|

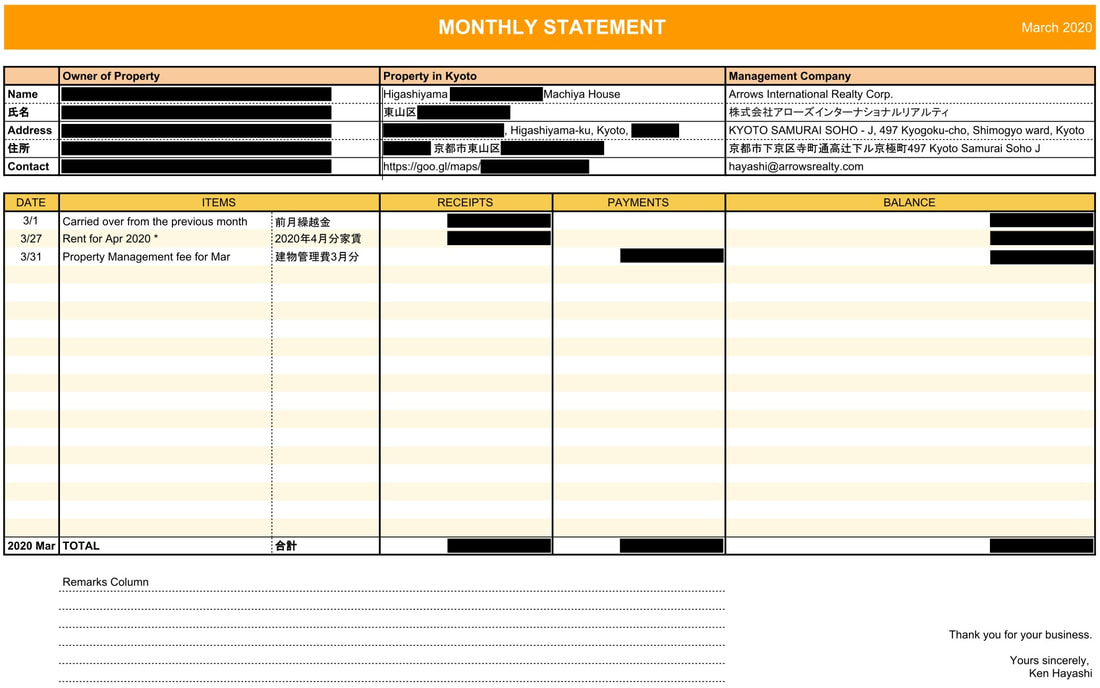

Today we're going to look at each investor's individual investment case. First of all, the investor in this case is a citizen of a country whose passport is in Europe, whose residence is in Asia, and who owns one property in Japan. The investment target is a remodeled Kyo-Machiya house, an attached house located in Higashiyama-ku, Kyoto City. The reason for investing is that they come to Japan regularly for work, love Kyoto, and want to have a vacation house in Kyoto to enjoy a relaxing time after retiring the work. The property in which they invested was a Kyo-Machiya house built in 1927 and renovated in 2019, a four-minute walk from Tofukuji. The investment method is for long-term leasing, they plan to use it as their own second home in the future when they retire from the company. In this case, the married couple registered 50% ownership of the property each, and the family owned the property. After purchasing the property, they signed a building management contract with us, and we began offering rentals immediately afterwards. The acquisition tax and property tax of the real estate are paid from the rental income, and the deposited rent is kept and managed by management company until instructed by the owner. The monthly balance report is shared in a folder on the cloud, and the monthly balance and deposit information are also shared. For the tenant recruitment, we will share the information with each agency and conduct business activities to find tenants. The management company takes photographs, draws up floor plans, assesses rents, and sets detailed conditions when recruiting. Once the details are finalized, we use the network system of real estate agents to register the information and recruit tenants through e-mails, faxes, and websites. Once we receive an offer for rent, we work with the guarantee company to screen the tenants, and take care of the necessary procedures such as the contract, fire insurance and other necessary procedures on owners behalf.

Before the tenants moving in, we will make sure that the room is cleaned and free of defects, change the locks and make sure it is ready to move in and hand the keys to the new tenant. The management company will take care of any inquiries or requests after tenants move in, and the owner basically does not do any work for management. We also provide information to owner's tax accountant and pay the income tax via owner's tax accountant. Therefore, after signing the management contract, there is no problem if owner leaves the various tasks to the management company. Case 1: Gross yield 6.04%, Net yield 5.28% *Management fee, fire insurance and property annual fixed asset tax included Comments are closed.

|

Details

AuthorArrows International Realty Corp. Archives

June 2023

Categories

All

|

RSS Feed

RSS Feed