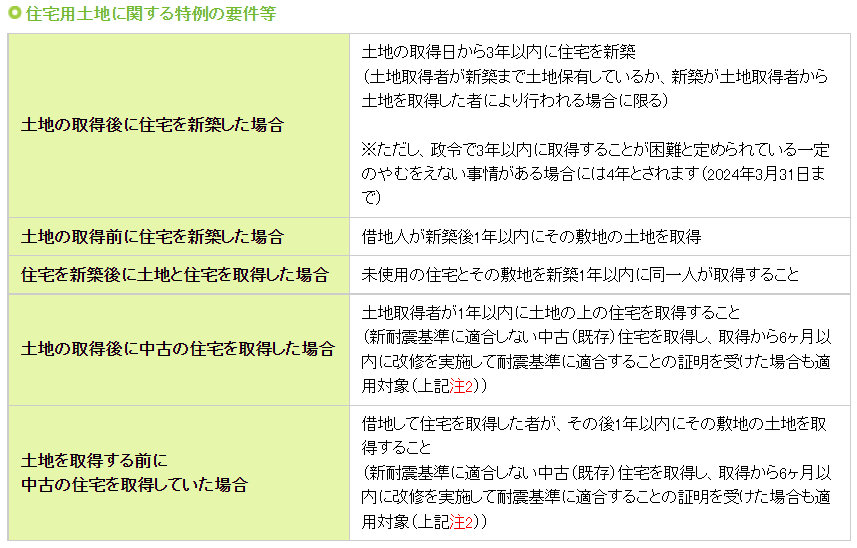

Real Estate Acquisition TaxSpecial Exception for Reduction on Residential Land If the house meets the same floor area and other requirements as described in the Special Provisions for Tax Base on Acquisition of Certain Residential Property and the acquisition of land meets one of the requirements in the table below, the larger amount of either 1. or 2. can be deducted from the tax for the residential land.

*2 Tax rate until March 31, 2024 under the special exception for reduced tax rates for land and housing acquisitions In principle, the collection of real estate acquisition tax is deferred if a new residential house is built within three years of the acquisition of the land. ≪Requirements for special exemptions for residential land≫

(Provided that the land acquirer holds the land until a new house is built or the new house is built by the person who acquires the land from the land acquirer.) * However, if certain unforeseeable circumstances arise that make it difficult to acquire the property within three years as stipulated by the government ordinance, the period will be extended to four years (until March 31, 2024).

(This also applies to cases where an existing house that does not conform to the new earthquake-proof standard is acquired and renovated within 6 months of acquisition to conform to the earthquake-proof standard (see Note 2 above)).

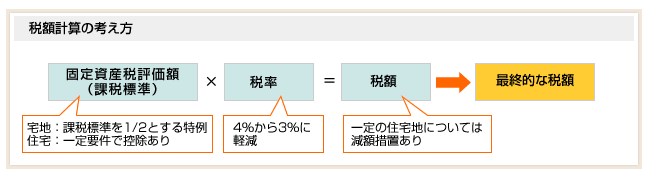

(This also applies to cases where an existing house that does not conform to the new earthquake-proof standard is acquired and renovated within 6 months of acquisition to conform to the earthquake-proof standard (see Note 2 above)). How to Calculate Tax Assessed value of fixed assets (tax base) x Tax rate = Tax amount ➡ Final tax amount Notes:

Assessed value of fixed assets Residential land: Special exception to halve the taxable base Housing: Deduction available under certain conditions Tax rate Reduced from 4% to 3%. Tax amount Reduction measures are available for certain residential land. Comments are closed.

|

Details

AuthorArrows International Realty Corp. Archives

June 2023

Categories

All

|

RSS Feed

RSS Feed