|

Japan to ease entry for businesspeople, students but not tourists Exclusive: Quarantines for short-term trips to be cut to 3 days published by YUKI NAKAMURA, Nikkei staff writer on November 1, 2021 23:00 JST

1/13/2021 State of emergency in Kyoto Prefecture toprevent the spread of the novel coronavirus infectionRead Now State of emergency in Kyoto Prefecture to |

||||||||||||||

Upper limit: 5,000 people Capacity rate: up to 50% of the maximum capacity for indoor facilities Secure adequate distancing between people (target: 2 meters) |

• In addition, we request event organizers to cooperate to end events before 8 p.m.

• Consultation in advance regarding the holding of events

Request to consult with Kyoto Prefecture in advance before planning to hold an event with participants more than 1,000 people or when participants will be traveling

nationwide

• Consultation in advance regarding the holding of events

Request to consult with Kyoto Prefecture in advance before planning to hold an event with participants more than 1,000 people or when participants will be traveling

nationwide

3 Restrictions on the use of facilities, etc.

(1) Facilities requested to undertake appropriate measures to prevent infection based upon the special measures law

Request to shorten the business hours of restaurants and entertainment facilities that have a restaurant business license under the Food Sanitation Law to 8pm (alcoholic beverages are to be served from 11 a.m. to 7 p.m.) (Special Measures Law, Article 24, Paragraph 9)

Request to shorten the business hours of restaurants and entertainment facilities that have a restaurant business license under the Food Sanitation Law to 8pm (alcoholic beverages are to be served from 11 a.m. to 7 p.m.) (Special Measures Law, Article 24, Paragraph 9)

Types of facilities |

Request contents |

[Restaurants] Restaurants (including Izakaya restaurant), cafes, etc. (excluding home delivery and take- out services.) [Entertainment facilities] Bars, karaoke boxes, etc. that are licensed to operate as restaurants under the Food Sanitation Law. |

Request for shortened business hours (5 a.m. to 8 p.m.) However, alcoholic beverages are to be served from 11 a.m. to 7 p.m. |

Monetary allowance for outlets cooperating with reduced business hours

Financial allowance to the store |

60,000 yen per outlet per day in response to cooperating with requests for shorter working hours (excluding regular holidays) |

(2 ) Facilities not requested under the special law, but encouraged to cooperate

For facilities such as theatres, meeting venues, sports facilities, and amusement parks, according to Article 11

of the Ordinance for Enforcement of the Special Measures Law, we request the shortening of business hours to

8 p.m. (alcoholic beverages are to be provided from 11 a.m. to 7 p.m.) regardless of the Special Measures Law.

For facilities such as theatres, meeting venues, sports facilities, and amusement parks, according to Article 11

of the Ordinance for Enforcement of the Special Measures Law, we request the shortening of business hours to

8 p.m. (alcoholic beverages are to be provided from 11 a.m. to 7 p.m.) regardless of the Special Measures Law.

Types of facilities

Sports facilities, amusement parks

Theatres, viewing halls, cinemas, etc.

Meeting and exhibition facilities

Museums, art galleries, libraries, etc.

Hotels and inns (Limited to the areas that are used for meetings)

Sports facilities, amusement parks

Theatres, viewing halls, cinemas, etc.

Meeting and exhibition facilities

Museums, art galleries, libraries, etc.

Hotels and inns (Limited to the areas that are used for meetings)

Request contents

Request for cooperation for the following points

・ Shortened business hours (5am to 8pm) However, alcoholic beverages are to be served from 11 a.m. to

7 p.m.

・ The maximum number of people at events is to be 5,000, and should not exceed 50% of the maximum capacity of the venue.

Request for cooperation for the following points

・ Shortened business hours (5am to 8pm) However, alcoholic beverages are to be served from 11 a.m. to

7 p.m.

・ The maximum number of people at events is to be 5,000, and should not exceed 50% of the maximum capacity of the venue.

Types of facilities

Amusement facilities*

Stores that sell goods (over 1000㎡ floor size)

Excluding daily necessities

Stores operating in the service industry (over 1000㎡)

Excluding services necessary for daily life

Amusement facilities*

Stores that sell goods (over 1000㎡ floor size)

Excluding daily necessities

Stores operating in the service industry (over 1000㎡)

Excluding services necessary for daily life

Request for cooperation for the following points

・ Shortened business hours (5 a.m. to 8 p.m.) However, alcoholic beverages are to be served from 11 a.m. to 7 p.m.

・ Shortened business hours (5 a.m. to 8 p.m.) However, alcoholic beverages are to be served from 11 a.m. to 7 p.m.

* Among entertainment facilities, outlets that possess a restaurant business license under the Food Sanitation Law are subject to requests based on the Special Measures Law. Facilities that are expected to be used for accommodation purposes, such as Internet cafes and manga cafes, are not subject to cooperation requests.

4 Regarding going to work

Request business operators to take thorough measures of implementing teleworking

(Special Measures Law, Article 24 Paragraph 9)

• Aim to reduce the number of commuting employees by 70% through promoting teleworking. If teleworking is difficult, promote staggering working days, working hours as well as bicycle commuting.

• If teleworking is difficult due to the type of business being conducted, avoid crowded situations in the workplace by staggering weekly holidays or taking leaves.

• Urge business operators not to let employees work after 8 p.m. unless absolutely necessary for the continuation of business operations.

(Special Measures Law, Article 24 Paragraph 9)

• Aim to reduce the number of commuting employees by 70% through promoting teleworking. If teleworking is difficult, promote staggering working days, working hours as well as bicycle commuting.

• If teleworking is difficult due to the type of business being conducted, avoid crowded situations in the workplace by staggering weekly holidays or taking leaves.

• Urge business operators not to let employees work after 8 p.m. unless absolutely necessary for the continuation of business operations.

5 Request to universities, etc.

Request to take infection prevention measures and alert students

(Special Measures Law, Article 24 Paragraph 9)

• Secure learning opportunities by effectively implementing infection prevention measures and in-person and remote classes.

• Take thorough infection prevention measures in club and extra-curricular activities, as well as in dormitories, and refrain from dining parties, dining with people and activities with high risk of infection.

• As for university examinations, organizers should fully secure opportunities for entrance examinations by taking infection prevention measures as well as offering additional examination opportunities.

(Special Measures Law, Article 24 Paragraph 9)

• Secure learning opportunities by effectively implementing infection prevention measures and in-person and remote classes.

• Take thorough infection prevention measures in club and extra-curricular activities, as well as in dormitories, and refrain from dining parties, dining with people and activities with high risk of infection.

• As for university examinations, organizers should fully secure opportunities for entrance examinations by taking infection prevention measures as well as offering additional examination opportunities.

Capital Gain Tax

A capital gain is the profit realised on the sale of a property. Capital gains tax is charged on the taxable portion of the gain. Any gain is declared on your income tax statement as ‘other income‘ and is taxed separately to your own income. Both residents and non-residents (eg. those living overseas) are liable to pay this tax, although non-residents are not required to pay the municipal tax. Also, both foreign and domestic investors may be liable to pay consumption tax to the Japanese tax office upon the sale of Japanese property. This may include private individuals who were renting out their property to a tenant.

https://www.arrowsrealty.com/capital-gain-tax.html

A capital gain is the profit realised on the sale of a property. Capital gains tax is charged on the taxable portion of the gain. Any gain is declared on your income tax statement as ‘other income‘ and is taxed separately to your own income. Both residents and non-residents (eg. those living overseas) are liable to pay this tax, although non-residents are not required to pay the municipal tax. Also, both foreign and domestic investors may be liable to pay consumption tax to the Japanese tax office upon the sale of Japanese property. This may include private individuals who were renting out their property to a tenant.

https://www.arrowsrealty.com/capital-gain-tax.html

Taxes on Gifts and Inheritances

( 1 ) Gift Tax

Those who acquired property as a gift must file a return to pay gift tax in the period from February 1 to March 15 of the year following the acquisition of the property. The taxable value is the amount after deducting the basic allowance (¥1,100,000) and the special spouse allowance (¥20,000,000).

The donee who receives a gift from the parents or grandparents has an option to apply the inheritance tax adjustment system in which the donee pays smaller amount of tax on gifts and settles the final amount as inheritance tax later.

Those who acquired property as a gift must file a return to pay gift tax in the period from February 1 to March 15 of the year following the acquisition of the property. The taxable value is the amount after deducting the basic allowance (¥1,100,000) and the special spouse allowance (¥20,000,000).

The donee who receives a gift from the parents or grandparents has an option to apply the inheritance tax adjustment system in which the donee pays smaller amount of tax on gifts and settles the final amount as inheritance tax later.

( 2 ) Inheritance Tax

Those who acquired properties by inheritance or bequest, and the total value of the properties exceeds the basic deductible allowance, must file a return to pay inheritance tax within, in principle, ten months after the date of the acquisition. The person who died is called the ancestor, and the person who inherited property is called the inheritor. The scope of property subject to inheritance tax varies depending on whether the inheritor’s address (domicile) is within or outside of Japan.

Those who acquired properties by inheritance or bequest, and the total value of the properties exceeds the basic deductible allowance, must file a return to pay inheritance tax within, in principle, ten months after the date of the acquisition. The person who died is called the ancestor, and the person who inherited property is called the inheritor. The scope of property subject to inheritance tax varies depending on whether the inheritor’s address (domicile) is within or outside of Japan.

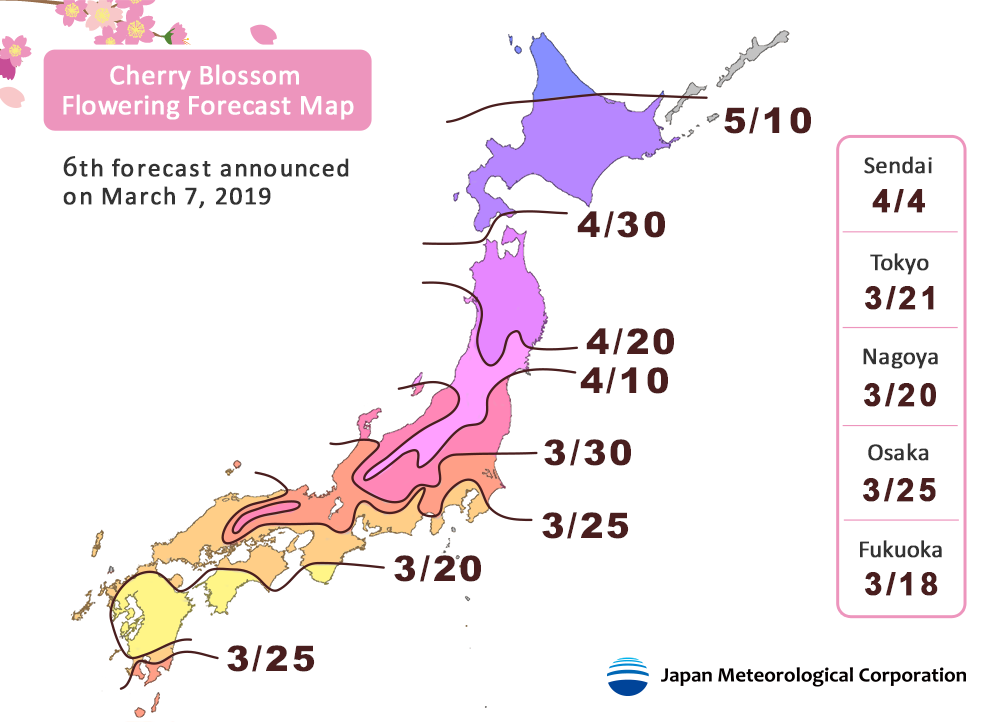

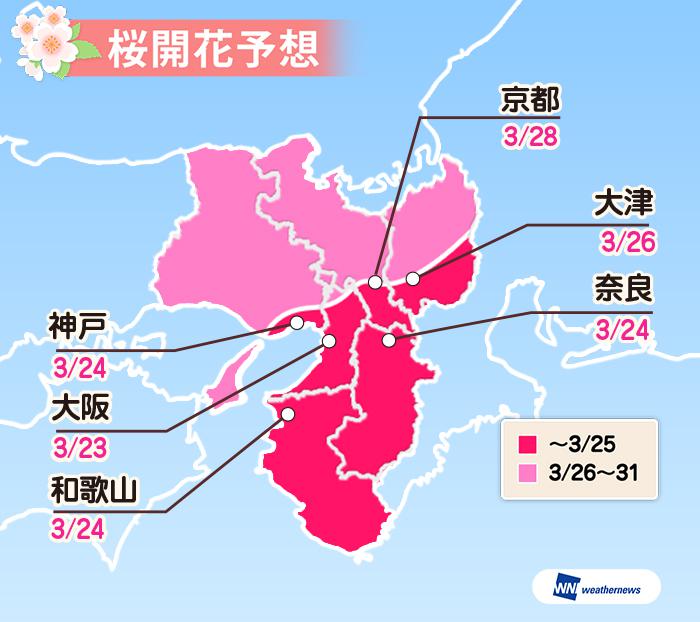

Sakura / Cherry Blossom Forecast of Kyoto in 2019

Flowering date : 22 March

First day of cherry blossoms reaching full bloom : 31 March

First day of cherry blossoms reaching full bloom : 31 March

(6th forecast announced on March 7, 2019)

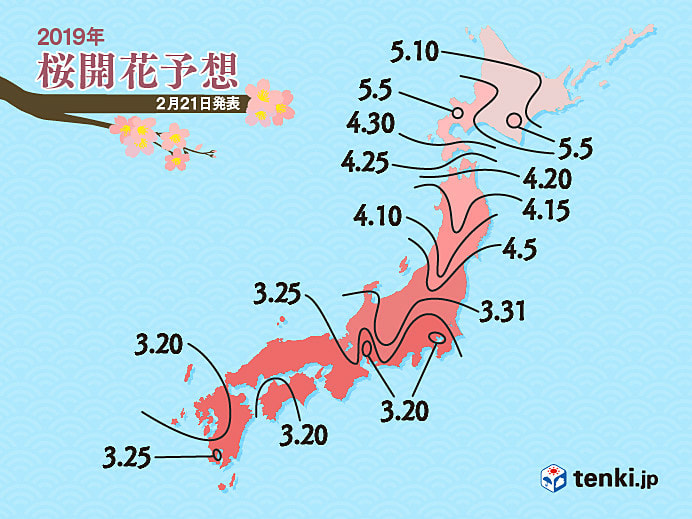

Flowering date : 23 March

First day of cherry blossoms reaching full bloom : 31 March

First day of cherry blossoms reaching full bloom : 31 March

(information and image based on announcement on 21 Feb.)

Sakura of this year seems to be somewhat earlier than the normal year. It is expected to be late than last year which was quite early. There is no big change from the forecast announced in the previous 1/24 announcement, but there are points several days earlier in western Japan.

It was warm winter in 2018/2019 because the condition of cold air continued hardly flows near Japan. For this reason, breakdown of dormancy is slow and flower bud growth is seen to be slow.

In the middle of February, a strong cold will flow and the temperature will be lower, but after that the spring will be coming soon as the temperature is expected to be quite high.

For this reason, Sakura's flowering is expected to be faster than normal, but it will not be a record quickness because the break-through of dormancy is slow due to the warm winter.

It was warm winter in 2018/2019 because the condition of cold air continued hardly flows near Japan. For this reason, breakdown of dormancy is slow and flower bud growth is seen to be slow.

In the middle of February, a strong cold will flow and the temperature will be lower, but after that the spring will be coming soon as the temperature is expected to be quite high.

For this reason, Sakura's flowering is expected to be faster than normal, but it will not be a record quickness because the break-through of dormancy is slow due to the warm winter.

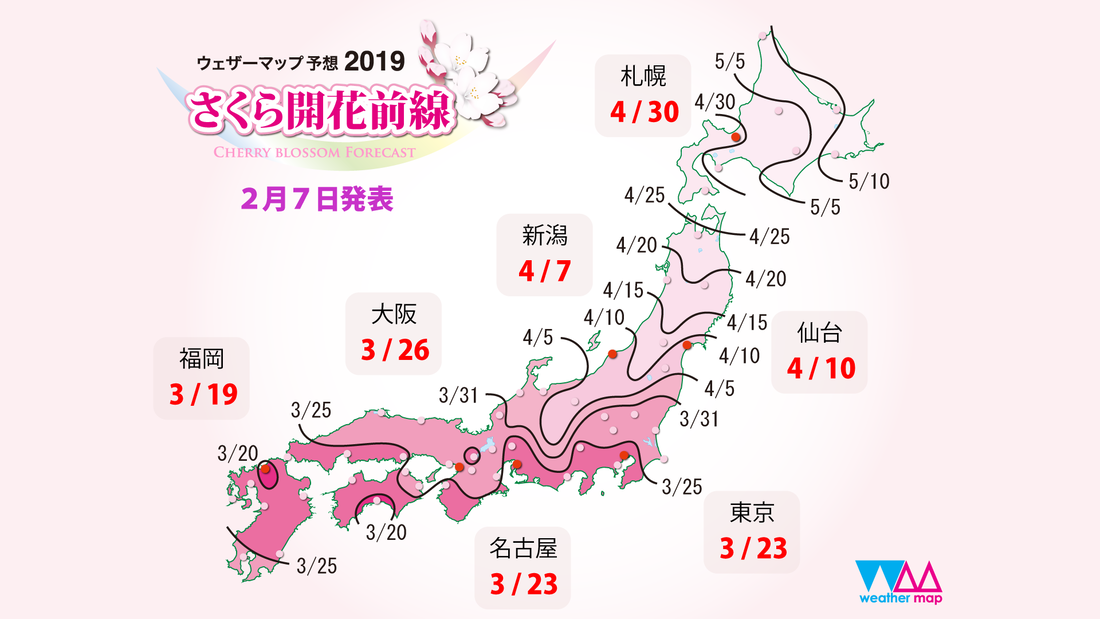

Flowering date : 24 - 26 March

First day of cherry blossoms reaching full bloom : 2 April

First day of cherry blossoms reaching full bloom : 2 April

(information and image based on announcement on 7 Feb.)

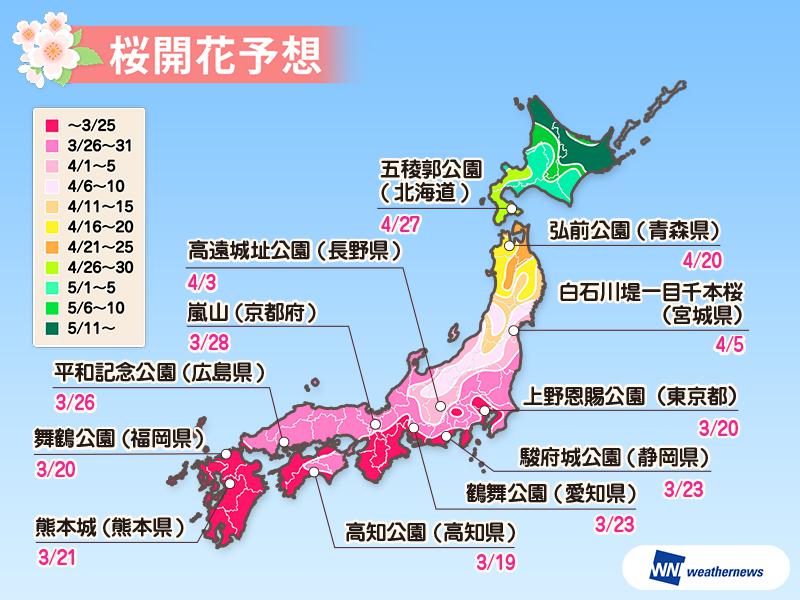

(information and image based on announcement on 16 Jan.)

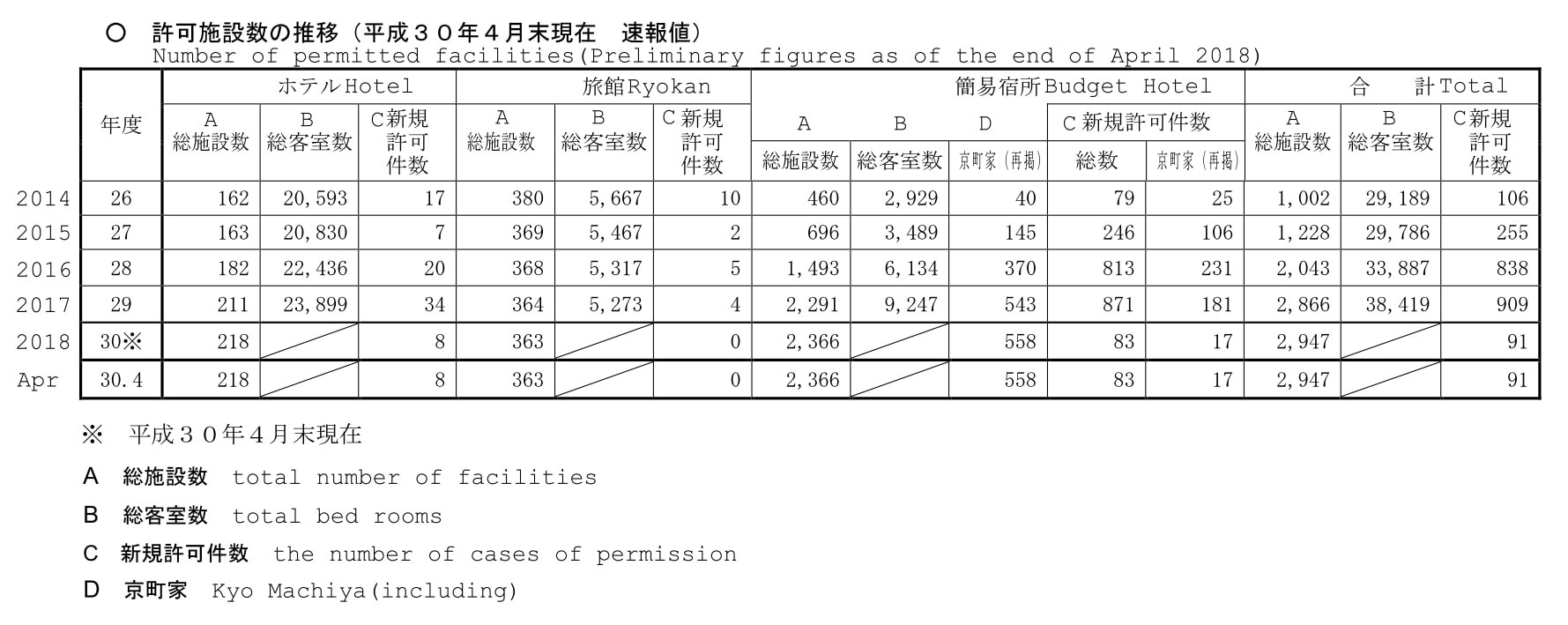

Kyoto City Government estimated that there would be need for 40,000 hotel rooms by 2020, however, calculations by the Kyoto Shimbun found that the total number of hotel rooms located in Kyoto City has already exceeded 40,000, and will surpass 50,000 within two years. In response to an increasing number of foreigners visiting in Japan, a hotel construction boom, also called the "hotel bubble," has been ongoing in Kyoto. This has caused...

https://e.kyoto-np.jp/news/20181205/3466.html

https://e.kyoto-np.jp/news/20181205/3466.html

The government greatly simplifies the procedures for business succession by sole proprietors.

Currently it is necessary to conduct a new start-up procedure other than inheritance due to death in many industries. The government will summarize the reform plan in the middle of 2019, the government will allow the current law to be handed over to the new sole proprietors without new permission and approval as well as to inherit it. The Government aims to cover not only children, but also business succession to third parties such as relatives such as grandchildren and brothers and employees.

In the current system, in food and beverage industry, liquor retailing business, cleaning industry, hotel industry and beauty care business are inheritance, in principle, submit one application form and several related documents to the national government and municipalities to take over the business. However, if the former sole proprietors takes over in the lifetime, new sole proprietors will open up new business after the previous proprietors has left the business.

For example, in the inheritance of a restaurant business, in principle, the heir will inherit the business in accordance with the application form and family register certificate. However, in the succession to live, submission of a business license application form and arrangement map of sales facilities, inspection by the public health center and application fee fee will be required. It takes time to be permitted even after the inspection, sometimes being obliged to be closed.

Same as Hotel industry, if new sole proprietors apply hotel license, start new business after purchase Hotel, Ryokan or Guesthouse, it will require to apply new license again, will take approximately 2 months and hotel will not be able to run during this period.

After reform of plan in middle of 2019, after the enforcement of this Act, it may easy to start new business by new solo proprietors.

However, in parallel, in hotel business, we still need to check new Act will include business succession by property by property, or all properties by solo proprietor. We support M&A, purchase business with license, establish new business and company in Japan.

Sincerely,

Ken Hayashi

In the current system, in food and beverage industry, liquor retailing business, cleaning industry, hotel industry and beauty care business are inheritance, in principle, submit one application form and several related documents to the national government and municipalities to take over the business. However, if the former sole proprietors takes over in the lifetime, new sole proprietors will open up new business after the previous proprietors has left the business.

For example, in the inheritance of a restaurant business, in principle, the heir will inherit the business in accordance with the application form and family register certificate. However, in the succession to live, submission of a business license application form and arrangement map of sales facilities, inspection by the public health center and application fee fee will be required. It takes time to be permitted even after the inspection, sometimes being obliged to be closed.

Same as Hotel industry, if new sole proprietors apply hotel license, start new business after purchase Hotel, Ryokan or Guesthouse, it will require to apply new license again, will take approximately 2 months and hotel will not be able to run during this period.

After reform of plan in middle of 2019, after the enforcement of this Act, it may easy to start new business by new solo proprietors.

However, in parallel, in hotel business, we still need to check new Act will include business succession by property by property, or all properties by solo proprietor. We support M&A, purchase business with license, establish new business and company in Japan.

Sincerely,

Ken Hayashi

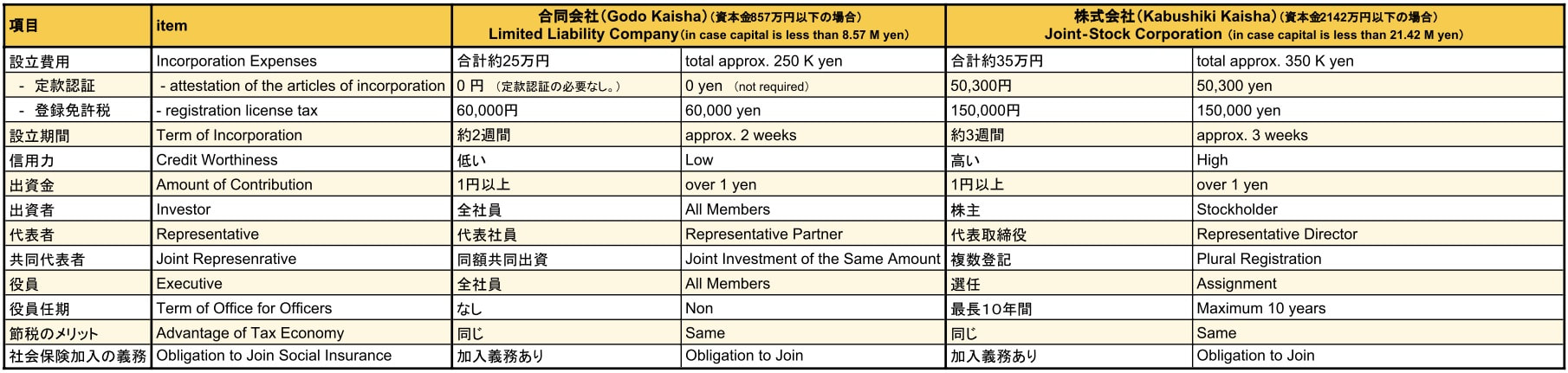

Table of cost for Incorporation of Kabushiki Kaisha and Gojo Kaisha in Japan

This is roughly idea of how much and what is different between Kabushiki Kaisha and Godo Kaisha when you incorporate company in Japan. The total price will be less than what showing on table, but are idea of how much it will cost including scrivener fee.

There are each advantages and disadvantages in types of company, please discuss with scrivener that which type will be more suitable for your idea of company, what the purpose of incorporating company, how you want to manage and how you want to grow up your business in Japan.

There is idea of buying real estate under company name, may use company to save tax payment, application of Business Manager visa or inheritance tax measures. Also if you are planning to purchase property for hotel, guesthouse, Minshuku or Minpaku business as investment in Japan, you may better to use company name for application of license, and sell the property with hotel license by higher price in the future.

We work with team of judicial scrivener for incorporate, tax accountant for tax payment, architect for designing, constructor for renovation work, administrative scrivener for hotel license, and management company for running guesthouse. If you are planning to purchase property in Japan, for any investment use, please contact us in advance and check what is best way to own property in Japan.

Regards,

Ken

There are each advantages and disadvantages in types of company, please discuss with scrivener that which type will be more suitable for your idea of company, what the purpose of incorporating company, how you want to manage and how you want to grow up your business in Japan.

There is idea of buying real estate under company name, may use company to save tax payment, application of Business Manager visa or inheritance tax measures. Also if you are planning to purchase property for hotel, guesthouse, Minshuku or Minpaku business as investment in Japan, you may better to use company name for application of license, and sell the property with hotel license by higher price in the future.

We work with team of judicial scrivener for incorporate, tax accountant for tax payment, architect for designing, constructor for renovation work, administrative scrivener for hotel license, and management company for running guesthouse. If you are planning to purchase property in Japan, for any investment use, please contact us in advance and check what is best way to own property in Japan.

Regards,

Ken

5/18/2018

Concerning the use of Minpaku Accommodations as well as the offering of Minpaku Services

Read Now

List of Accommodations which have received permission from Kyoto City based on the Hotel and Ryokan Management Law(30 April 2018)

Ministry of Land, Infrastructure, Transport and Tourism

http://www.mlit.go.jp/en/totikensangyo/totikensangyo_fr5_000017.html

In order to understand the trends of the real-estate market timely and appropriately, MLIT collects real-estate related indeces and other data and publishes the “Monthly marketing report on real-estate market”.(Last update date:March 7, 2018)

Graph version

1.Trends in Land Ownership Transfer

2.Trends in the Housing Market

3.Trends in the Rental Office Market

4.Trends in the Real Estate Securitization Market

5.Trends in Lending by Domestic Banks

http://www.mlit.go.jp/en/totikensangyo/totikensangyo_fr5_000017.html

In order to understand the trends of the real-estate market timely and appropriately, MLIT collects real-estate related indeces and other data and publishes the “Monthly marketing report on real-estate market”.(Last update date:March 7, 2018)

Graph version

1.Trends in Land Ownership Transfer

2.Trends in the Housing Market

3.Trends in the Rental Office Market

4.Trends in the Real Estate Securitization Market

5.Trends in Lending by Domestic Banks

| 001223610.pdf | |

| File Size: | 1201 kb |

| File Type: | |

RSS Feed

RSS Feed