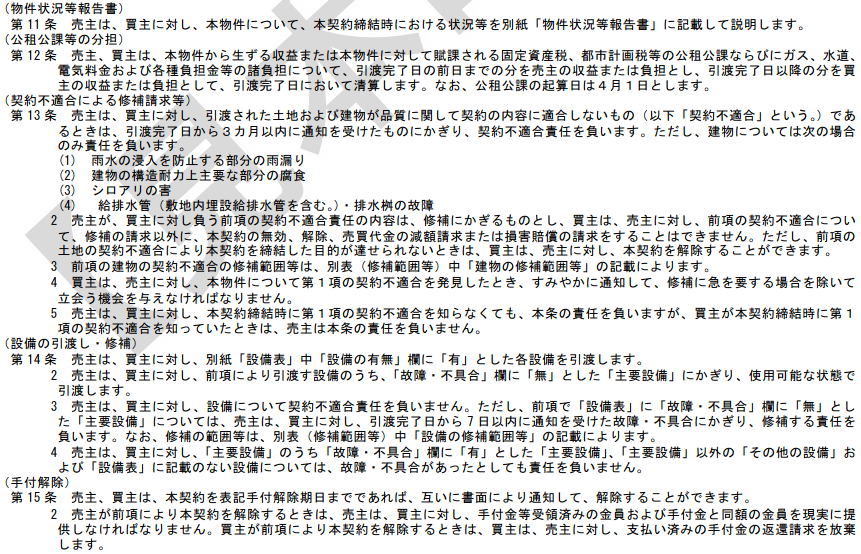

Real Estate Sales Contract Clauses 11-15Article 11: Property Condition Report

The Seller will provide the Buyer with an explanation of the condition of the Property at the time of execution of this Contract in the attached "Property Condition Report". Article 12: Sharing of taxes and public dues, etc. The Seller and the Buyer shall settle on the date of completion of delivery, the portion up to the day before the completion date of delivery as the Seller's income or burden and the portion after the completion date of delivery as the Buyer's income or burden, with respect to the income generated from the Property or various burdens imposed on the Property such as fixed property tax, city planning tax and other taxes and public charges, gas, water, electricity charges and various other contributions. The accrual date for taxes and public dues is April 1. Article 13: Claim for repair due to nonconformity with the Contract 1. The Seller shall be liable to the Buyer for non-conformity to the contract if the land and building delivered to the Buyer do not conform to the terms of the contract in terms of quality (hereinafter referred to as "non-conformity to the contract"), provided that the Seller notifies the Buyer within 3 months of the date of completion of delivery. However, with respect to buildings, liability shall be assumed only in the following cases: (1) Leaks in areas that prevent rainwater leakage (2) Corrosion in major structural durability components of the building (3) Damage caused by termites (4) Damage to water supply and drainage pipes (including water supply and drainage pipes buried on the site) and drainage catch basins 2. The Seller's liability to the Buyer for nonconformity with the contract as set forth in the preceding However, if the purpose for which this contract was concluded cannot be achieved due to the nonconformity of the land as set forth in the preceding paragraph, the Buyer may cancel this contract with the Seller. shall be limited to repair, and the Buyer may not make a claim against the Seller for breach of contract, cancellation of this Contract, reduction of the purchase price, or compensation for damages, other than a claim for repair of the nonconformity as set forth in the preceding Article. However, if the purpose for which this contract was concluded cannot be achieved due to the nonconformity of the land as set forth in the preceding paragraph, the Buyer may cancel this contract with the Seller. 3. The scope of repair of the nonconformity of the building set forth in the preceding paragraph shall be in accordance with the description of "Scope of Repair of Building, etc." in the Appendix (Scope of Repair, etc.). 4. When the Buyer discovers a contractual nonconformity under Paragraph 1 regarding the Property, the Buyer shall promptly notify the Seller and give the Seller an opportunity to be present, except in cases where the repair is urgent. 5. The Seller shall be liable to the Buyer hereunder even if the Seller did not know of the contractual non-conformity described in Paragraph 1 at the time of the conclusion of this Contract, but if the Buyer knew of the contractual non-conformity at the time of the conclusion of this Contract, the Seller shall not be liable hereunder. Article 14: Delivery and repair of the equipment 1. The Seller shall deliver to the Buyer each equipment that is marked "Yes" in the "Availability of Equipment" column in the attached "Equipment List". 2. The Seller shall deliver to the Buyer, among the equipment delivered in accordance with the preceding paragraph, only the "main equipment" marked "None" in the "Failures and Defects" column shall be delivered in a usable condition. 3. The Seller shall not be liable to the Buyer for any contractual nonconformity with respect to the equipment. However, with respect to the "Major Facilities" indicated as "None" in the "Failure/Defect" column of the "Equipment List" in the preceding paragraph, the Seller shall be liable to the Buyer for repair only for failures or defects for which notice is received within 7 days of the date of the completion of delivery. The scope of repair, etc. shall be in accordance with the description of "Scope of Repair of Equipment" in the Appendix (Scope of Repair, etc.). 4. The Seller shall not be liable to the Buyer for any failure or malfunction of any equipment other than the "Major Equipment" and "Major Equipment" which are marked "Yes" in the "Failure or Defect" column of the "Major Equipment" and for any equipment not listed in the "Equipment List". Article 15: Release of the deposit 1. The Seller and the Buyer may cancel this Contract by written notice to each other up to the stated deposit release date. 2. If the Seller cancels this Contract pursuant to the preceding paragraph, the Seller must actually return to the Buyer the deposit and other money received. If the Buyer cancels this Contract pursuant to the preceding paragraph, the Buyer waives any claim against the Seller for the return of the deposit paid. Comments are closed.

|

Details

AuthorArrows International Realty Corp. Archives

June 2023

Categories

All

|

RSS Feed

RSS Feed