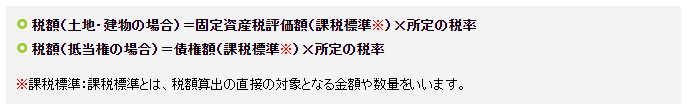

Registration and License TaxRegistration and license tax is a tax imposed when registering land, buildings, etc. For ownership registration, the tax amount is calculated by multiplying the assessed taxable value of the property by the designated tax rate. The amount of tax for mortgage registrations is calculated by multiplying the amount of the claim (the amount of the mortgage or other loans) by the designated tax rate. Tax payment is to be made when applying for registration. If the building is newly constructed and does not yet have a property tax assessment, the assessed value is calculated based on the New Building Value Approval Standard Table by the Legal Affairs Bureau.

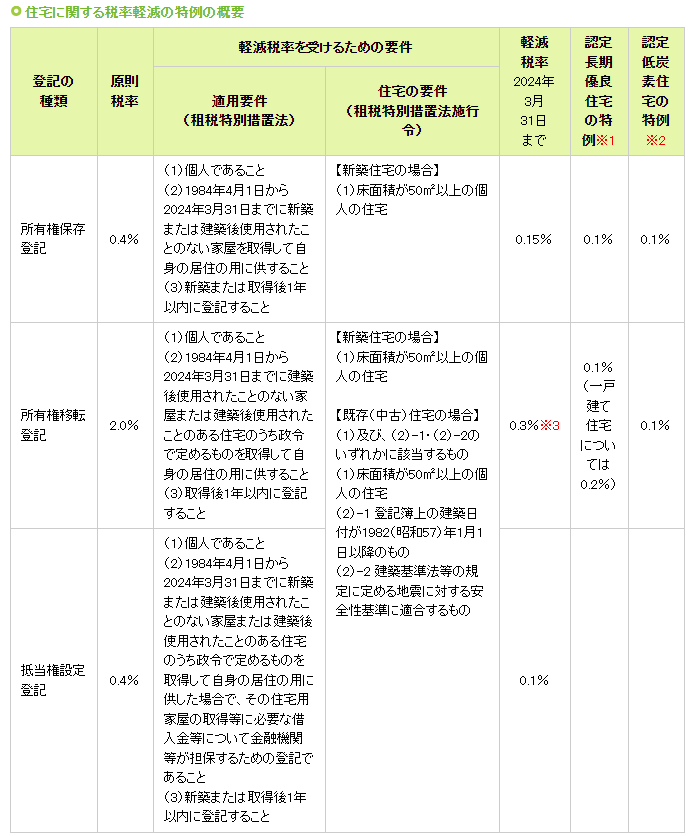

Special Tax Rate Reductions for Housing In the case of the registration of a house with a floor area of 50㎡ or more, the reduced registration and license tax rate will be applied if the house is certified by the mayor of the municipality where the house is located as meeting the requirements in the table below. Further special measures are available for Certified Long-term Quality Housing*1 and Certified Low Carbon Housing*2. *1 Long-term quality housing certified under the provisions of the Act on Promoting the Development of Long-Term Quality Housing, hereinafter referred to as "Certified Long-Term Quality Housing. *2 Low-carbon housing certified in accordance with the provisions of the Act Concerning the Promotion of Low Carbon Emission in Urban Areas, hereinafter referred to as "Certified Low Carbon Housing". It includes housing that is a specified building to be developed through a certified intensive urban development project that is deemed to be a certified low-carbon housing. ≪Overview of the special tax rate reductions for housing≫ Types of registration (1-3) 1. Registration of preservation of ownership ・・・ 0.4% (Basic tax rate)

(1) Be private individuals. (2) Acquire between April 1, 1984 and March 31, 2024 a newly built house or a house that has not been used since its construction and use it for one's own residence. (3) Register it within a year of construction or acquisition. Housing Requirements (Special Taxation Measures Law Enforcement Order) In the case of a newly built house: (1) Private housing with a floor area of 50㎡ or more

2. Registration of transfer of ownership ・・・ 2.0% (Basic tax rate)

(1) Be private individuals. (2) Acquire between April 1, 1984 and March 31, 2024 a house that has not been used since its construction or a house that has been used since its construction -which is specified by a Cabinet Order - and has been used for one's own residence. (3) Register it within a year of acquisition. Housing Requirements (Special Taxation Measures Law Enforcement Order) In the case of a newly built house: (1) Private housing with a floor area of 50㎡ or more In the case of an existing (used) house: When either (1), (2)-1, or (2)-2 below applies, the tax rate will be reduced. (1) Individual residences with a floor area of 50 ㎡or more (2)-1 Those whose construction date on the registry is January 1, 1982 or later. (2)-2 Those that comply with the earthquake safety standards stipulated in the Building Standard Law and other regulations.

3. Registration of mortgage ・・・ 0.4% (Basic tax rate)

(1) Be private individuals. (2) Acquire between April 1, 1984 and March 31, 2024 a newly built house, a house that has never been used since its construction, or a house that has been used since its construction - which is specified by a Cabinet Order - and has been used for one's own residence as specified by a Cabinet Order, and the registration is for the purpose of securing loans necessary for the acquisition of the residential house from a financial institution. (3) Register it within a year of construction or acquisition. Housing Requirements (Special Taxation Measures Law Enforcement Order) In the case of a newly built house: (1) Private housing with a floor area of 50㎡ or more

When either (1), (2)-1, or (2)-2 below applies, the tax rate will be reduced. (1) Individual residences with a floor area of 50 ㎡or more (2)-1 Those whose construction date on the registry is January 1, 1982 or later. (2)-2 Those that comply with the earthquake safety standards stipulated in the Building Standard Law and other regulations.

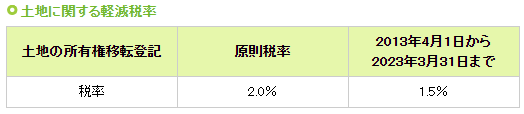

*1*2 The special provisions for Certified Long-term Quality Housing and Certified Low Carbon Housing are applicable when a private individual builds a new Certified Long-term Quality Housing or Certified Low Carbon Housing within a certain period or acquires one that has never been used after construction, uses it for the individual's residence, and registers the preservation of ownership or the transfer of ownership within a year of acquisition. *3 If a private individual acquires an existing residential building for which certain additions, alterations, etc. have been made by a real estate agent between April 1, 2014 and March 31, 2024, the tax rate for the registration of ownership transfer of the residential building will be reduced to 0.1% when the registration is made within a year of acquisition. Special Tax Rate Reduction for Land The registration and license tax for the transfer of ownership of land is reduced by a time-limited measure. ≪Reduced tax rates on land≫ Registration of transfer of ownership of land

Basic tax rate ・・・ 2.0% From April 1, 2013 to March 31, 2023 ・・・ 1.5% Comments are closed.

|

Details

AuthorArrows International Realty Corp. Archives

June 2023

Categories

All

|

RSS Feed

RSS Feed