Real Estate Acquisition TaxReal estate acquisition tax is a tax paid when real estate is acquired. In principle, the tax amount is calculated by multiplying the assessed value of fixed property by a tax rate of 4%. In the case of a newly constructed building that has not yet been assessed for property tax, the value of the building is calculated based on the standards for calculating the value of fixed property by the prefectural governor. The principle method of determining the tax amount is as follows.

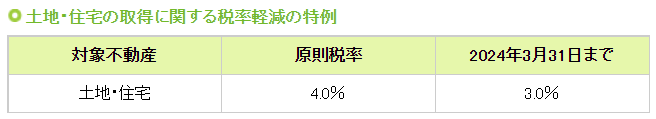

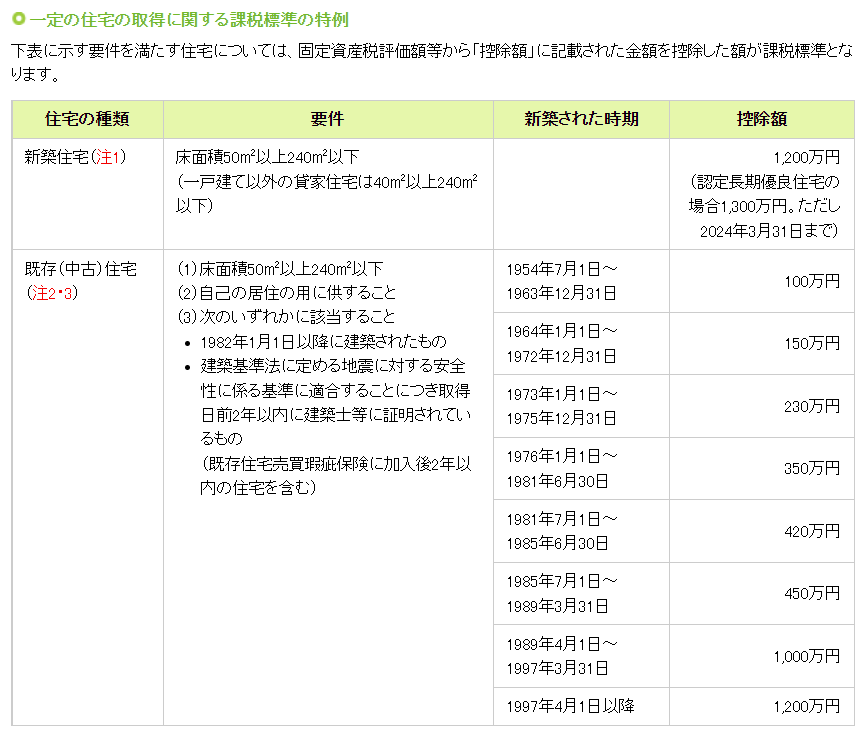

Special Tax Rate Reduction for Land and Housing Acquisitions The tax rate applicable to the acquisition of land and housing is subject to a special tax rate of 3% until March 31, 2024. ≪Reduced tax rate on land≫ Eligible property ・・・ Land and housing Basic tax rate ・・・ 4.0% Until March 31, 2024 ・・・ 3.0% Special Taxation Standards for Residential Land and Land Whose Assessed Value Is Determined on the Basis of Residential Land If residential land is acquired by March 31, 2024, the tax base for residential land will be reduced by one-half. ≪Special provisions for tax base on acquisition of certain houses≫ For houses that meet the requirements shown in the table below, the amount shown in the "Deduction Amount" section will be deducted from the assessed taxable value: tax base = assessed taxable value - deduction amount Types of houses 1. New housing (Note 1) Requirement(s): Floor area of 50 ㎡ or more but less than 240 ㎡. (40 ㎡ to 240 ㎡ or more for rental housing other than single-family houses) Amount deducted: 12 million yen (13 million yen for certified excellent long-term housing, but only until March 31, 2024) 2. Existing (used) housing (Note 2 & 3) Requirement(s): (1) Floor area of 50 ㎡ to 240 ㎡ or more (2) To be used for one's own residence (3) One of the following is applicable

Date built: January 1, 1964 to December 31, 1972 ⇒ Amount deducted: 1.5 million yen Date built: January 1, 1973 to December 31, 1975 ⇒ Amount deducted: 2.3million yen Date built: January 1, 1976 to June 30, 1981 ⇒ Amount deducted: 3.5million yen Date built: July 1, 1981 to June 30, 1985 ⇒ Amount deducted: 4.2 million yen Date built: July 1, 1985 to March 31, 1989 ⇒ Amount deducted: 4.5 million yen Date built: April 1, 1989 to March 31, 1997 ⇒ Amount deducted: 10 million yen Date built: On and after April 1, 1997 ⇒ Amount deducted: 12 million yen (Note 1) Taxation on residential high-rise buildings (tower condominiums, etc. exceeding 60 meters in height)

(Note 2) Special exception for reduction for acquisition of existing Houses nonconforming to seismic standards

(Note 3) There are measures designed to reduce the real estate acquisition tax imposed on the buyer-reseller when the buyer-reseller purchases an existing (used) house, makes improvements to certain housing quality, and then resells the house.

Comments are closed.

|

Details

AuthorArrows International Realty Corp. Archives

June 2023

Categories

All

|

RSS Feed

RSS Feed