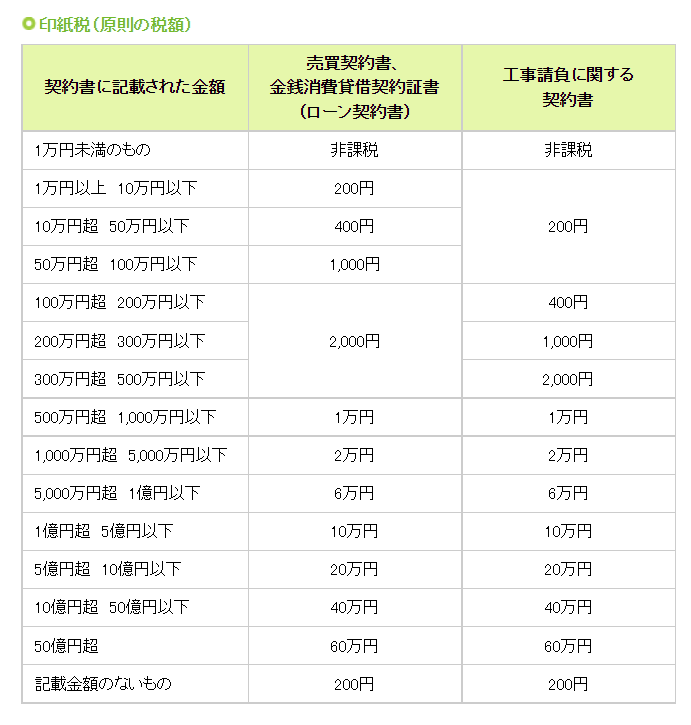

Taxes When Buying a HomeWhen buying a house, you will have to pay stamp tax, consumption tax, registration and license tax, real estate acquisition tax, and other taxes. Stamp TaxStamp tax is a tax that is imposed on contracts when a purchase agreement for the sale of a house or a mortgage contract is signed. The amount of tax is determined by the amount of money stated in the contract. In principle, the tax is paid by affixing revenue stamps to the contract and stamping a seal. ≪Stamp Tax ( general tax amount)≫ Sales Contracts and Loan Agreements

Construction Contracts

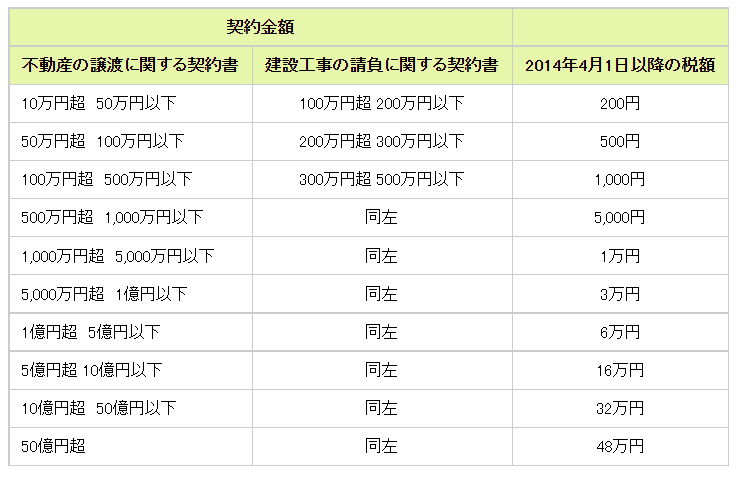

Tax Reduction for Home Acquisition Stamp tax on sales contracts for the purchase of real estate such as houses and contracts for the construction of houses is reduced as follows from April 1, 2014 to March 31, 2024. Real Estate Transfer Agreement

Construction Contract Agreement

*Only sales contracts for the purchase of real estate and contracts for the construction of housing are eligible for the reduction.

Comments are closed.

|

Details

AuthorArrows International Realty Corp. Archives

June 2023

Categories

All

|

RSS Feed

RSS Feed