children, and the registered address is Hong Kong. The investment target is a wooden apartment, 4 units, and an old apartment that was located on land that cannot be re-built. This time, the investment is to buy an existing apartment at a cheap price, no tenants, renovate it, operate it as a rental, and sell it for an exit. The real estate purchase amount is 10 million yen or less, renovation costs are about 7 million yen, and rental income is about 1.6 million yen per year. Real estate prices were very low, as the property was in such disrepair condition that it needed major renovations, was before land prices soared, and could pn the not re-buildable land. Since investors could not come to Kyoto at the time of contract or settlement, they delegated to an agent and completed the transaction. For the renovation, we prepared a room with a unit bath for the university students and a room with a shower room only. Initially we did not install furniture, but now we are operating as a rental with furniture as furnished apartment. For the renovation, we asked a local contractor through the management company, and the management company confirmed the progress of the construction and detailed specifications. For rent management, we have been promoting recruitment centered on companies that are strong in renting students, and we have achieved almost full occupancy management. When international students rent a room, they prefer furnished rooms, so there are refrigerators, washing machines, beds, desks, and chairs. The internet is also contracted with the apartment, so it is possible to use it immediately after moving in. Currently we are both renting and selling an apartment at same time. Since the investor has an account of Bank of China opened in Japan, the rent is remitted monthly to the Japanese account. We are executing an exit strategy while investing and renting the property, including renovations. For renovations, we have English-speaking contractors and architect partners, so please contact us if you are interested. Case 2: Gross yield approx. 10%, Net yield approx. 8.87% *Management fee, fire insurance and property annual fixed asset tax included |

Details

AuthorArrows International Realty Corp. Archives

June 2023

Categories

All

|

RSS Feed

RSS Feed